Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with PA 8-3 !! Assumre instead Kralt Hein uses the wing of accounts receivable method and estimates Journal entry required for the year

Please help with PA 8-3 !!

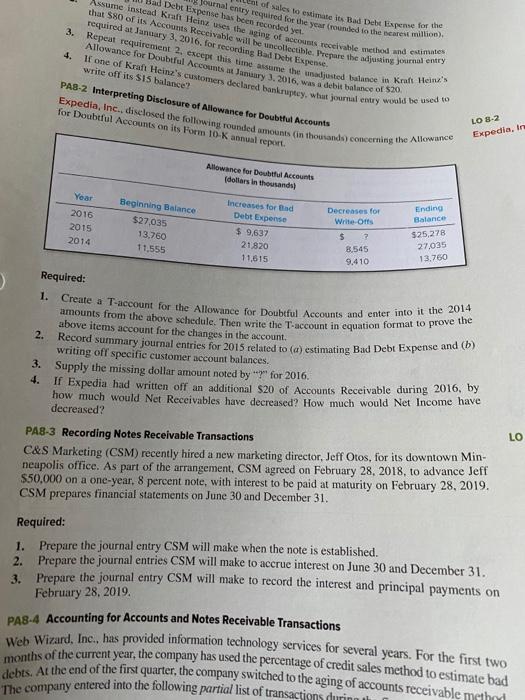

Assumre instead Kralt Hein uses the wing of accounts receivable method and estimates Journal entry required for the year rounded in the nearest million), Repeat requirement 2, except this time assume the wasted balance in Kraft Hein's Allowance for Doubtful Acces w January 3, 2016, was a debit balance of $20. months of the current year, the company has used the percentage of credit sales method to estimate bad debts. At the end of the first quarter, the company switched to the aging of accounts receivable method that $80 of its Accounts Receivable will be uncollectible. Prepare the adjusting journal entry of sales to estimate its Bad Debt Expense for the If one of a Hein's customers declared bankruptcy, what journal entry wald be used to Expedia, Inc., disclosed the following rounded amounts (in the sands) concerning the Allowance Create a T-account for the Allowance for Doubtful Accounts and enter into it the 2014 Expense has yet required at January 3, 2016. for recording Bad Debt Expense. 3. 4. write off its S15 balance? PAB-2 Interpreting Disclosure of Allowance for Doubtful Accounts for Doubtful Accounts on its Form 10-K annual report LO 3-2 Expedia, in Allowance for Doubtful Accounts dollars in thousands Year 2016 2015 2014 Beginning Balance $27.035 13,760 11.555 Increases for Bund Debt Expense $9.637 21820 11.615 Decreases for Write Offs $ 3 8.545 9.410 Ending Balance $25,278 27.035 13.760 Required: 1. above items account for the changes in the account, 2. Record summary journal entries for 2015 related to (a) estimating Bad Debt Expense and (b) writing off specific customer account balances. 3. Supply the missing dollar amount noted by "Y" for 2016. If Expedia had written off an additional $20 of Accounts Receivable during 2016, by how much would Net Receivables have decreased? How much would Net Income have decreased? 4. LO PA8-3 Recording Notes Receivable Transactions C&S Marketing (CSM) recently hired a new marketing director, Jeff Otos, for its downtown Min- neapolis office. As part of the arrangement, CSM agreed on February 28, 2018, to advance Jeff $50,000 on a one-year. 8 percent note, with interest to be paid at maturity on February 28, 2019. CSM prepares financial statements on June 30 and December 31. Required: 1. Prepare the journal entry CSM will make when the note is established. 2. Prepare the journal entries CSM will make to accrue interest on June 30 and December 31. 3. Prepare the journal entry CSM will make to record the interest and principal payments on February 28, 2019. PA8-4 Accounting for Accounts and Notes Receivable Transactions Web Wizard, Inc., has provided information technology services for several years. For the first two The company entered into the following partial list of transactions during Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started