Answered step by step

Verified Expert Solution

Question

1 Approved Answer

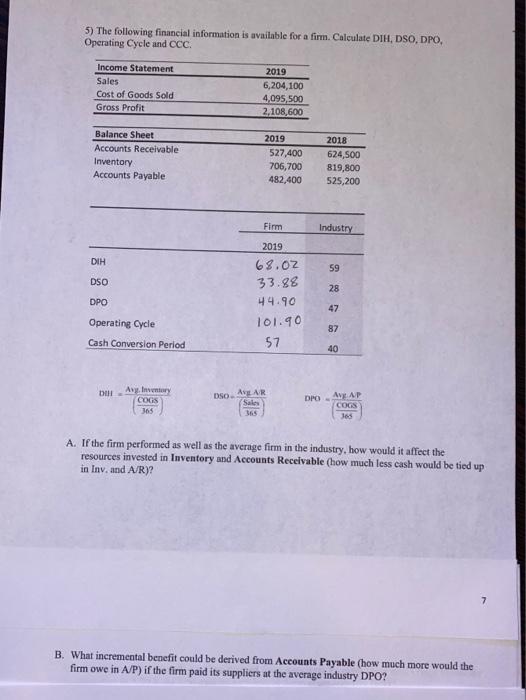

please help with parts A and B (at the very bottom) 5) The following financial information is available for a firm. Calculate DIH, DSO, DPO,

please help with parts A and B (at the very bottom)

5) The following financial information is available for a firm. Calculate DIH, DSO, DPO, Operating Cycle and CCC. Income Statement Sales Cost of Goods Sold Gross Profit 2019 6,204,100 4,095,500 2,108,600 Balance Sheet Accounts Receivable Inventory Accounts Payable 2019 527,400 706,700 482,400 2018 624,500 819,800 525,200 Firm Industry DIH 59 DSO 28 2019 68.02 33.88 44.90 101.90 57 DPO 47 Operating Cycle 87 Cash Conversion Period 40 DU Awiniary COGS 365 DS. ANAR DPO - Sales AVAP COGS A. If the firm performed as well as the average firm in the industry, how would it affect the resources invested in Inventory and Accounts Receivable (how much less cash would be tied up in Inv. and A/R)? 7 B. What incremental benefit could be derived from Accounts Payable (how much more would the firm owe in A/P) if the firm paid its suppliers at the average industry DPO Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started