please help with C D and E. thanks

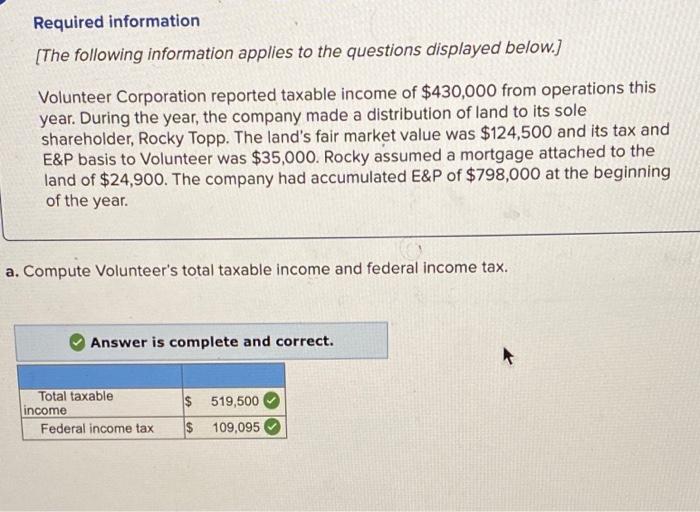

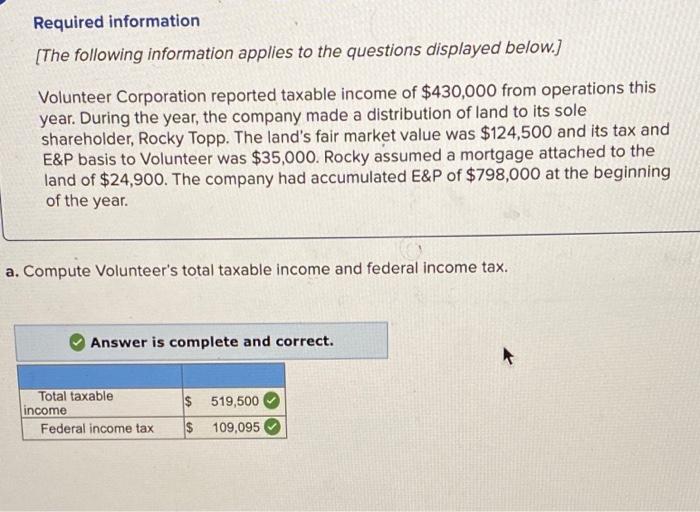

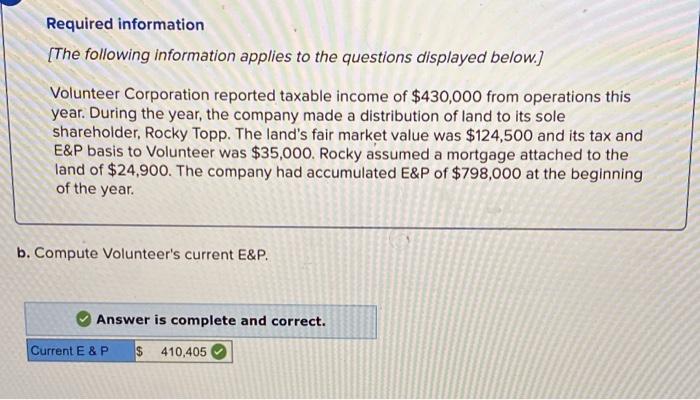

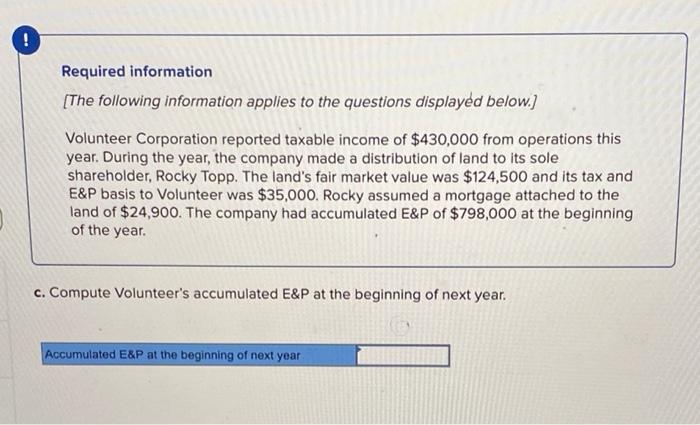

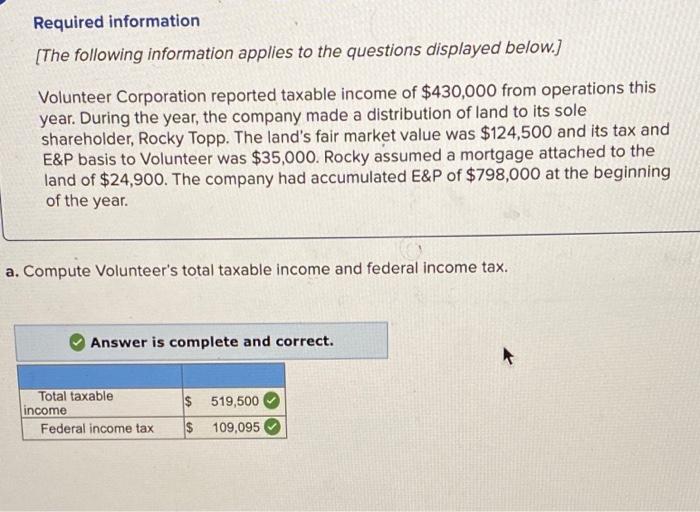

Required information [The following information applies to the questions displayed below.) Volunteer Corporation reported taxable income of $430,000 from operations this year. During the year, the company made a distribution of land to its sole shareholder, Rocky Topp. The land's fair market value was $124,500 and its tax and E&P basis to Volunteer was $35,000. Rocky assumed a mortgage attached to the land of $24,900. The company had accumulated E&P of $798,000 at the beginning of the year. a. Compute Volunteer's total taxable income and federal income tax. Answer is complete and correct. Total taxable income Federal income tax $ 519,500 $ 109,095 Required information [The following information applies to the questions displayed below.) Volunteer Corporation reported taxable income of $430,000 from operations this year. During the year, the company made a distribution of land to its sole shareholder, Rocky Topp. The land's fair market value was $124,500 and its tax and E&P basis to Volunteer was $35,000. Rocky assumed a mortgage attached to the land of $24.900. The company had accumulated E&P of $798,000 at the beginning of the year. b. Compute Volunteer's current E&P. Answer is complete and correct. Current E&P $ 410,405 Required information [The following information applies to the questions displayed below.) Volunteer Corporation reported taxable income of $430,000 from operations this year. During the year, the company made a distribution of land to its sole shareholder, Rocky Topp. The land's fair market value was $124,500 and its tax and E&P basis to Volunteer was $35,000. Rocky assumed a mortgage attached to the land of $24,900. The company had accumulated E&P of $798,000 at the beginning of the year. c. Compute Volunteer's accumulated E&P at the beginning of next year. Accumulated E&P at the beginning of next year Required information (The following information applies to the questions displayed below.) Volunteer Corporation reported taxable income of $430,000 from operations this year. During the year, the company made a distribution of land to its sole shareholder, Rocky Topp. The land's fair market value was $124,500 and its tax and E&P basis to Volunteer was $35,000. Rocky assumed a mortgage attached to the land of $24,900. The company had accumulated E&P of $798,000 at the beginning of the year. d. What amount of dividend income does Rocky report as a result of the distribution? Dividend income Required information [The following information applies to the questions displayed below.) Volunteer Corporation reported taxable income of $430,000 from operations this year. During the year, the company made a distribution of land to its sole shareholder, Rocky Topp. The land's fair market value was $124,500 and its tax and E&P basis to Volunteer was $35,000. Rocky assumed a mortgage attached to the land of $24,900. The company had accumulated E&P of $798,000 at the beginning of the year. e. What is Rocky's income tax basis in the land received from Volunteer? Income tax basis