Answered step by step

Verified Expert Solution

Question

1 Approved Answer

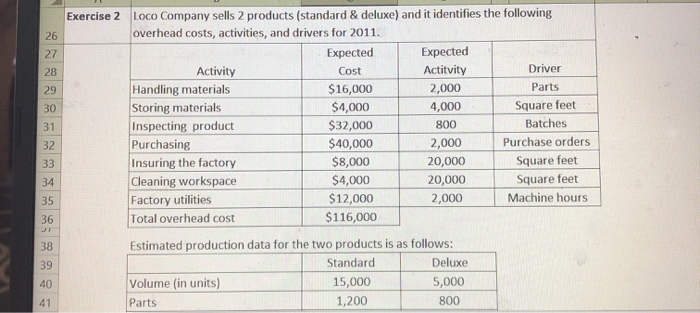

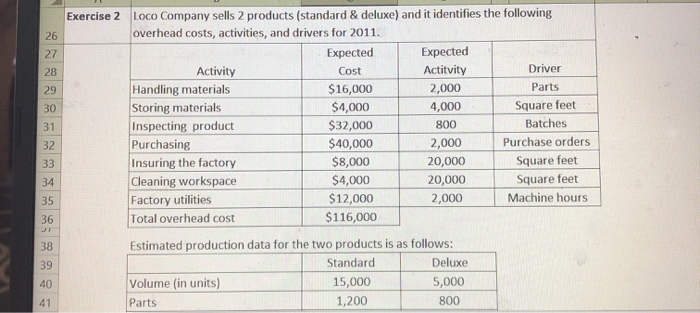

Please help with explaination. Ex 2, and Ex 3. Exercise 2 Loco Company sells 2 products (standard & deluxe) and it identifies the following overhead

Please help with explaination. Ex 2, and Ex 3.

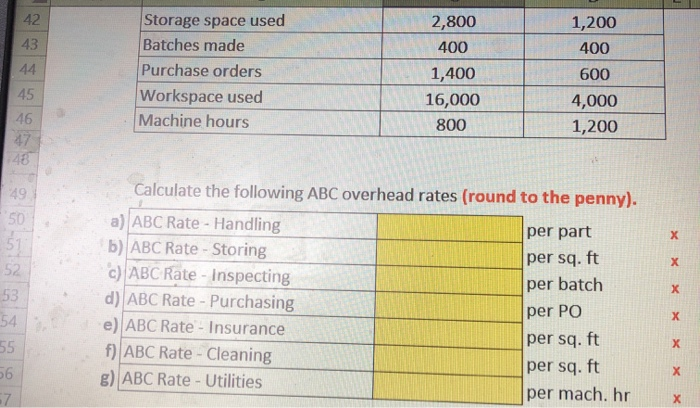

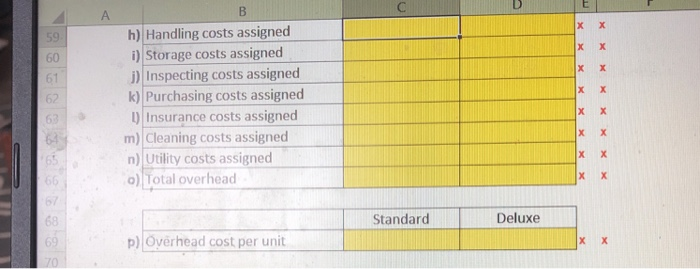

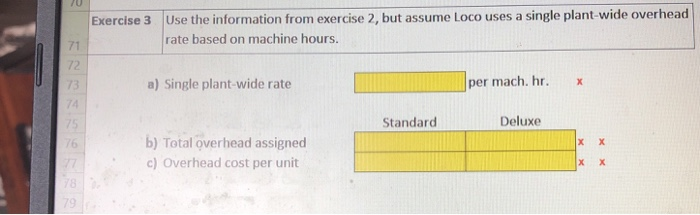

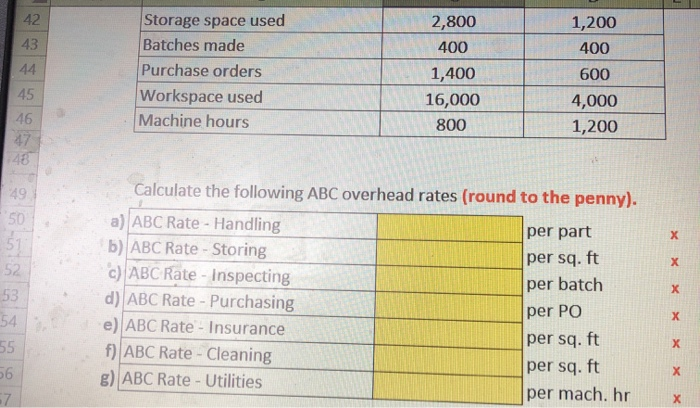

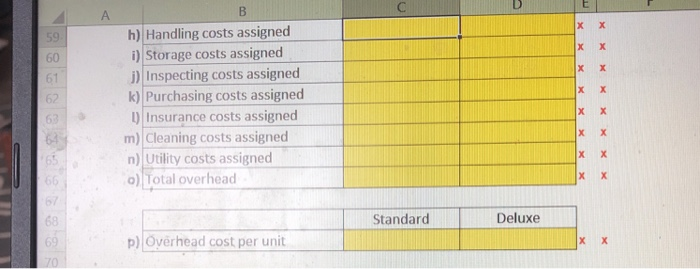

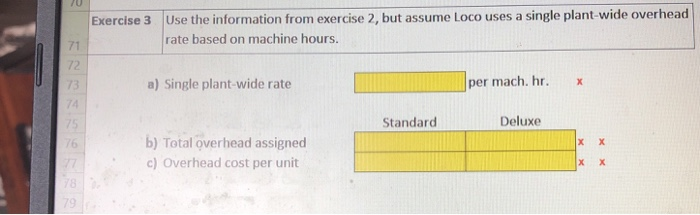

Exercise 2 Loco Company sells 2 products (standard & deluxe) and it identifies the following overhead costs, activities, and drivers for 2011 Expected Expected Activity Cost Actitvity Driver Handling materials $16,000 2,000 Parts Storing materials $4,000 4,000 Square feet Inspecting product $32,000 800 Batches Purchasing $40,000 2,000 Purchase orders Insuring the factory $8,000 20,000 Square feet Cleaning workspace $4,000 20,000 Square feet Factory utilities $12,000 2,000 Machine hours Total overhead cost $116,000 Estimated production data for the two products is as follows: Standard Deluxe Volume (in units) 15,000 5,000 1,200 800 Parts Storage space used Batches made Purchase orders Workspace used Machine hours 400 1,400 16,000 800 1,200 400 600 4,000 1,200 Calculate the following ABC overhead rates (round to the penny). a) ABC Rate - Handling per part b) ABC Rate - Storing per sq. ft c) ABC Rate - Inspecting per batch d) ABC Rate - Purchasing per PO e) ABC Rate - Insurance per sq.ft f) ABC Rate - Cleaning per sq.ft g) ABC Rate - Utilities per mach.hr 54 U B h) Handling costs assigned i) Storage costs assigned 1) Inspecting costs assigned k) Purchasing costs assigned D) Insurance costs assigned m) Cleaning costs assigned n) Utility costs assigned c) Total overhead Standard Deluxe p) Overhead cost per unit Exercise 3 Use the information from exercise 2, but assume Loco uses a single plant-wide overhead rate based on machine hours. a) Single plant-wide rate per mach.hr. * Standard Deluxe b) Total overhead assigned c) Overhead cost per unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started