Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with question 4 O PDE BCom Y1 AA Calendar JULY 202 DE BCOM SCM Y1_Eco 1_Assignmer X + a File C:/Users/silence/Downloads/BCom%20Y1%20AA%20Calendar%20JULY%202021%20PC.pdf 2 :

please help with question 4

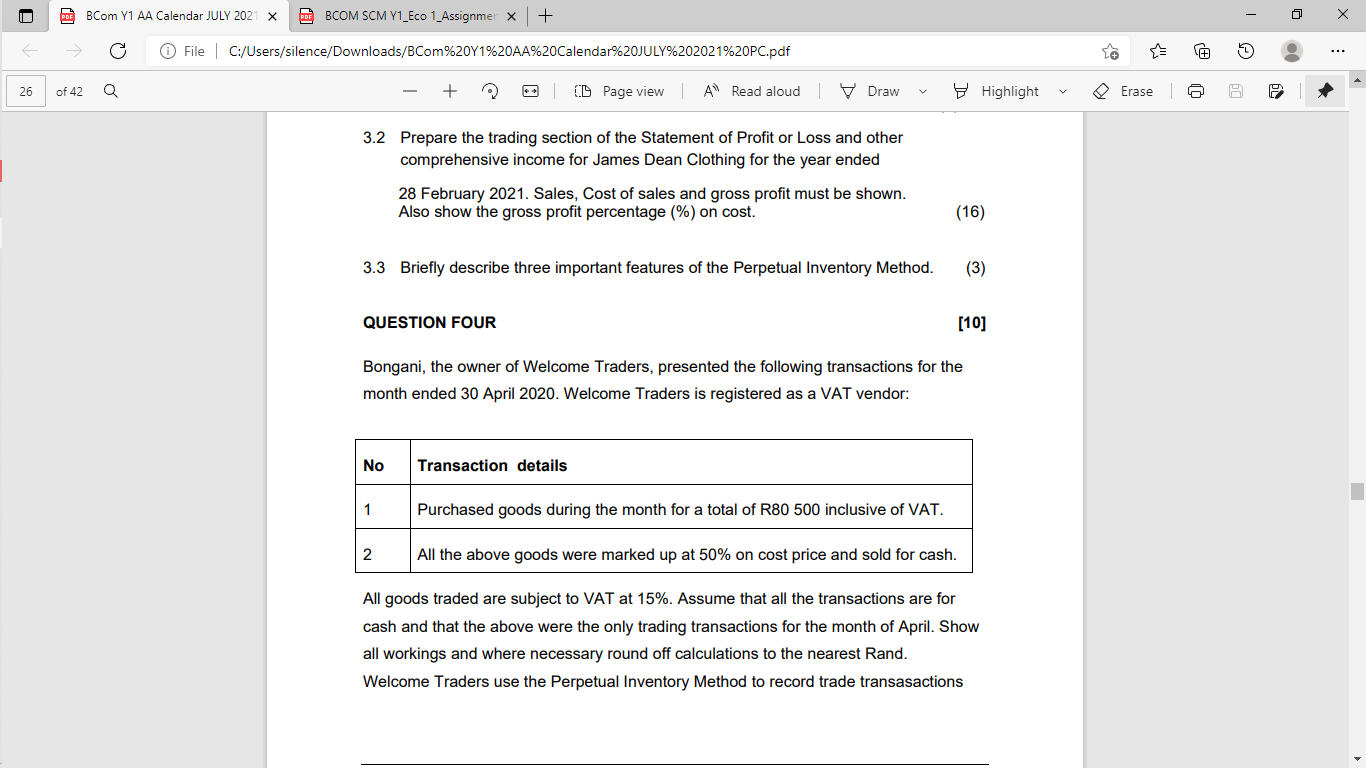

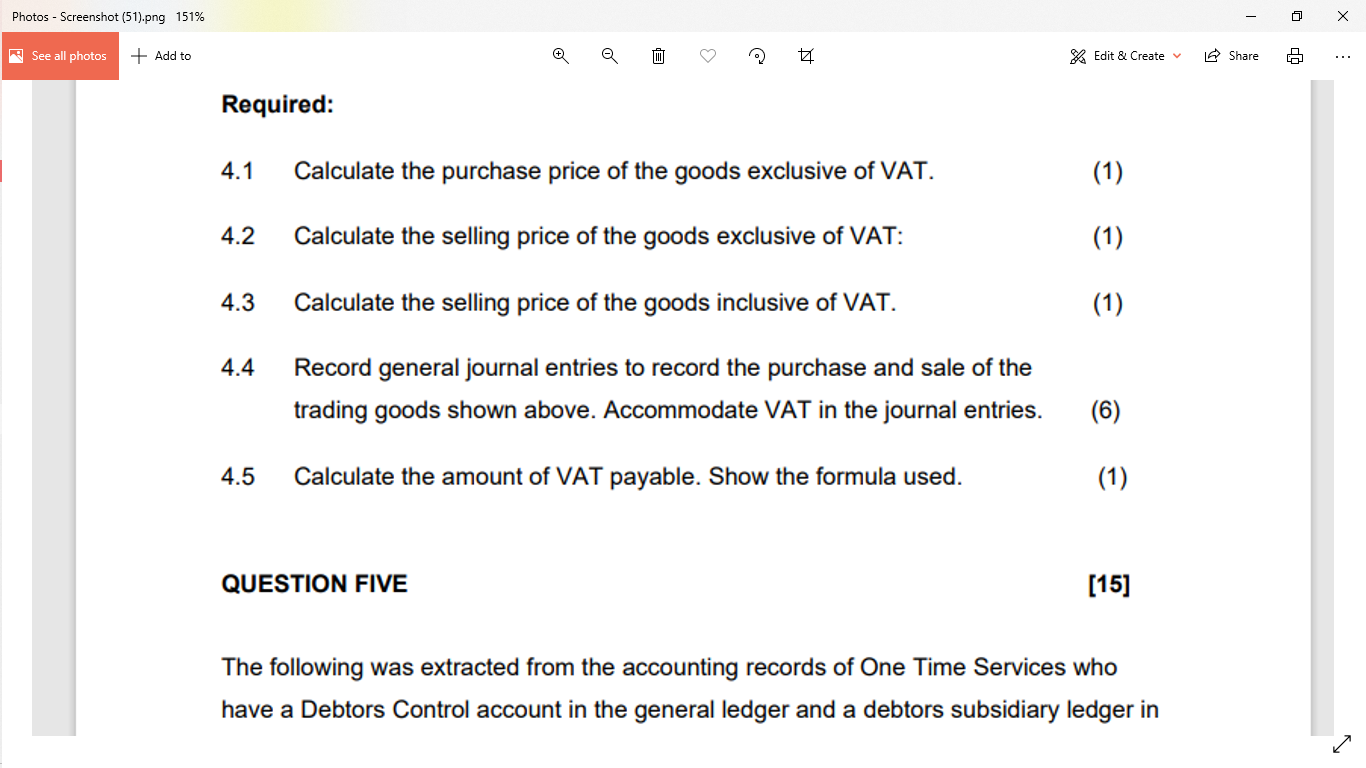

O PDE BCom Y1 AA Calendar JULY 202 DE BCOM SCM Y1_Eco 1_Assignmer X + a File C:/Users/silence/Downloads/BCom%20Y1%20AA%20Calendar%20JULY%202021%20PC.pdf 2 : 26 of 42 a + O L Page view A Read aloud Draw Highlight Erase 09 A 19 3.2 Prepare the trading section of the Statement of Profit or Loss and other comprehensive income for James Dean Clothing for the year ended 28 February 2021. Sales, Cost of sales and gross profit must be shown. Also show the gross profit percentage (%) on cost. (16) 3.3 Briefly describe three important features of the Perpetual Inventory Method. (3) QUESTION FOUR [10] Bongani, the owner of Welcome Traders, presented the following transactions for the month ended 30 April 2020. Welcome Traders is registered as a VAT vendor: No Transaction details 1 Purchased goods during the month for a total of R80 500 inclusive of VAT. 2 All the above goods were marked up at 50% on cost price and sold for cash. All goods traded are subject to VAT at 15%. Assume that all the transactions are for cash and that the above were the only trading transactions for the month of April. Show all workings and where necessary round off calculations to the nearest Rand. Welcome Traders use the Perpetual Inventory Method to record trade transasactions Photos - Screenshot (51).png 151% See all photos + Add to a % Edit & Create Share 05 Required: 4.1 Calculate the purchase price of the goods exclusive of VAT. (1) 4.2 Calculate the selling price of the goods exclusive of VAT: (1) 4.3 Calculate the selling price of the goods inclusive of VAT. (1) 4.4 Record general journal entries to record the purchase and sale of the trading goods shown above. Accommodate VAT in the journal entries. (6) 4.5 Calculate the amount of VAT payable. Show the formula used. (1) QUESTION FIVE [15] The following was extracted from the accounting records of One Time Services who have a Debtors Control account in the general ledger and a debtors subsidiary ledger inStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started