Please help with both question 1 and 2. Thank you!

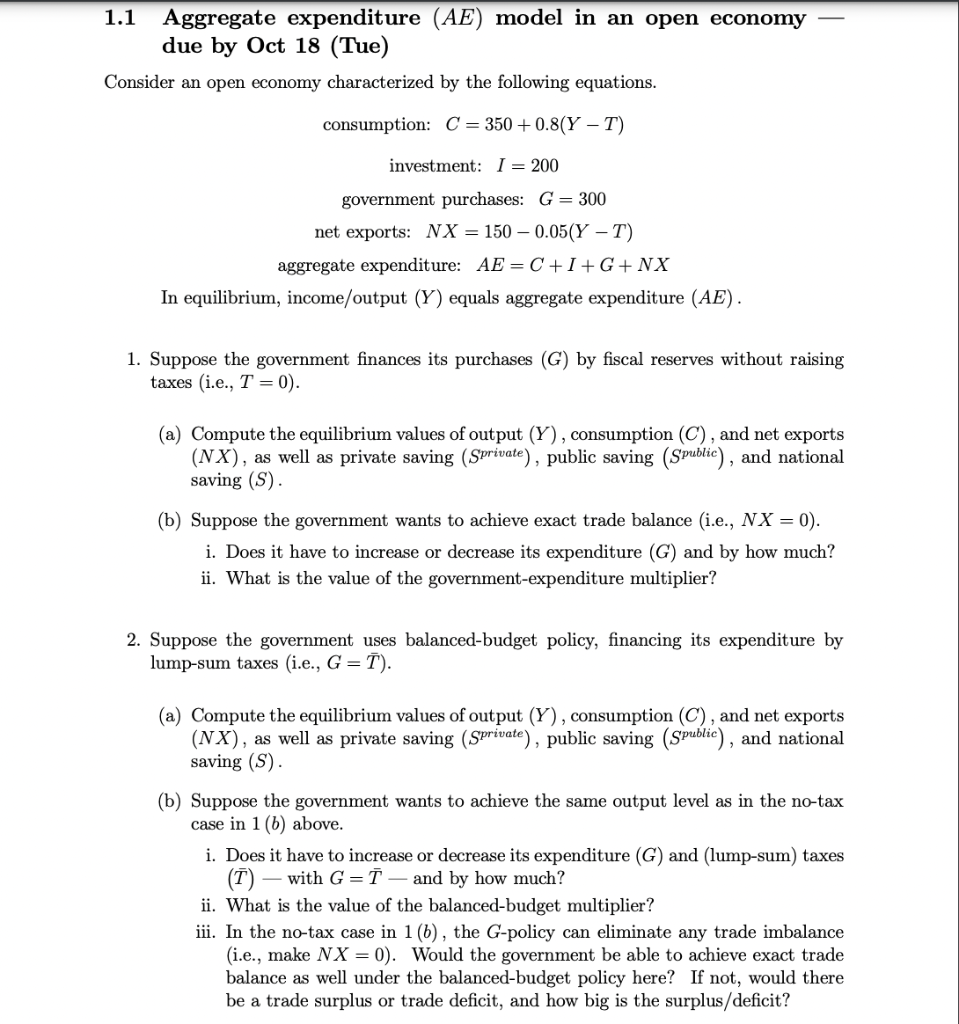

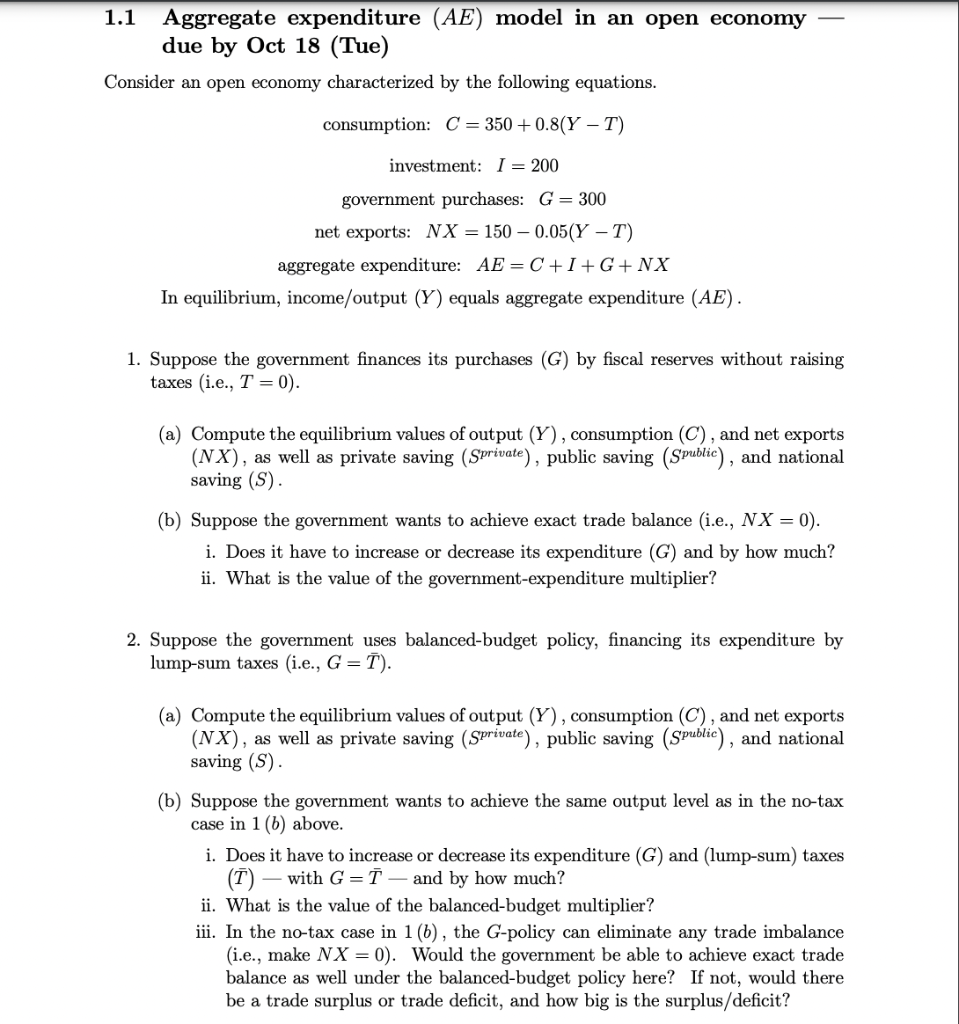

1.1 Aggregate expenditure (AE) model in an open economy due by Oct 18 (Tue) Consider an open economy characterized by the following equations. consumption: C=350+0.8(YT) investment: I=200 government purchases: G=300 net exports: NX=1500.05(YT) aggregate expenditure: AE=C+I+G+NX In equilibrium, income/output (Y) equals aggregate expenditure (AE). 1. Suppose the government finances its purchases (G) by fiscal reserves without raising taxes (i.e., T=0 ). (a) Compute the equilibrium values of output (Y), consumption (C), and net exports (NX), as well as private saving (Sprivate), public saving (Spublic), and national saving (S). (b) Suppose the government wants to achieve exact trade balance (i.e., NX=0 ). i. Does it have to increase or decrease its expenditure (G) and by how much? ii. What is the value of the government-expenditure multiplier? 2. Suppose the government uses balanced-budget policy, financing its expenditure by lump-sum taxes (i.e., G=T ). (a) Compute the equilibrium values of output (Y), consumption (C), and net exports (NX), as well as private saving (Sprivate), public saving (Spublic), and national saving (S). (b) Suppose the government wants to achieve the same output level as in the no-tax case in 1(b) above. i. Does it have to increase or decrease its expenditure (G) and (lump-sum) taxes (T) - with G=T - and by how much? ii. What is the value of the balanced-budget multiplier? iii. In the no-tax case in 1(b), the G-policy can eliminate any trade imbalance (i.e., make NX=0 ). Would the government be able to achieve exact trade balance as well under the balanced-budget policy here? If not, would there be a trade surplus or trade deficit, and how big is the surplus/deficit? 1.1 Aggregate expenditure (AE) model in an open economy due by Oct 18 (Tue) Consider an open economy characterized by the following equations. consumption: C=350+0.8(YT) investment: I=200 government purchases: G=300 net exports: NX=1500.05(YT) aggregate expenditure: AE=C+I+G+NX In equilibrium, income/output (Y) equals aggregate expenditure (AE). 1. Suppose the government finances its purchases (G) by fiscal reserves without raising taxes (i.e., T=0 ). (a) Compute the equilibrium values of output (Y), consumption (C), and net exports (NX), as well as private saving (Sprivate), public saving (Spublic), and national saving (S). (b) Suppose the government wants to achieve exact trade balance (i.e., NX=0 ). i. Does it have to increase or decrease its expenditure (G) and by how much? ii. What is the value of the government-expenditure multiplier? 2. Suppose the government uses balanced-budget policy, financing its expenditure by lump-sum taxes (i.e., G=T ). (a) Compute the equilibrium values of output (Y), consumption (C), and net exports (NX), as well as private saving (Sprivate), public saving (Spublic), and national saving (S). (b) Suppose the government wants to achieve the same output level as in the no-tax case in 1(b) above. i. Does it have to increase or decrease its expenditure (G) and (lump-sum) taxes (T) - with G=T - and by how much? ii. What is the value of the balanced-budget multiplier? iii. In the no-tax case in 1(b), the G-policy can eliminate any trade imbalance (i.e., make NX=0 ). Would the government be able to achieve exact trade balance as well under the balanced-budget policy here? If not, would there be a trade surplus or trade deficit, and how big is the surplus/deficit