Answered step by step

Verified Expert Solution

Question

1 Approved Answer

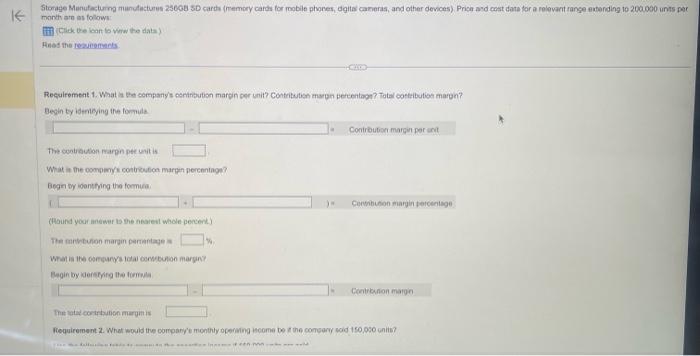

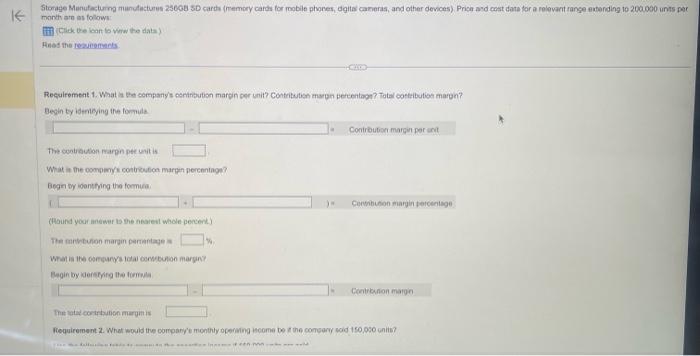

Please help with all requirments! month are as folows: Tiii (cick. (be kean to viw the date) Hest the teverements. Begin ty iaterteying the fomids

Please help with all requirments!

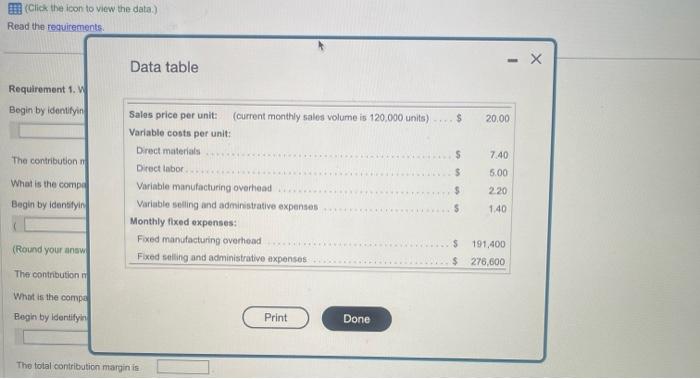

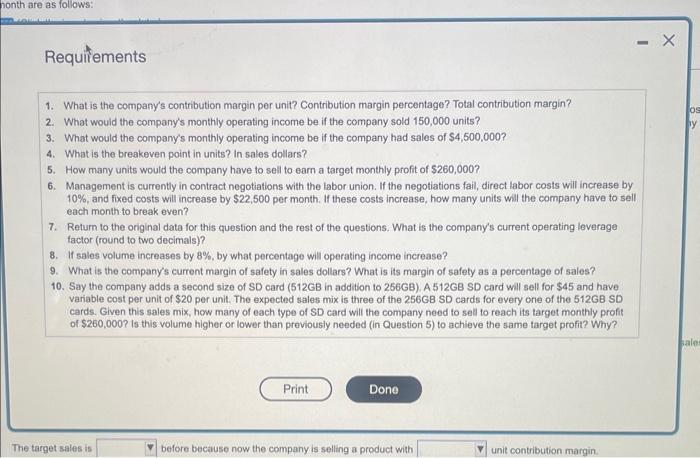

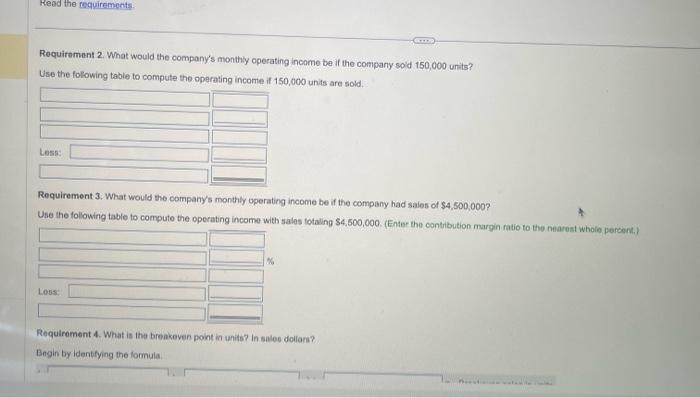

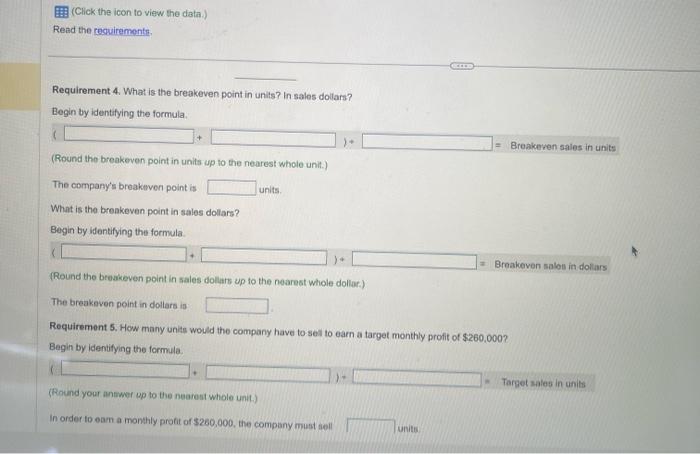

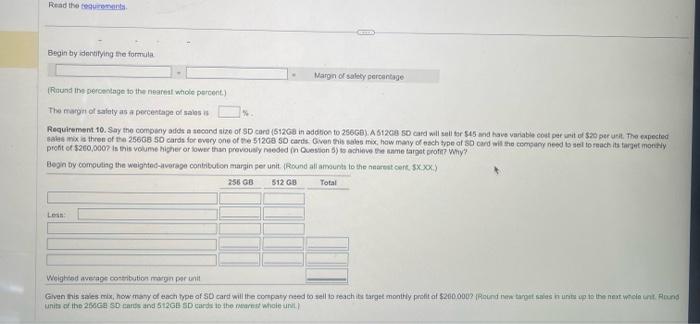

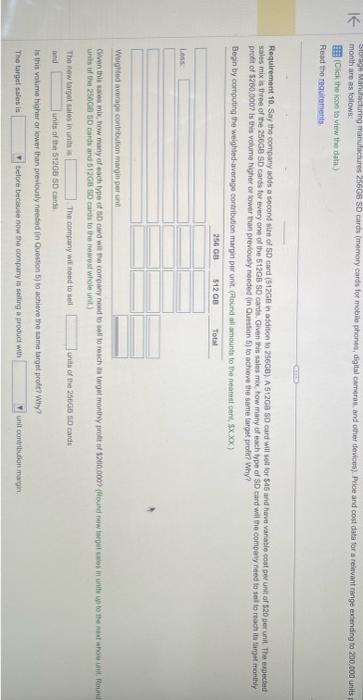

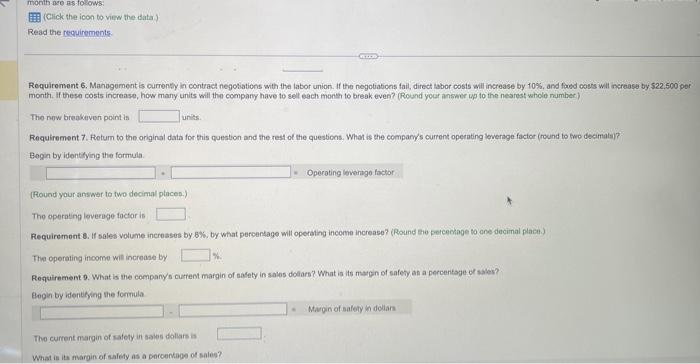

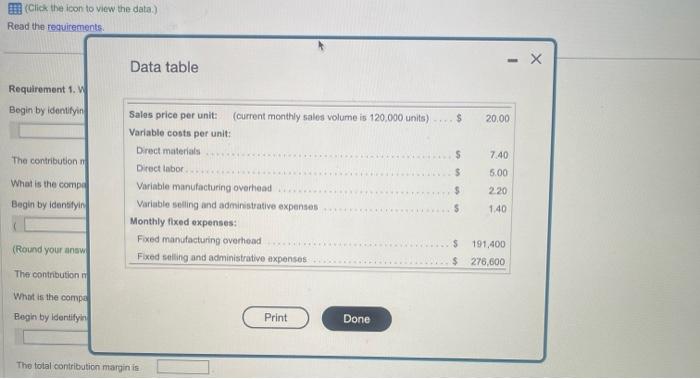

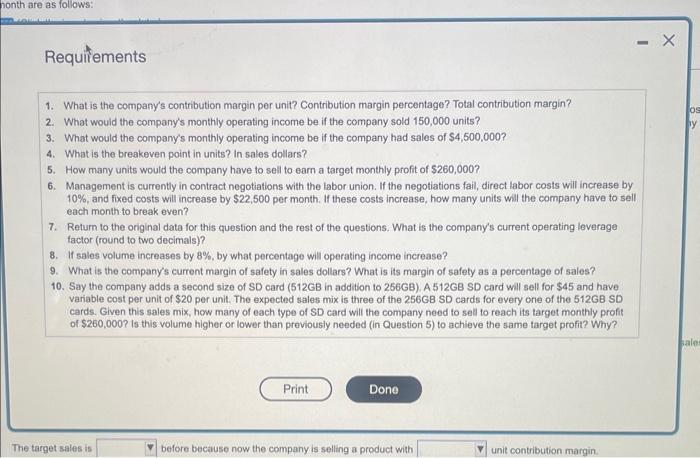

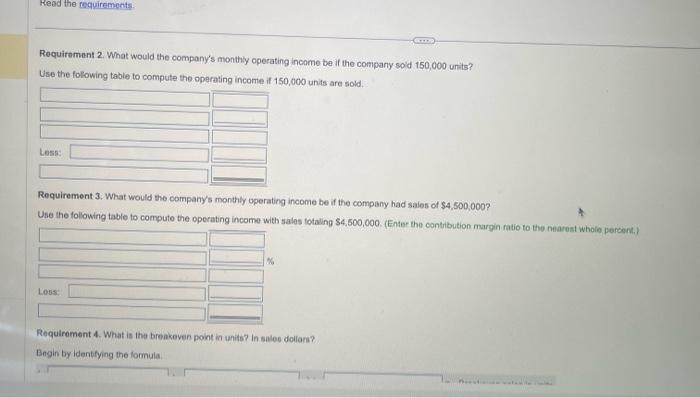

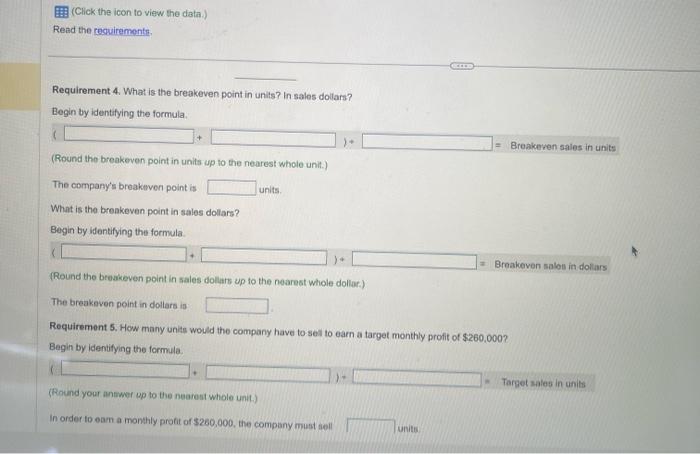

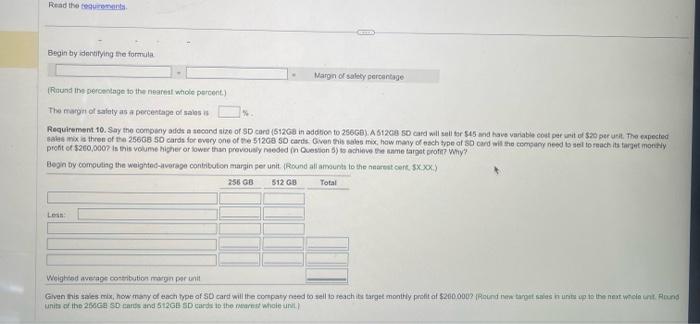

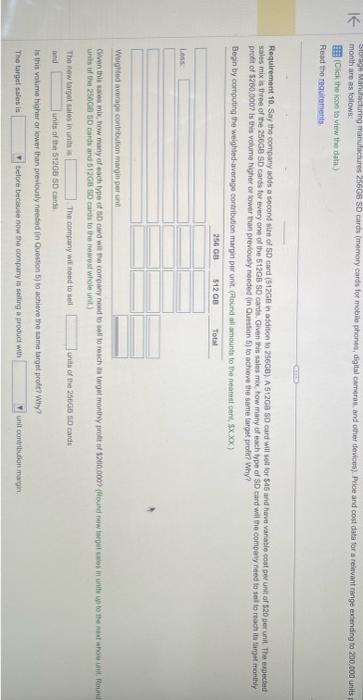

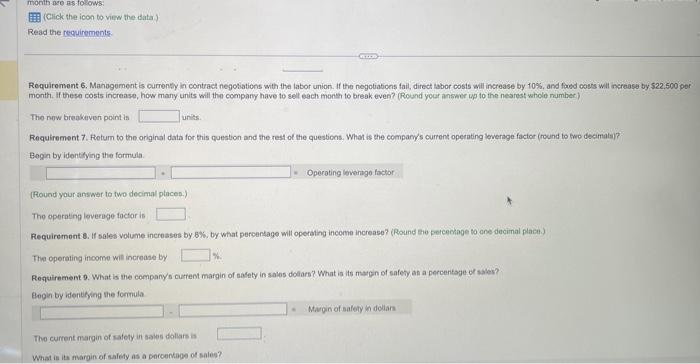

month are as folows: Tiii (cick. (be kean to viw the date) Hest the teverements. Begin ty iaterteying the fomids The continuth maren pet unt is What io the compiny's contreution marten percentage? Begn by ioensthing the formuna: (Hound your anewer ts the nearen whole peccerit) The corwtuson margin perantage a What is toe comesaryat loal osewtouton margin? Begin by kerthepro the formela The vated corthabion maryitis Data table Requitements 1. What is the company's contribution margin per unit? Contribution margin percentage? Total contribution margin? 2. What would the company's monthly operating income be if the company sold 150,000 units? 3. What would the company's monthly operating income be if the company had sales of $4,500,000 ? 4. What is the breakeven point in units? In sales dollars? 5. How many units would the company have to sell to earn a target monthly profit of $260,000 ? 6. Management is currently in contract negotiations with the labor union. If the negotiations fail, direct labor costs will increase by 10%, and fixed costs will increase by $22,500 per month. If these costs increase, how many units will the company have to sell each month to break even? 7. Return to the original data for this question and the rest of the questions. What is the company's current operating leverage factor (round to two decimals)? 8. If sales volume increases by 8%, by what percentage will operating income increase? 9. What is the company's current margin of safety in sales dollars? What is its margin of safety as a percentage of sales? 10. Say the company adds a second size of SD card (512GB in addition to 256GB) A 512GBSD card will sell for \$45 and have variable cost per unit of $20 per unit. The expected sales mix is three of the 256GB SD cards for every one of the 512GB SD cards. Given this sales mix, how many of each type of SD card will the company need to sell to reach its target monthly profit of $260,000 ? is this volume higher or lower than previously needed (in Question 5) to achieve the same target profit? Why? Requirement 2. What would the company's monthly operating income be if the company sold 150,000 units? Use the folowing table to compute the operating income if 150,000 units are sold. Requirement 3. What would the company's monthly operating income be if the company had salos of $4,500,000 ? Use the following table to compute the operating income with sales totalling $4,500,000. (Enter the contribution margin ratio to the nearest whole percent.) Requirement 4. What is the breakeven point in units? In sales dollare? Begin by identying the lormula (Click the icon to view the data.) Read the reguiremente Requirement 4. What is the breakeven point in unils? in sales dollars? Begin by identifying the formula. (Round the breakeven point in units up to the nearest whole unit.) The company's breakeven point is units. What is the broakeven point in sales dollars? Begin by identifying the formula. (Round the breakeven point in sales dollars up to the nearest whole dollar.) The breakeven point in dollars is Requirement 5. How many unias would the company have to sel to earn a target monthly profit of $260,000 ? Begin by identifying the formula. (Round your answer up to the nearest whole unit.) In order to eam a monthly proft of $260,000, the company must tell units Begit by it ontifying the formula (Ruund ins peropelege to the neareal whole pertent) The marget of safaty as a porcentape of sales is Begin by comouling the weightec-average contibuton margin per unit. (Round all amsunta to the naartat cerk $x.). month are as follows. (Cick the ispe th yiew the dithis) Fest tho reguitetients prodit of \$260,000? ts this volume higher or Hower than previously noeded (in Quntian 5) to acheve the same target protar why? Begin by cornputing the welghled-avorage contribution marpit per unt. (Round all amounts to the nearest cens, $X C.) The Rww targot caies in with a The company ait notd to sed unats of the 25600500 carat and units af the 61260 s0 cans. Is thit volime higher or lewer than previoully netsed (n Quenion 5) to achieve the name target prode? Why? Toe target cales is Requirement 6. Manbgement is currenty in contract negotiations with the labor union. If the negotiations fail, direct tabor costs wili increase by 10%, and fowod coss will inerease by $22, 500 por month. If these costs increase, how many units will the company have to selt each monsh to break even? (Round your answer ug to the nearest whole number) The now breakeven point is Requirement 7. Flotum to the original data for this question and the rest of the questions. What is che company's current operating leverage factor (round to two decimals)? Bogin by identitying the formula. (Round your answer to two decimal placen.) The operating loverege foctor is Requiremont 8. If sales volume increases by 8%, by what percentage will operaing income increaso? (Round she pereechage to one decimal place.) The operating incorme wit increase by Requirement 9. What is the company/s curtent margin of aasety in sales dolars? What is its magn of safety an a percentsge of sabes? Blegin by identifying the formula The current margin of satety in sales doliars is What is its margin of alelefy as a percentaos of sales

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started