Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with parts A&B. will upvote if I score correctly on my homework 2016 SCANDI HOME FURNISHINGS, INC. INCOME STATEMENTS 2014 2015 Net sales

please help with parts A&B. will upvote if I score correctly on my homework

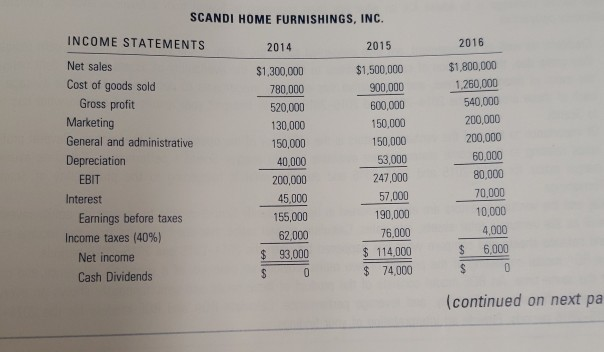

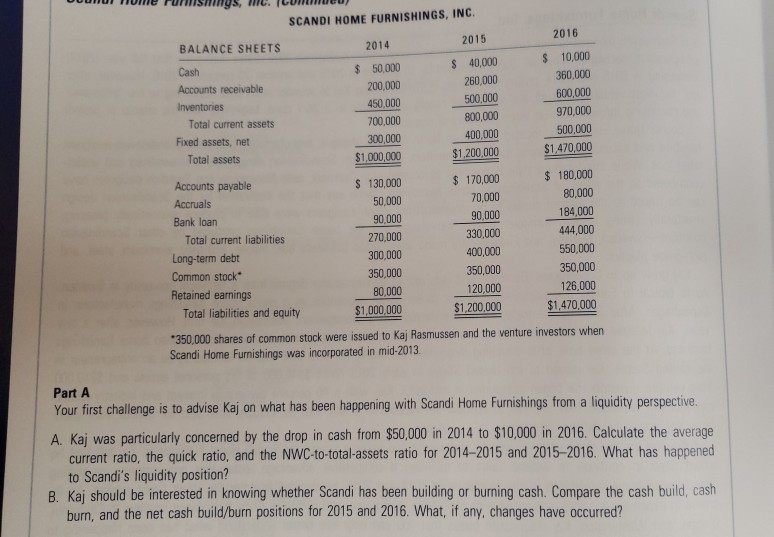

2016 SCANDI HOME FURNISHINGS, INC. INCOME STATEMENTS 2014 2015 Net sales $1,300,000 $1,500,000 Cost of goods sold 780,000 900,000 Gross profit 520,000 600,000 Marketing 130,000 150,000 General and administrative 150,000 150,000 Depreciation 40,000 53,000 EBIT 200,000 247,000 Interest 45,000 57,000 Earnings before taxes 190,000 Income taxes (40%) 62,000 76,000 $ 114,000 93,000 Net income $ 74,000 Cash Dividends $1,800,000 1.260,000 540,000 200,000 200,000 60.000 80,000 70,000 155,000 10,000 4,000 6,000 $ (continued on next pa 2016 $ 10,000 360,000 600,000 970,000 500,000 $1,470,000 Domov nome pummings, me. (Lommeu SCANDI HOME FURNISHINGS, INC. 2015 BALANCE SHEETS 2014 $ 40,000 Cash $ 50,000 260,000 Accounts receivable 200,000 500,000 Inventories 450,000 Total current assets 700,000 800,000 400,000 Fixed assets, net 300,000 $1,200,000 Total assets $1,000,000 $ 170,000 Accounts payable $ 130,000 70,000 Accruals 50,000 Bank loan 90,000 90,000 Total current liabilities 270,000 330,000 Long-term debt 300,000 400,000 Common stock 350,000 350,000 Retained earnings 80,000 120,000 $1,200,000 $1,000,000 Total liabilities and equity $ 180,000 80,000 184,000 444,000 550,000 350,000 126,000 $1,470,000 *350.000 shares of common stock were issued to Kaj Rasmussen and the venture investors when Scandi Home Furnishings was incorporated in mid-2013 Part A Your first challenge is to advise kaj on what has been happening with Scandi Home Furnishings from a liquidity perspective. A. Kaj was particularly concerned by the drop in cash from $50,000 in 2014 to $10,000 in 2016. Calculate the average current ratio, the quick ratio, and the NWC-to-total-assets ratio for 2014-2015 and 2015-2016. What has happened to Scandi's liquidity position? B. Kaj should be interested in knowing whether Scandi has been building or burning cash. Compare the cash build, cash burn, and the net cash build/burn positions for 2015 and 2016. What, if any, changes have occurredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started