Please help with income statement and balance sheet. I provided the trial balance just incase u needed. thank you

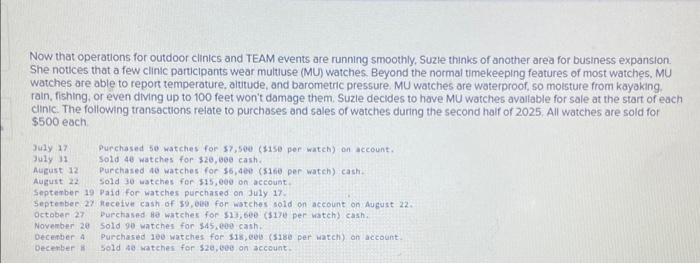

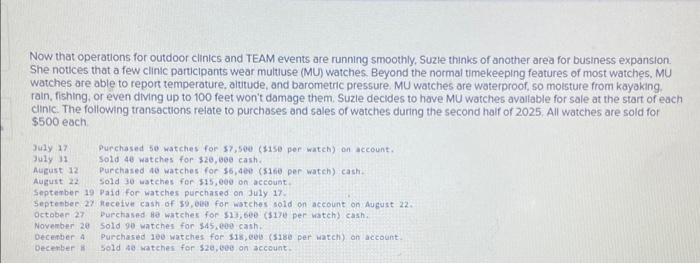

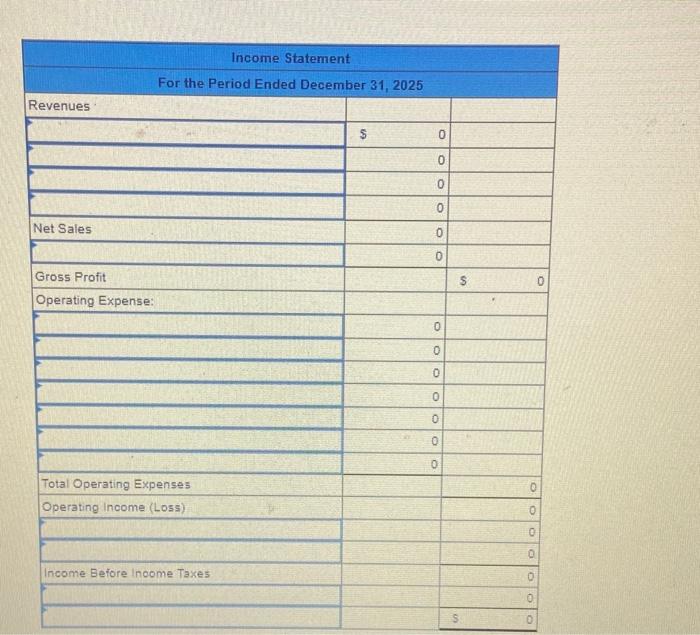

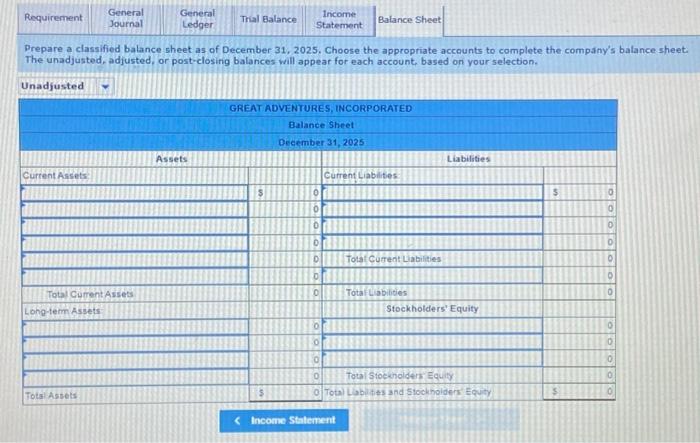

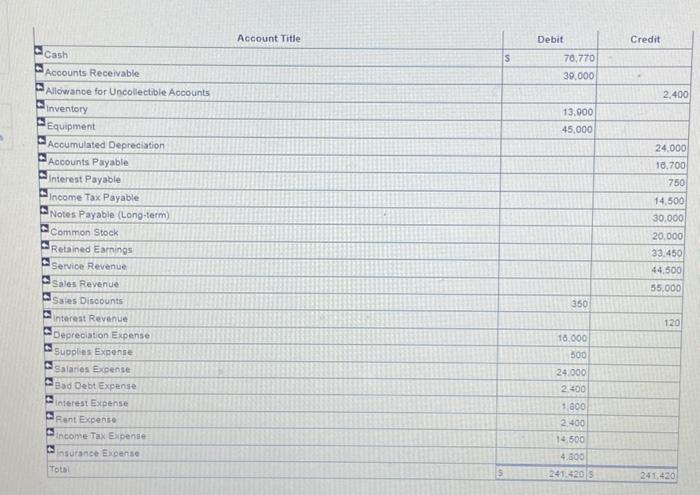

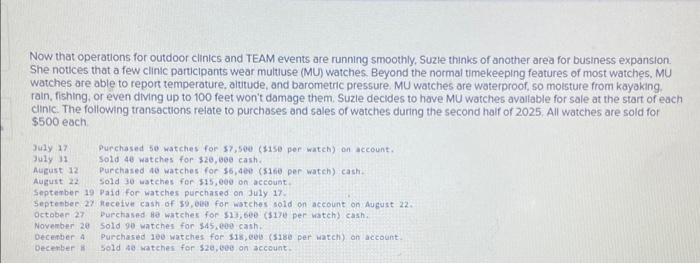

Now that operations for outdoor clinics and TEAM events are running smoothly, Suzle thinks of another area for business expansion. She notices that a few clinic participants wear multuse (MU) watches. Beyond the normal timekeeping features of most watches, MU watches are able to report temperature, alutude, and barometric pressure. MU watches are waterproof, so molsture from kayaking rain, fishing, or even diving up to 100 feet won't damage them. Suzle decides to have MU watches avallable for sale at the start of each cinic. The following transactions relate to purchases and sales of watches during the second half of 2025 , All watches are sold for $500 each 3u1y,17 3uly 31 August 12 August 22 Getpertop 19 pald for watches puechased on July 17 . Septenber 27 itecetvet cash of 59 , eis for wistehes sold on account on August 22. Dctober 27 . Durchased He watches for $21,600 ( 317 per watch) cash. Noverber 20 sold 90 watches for $45,009 cash. Decerber if sold as watches for $20, vog on account. Prepare a classified balance sheet as of December 31,2025 . Choose the appropriate accounts to complete the compsiny's balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Income Statement } \\ \hline \multicolumn{4}{|c|}{ For the Period Ended December 31, 2025} \\ \hline \multicolumn{4}{|l|}{ Revenues } \\ \hline & $ & & \\ \hline & 0 & & \\ \hline & 0 & & \\ \hline & 0 & & \\ \hline Net Sales & 0 & & \\ \hline & 0 & & \\ \hline Gross Profit & & $ & 0 \\ \hline Operating Expense: & & & \\ \hline & 0 & & \\ \hline & 0 & & \\ \hline & 0 & & \\ \hline & 0 & & \\ \hline & 0 & & \\ \hline & 0 & 6 & \\ \hline & 0) & & \\ \hline Total Operating Expenses & & & 0 \\ \hline Operating income (Loss) & & & 0 \\ \hline & & & 0 \\ \hline 7 & & & 0 \\ \hline Income Before Inoome Taxes & & & 0 \\ \hline & & & 0 \\ \hline & & S & 0 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline & Account Title & & Debit & Credit \\ \hline Cash & & s & 70,770 & \\ \hline Accounts Receivable & & & 39.000 & . \\ \hline Allowance for Uncollectible Accounts & & & & 2,400 \\ \hline Sinventory & & & 13,000 & \\ \hline Equipment & & & 45,000 & \\ \hline Accumulated Depreciation & & & & 24,000 \\ \hline Accounts Payable & & & & 10,700 \\ \hline Dinterest Payable & & & & 750 \\ \hline Q Income Tax Payable & & & & 14,500 \\ \hline Notes Payable (Lono-term) & & & & 30,000 \\ \hline Common Stock & & & & 20,000 \\ \hline QRetained Earnings & & & & 33,450 \\ \hline Service Revenue & & & & 44,500 \\ \hline Pales Revenue & & & & 35,000 \\ \hline Saies Discounts & & & 350 & \\ \hline Qinterest Revenue & & & & 120 \\ \hline Depreciation Expense & & & 10.000 & \\ \hline Supplies Exponse & & & 500 & \\ \hline Q Palaries Expense & & & 24.000 & \\ \hline Q Qad Debt Expense & & & 2.400 & \\ \hline Qniterst Expense & & & 1,000 & \\ \hline QRent Expense & & & 2400 & \\ \hline Qincome Tax Expense & & & 14.500 & \\ \hline Q & & & 4.900 & \\ \hline Tots: & & 5 & 241.420 .3 & 241,420 \\ \hline \end{tabular}