Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with questions 5-6 94.60. By the terms of the futures contract, the Ihe December Eurodollar futures price is P anterest rates for Eurodollars

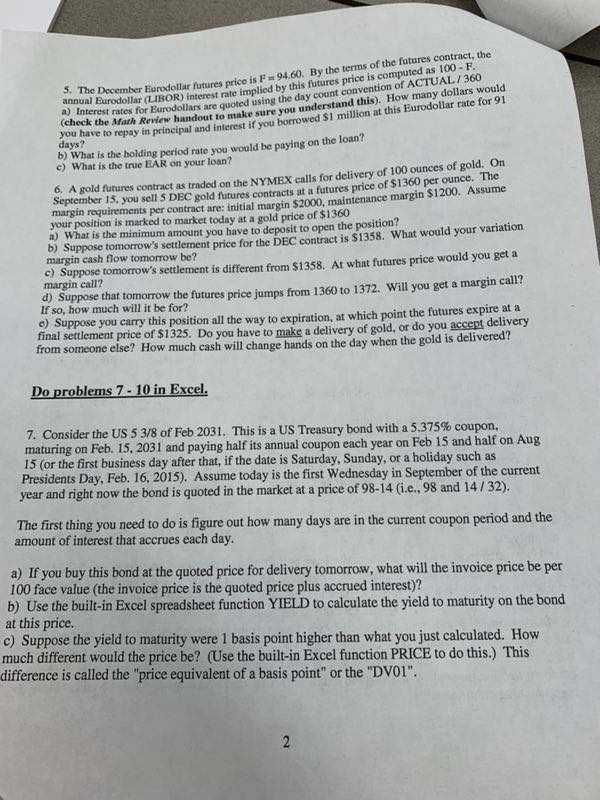

Please help with questions 5-6

94.60. By the terms of the futures contract, the Ihe December Eurodollar futures price is P anterest rates for Eurodollars are quoted using the ay count convention of ACTUAL/360 ektheMath Review handout to make sure you understand this). How many dollars would ollar (LIBOR) interest rate implied by this futures price is computed as 100- F ave to repay in principal and interest if you borrowed $1 million at this Eurodollar rate for 91 days? b) What is the holding period rate you would be paying on the loan? c) What is the true EAR on your loan? res contract as traded on the NYMEx calls for delivery of 100 ounces of gold. 15, you sell 5 DEC On 6. A gold futu gold futures contracts at a futures price of $1360 per ounce. The margin requirements per contract are: initial margin $2000, maintenance margin $1200. Assume your position is marked to market today at a gold price of $1360 a) What is the minimum amount you have to deposit to open the position b) Suppose tomorrow's settlement price for the DEC contract is $1358. What would your variation margin cash flow tomorrow be? c) Suppose tomorrow's settlement is different from $1358. At what futures price would you get a margin call? d) Suppose that tomorrow the futures price jumps from 1360 to 1372. Will you get a margin call? If so, how much will it be for? e) Suppose you carry this position all the way to expiration, at which point the futures expire at a final settlement price of $1325. Do you have to make a delivery of gold, or do you accept delivery from someone else? How much cash will change hands on the day when the gold is delivered? Do problems 7-10 in Excel 7. Consider the US 5 38 of Feb 2031, This is a US Treasury bond with a 5.375% coupon. 15 (or the first business day after that, if the date is Saturday, Sunday, or a holiday such as year and right now the bond is quoted in the market at a price of 98-14 (ie, 98 and 14/32). maturing on Feb. 15, 2031 and paying half its annual coupon each year on Feb 15 and half on Aug Presidents Day, Feb. 16, 2015). Assume today is the first Wednesday in September of the current The first thing you need to do is figure out how many days are in the current coupon period and the a) If you buy this bond at the quoted price for delivery tomorrow, what will the invoice price be per b) Use the built-in Excel spreadsheet function YIELD to calculate the yield to maturity on the bond amount of interest that accrues each day. 100 face value (the invoice price is the quoted price plus accrued interest)? at this price c) Suppose the yield to maturity were 1 basis point higher than what you just calculated. How much different would the price be? (Use the built-in Excel function PRICE to do this.) This difference is called the "price equivalent of a basis point" or the "DVoI". 94.60. By the terms of the futures contract, the Ihe December Eurodollar futures price is P anterest rates for Eurodollars are quoted using the ay count convention of ACTUAL/360 ektheMath Review handout to make sure you understand this). How many dollars would ollar (LIBOR) interest rate implied by this futures price is computed as 100- F ave to repay in principal and interest if you borrowed $1 million at this Eurodollar rate for 91 days? b) What is the holding period rate you would be paying on the loan? c) What is the true EAR on your loan? res contract as traded on the NYMEx calls for delivery of 100 ounces of gold. 15, you sell 5 DEC On 6. A gold futu gold futures contracts at a futures price of $1360 per ounce. The margin requirements per contract are: initial margin $2000, maintenance margin $1200. Assume your position is marked to market today at a gold price of $1360 a) What is the minimum amount you have to deposit to open the position b) Suppose tomorrow's settlement price for the DEC contract is $1358. What would your variation margin cash flow tomorrow be? c) Suppose tomorrow's settlement is different from $1358. At what futures price would you get a margin call? d) Suppose that tomorrow the futures price jumps from 1360 to 1372. Will you get a margin call? If so, how much will it be for? e) Suppose you carry this position all the way to expiration, at which point the futures expire at a final settlement price of $1325. Do you have to make a delivery of gold, or do you accept delivery from someone else? How much cash will change hands on the day when the gold is delivered? Do problems 7-10 in Excel 7. Consider the US 5 38 of Feb 2031, This is a US Treasury bond with a 5.375% coupon. 15 (or the first business day after that, if the date is Saturday, Sunday, or a holiday such as year and right now the bond is quoted in the market at a price of 98-14 (ie, 98 and 14/32). maturing on Feb. 15, 2031 and paying half its annual coupon each year on Feb 15 and half on Aug Presidents Day, Feb. 16, 2015). Assume today is the first Wednesday in September of the current The first thing you need to do is figure out how many days are in the current coupon period and the a) If you buy this bond at the quoted price for delivery tomorrow, what will the invoice price be per b) Use the built-in Excel spreadsheet function YIELD to calculate the yield to maturity on the bond amount of interest that accrues each day. 100 face value (the invoice price is the quoted price plus accrued interest)? at this price c) Suppose the yield to maturity were 1 basis point higher than what you just calculated. How much different would the price be? (Use the built-in Excel function PRICE to do this.) This difference is called the "price equivalent of a basis point" or the "DVoIStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started