Please help with making journal entries for the below transactions.

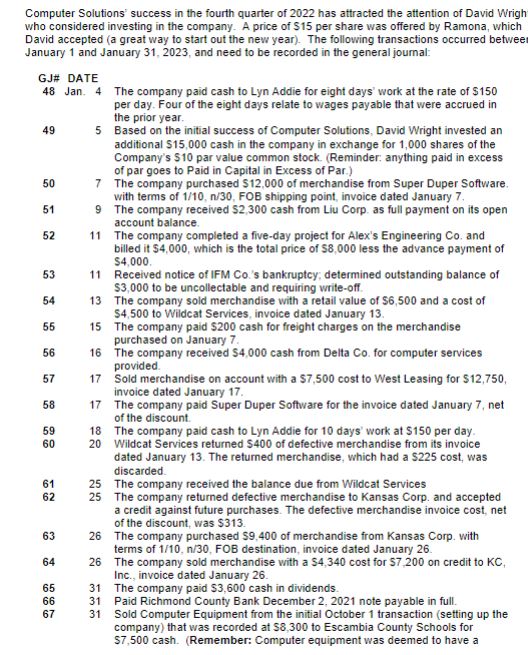

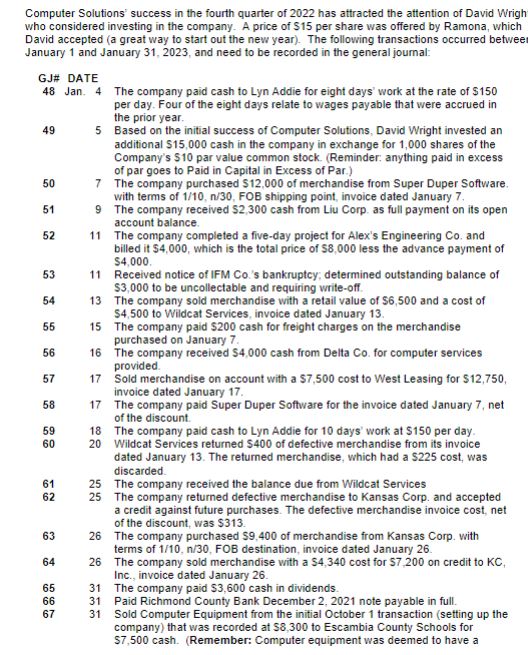

Computer Solutions' success in the fourth quarter of 2022 has attracted the attention of David Wrigh who considered investing in the company. A price of $15 per share was offered by Ramona, which David accepted (a great way to start out the new year). The following transactions occurred betwee January 1 and January 31,2023, and need to be recorded in the general journal: GJH DATE 48 Jan. 4 The company paid cash to Lyn Addie for eight days' work at the rate of $150 per day. Four of the eight days relate to wages payable that were accrued in the prior year. 49 5 Based on the initial success of Computer Solutions, David Wright invested an additional $15,000 cash in the company in exchange for 1,000 shares of the Company's $10 par value common stock. (Reminder: anything paid in excess of par goes to Paid in Capital in Excess of Par.) 507 The company purchased $12,000 of merchandise from Super Duper Software. with terms of 1/10,n/30, FOB shipping point, invoice dated January 7. 9 The company received $2,300 cash from Liu Corp. as full payment on its open account balance. 11 The company completed a five-day project for Alex's Engineering Co. and billed it $4,000, which is the total price of $8,000 less the advance payment of $4,000. 5311 Received notice of IFM Co.'s bankruptcy; determined outstanding balance of $3,000 to be uncollectable and requiring write-off. 5413 The company sold merchandise with a retail value of $6,500 and a cost of $4,500 to Wildcat Services, invoice dated January 13. 5515 The company paid $200 cash for freight charges on the merchandise purchased on January 7. 5616 The company received $4,000 cash from Delta Co. for computer services provided. 5717 Sold merchandise on account with a $7,500 cost to West Leasing for $12,750, invoice dated January 17. 5817 The company paid Super Duper Software for the invoice dated January 7 , net of the discount. 5918 The company paid cash to Lyn Addie for 10 days' work at $150 per day. 6020 Wildcat Services returned $400 of defective merchandise from its invoice dated January 13 . The returned merchandise, which had a $225 cost, was discarded. 6125 The company received the balance due from Wildcat Services 6225 The company returned defective merchandise to Kansas Corp. and accepted a credit against future purchases. The defective merchandise invoice cost, net of the discount, was $313 6326 The company purchased $9,400 of merchandise from Kansas Corp. with terms of 1/10,n/30, FOB destination, invoice dated January 26. 6426 The company sold merchandise with a $4,340 cost for $7,200 on credit to KC, Inc., invoice dated January 26. 6531 The company paid $3,600 cash in dividends. 6631 Paid Richmond County Bank December 2, 2021 note payable in full. 6731 Sold Computer Equipment from the initial October 1 transaction (setting up the company) that was recorded at $8,300 to Escambia County Schools for \$7,500 cash. (Remember: Computer equipment was deemed to have a