Please help with below financial analysis

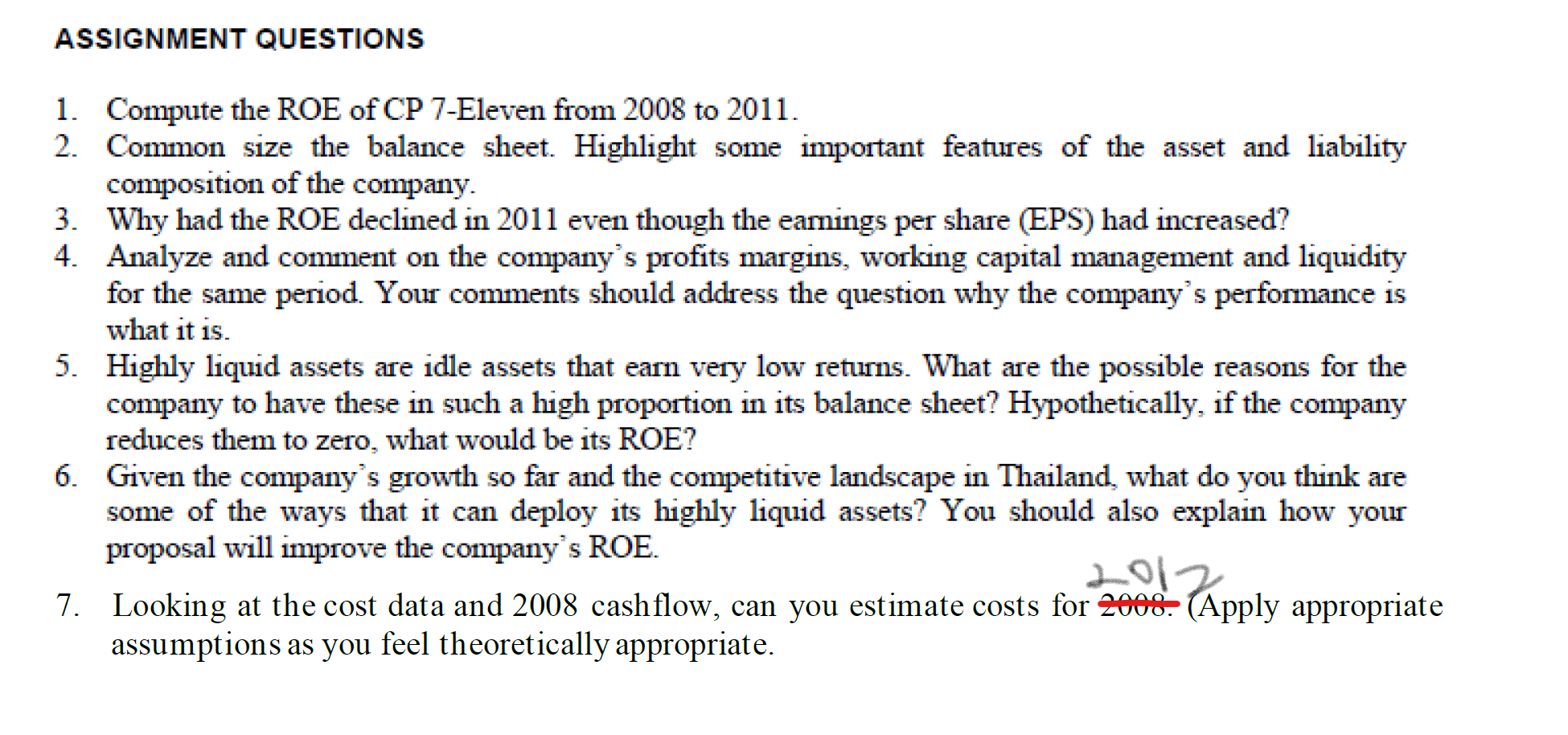

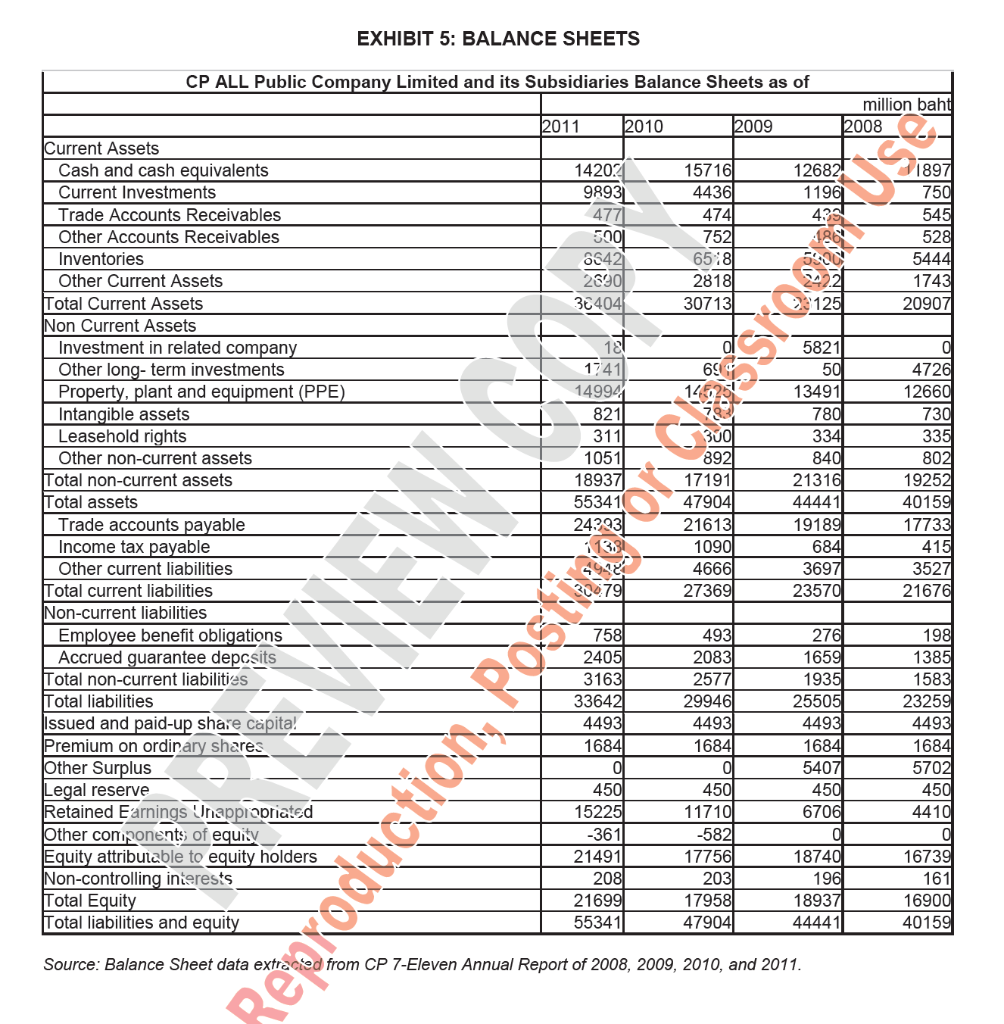

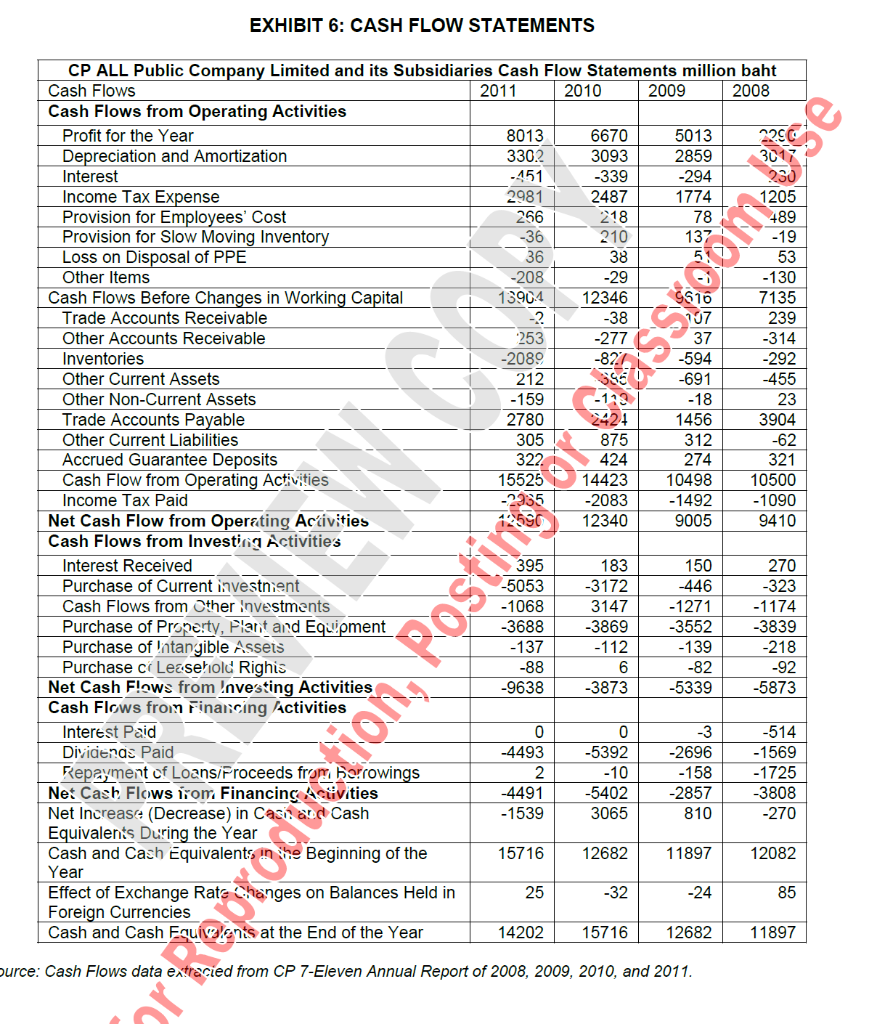

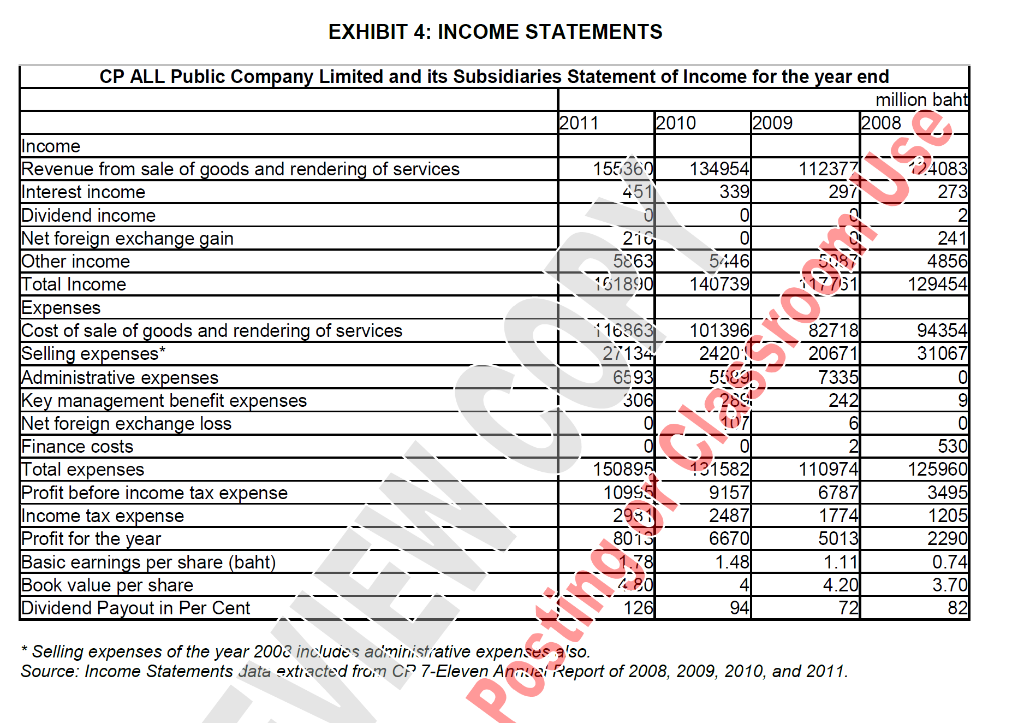

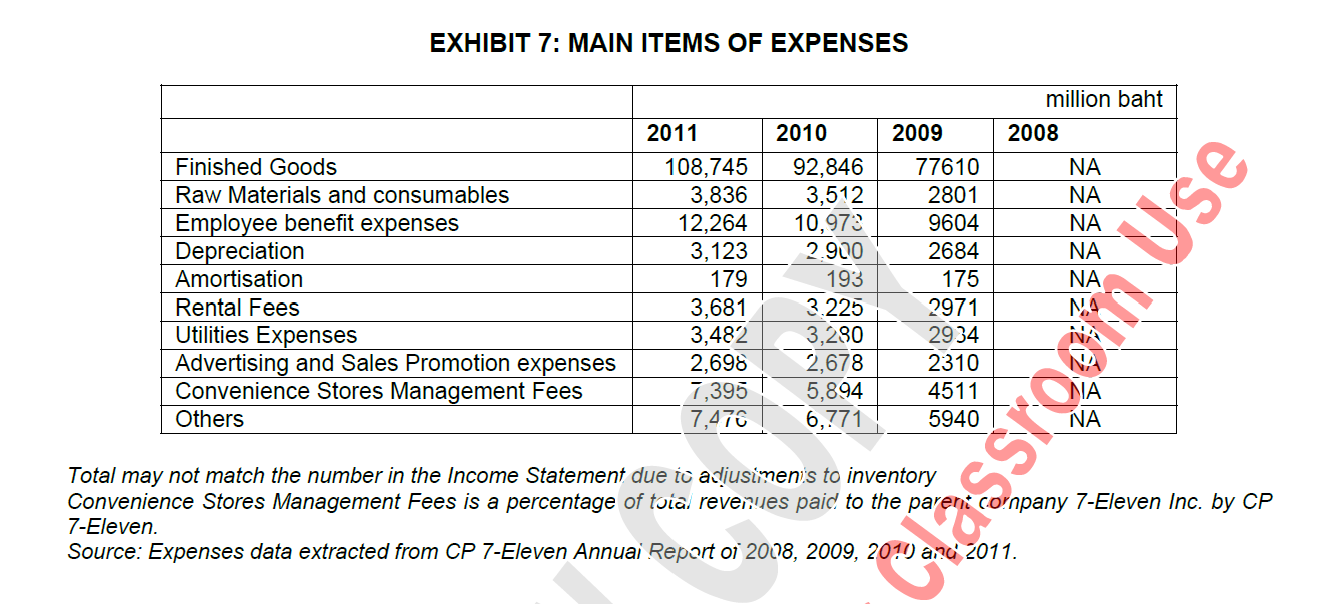

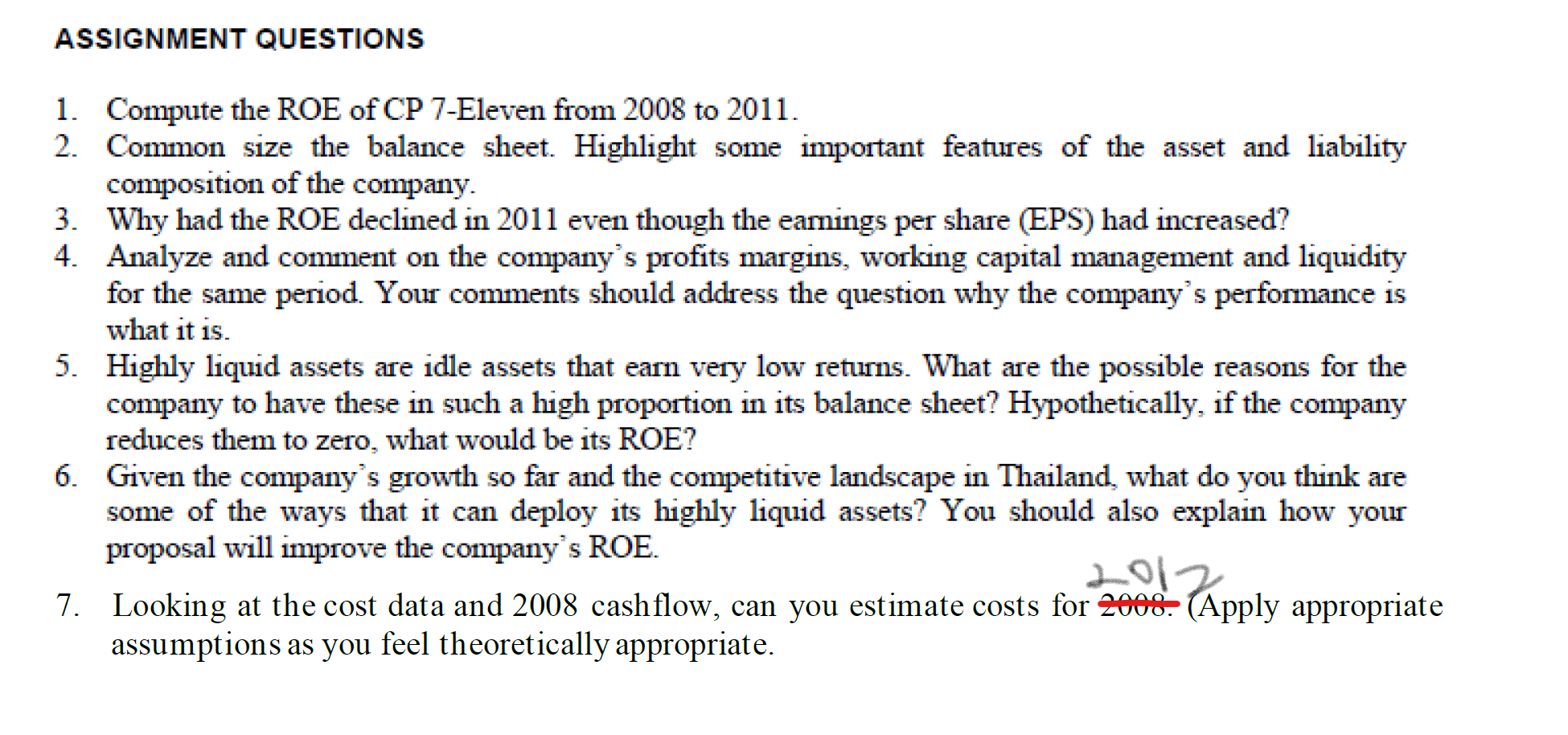

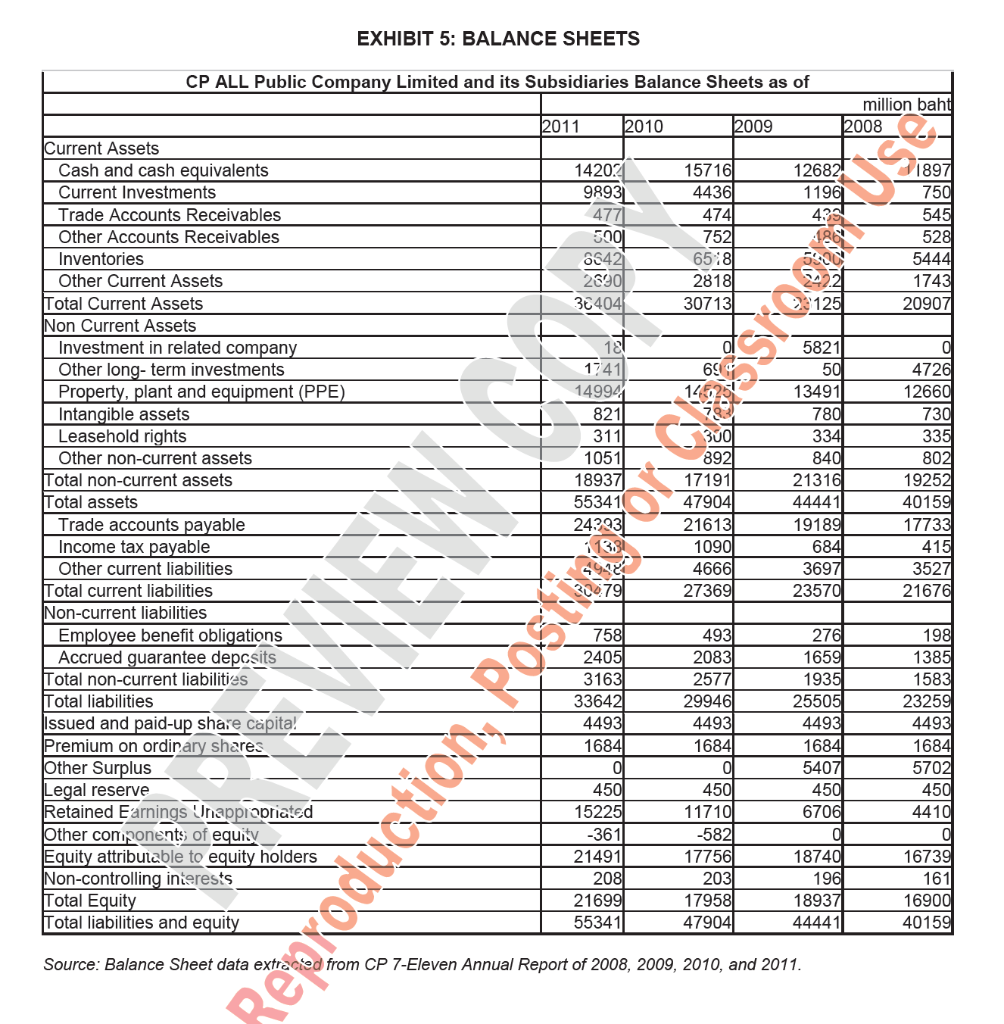

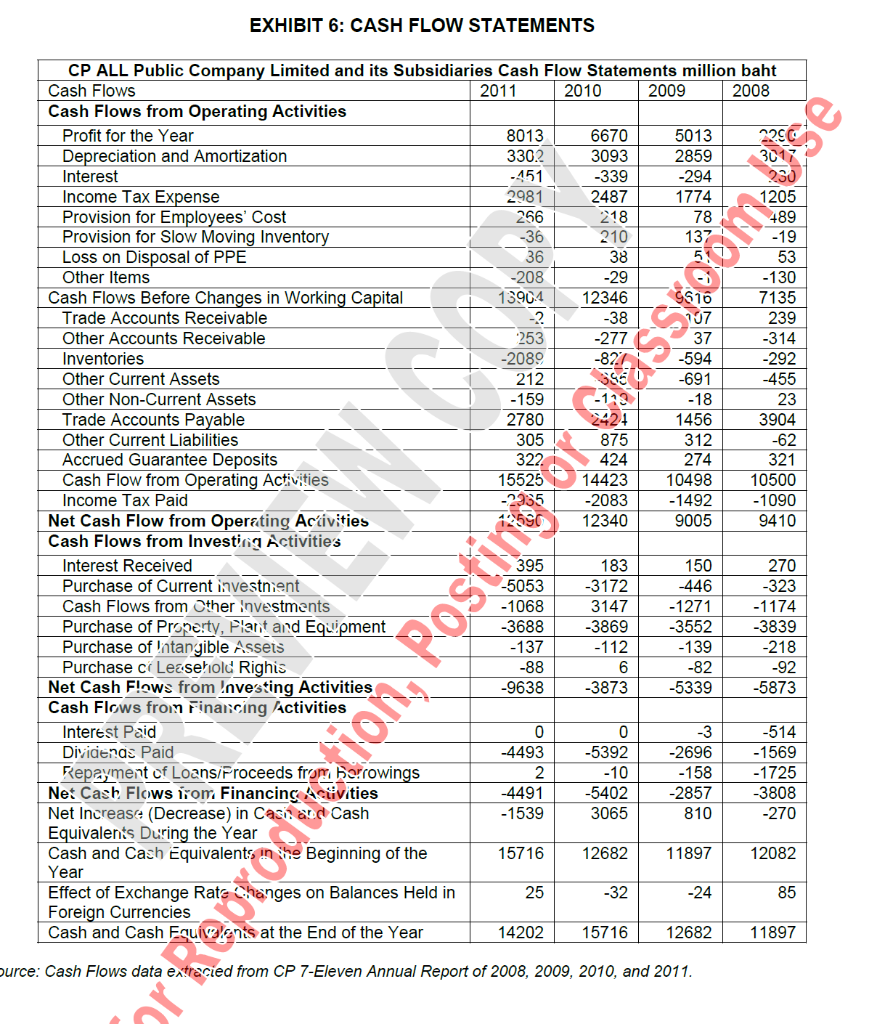

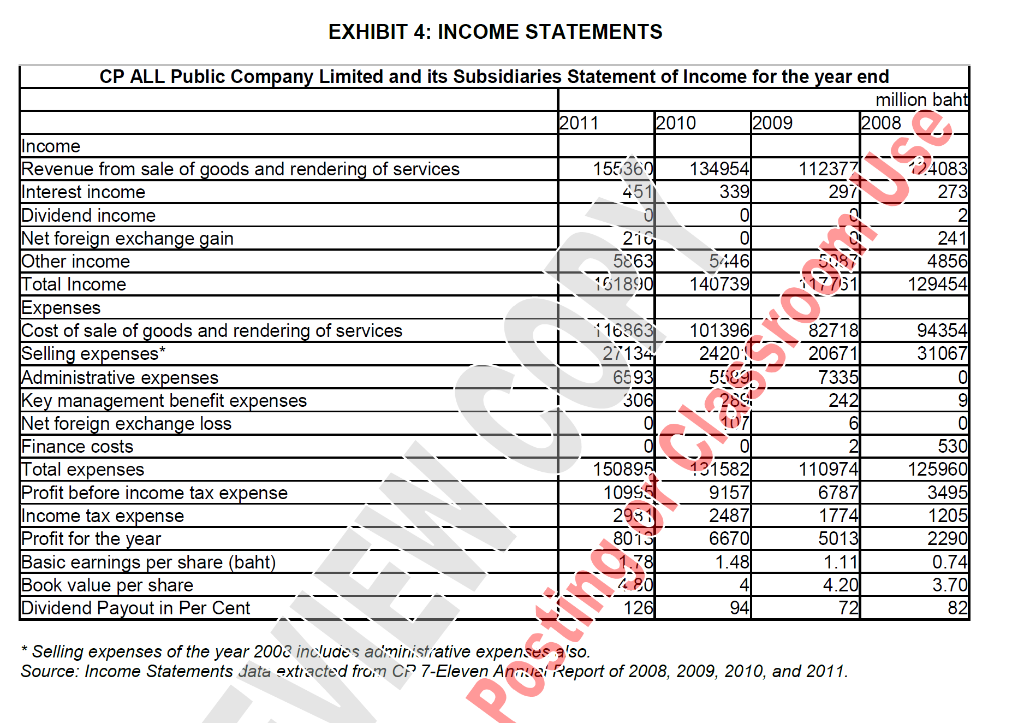

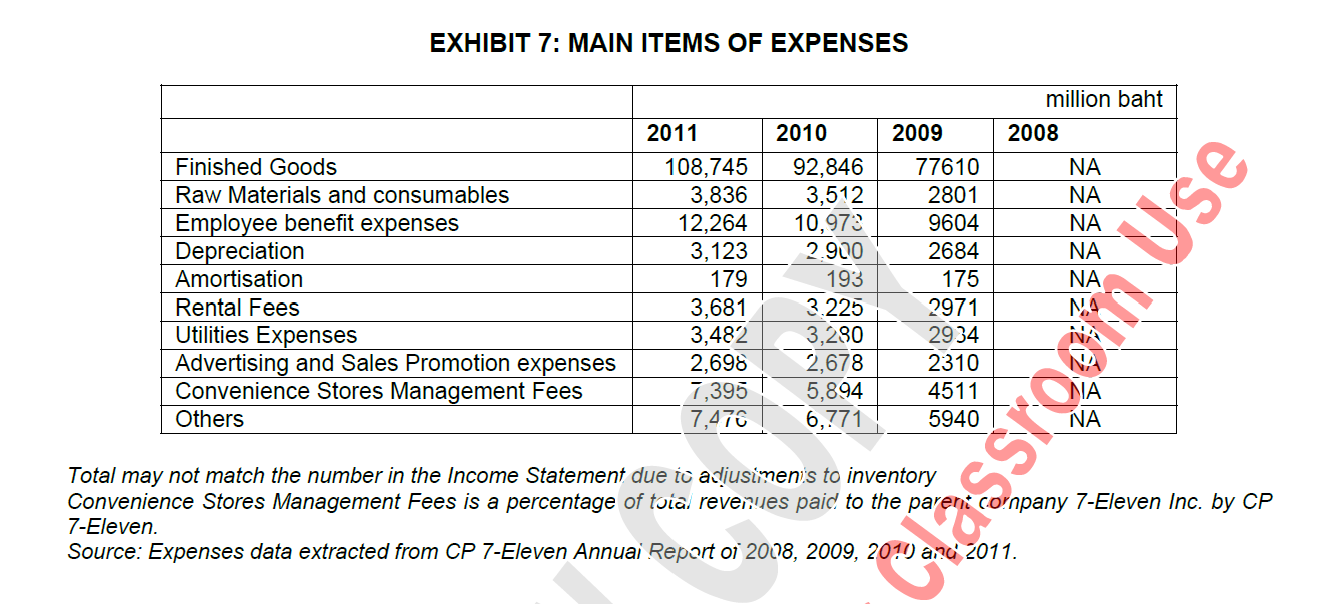

ASSIGNMENT QUESTIONS 1. Compute the ROE of CP 7-Eleven from 2008 to 2011. 2. Common size the balance sheet. Highlight some important features of the asset and liability composition of the company. 3. Why had the ROE declined in 2011 even though the eamings per share (EPS) had increased? 4. Analyze and comment on the company's profits margins, working capital management and liquidity for the same period. Your comments should address the question why the company's performance is what it is. 5. Highly liquid assets are idle assets that earn very low returns. What are the possible reasons for the company to have these in such a high proportion in its balance sheet? Hypothetically, if the company reduces them to zero, what would be its ROE? Given the company's growth so far and the competitive landscape in Thailand, what do you think are some of the ways that it can deploy its highly liquid assets? You should also explain how your proposal will improve the company's ROE. 2012 7. Looking at the cost data and 2008 cash flow, can you estimate costs for 2008. (Apply appropriate assumptions as you feel theoretically appropriate. EXHIBIT 5: BALANCE SHEETS CP ALL Public Company Limited and its Subsidiaries Balance Sheets as of million baht 2008 2011 2010 2009 12682 1196 4351 14202 9893 4771 5001 6842 2830 3404 15716 4436 474 752 6518 2818 30713 186) 1897 750 545 528 5444 1743 20907 2222 23125 1 5821 699 50 300 Current Assets Cash and cash equivalents Current Investments Trade Accounts Receivables Other Accounts Receivables Inventories Other Current Assets Total Current Assets Non Current Assets Investment in related company Other long-term investments Property, plant and equipment (PPE) Intangible assets Leasehold rights Other non-current assets Total non-current assets Total assets Trade accounts payable Income tax payable | Other current liabilities Total current liabilities Non-current liabilities Employee benefit obligations | Accrued guarantee deposits Total non-current liabilities Total liabilities Issued and paid-up share Capital Premium on ordinary shares Other Surplus Legal reserve Retained Earnings Unappropriated Other components of equity Equity attributable to equity holders Non-controlling interests Total Equity Total liabilities and equity 1741 14994 8211 311 10511 18937 55341 24393 11331 892 17191 47904 21613 1090 4666 27369 13491 780 3341 840 21316 444411 19189 684 3697 23570 4726 12660 730 335 802 19252 40159 17733 415 3527 21676 K_30079 758 2405 31631 336421 4493 1684 493 2083 2577 29946 4493 1684 276 1659) 1935 25505 4493 1684 5407 450 6706 Reproduction, Rosor 198 1385 1583 23259 4493 1684 5702 450 4410 450 15225 -361 21491 208 21699 55341 4501 11710 -582 17756 203 17958 47904 16739 161 18740 196 18937 444411 16900 40159 Source: Balance Sheet data extracted from CP 7-Eleven Annual Report of 2008, 2009, 2010, and 2011. EXHIBIT 6: CASH FLOW STATEMENTS 78 137 36 38 511 aly CP ALL Public Company Limited and its subsidiaries Cash Flow Statements million baht Cash Flows 2011 2010 2009 2008 Cash Flows from Operating Activities Profit for the Year 8013 6670 5013 2290 Depreciation and Amortization 3302 3093 2859 3017 Interest -451 -339 -294 230 Income Tax Expense 2981 2487 1774 1205 Provision for Employees' Cost 256 218 489 Provision for Slow Moving Inventory -36 210 Loss on Disposal of PPE Other Items -208 -29 -130 Cash Flows Before Changes in Working Capital 13904 12346 7135 Trade Accounts Receivable -38 239 Other Accounts Receivable 253 -277 37 -314 Inventories -2089 -827 -594 -292 Other Current Assets 212 3560 -691 -455 Other Non-Current Assets -159 -18 23 Trade Accounts Payable 2780 1456 3904 Other Current Liabilities 305 875 312 -62 Accrued Guarantee Deposits 3221 424 274 321 Cash Flow from Operating Activities 155251 14423 10498 10500 Income Tax Paid -2335 -2083 - 1492 -1090 Net Cash Flow from Operating Activities 125601 12340 9005 9410 Cash Flows from Investing Activities Interest Received 395 183 150 270 Purchase of Current investnient -5053 -3172 -446 -323 Cash Flows from ther Investments -1068 3147 -1271 -1174 Purchase of Property, Flart and Equipment -3688 -3869 -3552 -3839 Purchase of latangible Assets -137 -112 -139 -218 Purchase c Leasehold Righis -88 -82 -92 Net Cash Flows from Investing Activities -9638 -3873 -5339 -5873 Cash Flows froin Financing activities Interest Paid 0 -3 -514 Divideras Paid -4493 -5392 -2696 -1569 Kepayment of Loans/Proceeds from borrowings -10 -158 -1725 Net Cash Flows from Financing Activities -4491 -5402 -2857 -3808 Net Increase (Decrease) in Casi: al Cash -1539 3065 810 -270 Equivalents During the Year Cash and Cash Equivalents in the Beginning of the 15716 12682 11897 12082 Year Effect of Exchange Rate Changes on Balances Held in 25 -32 85 Foreign Currencies Cash and Cash Equivalents at the End of the Year 14202 15716 12682 11897 or Reproduction, Postilig or glassroom Use - - 24 ource: Cash Flows data extracied from CP 7-Eleven Annual Report of 2008, 2009, 2010, and 2011. EXHIBIT 4: INCOME STATEMENTS 339 297 JY 2 CP ALL Public Company Limited and its subsidiaries Statement of Income for the year end million baht 2011 2010 2009 2008 Income Revenue from sale of goods and rendering of services 1553601349541123771 24083 Interest income 273 Dividend income Net foreign exchange gain 210 241 Other income 5863 5446 4856 Total Income 151890 140739 17751 129454 Expenses Cost of sale of goods and rendering of services i 16863 1013961 82718 94354 Selling expenses* 27134 2420:00 20671 31067 Administrative expenses 6593 55091 7335 Key management benefit expenses 306 242 Net foreign exchange loss Finance costs 0 530 Total expenses 150895 131582 110974 125960 Profit before income tax expense 109951 91571 6787 3495 Income tax expense 2931 2487 17741 1205 Profit for the year 80131 66701 5013 2290 Basic earnings per share (baht) 1.78 1.481 1.11 0.74 Book value per share 1.80 4 4.20 3.70 Dividend Payout in Per Cent 126 9472 82 _ O 071 * Selling expenses of the year 2003 includes administrative expenses also. Source: Income Statements data extracted from CP 7-Eleven Annual Report of 2008, 2009, 2010, and 2011. EXHIBIT 7: MAIN ITEMS OF EXPENSES million baht 2008 NA NA Finished Goods Raw Materials and consumables Employee benefit expenses Depreciation Amortisation Rental Fees | Utilities Expenses Advertising and Sales Promotion expenses Convenience Stores Management Fees Others 17 2011 2010 108,745 92,846 3,836 3,512 12,264 10,973 3,123 2.900 179 193 3,681 3.225 3,482 3,280 2,698 2,678 7,3955,894 7,476 6,771 2009 77610 2801 9604 2684 175 2971 2934 2310 4511 5940 NA NA NA Total may not match the number in the Income Statement due to adiusinen's to inventory Convenience Stores Management Fees is a percentage of toca, reverues paid to the parent cornpany 7-Eleven Inc. by CP 7-Eleven. Source: Expenses data extracted from CP 7-Eleven Annuai Report oi 2008, 2009, 2010) aru 2011. ASSIGNMENT QUESTIONS 1. Compute the ROE of CP 7-Eleven from 2008 to 2011. 2. Common size the balance sheet. Highlight some important features of the asset and liability composition of the company. 3. Why had the ROE declined in 2011 even though the eamings per share (EPS) had increased? 4. Analyze and comment on the company's profits margins, working capital management and liquidity for the same period. Your comments should address the question why the company's performance is what it is. 5. Highly liquid assets are idle assets that earn very low returns. What are the possible reasons for the company to have these in such a high proportion in its balance sheet? Hypothetically, if the company reduces them to zero, what would be its ROE? Given the company's growth so far and the competitive landscape in Thailand, what do you think are some of the ways that it can deploy its highly liquid assets? You should also explain how your proposal will improve the company's ROE. 2012 7. Looking at the cost data and 2008 cash flow, can you estimate costs for 2008. (Apply appropriate assumptions as you feel theoretically appropriate. EXHIBIT 5: BALANCE SHEETS CP ALL Public Company Limited and its Subsidiaries Balance Sheets as of million baht 2008 2011 2010 2009 12682 1196 4351 14202 9893 4771 5001 6842 2830 3404 15716 4436 474 752 6518 2818 30713 186) 1897 750 545 528 5444 1743 20907 2222 23125 1 5821 699 50 300 Current Assets Cash and cash equivalents Current Investments Trade Accounts Receivables Other Accounts Receivables Inventories Other Current Assets Total Current Assets Non Current Assets Investment in related company Other long-term investments Property, plant and equipment (PPE) Intangible assets Leasehold rights Other non-current assets Total non-current assets Total assets Trade accounts payable Income tax payable | Other current liabilities Total current liabilities Non-current liabilities Employee benefit obligations | Accrued guarantee deposits Total non-current liabilities Total liabilities Issued and paid-up share Capital Premium on ordinary shares Other Surplus Legal reserve Retained Earnings Unappropriated Other components of equity Equity attributable to equity holders Non-controlling interests Total Equity Total liabilities and equity 1741 14994 8211 311 10511 18937 55341 24393 11331 892 17191 47904 21613 1090 4666 27369 13491 780 3341 840 21316 444411 19189 684 3697 23570 4726 12660 730 335 802 19252 40159 17733 415 3527 21676 K_30079 758 2405 31631 336421 4493 1684 493 2083 2577 29946 4493 1684 276 1659) 1935 25505 4493 1684 5407 450 6706 Reproduction, Rosor 198 1385 1583 23259 4493 1684 5702 450 4410 450 15225 -361 21491 208 21699 55341 4501 11710 -582 17756 203 17958 47904 16739 161 18740 196 18937 444411 16900 40159 Source: Balance Sheet data extracted from CP 7-Eleven Annual Report of 2008, 2009, 2010, and 2011. EXHIBIT 6: CASH FLOW STATEMENTS 78 137 36 38 511 aly CP ALL Public Company Limited and its subsidiaries Cash Flow Statements million baht Cash Flows 2011 2010 2009 2008 Cash Flows from Operating Activities Profit for the Year 8013 6670 5013 2290 Depreciation and Amortization 3302 3093 2859 3017 Interest -451 -339 -294 230 Income Tax Expense 2981 2487 1774 1205 Provision for Employees' Cost 256 218 489 Provision for Slow Moving Inventory -36 210 Loss on Disposal of PPE Other Items -208 -29 -130 Cash Flows Before Changes in Working Capital 13904 12346 7135 Trade Accounts Receivable -38 239 Other Accounts Receivable 253 -277 37 -314 Inventories -2089 -827 -594 -292 Other Current Assets 212 3560 -691 -455 Other Non-Current Assets -159 -18 23 Trade Accounts Payable 2780 1456 3904 Other Current Liabilities 305 875 312 -62 Accrued Guarantee Deposits 3221 424 274 321 Cash Flow from Operating Activities 155251 14423 10498 10500 Income Tax Paid -2335 -2083 - 1492 -1090 Net Cash Flow from Operating Activities 125601 12340 9005 9410 Cash Flows from Investing Activities Interest Received 395 183 150 270 Purchase of Current investnient -5053 -3172 -446 -323 Cash Flows from ther Investments -1068 3147 -1271 -1174 Purchase of Property, Flart and Equipment -3688 -3869 -3552 -3839 Purchase of latangible Assets -137 -112 -139 -218 Purchase c Leasehold Righis -88 -82 -92 Net Cash Flows from Investing Activities -9638 -3873 -5339 -5873 Cash Flows froin Financing activities Interest Paid 0 -3 -514 Divideras Paid -4493 -5392 -2696 -1569 Kepayment of Loans/Proceeds from borrowings -10 -158 -1725 Net Cash Flows from Financing Activities -4491 -5402 -2857 -3808 Net Increase (Decrease) in Casi: al Cash -1539 3065 810 -270 Equivalents During the Year Cash and Cash Equivalents in the Beginning of the 15716 12682 11897 12082 Year Effect of Exchange Rate Changes on Balances Held in 25 -32 85 Foreign Currencies Cash and Cash Equivalents at the End of the Year 14202 15716 12682 11897 or Reproduction, Postilig or glassroom Use - - 24 ource: Cash Flows data extracied from CP 7-Eleven Annual Report of 2008, 2009, 2010, and 2011. EXHIBIT 4: INCOME STATEMENTS 339 297 JY 2 CP ALL Public Company Limited and its subsidiaries Statement of Income for the year end million baht 2011 2010 2009 2008 Income Revenue from sale of goods and rendering of services 1553601349541123771 24083 Interest income 273 Dividend income Net foreign exchange gain 210 241 Other income 5863 5446 4856 Total Income 151890 140739 17751 129454 Expenses Cost of sale of goods and rendering of services i 16863 1013961 82718 94354 Selling expenses* 27134 2420:00 20671 31067 Administrative expenses 6593 55091 7335 Key management benefit expenses 306 242 Net foreign exchange loss Finance costs 0 530 Total expenses 150895 131582 110974 125960 Profit before income tax expense 109951 91571 6787 3495 Income tax expense 2931 2487 17741 1205 Profit for the year 80131 66701 5013 2290 Basic earnings per share (baht) 1.78 1.481 1.11 0.74 Book value per share 1.80 4 4.20 3.70 Dividend Payout in Per Cent 126 9472 82 _ O 071 * Selling expenses of the year 2003 includes administrative expenses also. Source: Income Statements data extracted from CP 7-Eleven Annual Report of 2008, 2009, 2010, and 2011. EXHIBIT 7: MAIN ITEMS OF EXPENSES million baht 2008 NA NA Finished Goods Raw Materials and consumables Employee benefit expenses Depreciation Amortisation Rental Fees | Utilities Expenses Advertising and Sales Promotion expenses Convenience Stores Management Fees Others 17 2011 2010 108,745 92,846 3,836 3,512 12,264 10,973 3,123 2.900 179 193 3,681 3.225 3,482 3,280 2,698 2,678 7,3955,894 7,476 6,771 2009 77610 2801 9604 2684 175 2971 2934 2310 4511 5940 NA NA NA Total may not match the number in the Income Statement due to adiusinen's to inventory Convenience Stores Management Fees is a percentage of toca, reverues paid to the parent cornpany 7-Eleven Inc. by CP 7-Eleven. Source: Expenses data extracted from CP 7-Eleven Annuai Report oi 2008, 2009, 2010) aru 2011