Answered step by step

Verified Expert Solution

Question

1 Approved Answer

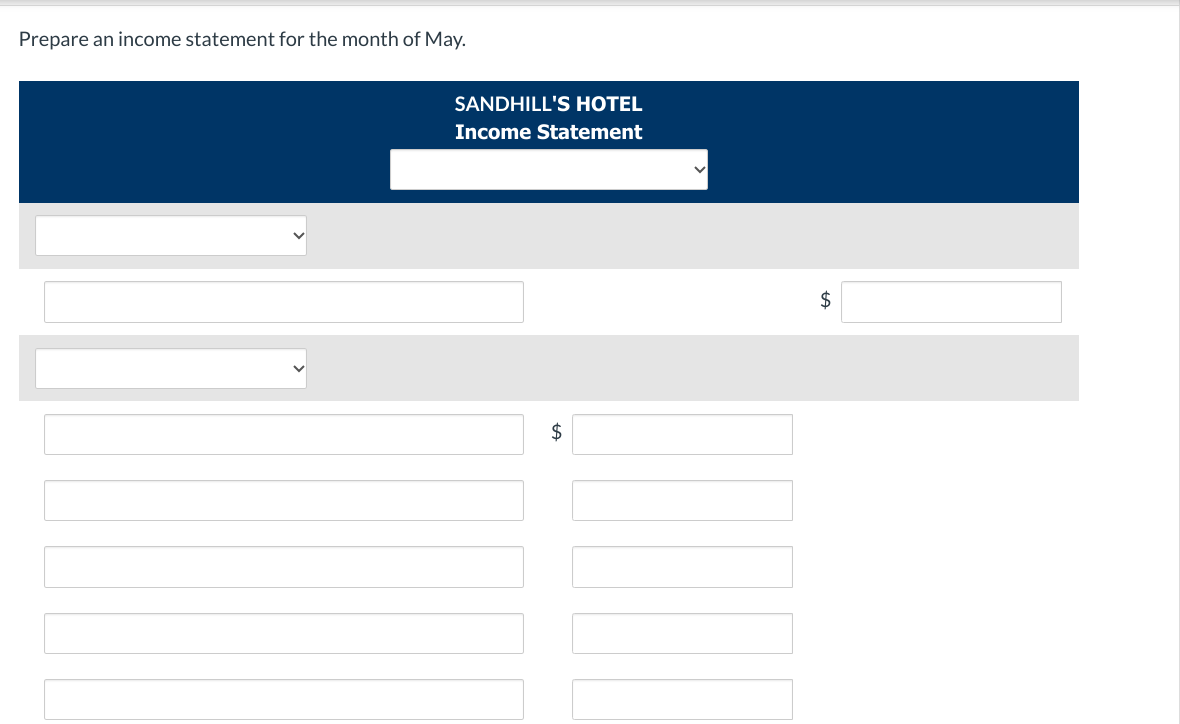

PLease help with answer, thank you so much! Prepare an income statement for the month of May. SANDHILL'S HOTEL Income Statement $ $ Accumulated Depreciation

PLease help with answer, thank you so much!

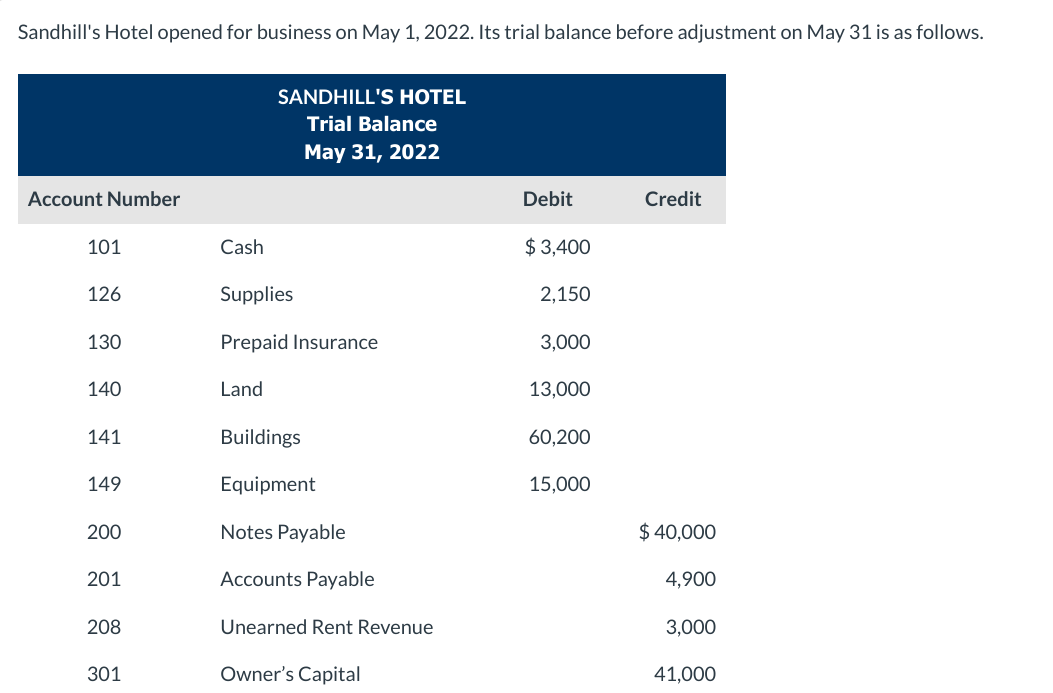

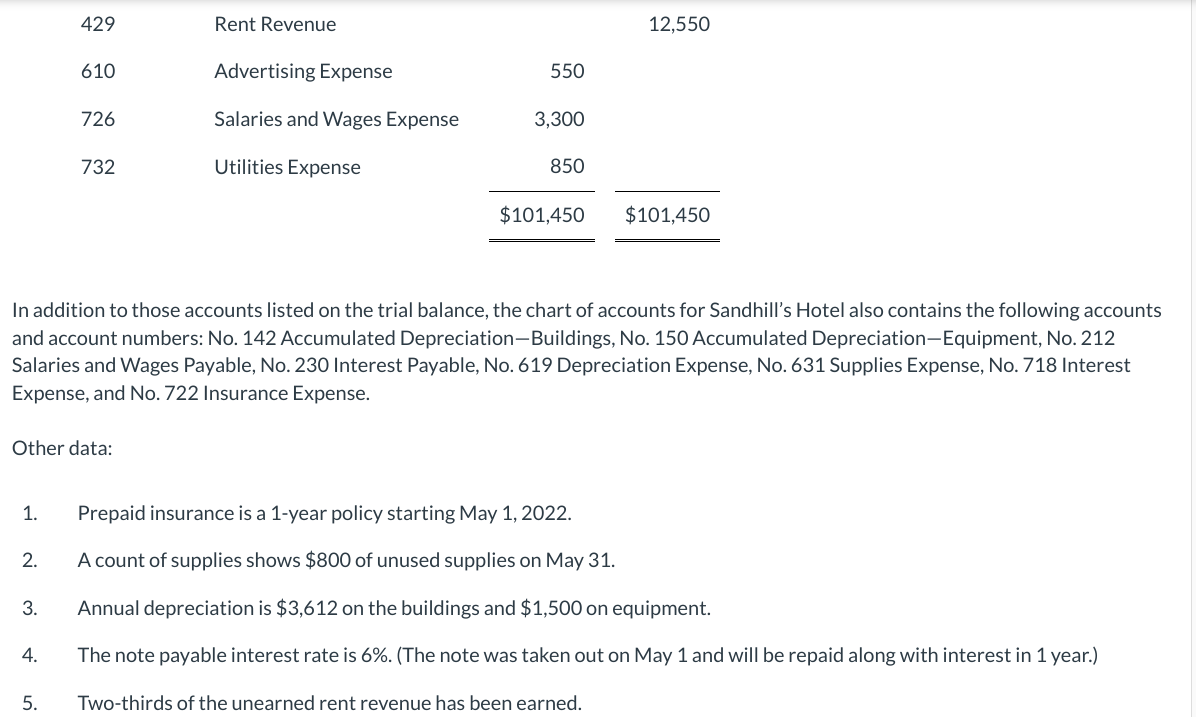

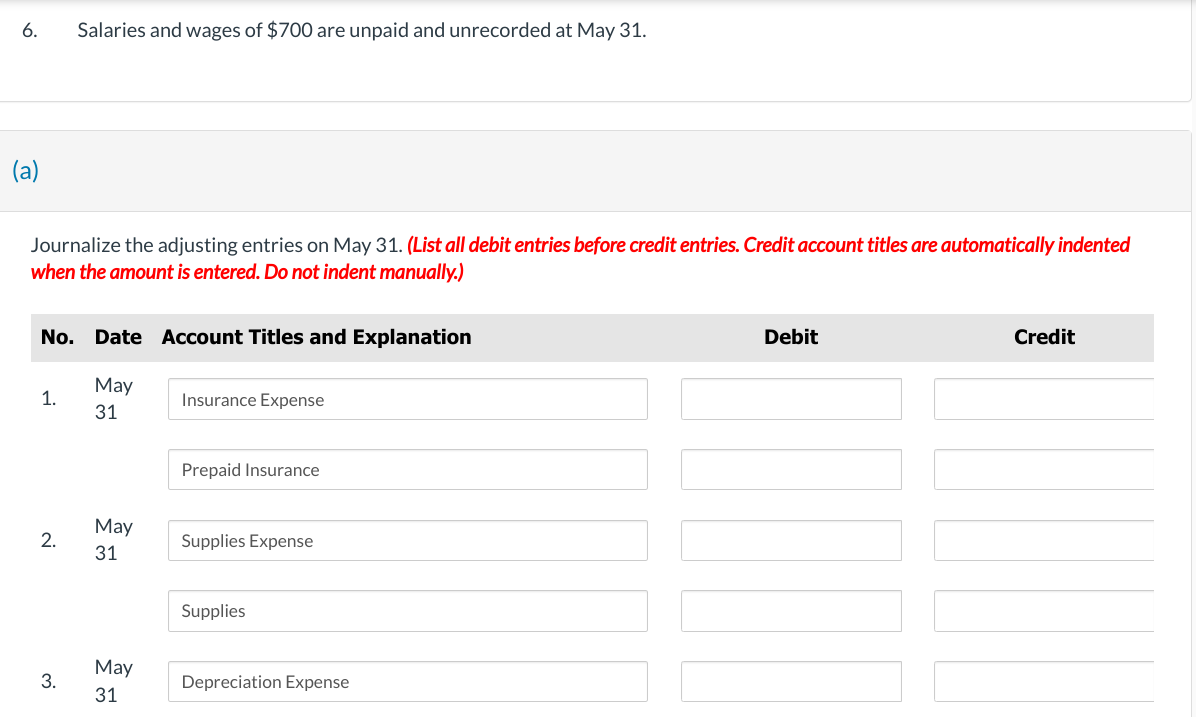

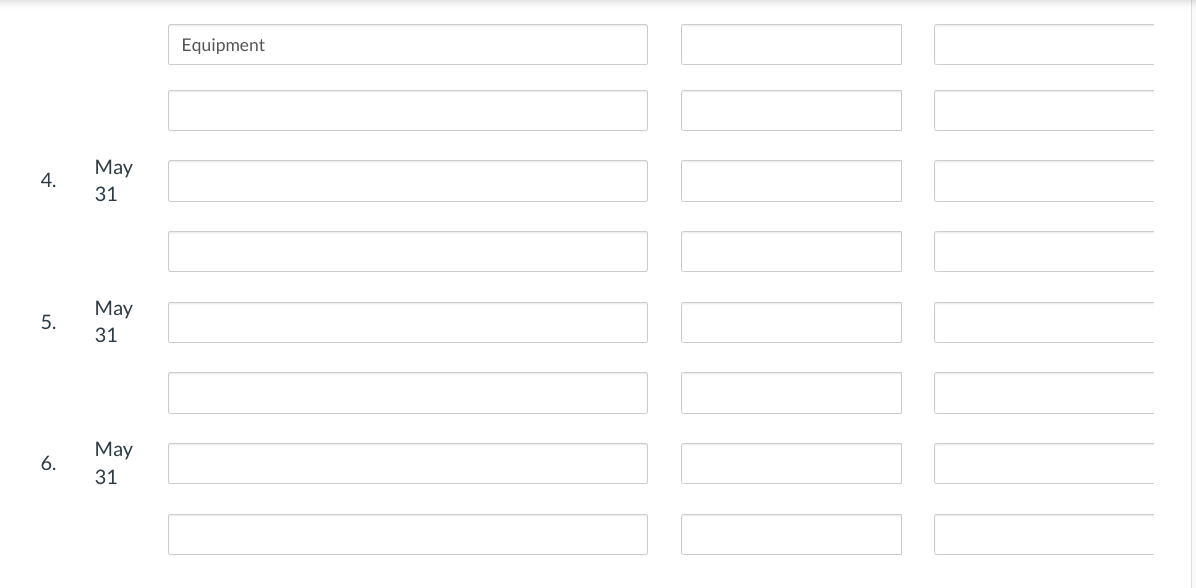

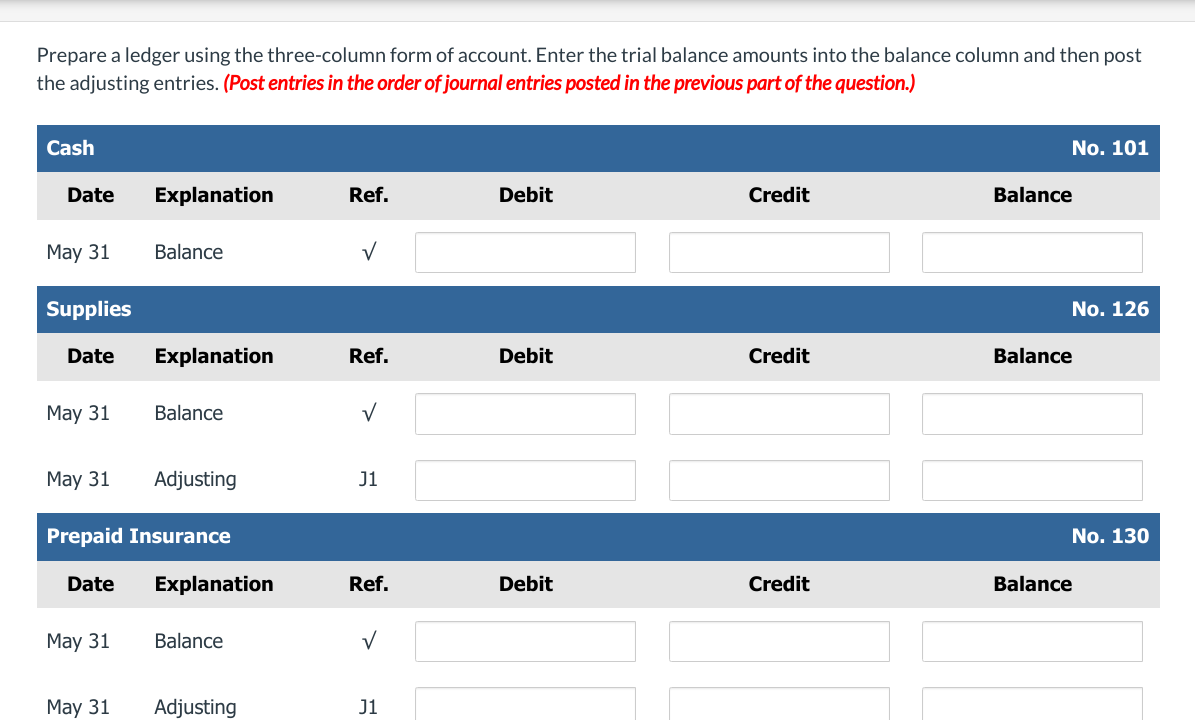

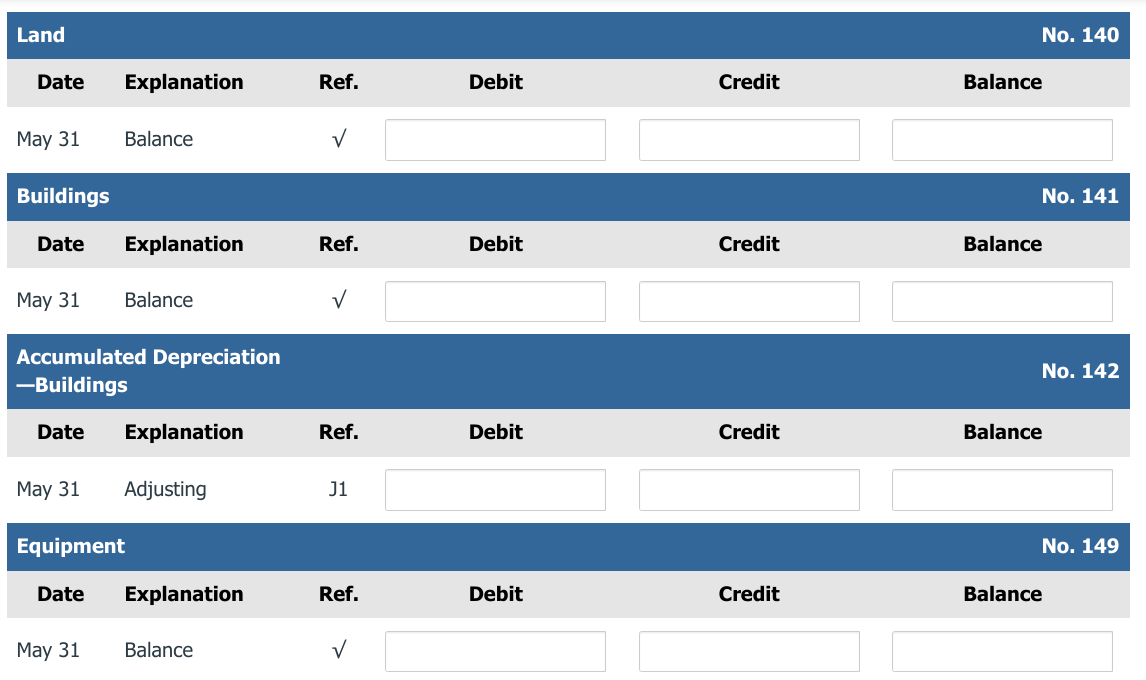

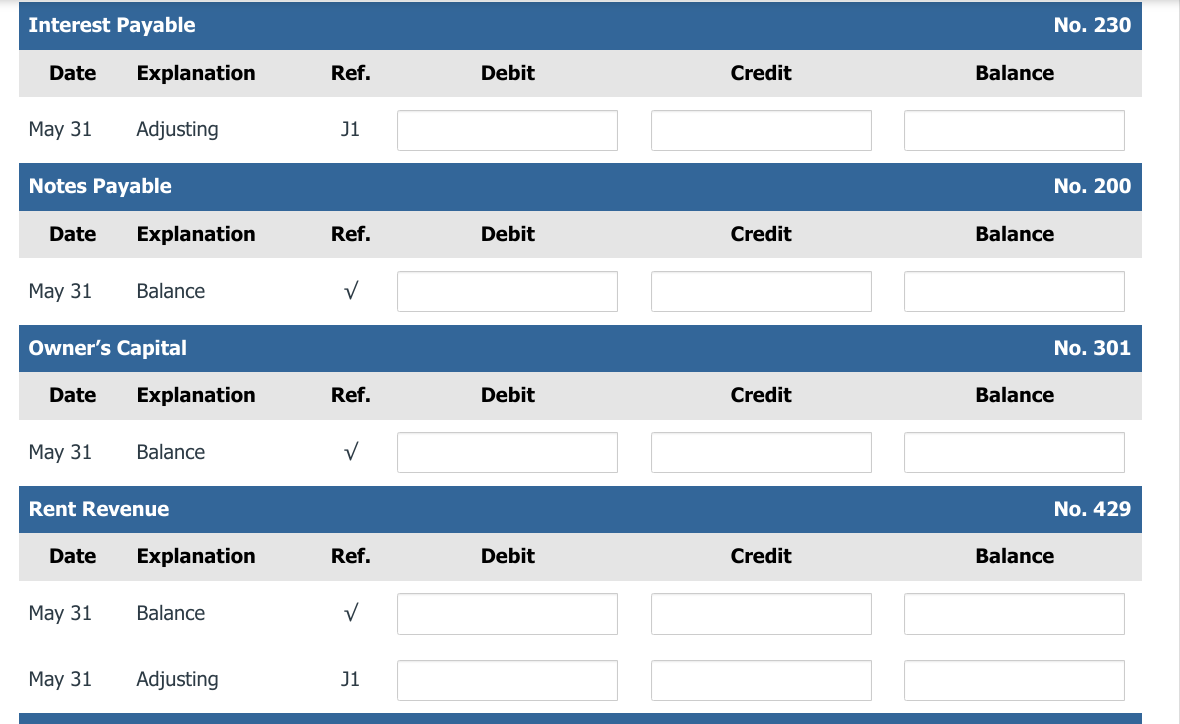

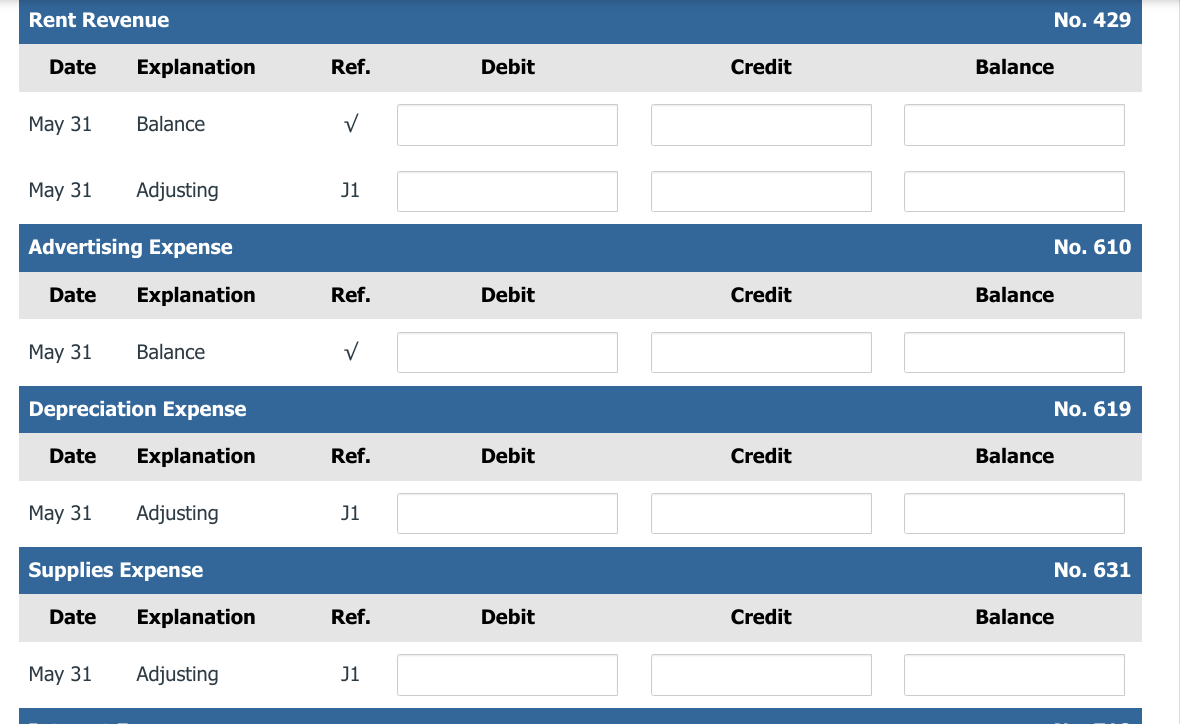

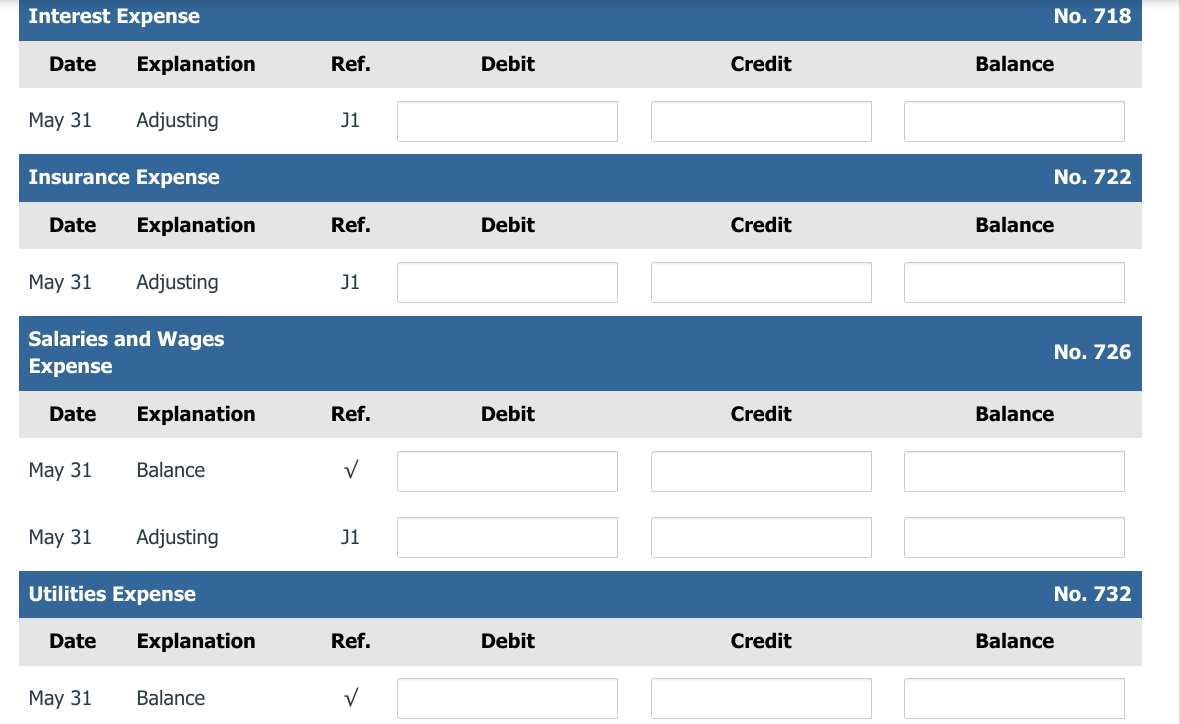

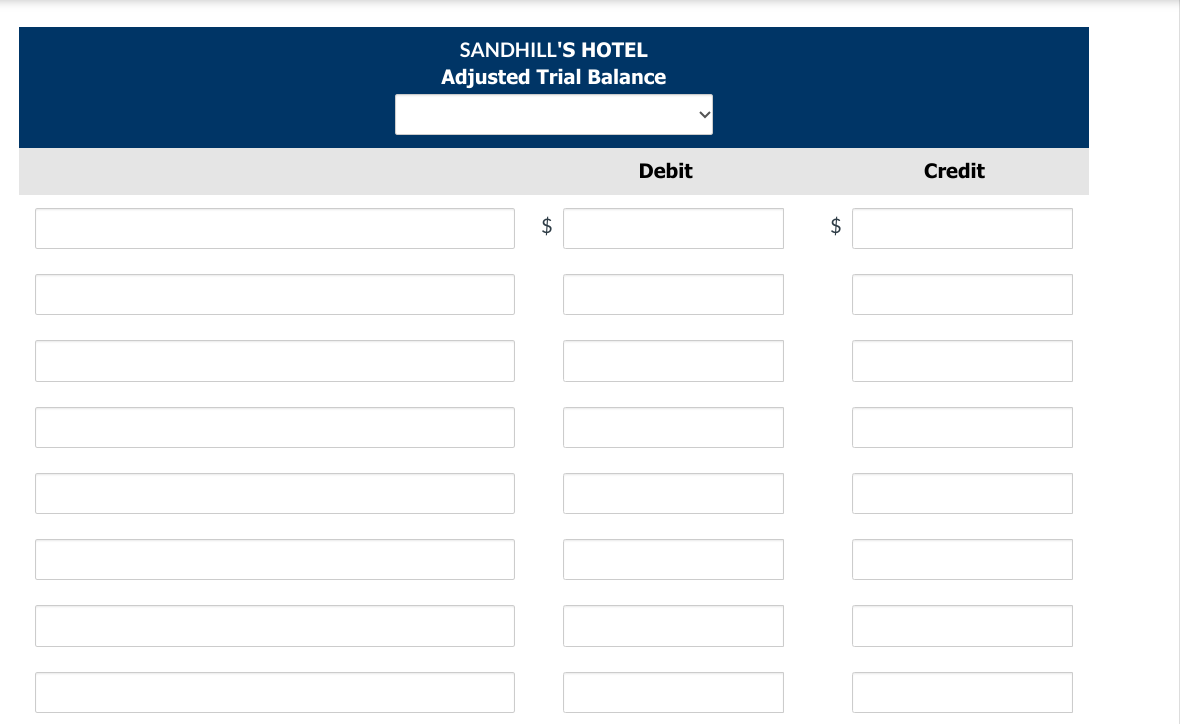

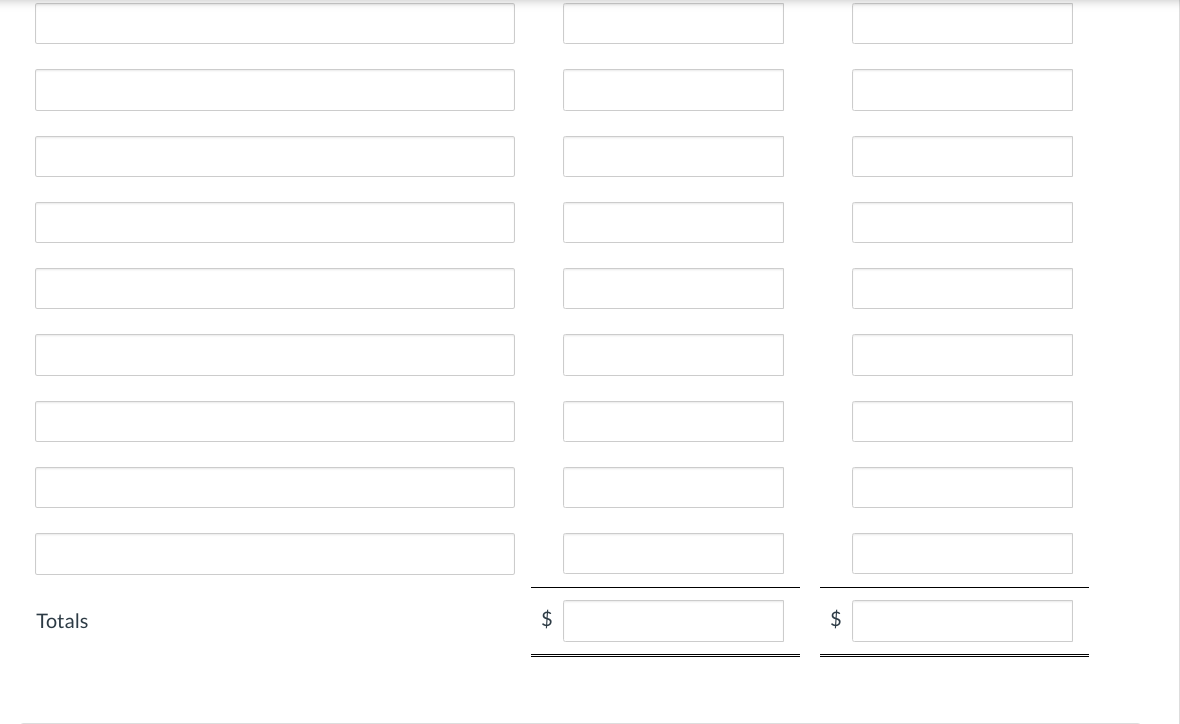

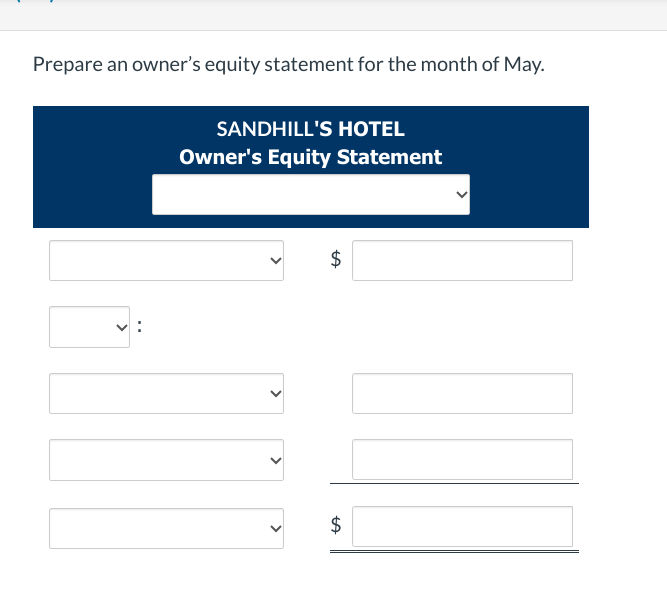

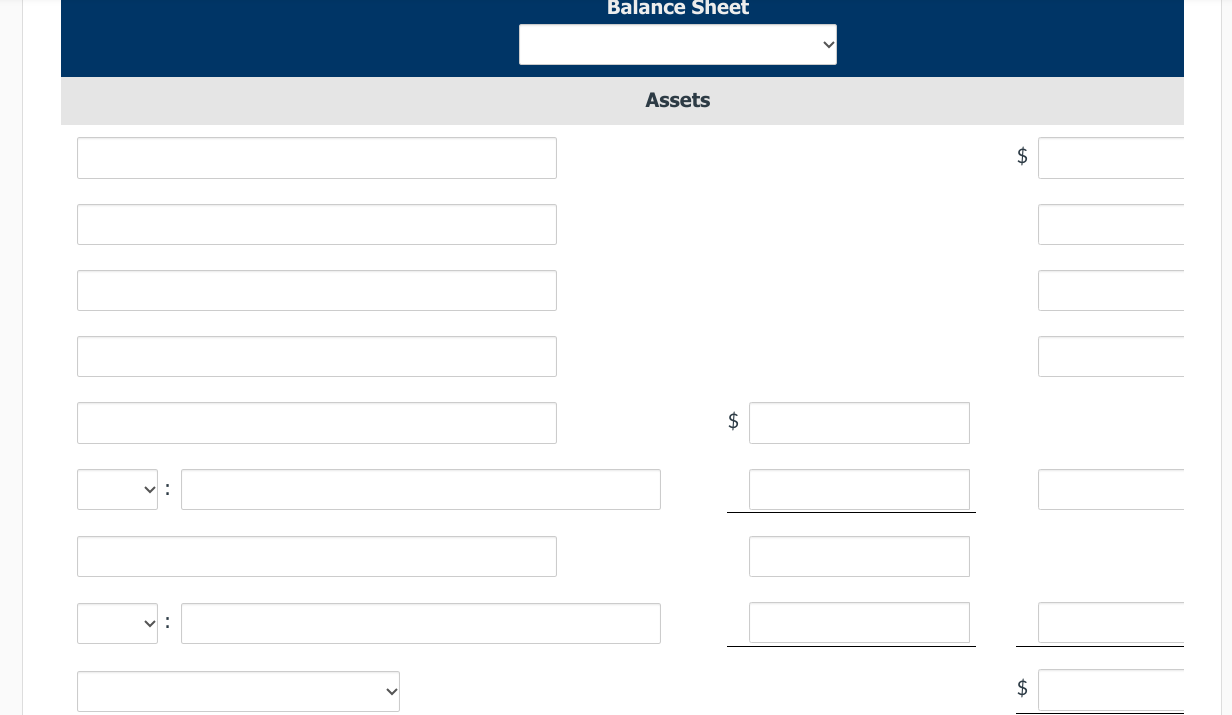

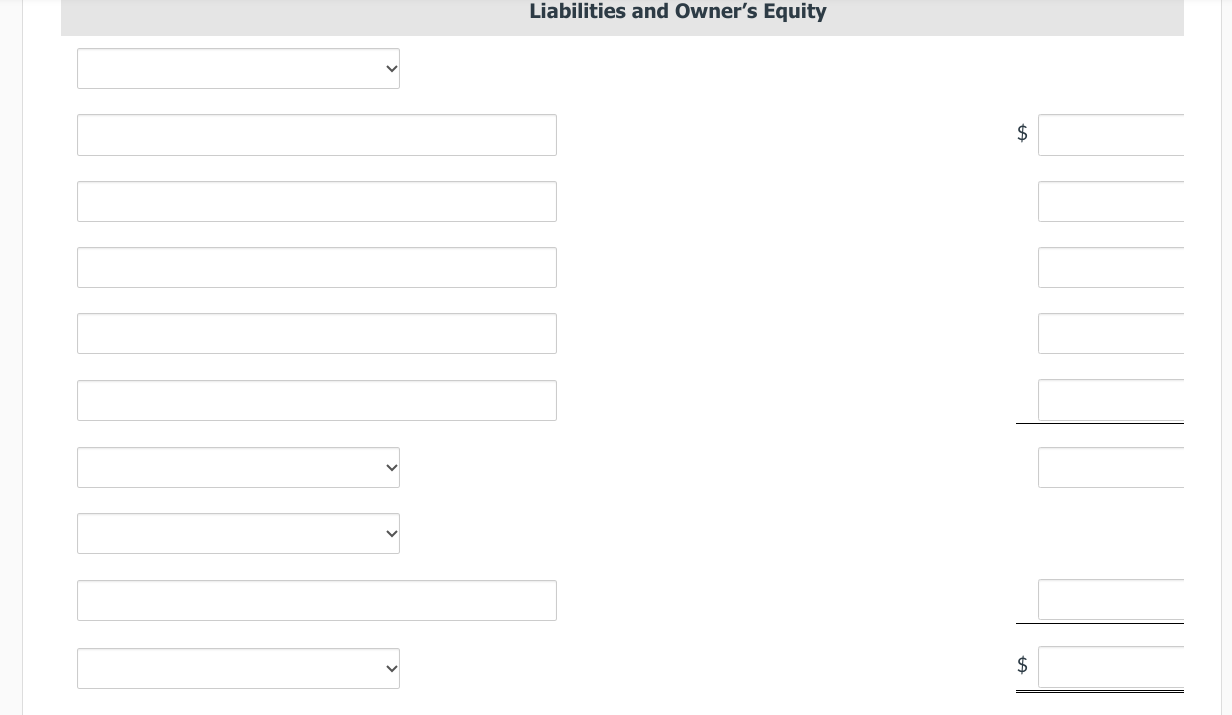

Prepare an income statement for the month of May. SANDHILL'S HOTEL Income Statement $ $ Accumulated Depreciation -Equipment \begin{tabular}{clcl} Date & Explanation & Ref. & Debit \\ May 31 & Adjusting & J1 & \\ \hline \end{tabular} Accounts Payable \begin{tabular}{cccc} Date & Explanation & Ref. & Debit \\ May 31 & Balance & & \\ \hline \end{tabular} Unearned Rent Revenue No. 150 Balance No. 201 \begin{tabular}{clccc} Date & Explanation & Ref. & Debit & Credit \\ May 31 & Balance & & \\ May 31 & Adjusting & J1 & \\ \hline \end{tabular} Salaries and Wages Payable No. 212 \begin{tabular}{clccc} Date & Explanation & Ref. & Debit & Credit \\ \hline May 31 & Adjusting & J1 & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline Land & & & & & \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & Balance & & & & \\ \hline Building & & & & & \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & Balance & & & & \\ \hline \begin{tabular}{l} Accumu \\ -Buildi \end{tabular} & \begin{tabular}{l} ted Depreciat \\ is \end{tabular} & & & & \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & Adjusting & J1 & & & \\ \hline Equipm & & & & & \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & Balance & & & & \\ \hline \end{tabular} Interest Expense No. 718 \begin{tabular}{|c|c|c|c|c|c|} \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & Adjusting & J1 & & & \\ \hline \multicolumn{5}{|c|}{ Insurance Expense } & No. 722 \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & Adjusting & J1 & & & \\ \hline \multicolumn{5}{|c|}{\begin{tabular}{l} Salaries and Wages \\ Expense \end{tabular}} & No. 726 \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & Balance & & & & \\ \hline May 31 & Adjusting & J1 & & & \\ \hline \multicolumn{5}{|c|}{ Utilities Expense } & No. 732 \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & Balance & & & & \\ \hline \end{tabular} Equipment 4. May 31 5. May 31 6. May 31 SANDHILL'S HOTEL Adjusted Trial Balance Debit $ Credit $ \begin{tabular}{|c|c|c|c|c|c|} \hline Interest & ayable & & & & \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & Adjusting & J1 & & & \\ \hline Notes P & able & & & & \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & Balance & & & & \\ \hline Owner's & apital & & & & \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & Balance & & & & \\ \hline Rent R & anue & & & & \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & Balance & & & & \\ \hline May 31 & Adjusting & J1 & & & \\ \hline \end{tabular} Prepare an owner's equity statement for the month of May. 6. Salaries and wages of $700 are unpaid and unrecorded at May 31 . a) Journalize the adjusting entries on May 31. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Balance Sheet Assets $ $ $ Sandhill's Hotel opened for business on May 1, 2022. Its trial balance before adjustment on May 31 is as follows. In addition to those accounts listed on the trial balance, the chart of accounts for Sandhill's Hotel also contains the following accounts and account numbers: No. 142 Accumulated Depreciation-Buildings, No. 150 Accumulated Depreciation-Equipment, No. 212 Salaries and Wages Payable, No. 230 Interest Payable, No. 619 Depreciation Expense, No. 631 Supplies Expense, No. 718 Interest Expense, and No. 722 Insurance Expense. Other data: 1. Prepaid insurance is a 1-year policy starting May 1, 2022. 2. A count of supplies shows $800 of unused supplies on May 31. 3. Annual depreciation is $3,612 on the buildings and $1,500 on equipment. 4. The note payable interest rate is 6%. (The note was taken out on May 1 and will be repaid along with interest in 1 year.) 5. Two-thirds of the unearned rent revenue has been earned. \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Rent Revenue } & No. 429 \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & Balance & & & & \\ \hline May 31 & Adjusting & J1 & & & \\ \hline \multicolumn{5}{|c|}{ Advertising Expense } & No. 610 \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & Balance & & & & \\ \hline \multicolumn{5}{|c|}{ Depreciation Expense } & No. 619 \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & Adjusting & J1 & & & \\ \hline \multicolumn{5}{|c|}{ Supplies Expense } & No. 631 \\ \hline Date & Explanation & Ref. & Debit & Credit & Balance \\ \hline May 31 & Adjusting & J1 & & & \\ \hline \end{tabular} Prepare a ledger using the three-column form of account. Enter the trial balance amounts into the balance column and then post the adjusting entries. (Post entries in the order of journal entries posted in the previous part of the question.) Totals Liabilities and Owner's Equity $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started