Please help with preparing the T-account to find the balance in maufacturing overhead

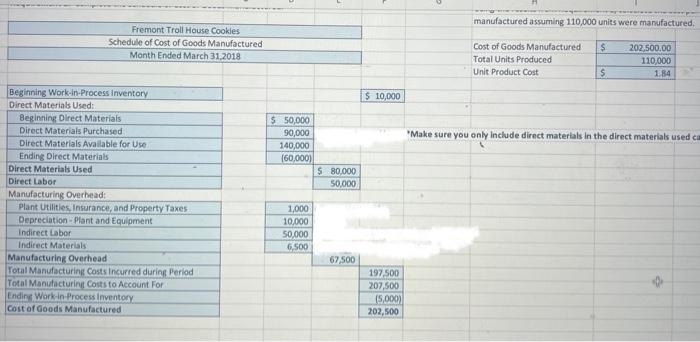

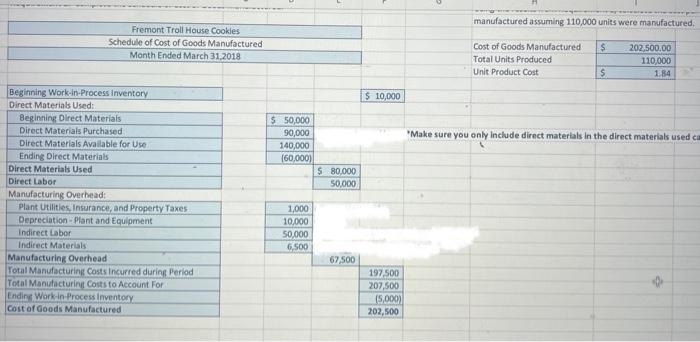

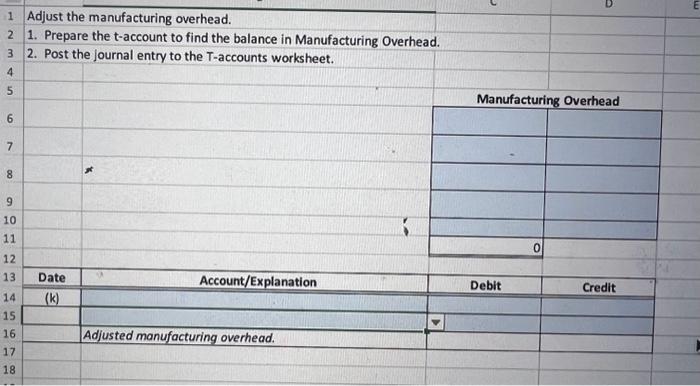

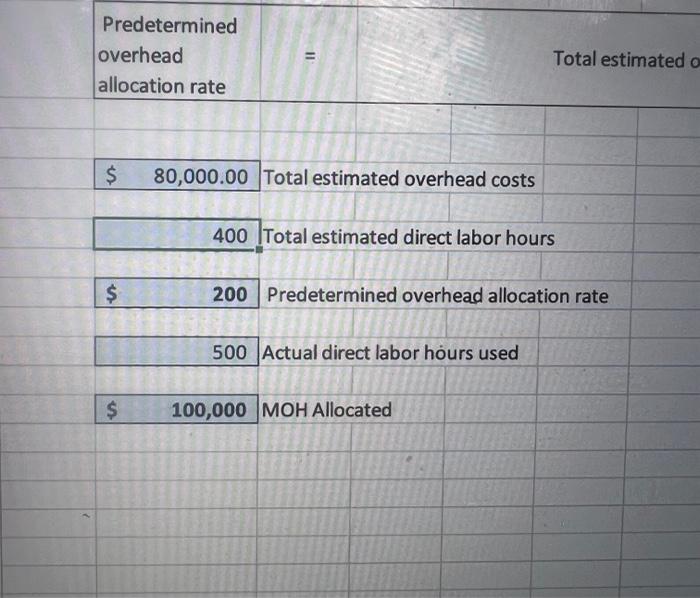

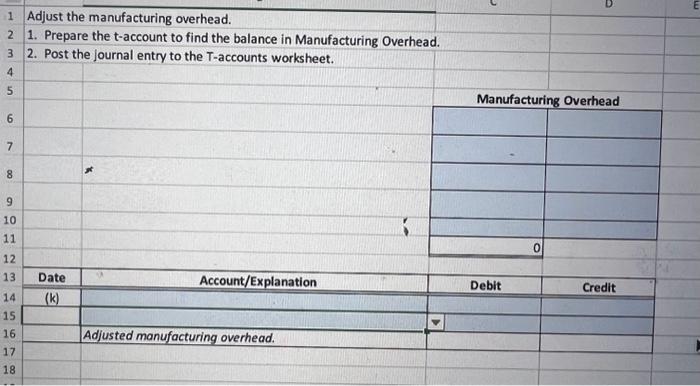

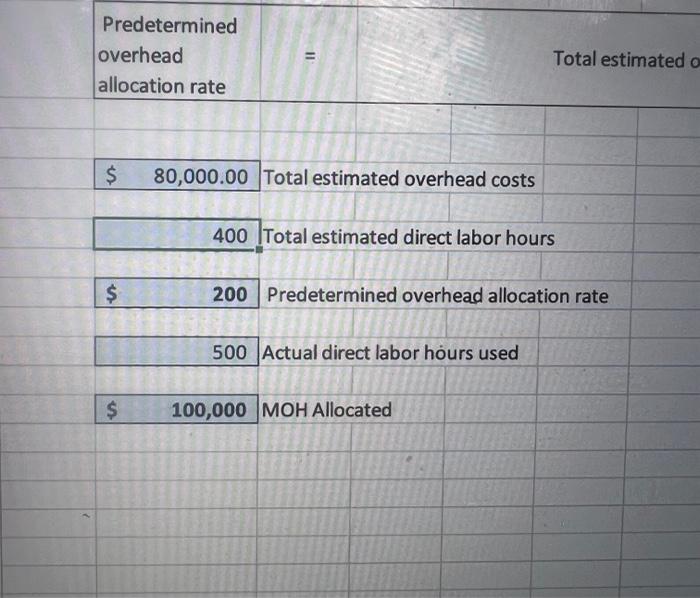

\begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & & & & & \multicolumn{3}{|c|}{ manufactured assuming 110,000 unies were manufactured. } \\ \hline \multicolumn{3}{|c|}{ Fremont Troll House Cookles } & & & & & \\ \hline \multicolumn{3}{|c|}{ Schedule of cost of Goods Manufactured } & & & Cost of Goods Manufactured & 202,500,00 & \\ \hline \multicolumn{3}{|c|}{ Month Ended March 31.2018} & & & Total Units Produced & 110,000 & \\ \hline & & & & & Unit Product Cost & 1.84 & sin2 \\ \hline & & & & & & & \\ \hline Beginning Work-in-Process inventory & & & $10,000 & & & & \\ \hline \multicolumn{8}{|l|}{\begin{tabular}{l} Direct Materials Used: \\ Beginging Direct Materials \end{tabular}} \\ \hline Beginning Direct Materials & $50,000 & & & & & & \\ \hline Direct Materials Purchased & 90,000 & & & \multicolumn{4}{|c|}{ 'Make sure you only include direct materials in the direct materials used ca } \\ \hline Direct Materlals Avallable for Use & 140,000 & & & & 6 & & \\ \hline Ending Direct Materials & (60,000) & & & & & 18 & \\ \hline Direct Materials Used & & $80.000 & 5 & & & & \\ \hline Direct Labor & & 50,000 & & & & & \\ \hline Manufacturing Overhead: & & & & * & & & \\ \hline Plant Utilities, Insurance, and Property Taxes & 1,000 & & & & & & \\ \hline Depreciation - Plant and Equlpment & 10,000 & & & & & & \\ \hline Indirect Labor & 50,000 & & & & & & \\ \hline Indirect Materials & 6,500 & & & & & & \\ \hline Manufacturing Overhead & & 67,500 & & & & & \\ \hline Fotal Manufacturing Costs Incurred during Period & & & 197500 & & & A. & \\ \hline Total Manufacturing Costs to Account For & & & 207,500 & & & & \\ \hline Endine Work-in-Process Inventory & & & {[5,000)} & & & & \\ \hline Cost of Goods Manufactured & & & 202,500 & & & & \\ \hlinez1 & & & & & & & \\ \hline \end{tabular} 1 Adjust the manufacturing overhead. 1. Prepare the t-account to find the balance in Manufacturing Overhead. 2. Post the journal entry to the T-accounts worksheet. 4 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Adjusted manufacturing overhead. \begin{tabular}{|r|r|} \hline \multicolumn{1}{|c|}{ Manufacturing Overhead } \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline 0 & \\ \hline \end{tabular} Date (k) Account/Explanation Debit Credit \begin{tabular}{|l|rr|} \hline Coconut Flakes Purchase & $ & 20,000 \\ \hline Oven Depreciation & $ & 10,000 \\ \hline Computer Insurance & $ & 5,000 \\ \hline Bakery Security Guard Wages & $ & 20,000 \\ \hline Flour Purchased & $ & 25,000 \\ \hline Bakers Salaries & $ & 50,000 \\ \hline Bakery Electricity & $ & 1,000 \\ \hline Eggs Purchased & $ & 30,000 \\ \hline Corporate Headquarters'Heating & $ & 7,000 \\ \hline Cookie Shipping & $ & 1,000 \\ \hline Butter Purchased & $ & 15,000 \\ \hline Baking Supervisor Salary & $ & 30,000 \\ \hline Sanitary Gloves Purchased (Worn by Bakers) & $ & 5,500 \\ \hline Sugar Purchased & $ & 20,000 \\ \hline \end{tabular} \begin{tabular}{|l|l|r|} \hline & \multicolumn{2}{|c|}{ Account Balances } \\ \hline Beg. Direct Materials & $ & 50,000 \\ \hline Ending Direct Materials & $ & 60,000 \\ \hline Beg. Work-In-Process Inventory & $ & 10,000 \\ \hline Beg. Finished Goods & $ & 6,000 \\ \hline Ending Work-In-Process Inventory & $ & 5,000 \\ \hline Ending Finished Goods & $ & 8,000 \\ \hline Cookies Produced & 110,000 cookies \\ \hline Cookies Sold & 100,000 cookies \\ \hline Actual Direct Labor Hours Used & 500 hrs \\ \hline \end{tabular}