Answered step by step

Verified Expert Solution

Question

1 Approved Answer

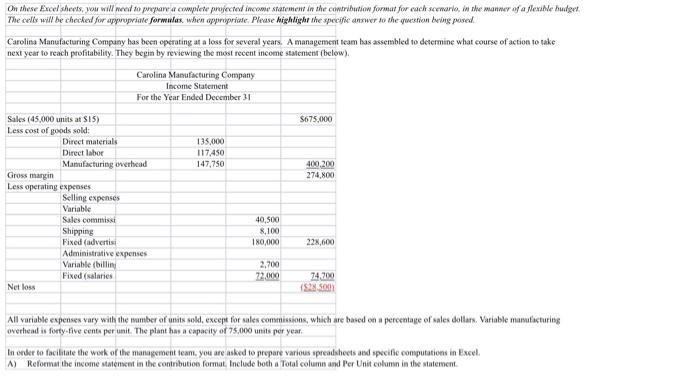

Please help with Part A,B, and E. Please show all work and formulas used to obtain the answers. Thank you in advance! Carolina Manufacturing Compuny

Please help with Part A,B, and E. Please show all work and formulas used to obtain the answers. Thank you in advance!

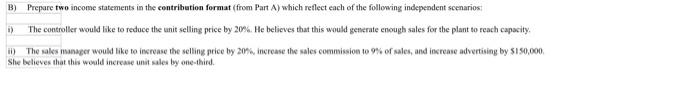

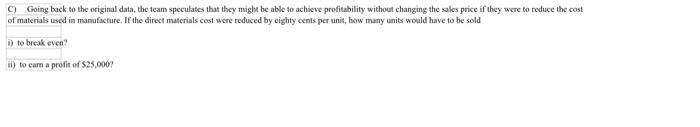

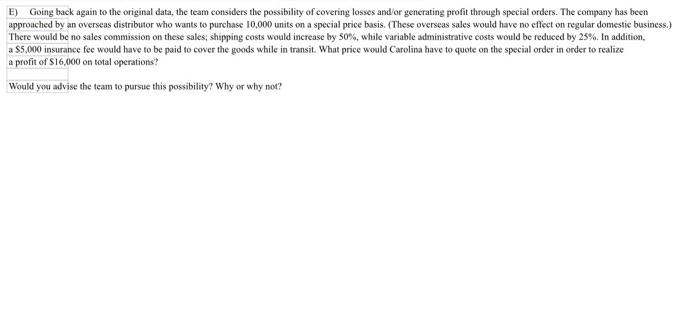

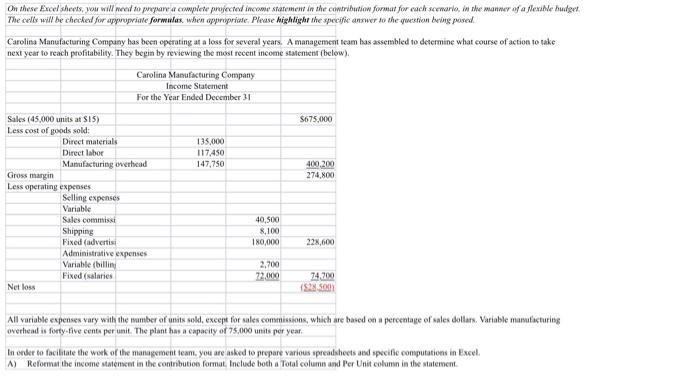

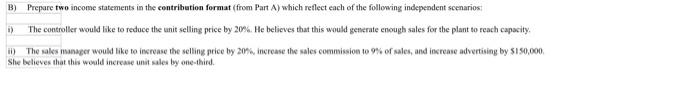

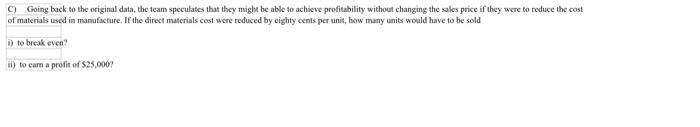

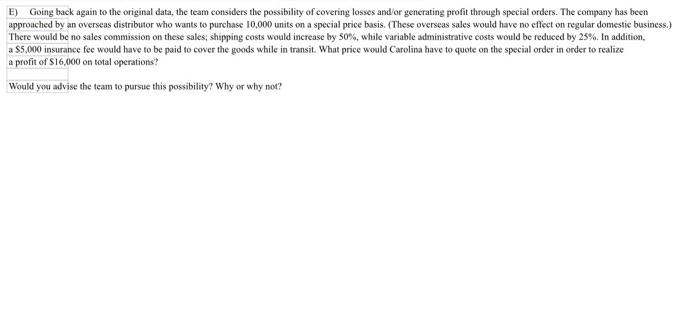

Carolina Manufacturing Compuny has been operating as a loss for several years. A managerment team bas assenbled to deternine what course of action to take next year to reach profitabality. They begia by revicwing the most recent income statenens (below). All variable expenses vary with the mamber of units sold, except for sales comsmissions, which are based en a percentage of sales dollars, Variable marufacturing overhead is forty-five cents per unit. The plant has a capacity of 75,000 units per year. In exder to facilitate the woek of the management icam. you are asked to grepare various spreadshects asd specifie computations in Excel. A) Refoemas the insome statemeet in the contributioe format Include boch a Fotal column and Per Unit colamn in the statement. B) Prepare two incone statements in the contribution format (from Part A) which reflect each of the following independent scenariosi i) The controller would lake to reduce the unit selling price by 20 . He belicves that this would generate enough sales for the plant to ecach capacity. ii) The sales manager would like to increase the selling price by zope, increase the sales comnission to 9% of sales, and increase advertising by $1 so, o00. She believes that this would increase unst sales by one-thied. C) Going back to the original data, the team speculates that they might be able to achieve profitability without changing the sales price if they were to reduce the cost of materials used in manufacture. If the direct materials cost were reduced by eighty cents per unit, bow many units woeld have to be sold i) to break even? ii) to carn a profit of $25,000% D) Again with original data, the tcam speculates that the problem might le in inadequate promotion. They want to know by how mach they could increase advertising and still allow the company to cara a target profit of 5% of sales on sales of 60,000 units. E) Going back again to the original data, the team considers the possibility of covering losses and/or generating profit throcigh special orders. The company has been approached by an overseas distributor who wants to purchase 10,000 units on a special price basis. (These overseas sales would have no effect on regular domestic business.) There would be no sales commission on these sales; shipping costs would increase by 50%, while variable administrative costs would be reduced by 25%. In addition, a $5,000 insurance fee would have to be paid to cover the goods while in transit. What price would Carolina have to quote on the special order in order to realize a profit of $16,000 on total operations? Would you advise the team to pursue this possibility? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started