Answered step by step

Verified Expert Solution

Question

1 Approved Answer

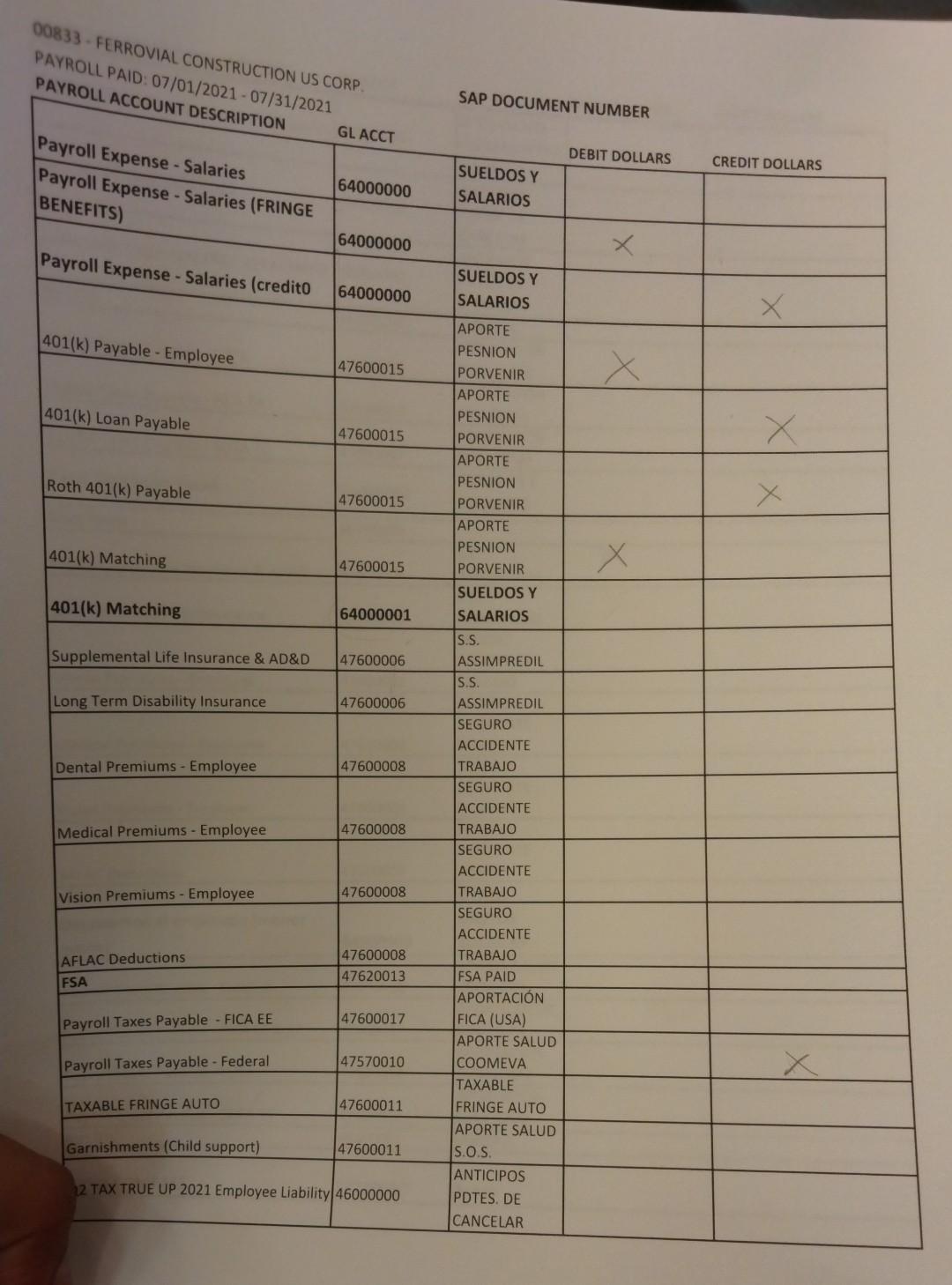

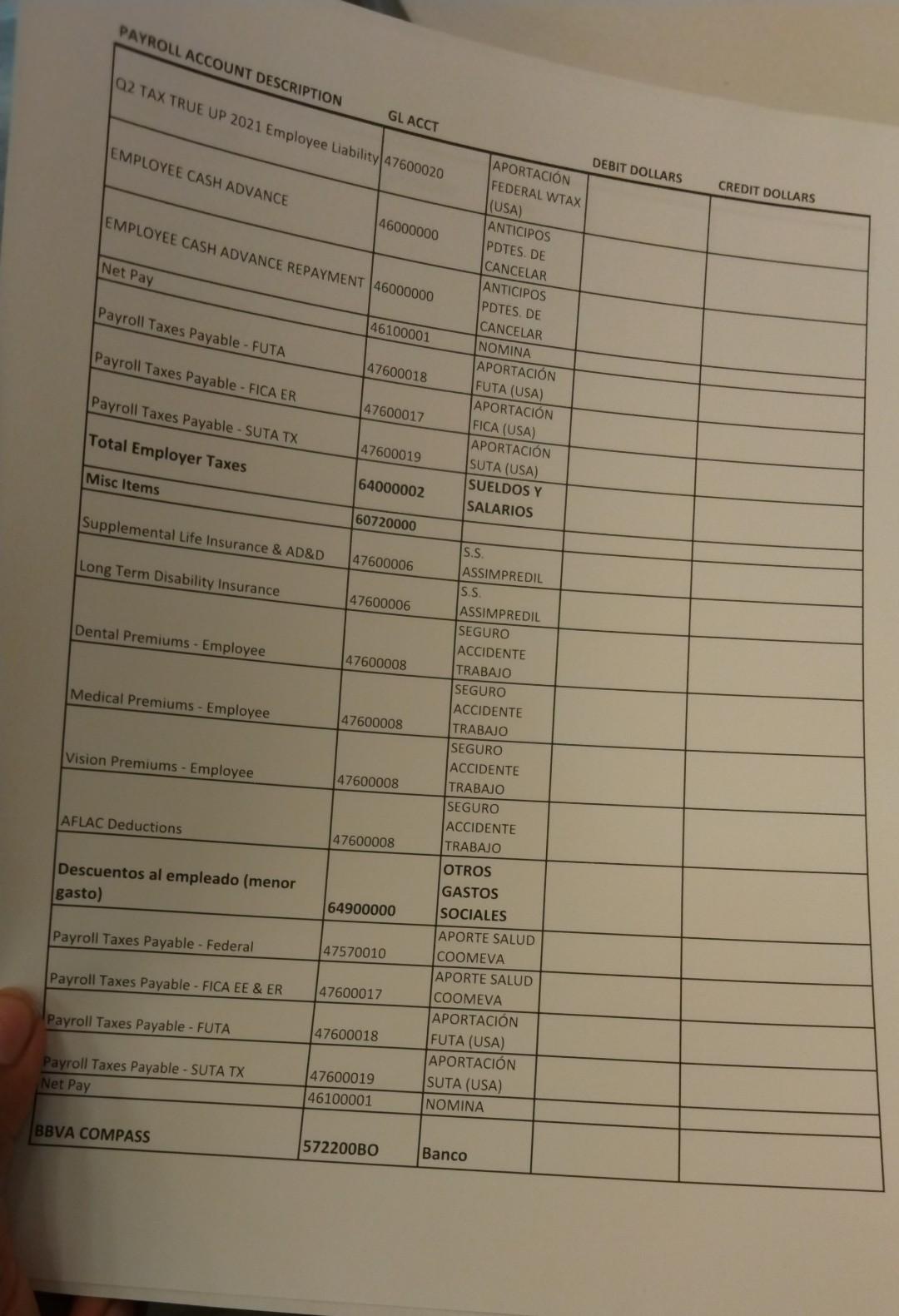

please help with exercise asap 00833 - FERROVIAL CONSTRUCTION US CORP. PAYROLL PAID: 07/01/2021 - 07/31/2021 PAYROLL ACCOUNT DESCRIPTION SAP DOCUMENT NUMBER GL ACCT DEBIT

please help with exercise asap

00833 - FERROVIAL CONSTRUCTION US CORP. PAYROLL PAID: 07/01/2021 - 07/31/2021 PAYROLL ACCOUNT DESCRIPTION SAP DOCUMENT NUMBER GL ACCT DEBIT DOLLARS CREDIT DOLLARS Payroll Expense - Salaries Payroll Expense - Salaries (FRINGE BENEFITS) 64000000 SUELDOS Y SALARIOS 64000000 Payroll Expense - Salaries (credito 64000000 SUELDOS Y SALARIOS 401(k) Payable - Employee 47600015 x 401(k) Loan Payable 47600015 APORTE PESNION PORVENIR APORTE PESNION PORVENIR APORTE PESNION PORVENIR APORTE PESNION PORVENIR SUELDOS Y SALARIOS Roth 401(k) Payable 47600015 401(k) Matching X 47600015 401(k) Matching 64000001 Supplemental Life Insurance & AD&D 47600006 Long Term Disability Insurance 47600006 Dental Premiums - Employee 47600008 Medical Premiums - Employee 47600008 Vision Premiums - Employee 47600008 S.S. ASSIMPREDIL S.S. ASSIMPREDIL SEGURO ACCIDENTE TRABAJO SEGURO ACCIDENTE TRABAJO SEGURO ACCIDENTE TRABAJO SEGURO ACCIDENTE TRABAJO FSA PAID APORTACIN FICA (USA) APORTE SALUD COOMEVA TAXABLE FRINGE AUTO APORTE SALUD S.O.S. ANTICIPOS PDTES. DE CANCELAR AFLAC Deductions FSA 47600008 47620013 Payroll Taxes Payable - FICA EE 47600017 Payroll Taxes Payable - Federal 47570010 X TAXABLE FRINGE AUTO 47600011 Garnishments (Child support) 47600011 12 TAX TRUE UP 2021 Employee Liability 46000000 PAYROLL ACCOUNT DESCRIPTION Q2 TAX TRUE UP 2021 Employee Liability 47600020 GL ACCT EMPLOYEE CASH ADVANCE CREDIT DOLLARS EMPLOYEE CASH ADVANCE REPAYMENT 46000000 46000000 Net Pay DEBIT DOLLARS APORTACIN FEDERAL WTAX (USA) ANTICIPOS PDTES. DE CANCELAR ANTICIPOS PDTES. DE CANCELAR NOMINA APORTACIN FUTA (USA) Payroll Taxes Payable - FUTA 46100001 Payroll Taxes Payable - FICA ER 47600018 Payroll Taxes Payable - SUTA TX 47600017 Total Employer Taxes 47600019 APORTACIN FICA (USA) APORTACIN SUTA (USA) SUELDOS Y SALARIOS Misc Items 64000002 Supplemental Life Insurance & AD&D 60720000 47600006 Long Term Disability Insurance 47600006 Dental Premiums - Employee 47600008 Medical Premiums - Employee 47600008 Vision Premiums - Employee 47600008 AFLAC Deductions S.S ASSIMPREDIL S.S. ASSIMPREDIL SEGURO ACCIDENTE TRABAJO SEGURO ACCIDENTE TRABAJO SEGURO ACCIDENTE TRABAJO SEGURO ACCIDENTE TRABAJO OTROS GASTOS SOCIALES APORTE SALUD COOMEVA APORTE SALUD COOMEVA APORTACIN FUTA (USA) APORTACIN SUTA (USA) NOMINA 47600008 Descuentos al empleado (menor gasto) 64900000 Payroll Taxes Payable - Federal 47570010 Payroll Taxes Payable - FICA EE & ER 47600017 Payroll Taxes Payable - FUTA 147600018 Payroll Taxes Payable - SUTA TX Net Pay 47600019 46100001 BBVA COMPASS 572200BO Banco

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started