please help with questions a-d. thank you.

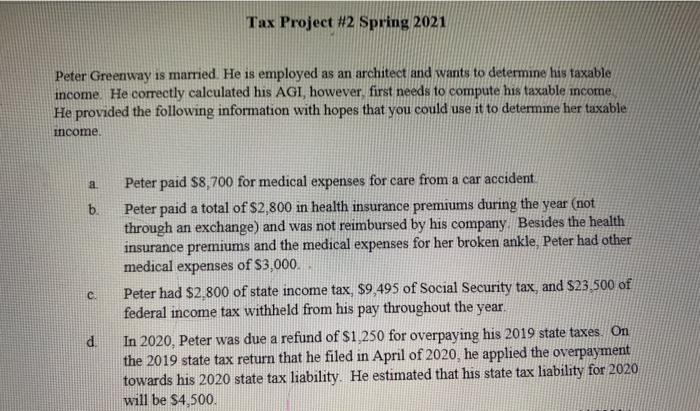

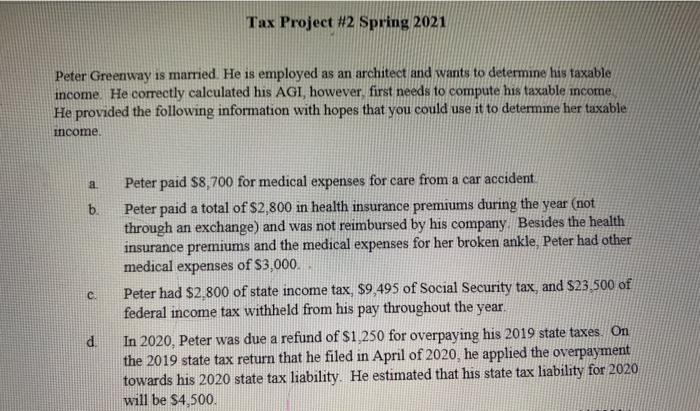

Tax Project #2 Spring 2021 Peter Greenway is married. He is employed as an architect and wants to determine his taxable income. He correctly calculated his AGI, however first needs to compute his taxable income He provided the following information with hopes that you could use it to determine her taxable income. a b. C Peter paid $8,700 for medical expenses for care from a car accident Peter paid a total of $2,800 in health insurance premiums during the year (not through an exchange) and was not reimbursed by his company. Besides the health insurance premiums and the medical expenses for her broken ankle, Peter had other medical expenses of $3,000. Peter had $2,800 of state income tax, $9,495 of Social Security tax, and $23.500 of federal income tax withheld from his pay throughout the year In 2020, Peter was due a refund of $1,250 for overpaying his 2019 state taxes. On the 2019 state tax return that he filed in April of 2020, he applied the overpayment towards his 2020 state tax liability. He estimated that his state tax liability for 2020 will be $4,500. d Tax Project #2 Spring 2021 Peter Greenway is married. He is employed as an architect and wants to determine his taxable income. He correctly calculated his AGI, however first needs to compute his taxable income He provided the following information with hopes that you could use it to determine her taxable income. a b. C Peter paid $8,700 for medical expenses for care from a car accident Peter paid a total of $2,800 in health insurance premiums during the year (not through an exchange) and was not reimbursed by his company. Besides the health insurance premiums and the medical expenses for her broken ankle, Peter had other medical expenses of $3,000. Peter had $2,800 of state income tax, $9,495 of Social Security tax, and $23.500 of federal income tax withheld from his pay throughout the year In 2020, Peter was due a refund of $1,250 for overpaying his 2019 state taxes. On the 2019 state tax return that he filed in April of 2020, he applied the overpayment towards his 2020 state tax liability. He estimated that his state tax liability for 2020 will be $4,500. d