Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with Part 3 only. Intro You just took out a 15-year traditional fixed-rate mortgage for $400,000 to buy a house. The interest rate

Please help with Part 3 only.

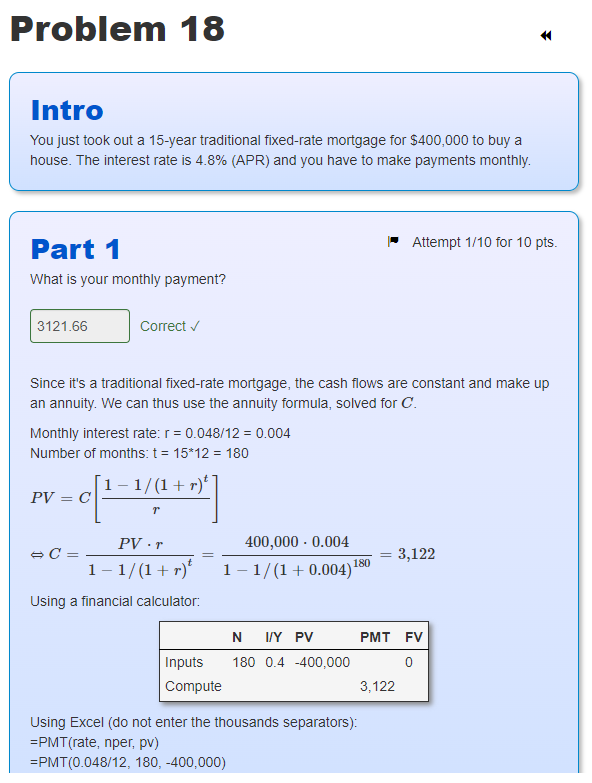

Intro You just took out a 15-year traditional fixed-rate mortgage for $400,000 to buy a house. The interest rate is 4.8% (APR) and you have to make payments monthly. Part 1 Attempt 1/10 for 10 pts. What is your monthly payment? Correct Since it's a traditional fixed-rate mortgage, the cash flows are constant and make up an annuity. We can thus use the annuity formula, solved for C. Monthly interest rate: r=0.048/12=0.004 Number of months: t=1512=180 PV=C[r11/(1+r)t]C=11/(1+r)tPVr=11/(1+0.004)180400,0000.004=3,122 Using a financial calculator: Using Excel (do not enter the thousands separators): = PMT(rate, nper, pv) =PMT(0.048/12,180,400,000) How much of your first monthly payment goes towards paying down the outstanding balance (in \$)? Correct Since the initial balance is $400,000 and the monthly interest rate is 0.004 , we have to pay $400,0000.004=$1,600 in interest in the first month. Therefore, the remainder of the payment is principal repayment, which reduces the outstanding balance: Principal repayment = Payment - Interest =3,1221,600=1,521.66 Using Excel (do not enter the thousands separators): = PPMT (rate, per, nper, pv) = PPMT (0.048/12,1,180,400,000) =1,521.66 Part 3 (1) Attempt 5/10 for 10 pts. How much of your 13th monthly payment goes towards paying down the outstanding balance (in \$)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started