Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with question 6 based off the tables provided. If my numbers are incorrect please help Thank you!! 17 | 6. Should the project

please help with question 6 based off the tables provided. If my numbers are incorrect please help Thank you!!

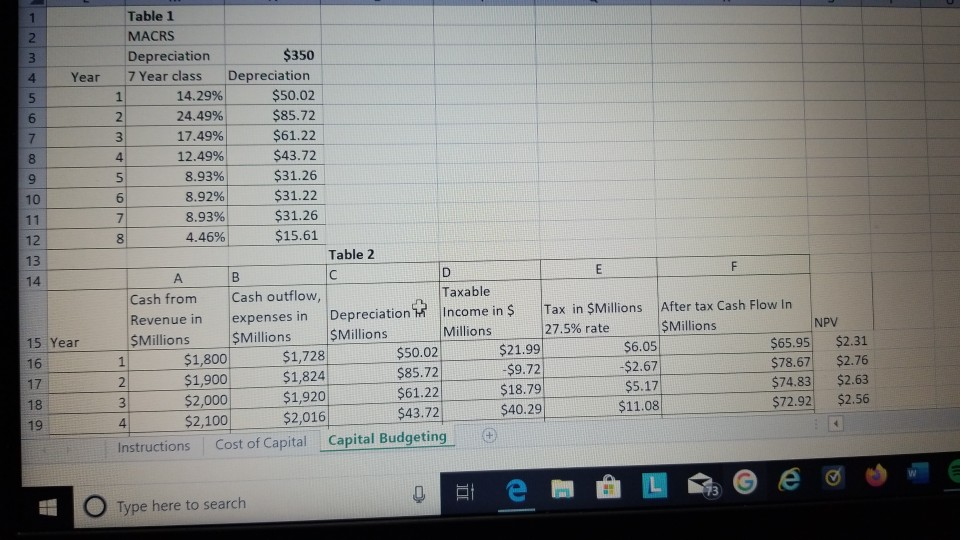

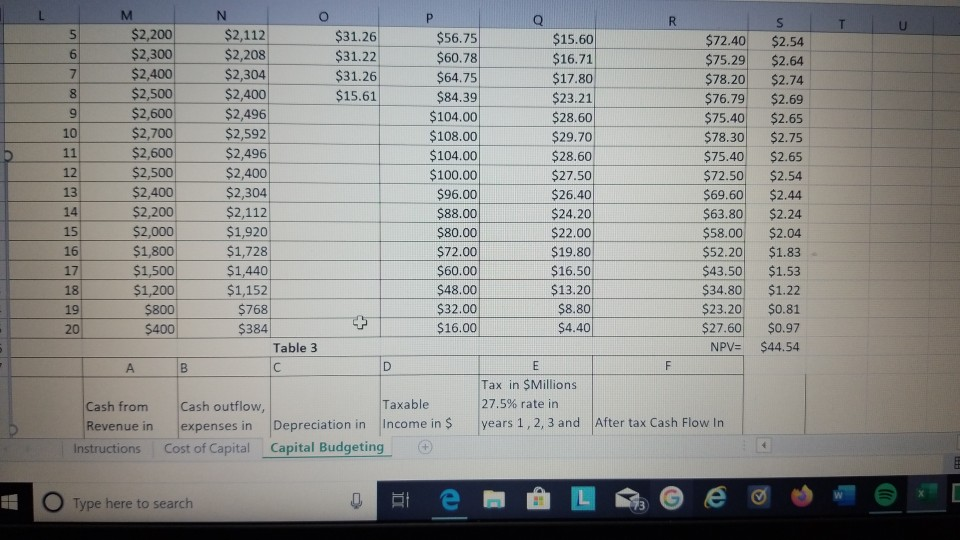

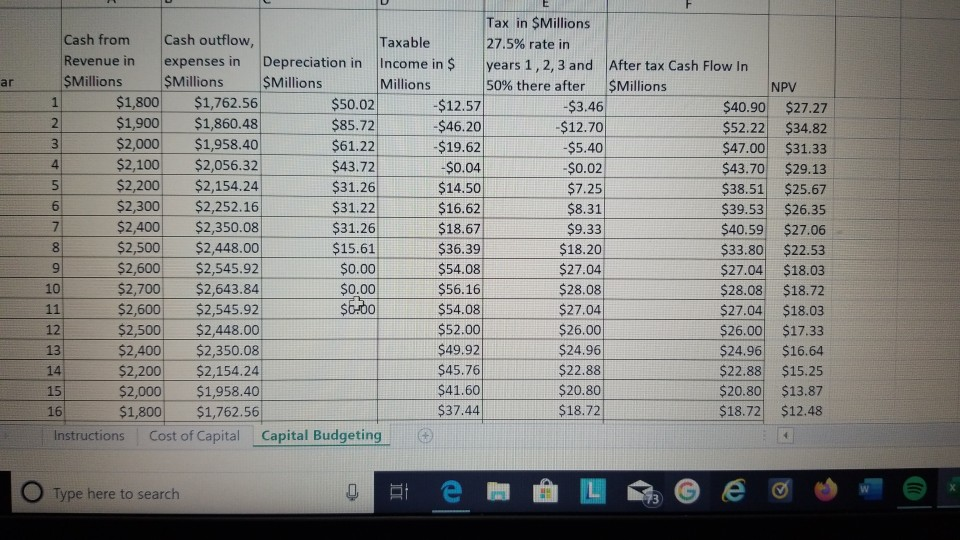

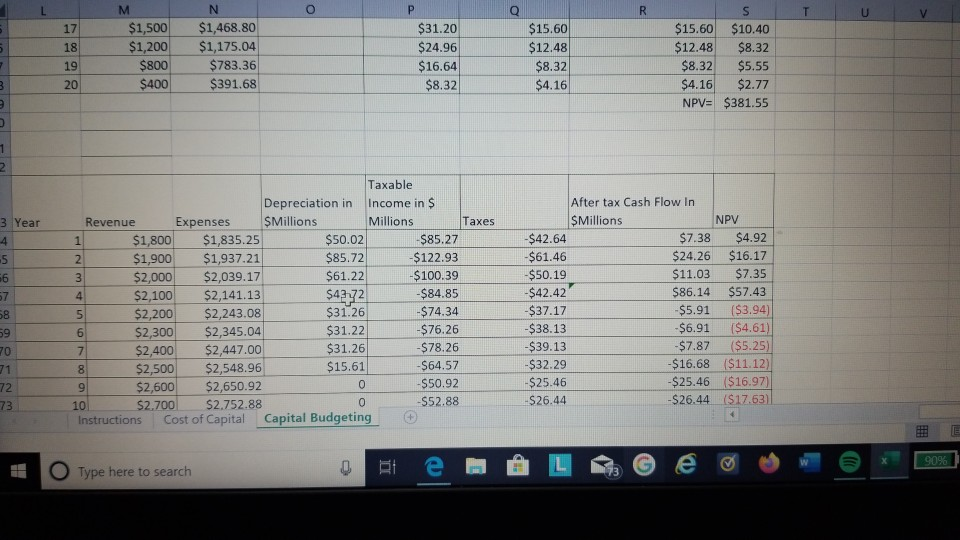

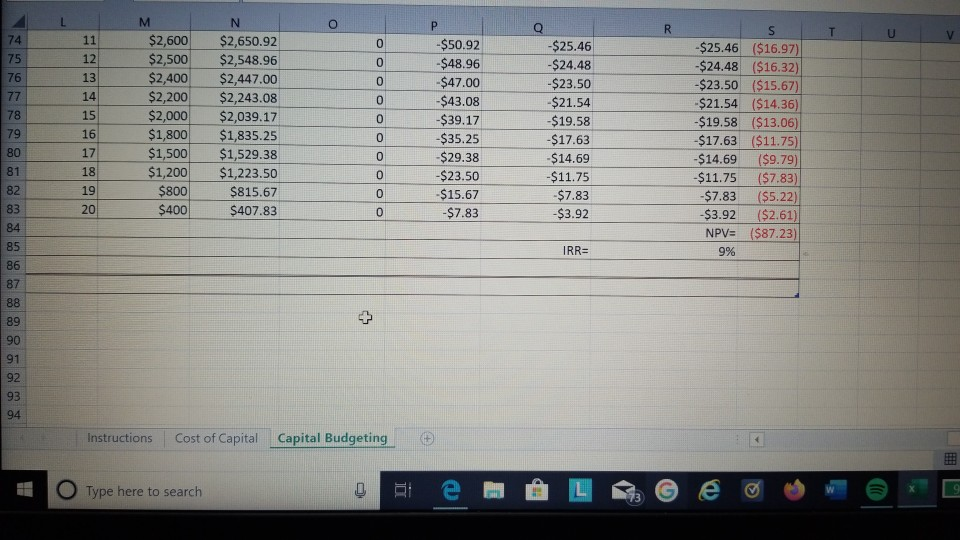

17 | 6. Should the project be accepted? Discuss the risk and the reward to McCormick Instructions Cost of Capital Capital Budgeting Type here to search Year Table 1 MACRS Depreciation $350 7 Year class Depreciation 1 14.29% $50.02 2 24.49% $85.72 3 17.49% $61.22 12.49% $43.72 8.93% $31.26 8.92% $31.22 8.93% $31.26 8 4.46% $15.61 Table 2 B Cash from Cash outflow, Taxable Revenue in expenses in Depreciation Tax in Millions After tax Cash Flow In $Millions $Millions $Millions Millions 27.5% rate $Millions NPV $1,728 $50.02 $1,800 $21.99 $65.95 $6.05 $2.31 $1,900 $85.72 $78.67 $1,824 -$9.72 $2.76 $2.67 $5.17 $61.22 $74.83 $18.79 $2,000 $2.63 $1,920 $11.08 $43.72 $40.29 $72.92 $2,100 $2.56 $2,016 Instructions Cost of Capital Capital Budgeting 15 Year O Type here to search M 6 $31.26 $31.22 $31.26 $15.61 8 9 10 11 12 $2,200 $2,300 $2,400 $2,500 $2,600 $2,700 $2,600 $2,500 $2,400 $2,200 $2,000 $1,800 $1,500 $1,200 $800 $400 N $2,112 $2,208 $2,304 $2,400 $2,496 $2,592 $2,496 $2,400 $2,304 $2,112 $1,920 $1,728 $1,440 $1,152 $768 $384 Table 3 13 14 15 16 17 18 19 20 $56.75 $60.78 $64.75 $84.39 $104.00 $108.00 $104.00 $100.00 $96.00 $88.00 $80.00 $72.00 $60.00 $48.00 $32.00 $16.00 $15.60 $16.71 $17.80 $23.21 $28.60 $29.70 $28.60 $27.50 $26.40 $24.20 $22.00 $19.80 $16.50 $13.20 $8.80 $4.40 $72.40 $75.29 $78.20 $76.79 $75.40 $78.30 $75.40 $72.50 $69.60 $63.80 $58.00 $52.20 $43.50 $34.80 $23.20 $27.60 NPV= S $2.54 $2.64 $2.74 $2.69 $2.65 $2.75 $2.65 $2.54 $2.44 $2.24 $2.04 $1.83 $1.53 $1.22 $0.81 $0.97 $44.54 300 A B Cash from Revenue in Instructions Cash outflow, Taxable expenses in Depreciation in Income in 5 Cost of Capital Capital Budgeting Tax in Millions 27.5% rate in years 1, 2, 3 and After tax Cash Flow In Type here to search o e - L e ar mano Tax in Millions Cash from Cash outflow, Taxable 27.5% rate in Revenue in expenses in Depreciation in Income in $ years 1, 2, 3 and After tax Cash Flow In $Millions SMillions SMillions Millions 50% there after SMillions NPV $1,800 $1,762.56 $50.02 $12.57 -$3.46 $40.90 $27.27 $1,900 $1,860.48 $85.72 -$46.20 -$12.70 $52.22 $34.82 $2,000 $1,958.40 $61.22 -$19.62 -$5.40 $47.00 $31.33 $2,100 $2,056.32 $43.72 -$0.04 -$0.02 $43.70 $29.13 $2,200 $2,154.24 $31.26 $14.50 $7.25 $38.51 $25.67 $2,300 $2,252.16 $31.22 $16.62 $8.31 $39.53 $26.35 $2,400 $2,350.08 $31.26 $18.67 $9.33 $40.59 $27.06 $2,500 $2,448.00 $15.61 $36.39 $18.20 $33.80 $22.53 $2,600 $2,545.92 $0.00 $54.08 $27.04 $27.04 $18.03 $2,700 $2,643.84 $0.00 $56.16 $28.08 $28.08 $18.72 $2,600 $2,545.92 $6.00 $54.08 $27.04 $27.04 $18.03 $2,500 $2,448.00 $52.00 $26.00 $26.00 $17.33 $2,400 $2,350.08 $49.92 $24.96 $24.96 $16.64 $2,200 $2,154.24 $45.76 $22.88 $22.88 $15.25 $2,000 $1,958.40 $41.60 $20.80 $20.80 $13.87 $1,800 $1,762.56 $37.44 $18.72 $18.72 $12.48 Instructions Cost of Capital Capital Budgeting EE 131 16 O Type here to search M N $1,500 $1,468.80 $1,175.04 $783.36 $391.68 $800 $400 $31.20 $24.96 $16.64 $8.32 $15.60 $12.48 $8.32 $4.16 S $15.60 $10.40 $12.48 $8.32 $8.32 $5.55 $4.16 $2.77 NPV= $381.55 20 Near Taxable Depreciation in Income in $ Revenue Expenses SMillions Millions Taxes $1,800 $1,835.25 $50.02 $85.27 $1,900 $1,937.21 $85.72 -$122.93 $2,039.17 $61.22 -$100.39 $2,141.13 $4272 -$84.85 $2,200 $2,243.08 $31.26 -$74.34 $2,300 $2,345.04 $31.22 -$76.26 $2,400 $2,447.00 $31.26 8 $2,500 $2,548.96 $15.61 -$64.57 $2,600 $2,650.92 -$50.92 $2.700 $2.752.88 -S52.88 Instructions Cost of Capital Capital Budgeting + After tax Cash Flow In SMillions NPV -$42.64 $7.38 $4.92 -$61.46 $24.26 $16.17 $50.19 $11.03 $7.35 -$42.42 $86.14 $57.43 -$37.17 -$5.91 ($3.94) -$6.91 $4.61) -$39.13 -$7.87 ($5.25) -$32.29 -$16.68 ($11.12) -$25.46 -$25.46 ($16.97) -$26.44 -$26.44 ($17.631 $38.13 -$78.26 10 0 O Type here to search ) T $2,600 $2,500 $2,400 $2,200 $2,000 $1,800 $1,500 $1,200 $800 $400 $2,650.92 $2,548.96 $2,447.00 $2,243.08 $2,039.17 $1,835.25 $1,529.38 $1,223.50 $815.67 $407.83 -$50.92 -$48.96 $47.00 -$43.08 -$39.17 -$35.25 -$29.38 -$23.50 -$15.67 -$7.83 -$25.46 -$24.48 -$23.50 $21.54 -$19.58 -$17.63 $14.69 -$11.75 -$7.83 -$3.92 -$25.46 ($16.97) -$24.48 ($16.32) -$23.50 ($15.67) -$21.54 ($14.36) -$19.58 ($13.06) $17.63 ($11.75) -$14.69 ($9.79) -$11.75 ($7.83) -$7.83 ($5.22) -$3.92 ($2.61) NPV= ($87.23) 9% O 0 IRRE Instructions Cost of Capital Capital Budgeting O Type here to searchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started