Please Help with Calculations Problem 1 Labs is a diagnostic laboratory that does various tests (blood tests, urine tests, etc.) for doctors' offices in the

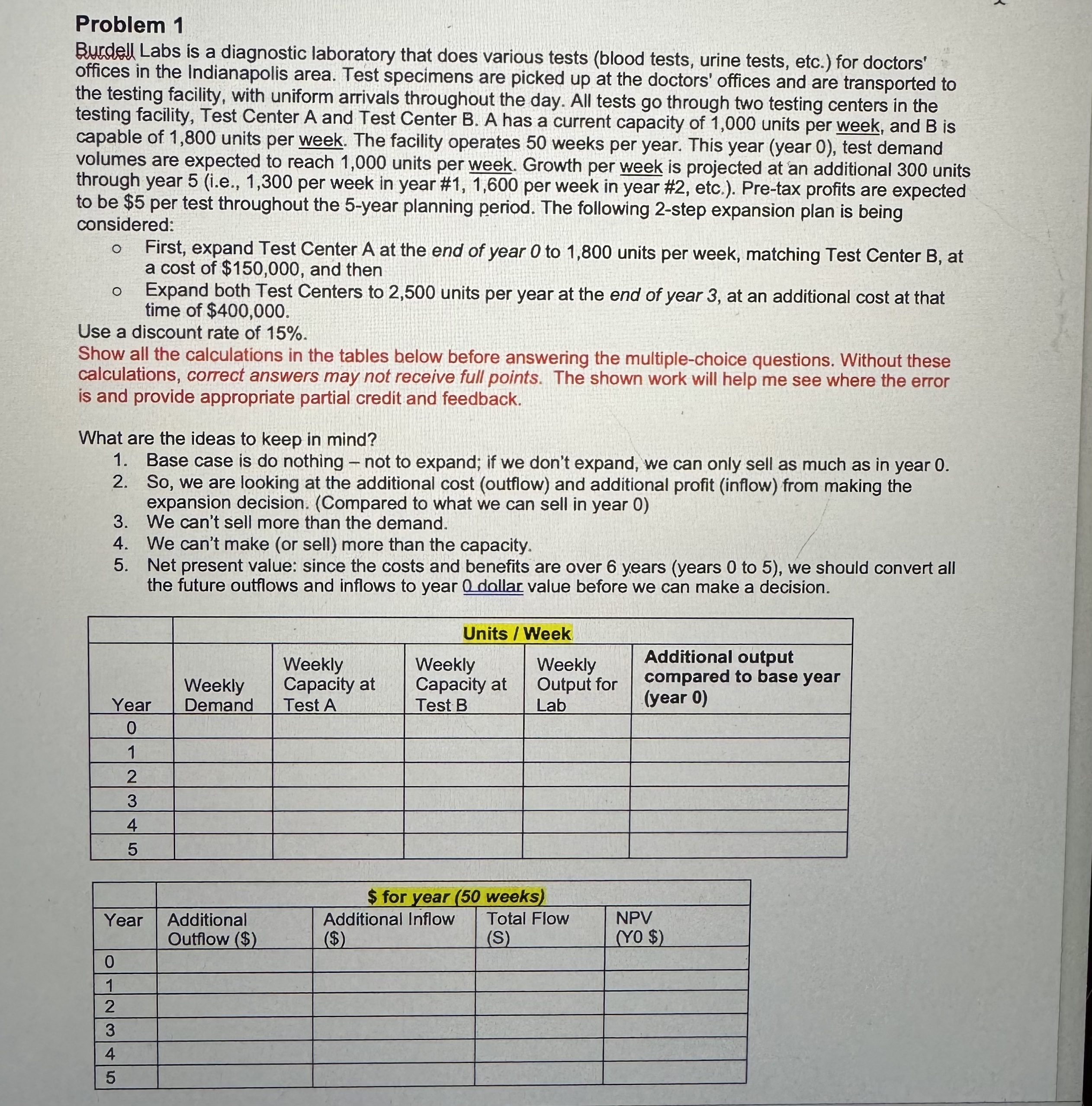

Problem 1 Labs is a diagnostic laboratory that does various tests (blood tests, urine tests, etc.) for doctors' offices in the Indianapolis area. Test specimens are picked up at the doctors' offices and are transported to the testing facility, with uniform arrivals throughout the day. All tests go through two testing centers in the testing facility, Test Center A and Test Center B. A has a current capacity of 19000 units per week, and B is capable of 1 ,800 units per week. The facility operates 50 weeks per year. This year (year 0), test demand volumes are expected to reach 1,000 units per week. Growth per week is projected at an additional 300 units through year 5 (i.e., 1 ,300 per week in year #1, 1 ,600 per week in year #2, etc.). Pre-tax profits are expected to be $5 per test throughout the 5-year planning period. The following 2-step expansion plan is being considered: o First, expand Test Center A at the end of year O to 1,800 units per week, matching Test Center B, at a cost of $150,000, and then o Expand both Test Centers to 2,500 units per year at the end of year 3, at an additional cost at that time of $400,000. Use a discount rate of 15%. Show all the calculations in the tables below before answering the multiple-choice questions. Without these calculations, correct answers may not receive full points. The shown work will help me see where the error is and provide appropriate partial credit and feedback. What are the ideas to keep in mind? 1. 2. 3. 4. 5. Base case is do nothing not to expand; if we don't expand, we can only sell as much as in year 0. So, we are looking at the additional cost (outflow) and additional profit (inflow) from making the expansion decision. (Compared to what we can sell in year 0) We can't sell more than the demand. We can't make (or sell) more than the capacity. Net present value: since the costs and benefits are over 6 years (years 0 to 5), we should convert all the future outflows and inflows to year 0 dollar value before we can make a decision. Weekly Demand Additional Outflow $ Weekly Capacity at Test A Units I Week Weekly Weekly Capacity at Output for Test B Lab Additional output compared to base year (year O) Year 1 2 3 4 5 Year 1 2 3 4 5 $ for ear Additional Inflow 50 weeks Total Flow s NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started