Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with problems 1 and 2 P 3-6 Balance sheet preparation; disclosures .LO3-2 through LO3 4 The following is the ending balances of accounts

Please help with problems 1 and 2

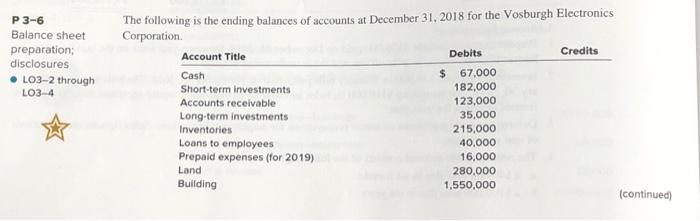

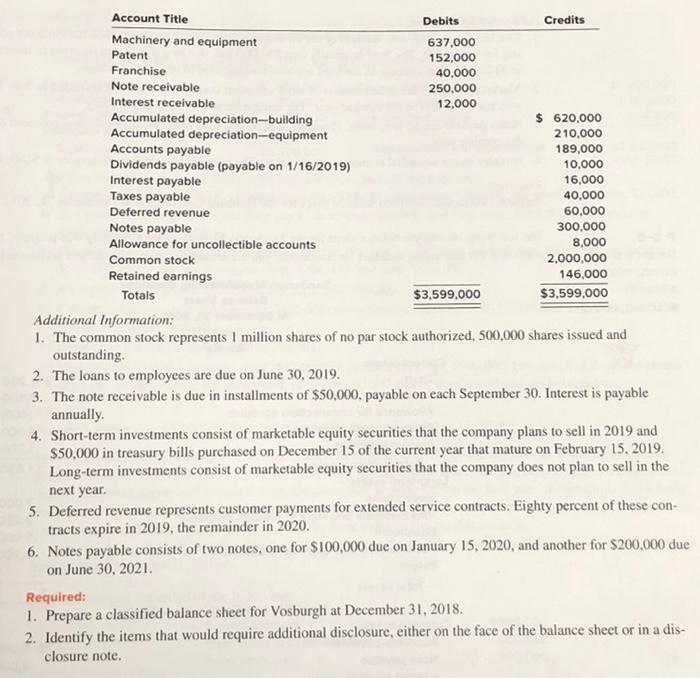

P 3-6 Balance sheet preparation; disclosures .LO3-2 through LO3 4 The following is the ending balances of accounts at December 31, 2018 for the Vosburgh Electronics Corporation Account Title Debits Credits Cash $ 67,000 Short-term investments 182,000 Accounts receivable 123,000 Long-term investments 35,000 Inventories 215,000 Loans to employees 40,000 Prepaid expenses (for 2019) 16,000 Land 280,000 Building 1,550,000 (continued) 210,000 Account Title Debits Credits Machinery and equipment 637,000 Patent 152,000 Franchise 40,000 Note receivable 250,000 Interest receivable 12,000 Accumulated depreciation-building $ 620.000 Accumulated depreciation-equipment Accounts payable 189,000 Dividends payable (payable on 1/16/2019) 10,000 Interest payable 16,000 Taxes payable 40,000 Deferred revenue 60,000 Notes payable 300,000 Allowance for uncollectible accounts 8,000 Common stock 2,000,000 Retained earnings 146,000 Totals $3,599,000 $3,599,000 Additional Information: 1. The common stock represents 1 million shares of no par stock authorized, 500,000 shares issued and outstanding. 2. The loans to employees are due on June 30, 2019. 3. The note receivable is due in installments of $50,000, payable on each September 30. Interest is payable annually. 4. Short-term investments consist of marketable equity securities that the company plans to sell in 2019 and $50,000 in treasury bills purchased on December 15 of the current year that mature on February 15, 2019. Long-term investments consist of marketable equity securities that the company does not plan to sell in the next year. 5. Deferred revenue represents customer payments for extended service contracts. Eighty percent of these con- tracts expire in 2019, the remainder in 2020. 6. Notes payable consists of two notes, one for $100,000 due on January 15, 2020, and another for $200,000 due on June 30, 2021 Required: 1. Prepare a classified balance sheet for Vosburgh at December 31, 2018. 2. Identify the items that would require additional disclosure, either on the face of the balance sheet or in a dis- closure

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started