Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with both requirements, I will make sure to upvote and I would really appreciate it!! Progressive Learning had prepared the following sales budget,

Please help with both requirements, I will make sure to upvote and I would really appreciate it!!

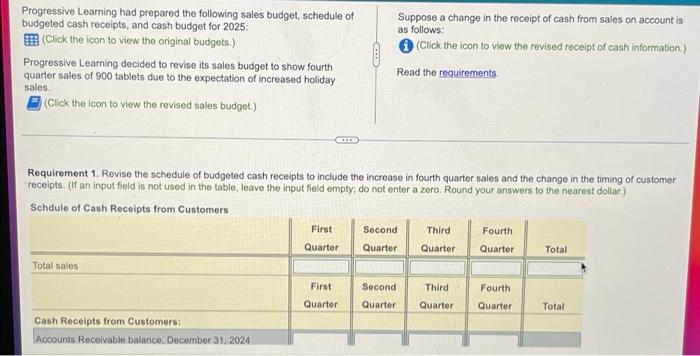

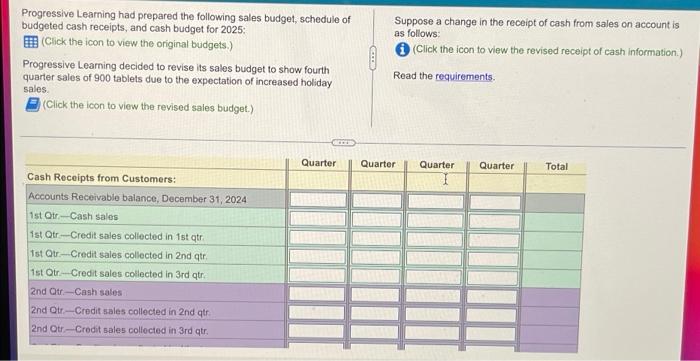

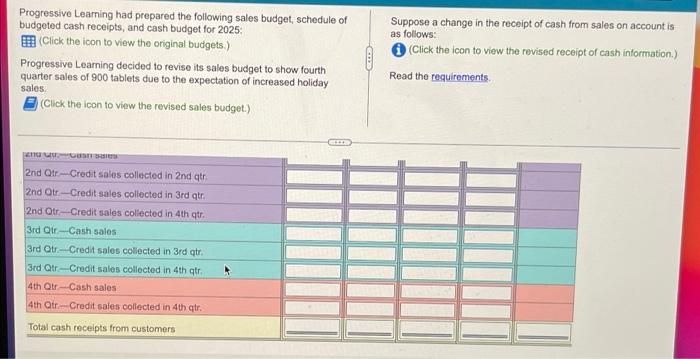

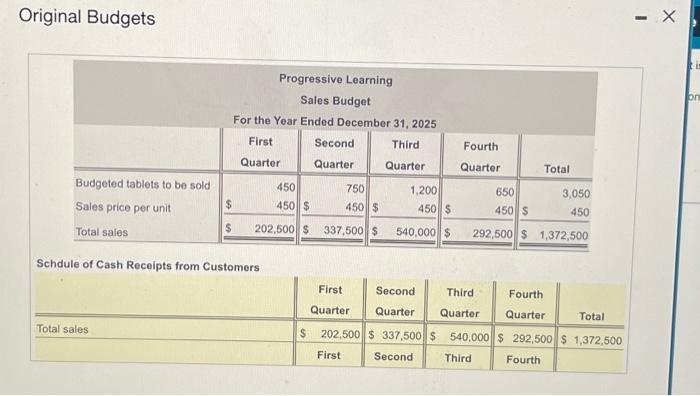

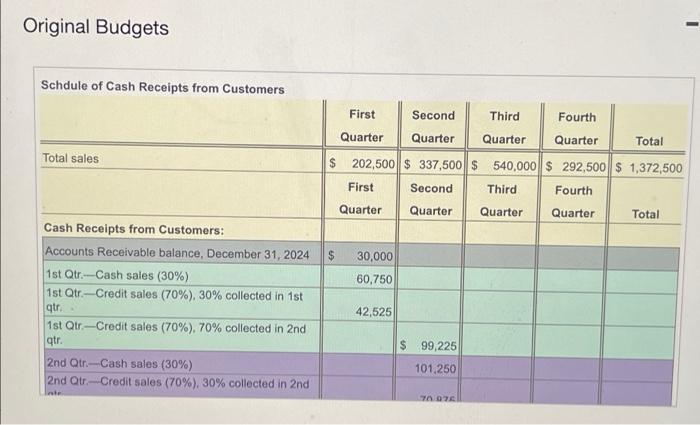

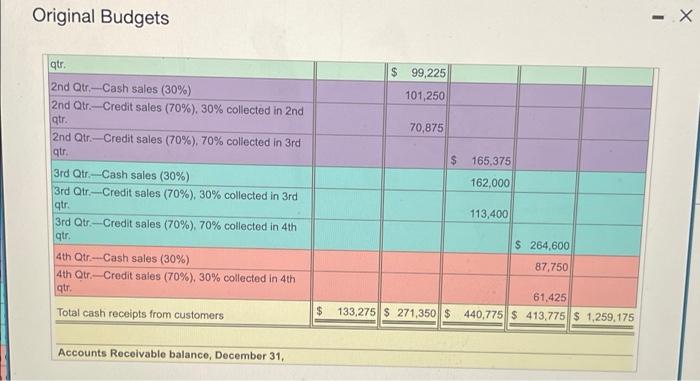

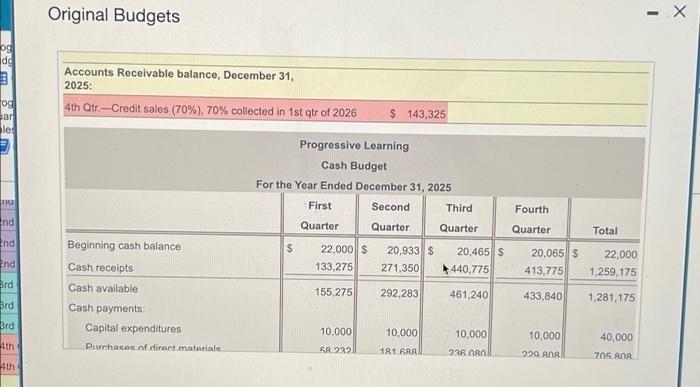

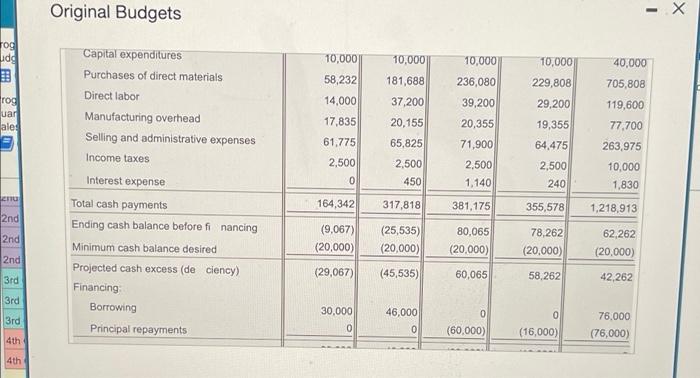

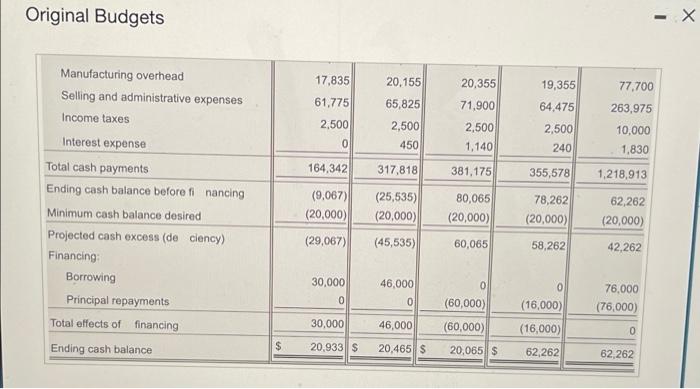

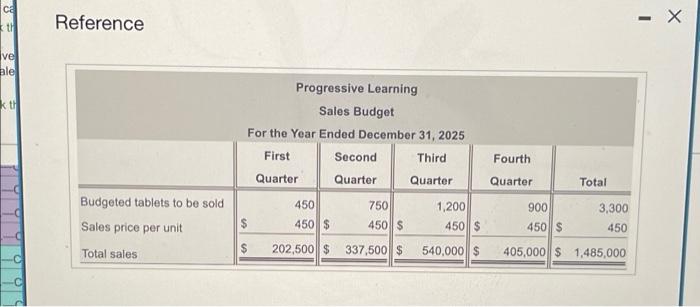

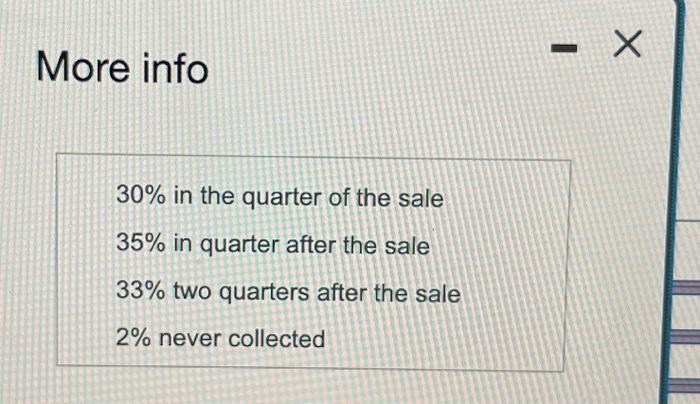

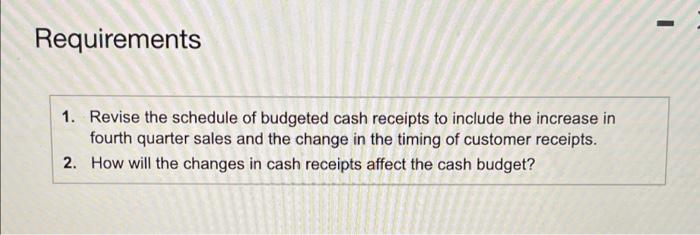

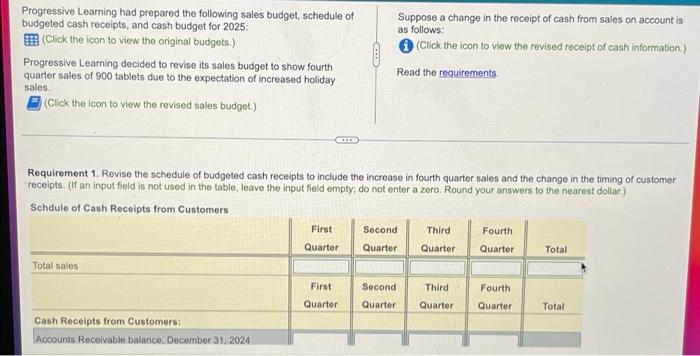

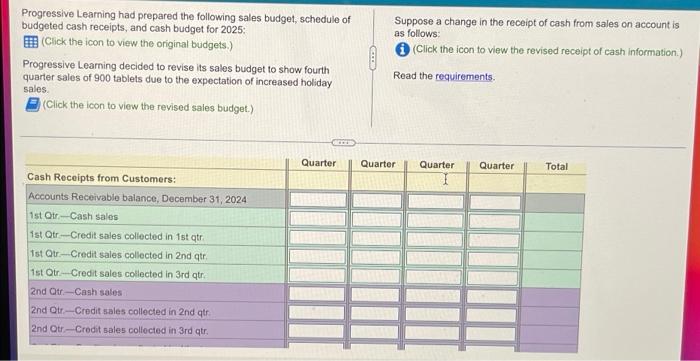

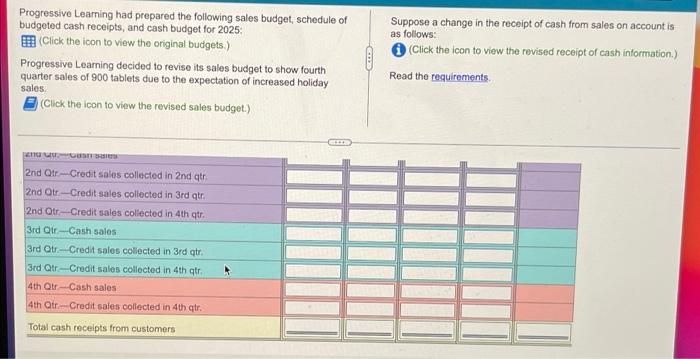

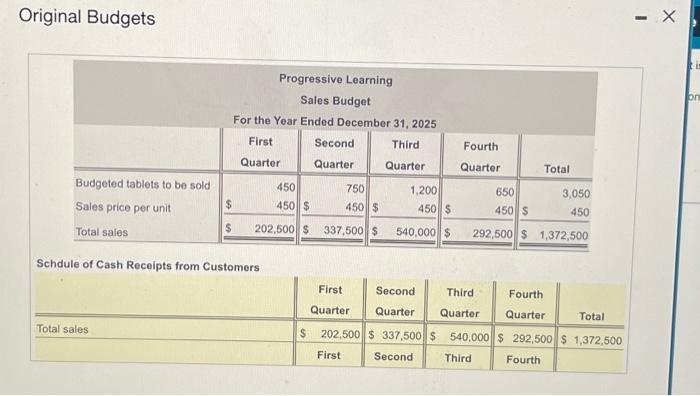

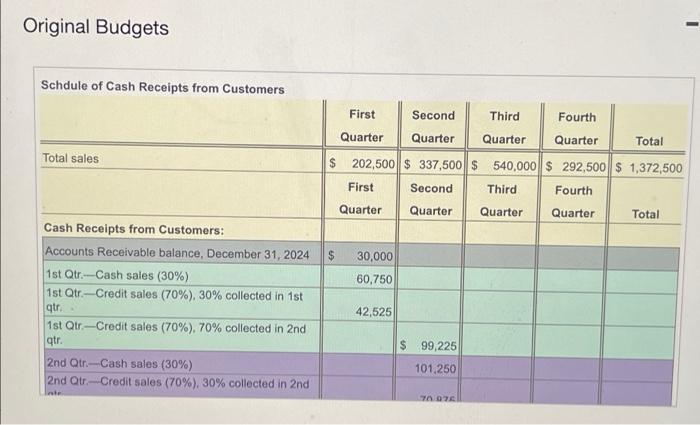

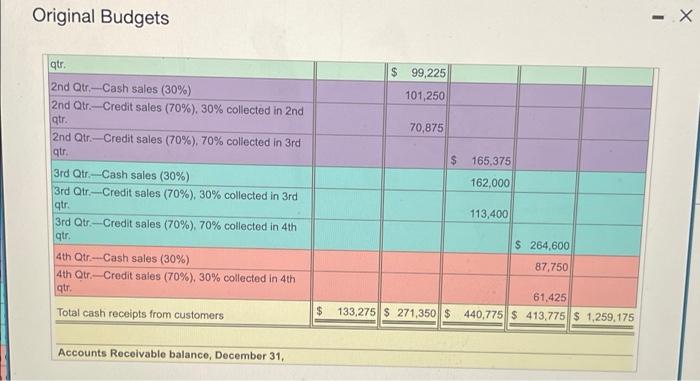

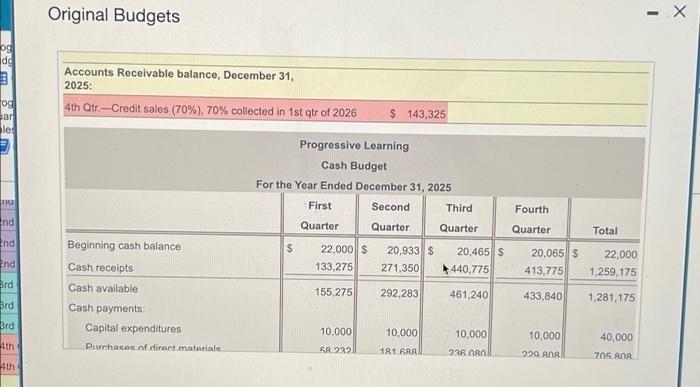

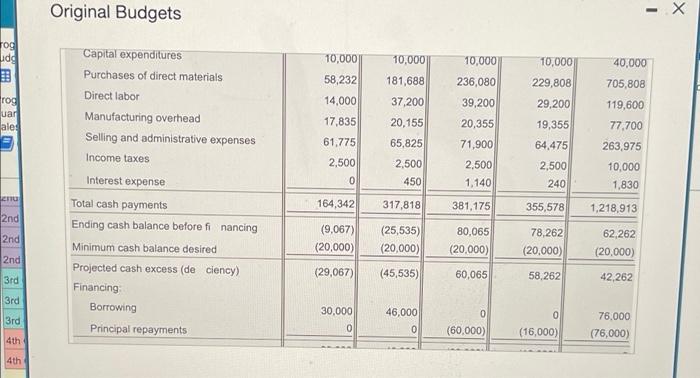

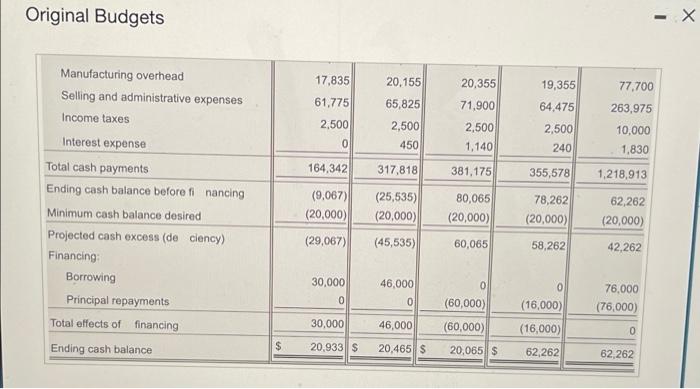

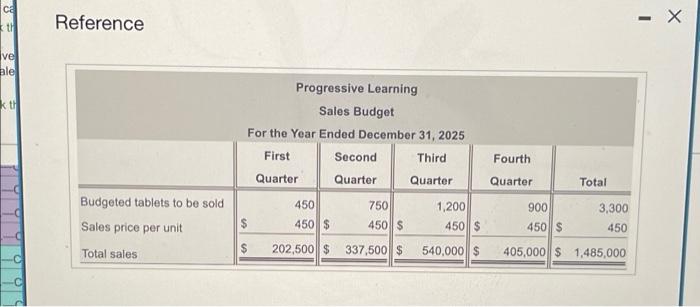

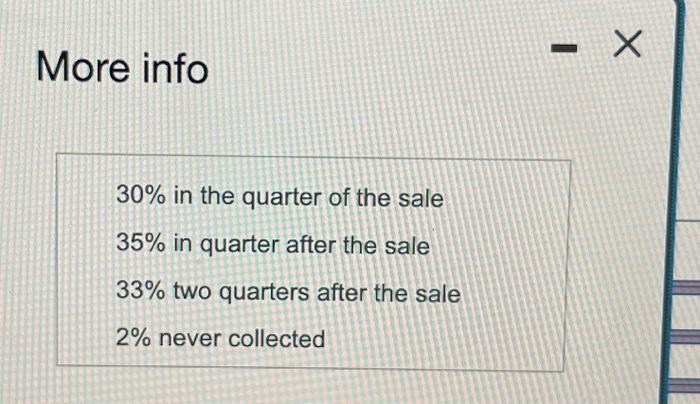

Progressive Learning had prepared the following sales budget, schedule of budgeted cash receipts, and cash budget for 2025: (Click the icon to view the original budgets.) Progressive Learning decided to revise its sales budget to show fourth quarter sales of 900 tablets due to the expectation of increased holiday sales. (Click the icon to view the revised sales budget.) Requirement 1. Revise the schedule of budgeted cash receipts to include the increase in fourth quarter sales and the change in the timing of customer receipts. (If an input field is not used in the table, leave the input field empty; do not enter a zero. Round your answers to the nearest dollar.) Schdule of Cash Receipts from Customers Total sales Cash Receipts from Customers: Accounts Receivable balance, December 31, 2024 First Quarter First Quarter Suppose a change in the receipt of cash from sales on account is as follows: (Click the icon to view the revised receipt of cash information.) Read the requirements. Second Third Quarter Quarter Second Quarter Third Quarter Fourth Quarter Fourth Quarter Total Total Progressive Learning had prepared the following sales budget, schedule of budgeted cash receipts, and cash budget for 2025: (Click the icon to view the original budgets.) Progressive Learning decided to revise its sales budget to show fourth quarter sales of 900 tablets due to the expectation of increased holiday sales. (Click the icon to view the revised sales budget.) Cash Receipts from Customers: Accounts Receivable balance, December 31, 2024 1st Qtr-Cash sales 1st Qtr-Credit sales collected in 1st qtr. 1st Qtr-Credit sales collected in 2nd qtr. 1st Qtr-Credit sales collected in 3rd qtr. 2nd Qtr-Cash sales 2nd Qtr-Credit sales collected in 2nd qtr. 2nd Qtr-Credit sales collected in 3rd qtr. CIEN Suppose a change in the receipt of cash from sales on account is as follows: (Click the icon to view the revised receipt of cash information.) Read the requirements. Quarter Quarter Quarter Quarter Total Progressive Learning had prepared the following sales budget, schedule of budgeted cash receipts, and cash budget for 2025: (Click the icon to view the original budgets.) Progressive Learning decided to revise its sales budget to show fourth quarter sales of 900 tablets due to the expectation of increased holiday sales. (Click the icon to view the revised sales budget.) en Can Bals 2nd Qtr-Credit sales collected in 2nd qtr. 2nd Qtr-Credit sales collected in 3rd qtr. 2nd Qtr-Credit sales collected in 4th qtr. 3rd Qtr-Cash sales 3rd Qtr-Credit sales collected in 3rd qtr. 3rd Qtr-Credit sales collected in 4th qtr.. 4th Qtr-Cash sales a 4th Qtr-Credit sales collected in 4th qtr. Total cash receipts from customers GXD Suppose a change in the receipt of cash from sales on account is as follows: (Click the icon to view the revised receipt of cash information.) Read the requirements. Original Budgets Budgeted tablets to be sold Sales price per unit Total sales $ Total sales Progressive Learning Sales Budget For the Year Ended December 31, 2025 First Third Quarter Quarter 450 450 $ 202,500 $ Schdule of Cash Receipts from Customers Second Quarter 750 450 $ 337,500 First Quarter 1,200 450 $ 540,000 $ Fourth Quarter 650 450 $ Second Third Quarter Quarter Total 292,500 $1,372,500 3,050 450 Fourth Quarter Total $ 202,500 $ 337,500 $ 540,000 $ 292,500 $1,372,500 First Second Third Fourth ti: on Original Budgets Schdule of Cash Receipts from Customers Total sales Cash Receipts from Customers: Accounts Receivable balance, December 31, 2024 1st Qtr.-Cash sales (30%) 1st Qtr.-Credit sales (70%), 30% collected in 1st qtr. 1st Qtr.-Credit sales (70%), 70% collected in 2nd qtr. 2nd Qtr.-Cash sales (30%) 2nd Qtr-Credit sales (70%), 30% collected in 2nd Inte First Second Third Fourth Quarter Quarter Quarter Quarter Total $ 202,500 $ 337,500 $ 540,000 $ 292,500 $1,372,500 First Second Quarter Quarter Third Fourth Quarter Quarter $ 30,000 60,750 42,525 $ 99,225 101,250 70 0761 Total Original Budgets qtr. 2nd Qtr.-Cash sales (30%) 2nd Qtr.-Credit sales (70%), 30% collected in 2nd qtr. 2nd Qtr.-Credit sales (70%), 70% collected in 3rd qtr. 3rd Qtr-Cash sales (30%) 3rd Qtr-Credit sales (70%), 30% collected in 3rd qtr. 3rd Qtr-Credit sales (70%), 70% collected in 4th qtr. 4th Qtr-Cash sales (30%) 4th Qtr.-Credit sales (70%), 30% collected in 4th qtr. Total cash receipts from customers Accounts Receivable balance, December 31, $ 99,225 101,250 70,875 $ 165,375 162,000 113,400 $ 264,600 87,750 61,425 $ 133,275 $ 271,350 $ 440,775 $ 413,775 $ 1,259,175 X og do og ar les nu nd End End Brd Brd Brd 4th 4th Original Budgets Accounts Receivable balance, December 31, 2025: 4th Qtr-Credit sales (70%), 70% collected in 1st qtr of 2026 Beginning cash balance Cash receipts Cash available Cash payments: Capital expenditures Purchases of direct materials Progressive Learning Cash Budget For the Year Ended December 31, 2025 Second Quarter $ First Quarter 22,000 $ 133,275 155,275 $ 143,325 10,000 58.232 20,933 $ 271,350 292,283 10,000 181 ARAL Third Quarter 20,465 $ 440,775 461,240 10,000 236.080 Fourth Quarter Total 20,065 $ 22,000 413,775 1,259,175 433,840 1,281,175 10,000 229.808 40,000 705 ROR - X rog udg B rog uar ales enu 2nd 2nd 2nd 3rd 3rd 3rd 4th 4th Original Budgets Capital expenditures Purchases of direct materials Direct labor Manufacturing overhead Selling and administrative expenses Income taxes Interest expense Total cash payments Ending cash balance before financing Minimum cash balance desired Projected cash excess (de ciency) Financing: Borrowing Principal repayments 10,000 58,232 14,000 17,835 61,775 2,500 0 10,000 181,688 37,200 20,155 30,000 0 65,825 2,500 450 164,342 317,818 (9,067) (25,535) (20,000) (20,000) (29,067) (45,535) 46,000 0 10,000 236,080 39,200 20,355 71,900 2,500 1,140 381,175 S 80,065 (20,000) 60,065 0 (60,000) 10,000 229,808 29,200 19,355 64,475 2,500 240 355,578 78,262 (20,000) 58,262 0 (16,000) 40,000 705,808 119,600 77,700 263,975 10,000 1,830 1,218,913 62,262 (20,000) 42,262 76,000 (76,000) x Original Budgets Manufacturing overhead Selling and administrative expenses Income taxes Interest expense Total cash payments Ending cash balance before financing Minimum cash balance desired Projected cash excess (de ciency) Financing: Borrowing Principal repayments Total effects of financing Ending cash balance $ 17,835 61,775 2,500 0 164,342 317,818 (9,067) (25,535) (20,000) (20,000) (29,067) (45,535) 30,000 0 20,155 65,825 2,500 450 30,000 20,933 $ 46,000 0 20,355 71,900 2,500 1,140 381,175 80,065 (20,000) 60,065 0 (60,000) 46,000 (60,000) 20,465 $ 20,065 $ 19,355 64,475 2,500 240 355,578 78,262 (20,000) 58,262 0 (16,000) (16,000) 62,262 77,700 263,975 10,000 1,830 1,218,913 62,262 (20,000) 42,262 76,000 (76,000) 0 62,262 X ca th ve ale kth Reference Budgeted tablets to be sold Sales price per unit Total sales Progressive Learning Sales Budget For the Year Ended December 31, 2025 Second Third Quarter Quarter 8885 750 1,200 450 $ 450 $ 202,500 $ 337,500 $ $ $ First Quarter 450 450 $ 540,000 $ Fourth Quarter Total 3,300 450 900 450 $ 405,000 $1,485,000 More info 30% in the quarter of the sale 35% in quarter after the sale 33% two quarters after the sale 2% never collected X Requirements 1. Revise the schedule of budgeted cash receipts to include the increase in fourth quarter sales and the change in the timing of customer receipts. 2. How will the changes in cash receipts affect the cash budget

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started