Question

Please help with question (A2). Tried working it out but continuing to get incorrect answer. Need help finding ending inventory, cost of goods sold, and

Please help with question (A2). Tried working it out but continuing to get incorrect answer. Need help finding ending inventory, cost of goods sold, and gross profit under LIFO, FIFO, and average cost. Pictures are attached for reference.

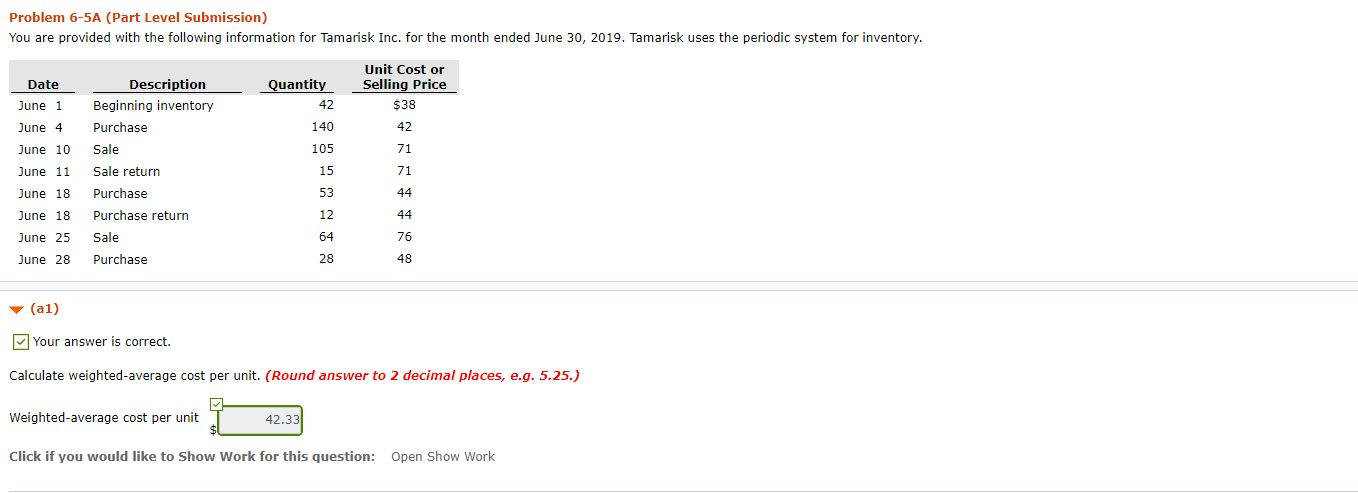

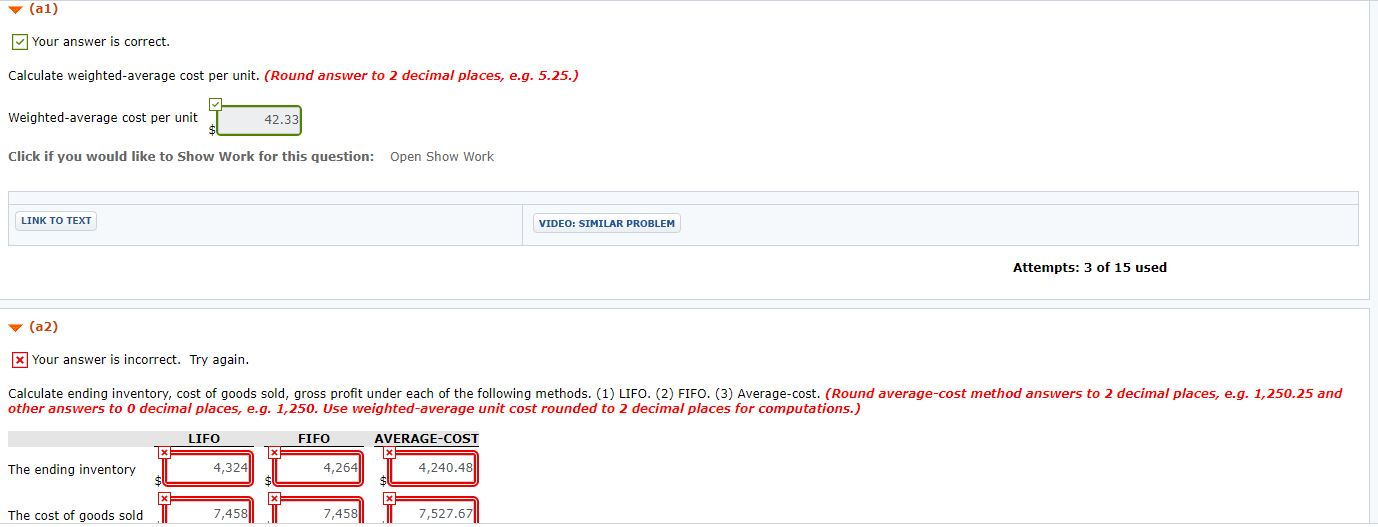

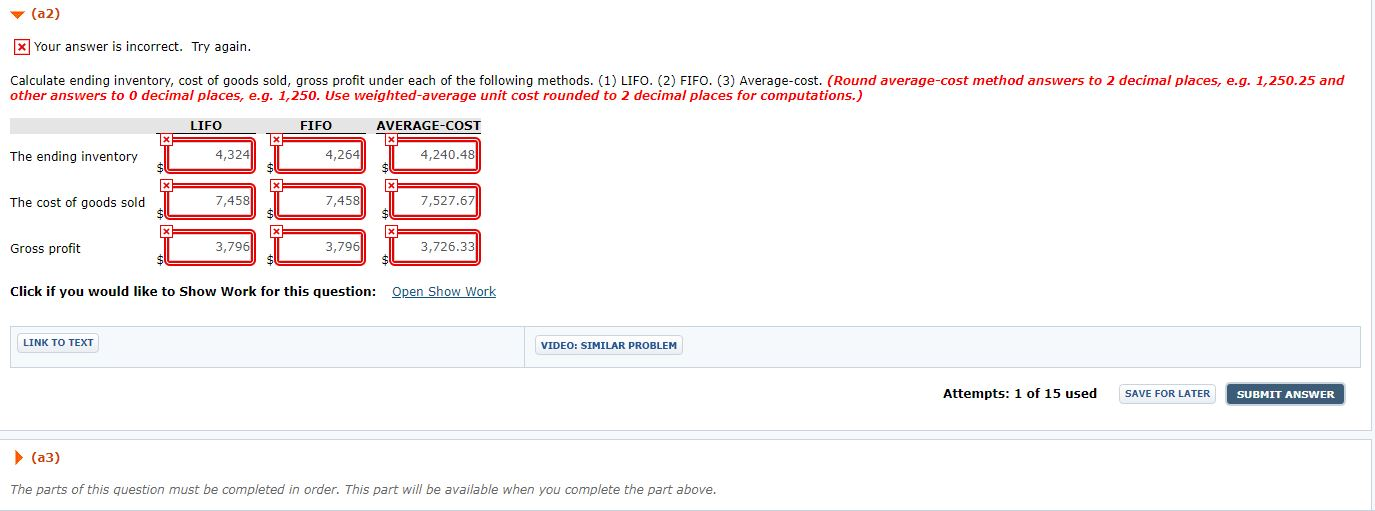

You are provided with the following information for Tamarisk Inc. for the month ended June 30, 2019. Tamarisk uses the periodic system for inventory. Date Description Quantity Unit Cost or Selling Price June 1 Beginning inventory 42 $38 June 4 Purchase 140 42 June 10 Sale 105 71 June 11 Sale return 15 71 June 18 Purchase 53 44 June 18 Purchase return 12 44 June 25 Sale 64 76 June 28 Purchase 28 48 Collapse question part (a1) Correct answer. Your answer is correct. Calculate weighted-average cost per unit. (Round answer to 2 decimal places, e.g. 5.25.) Weighted-average cost per unit $enter Weighted-average cost per unit in dollars rounded to 2 decimal placesEntry field with correct answer 42.33 Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT Attempts: 3 of 15 used Collapse question part (a2) Incorrect answer. Your answer is incorrect. Try again. Calculate ending inventory, cost of goods sold, gross profit under each of the following methods. (1) LIFO. (2) FIFO. (3) Average-cost. (Round average-cost method answers to 2 decimal places, e.g. 1,250.25 and other answers to 0 decimal places, e.g. 1,250. Use weighted-average unit cost rounded to 2 decimal places for computations.) LIFO FIFO AVERAGE-COST The ending inventory $enter a dollar amount rounded to 0 decimal placesEntry field with incorrect answer 4,324 $enter a dollar amount rounded to 0 decimal placesEntry field with incorrect answer 4,264 $enter a dollar amount rounded to 2 decimal placesEntry field with incorrect answer 4,240.48 The cost of goods sold $enter a dollar amount rounded to 0 decimal placesEntry field with incorrect answer 7,458 $enter a dollar amount rounded to 0 decimal placesEntry field with incorrect answer 7,458 $enter a dollar amount rounded to 2 decimal placesEntry field with incorrect answer 7,527.67 Gross profit $enter a dollar amount rounded to 0 decimal placesEntry field with incorrect answer 3,796 $enter a dollar amount rounded to 0 decimal placesEntry field with incorrect answer 3,796 $enter a dollar amount rounded to 2 decimal placesEntry field with incorrect answer 3,726.33 Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT Attempts: 1 of 15 used SAVE FOR LATER SUBMIT ANSWER Expand question part (a3) The parts of this question must be completed in order. This part will be available when you complete the part above. Expand question part (b) The parts of this question must be completed in order. This part will be available when you complete the part above.

Problem 6-5A (Part Level Submission) You are provided with the following information for Tamarisk Inc. for the month ended June 30, 2019. Tamarisk uses the periodic system for inventory. Quantity 42 Unit Cost or Selling Price $38 Date June 1 June 4 June 10 June 11 June 18 June 18 June 25 June 28 Description Beginning inventory Purchase Sale Sale return Purchase Purchase return Sale Purchase (a1) Your answer is correct. Calculate weighted average cost per unit. (Round answer to 2 decimal places, e.g. 5.25.) Weighted average cost per unit 42.33 Click if you would like to Show Work for this question: Open Show Work (a1) Your answer is correct. Calculate weighted average cost per unit. (Round answer to 2 decimal places, e.g. 5.25.) Weighted average cost per unit T 42.33 Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT VIDEO: SIMILAR PROBLEM Attempts: 3 of 15 used (a2) x Your answer is incorrect. Try again. Calculate ending inventory, cost of goods sold, gross profit under each of the following methods. (1) LIFO. (2) FIFO. (3) Average-cost. (Round average-cost method answers to 2 decimal places, e.g. 1,250.25 and other answers to o decimal places, e.g. 1,250. Use weighted average unit cost rounded to 2 decimal places for computations.) LIFO FIFO AVERAGE-COST x The ending inventory 4,324 4,264 4,240.48 7,458 7 ,459 7,527.67| The cost of goods sold | 7,527.67 (a2) x Your answer is incorrect. Try again. Calculate ending inventory, cost of goods sold, gross profit under each of the following methods. (1) LIFO. (2) FIFO. (3) Average-cost. (Round average-cost method answers to 2 decimal places, e.g. 1,250.25 and other answers to o decimal places, e.g. 1,250. Use weighted average unit cost rounded to 2 decimal places for computations.) LIFO FIFO AVERAGE-COST The ending inventory 4,324 4,264 4,240.48 The cost of goods sold 7,458 7,458 7,527.67 Gross profit 3,796 3,796 3,726.33 Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT VIDEO: SIMILAR PROBLEM Attempts: 1 of 15 used SAVE FOR LATER SUBMIT ANSWER (a3) The parts of this question must be completed in order. This part will be available when you complete the part aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started