Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with formulas needed to input in the blue cells roblem 14-9 omplete the steps below using cell references to given data or previous

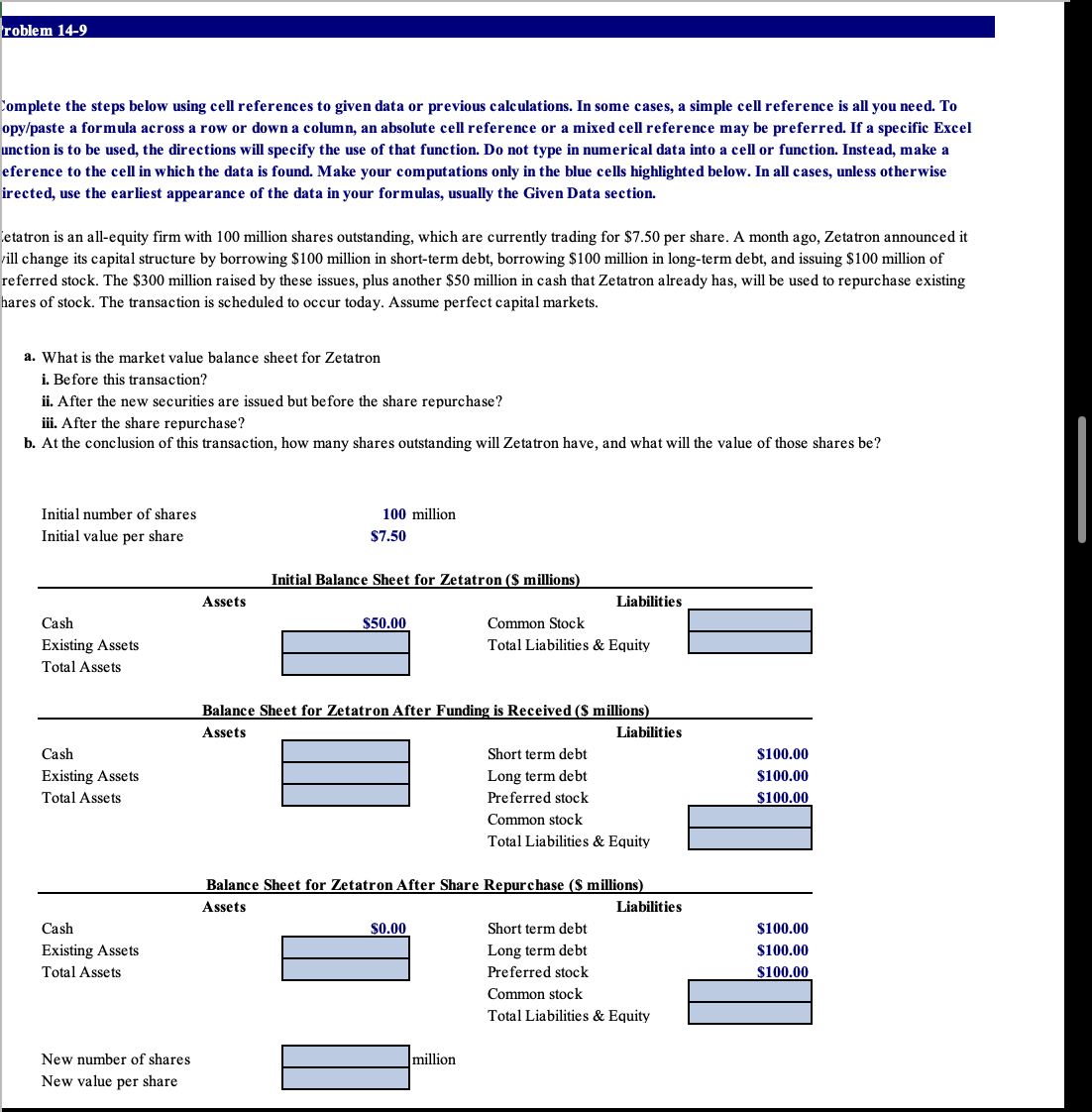

please help with formulas needed to input in the blue cells

roblem 14-9 omplete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To py/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel tion is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a ference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise ected, use the earliest appearance of the data in your formulas, usually the Given Data section. tatron is an all-equity firm with 100 million shares outstanding, which are currently trading for S7.50 per share. A month ago, Zetatron announced it ill change its capital structure by borrowing SIOO million in short-term debt, borrowing SIOO million in long-term debt, and issuing SIOO million of eferred stock. The S300 million raised by these issues, plus another S50 million in cash that Zetatron already has, will be used to repurchase existing res Of stock. The transaction is scheduled to occur today. Assume perfect capital markets. a. What is the market value balance sheet for Zetatron i. Before this transaction? ii. After the new securities are issued but before the share repurchase? iii. After the share repurchase? b. At the conclusion of this transaction, how many shares outstanding will Zetatron have, and what will the value of those shares be? Initial number of shares Initial value per share cash Existing Asse ts Total Assets cash Existing Asse ts Total Assets cash Existing Asse ts Total Assets New number Of shares New value per share 100 million S7.50 Initial Balance Sheet for Zetatron (S millions) Assets Liabilities sso.oo Common Stock Total Lia bilities & Equity Balance Sheet for Zetatron After Funding is Received (S millions) Assets Liabilities Short term de bt Long term de bt Preferred stock Common stock Total Lia bilities & Equity Balance Sheet for Zetatron After Share Repurchase (S millions) Assets S100.oo S100.oo S100.oo S100.oo S100.oo S100.oo so.oo million Liabilities Short term de bt Long term de bt Preferred stock Common stock Total Lia bilities & Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started