Question: please help with required 2 No. 1&3. Newton Labs leased chronometers from Brookline Instruments on January 1, 2018. Brookline Instruments manufactured the chronometers at a

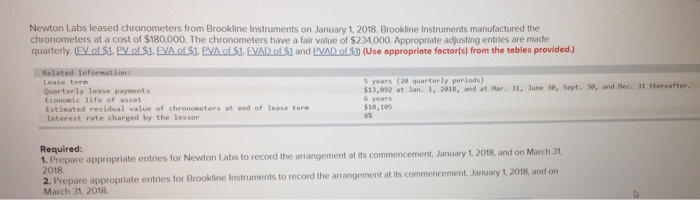

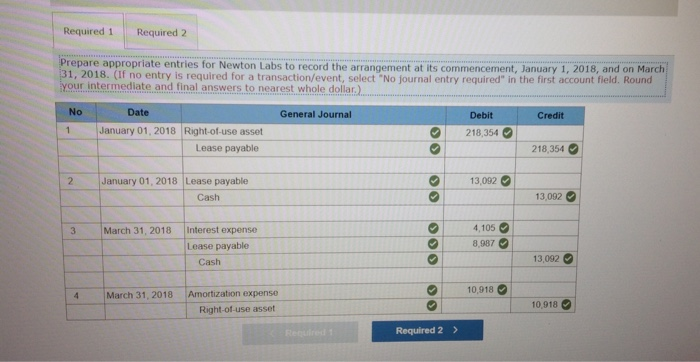

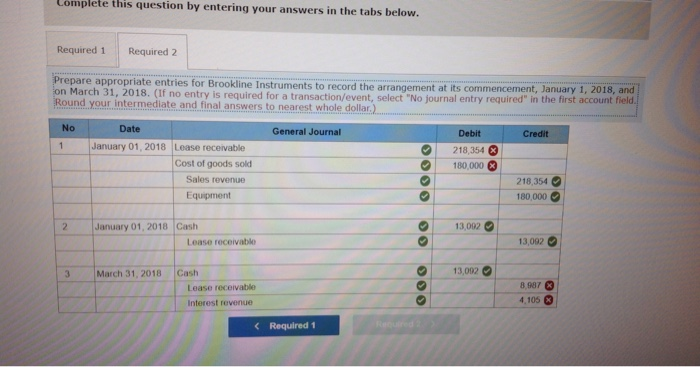

Newton Labs leased chronometers from Brookline Instruments on January 1, 2018. Brookline Instruments manufactured the chronometers at a cost of $180,000. The chronometers have a fair value of $234,000 Appropriate adjusting entries are made quarterly.(EY of S1. PV olS1. EVA ofSi. PVA of SI. EVAD of S1 and PVAD of SD (Use appropriate foctorls) from the tables provided.) Related Information s years (20 quarterly periods) Lease tere Quarterly lease payments Economic life of asset Estisated residual value of chrononeters at end of lease tere Interest rate charged by the lessor 513,092 at Jan. 1, 2018, and at Mar. 31, June 38, Sept. 30, and Dec. 31 thereafter. 6 years $10,105 Required: nt at its commencement, January 1, 2018, and on March 31, 2018. 2. Prepare appropriate entries for March 31, 2018. Brookline Instruments to record the arrangement at its commencement, January 1, 2018, and on Required 1 Required 2 repare appropriate entries for Newton Labs to record the arrangement at its commencement, January 1, 2018. (If no entry is required for a transaction/event, select No journal entry required" in the first account field. Round our intermediate and final answers to nearest whole dollar.) No Date General Journal Debit Credit 1January 01, 2018 Right-of-use asset 218,354 2 2183540 Lease payable January 01, 2018 Lease payable 13,092 Cash 13,092 3 March 31, 2018 Interest expense 4,10s 8,987 Lease payable 13,092 Cash 10,918 4 March 31, 2018 Amortization expense Right-of-use asset 10,918 Required 2> Lomplete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare appropriate entries for Brookline Instr Round your intermediate and final answers to nearest whole dollar. uments to record the arrangement at its commencement, January 1, 2018, and f no entry is required for a transaction/event, select "No journal entry required" in the first account field No Date General Journal Debit Credit January 01, 2018 Lease receivable 218,354 Cost of goods sold 180,000 3 218,354 80,000 Sales revenue Equipment 2January 01, 2018 Cash 13,092 Lease receivable 3,092 March 31, 2018 Cash 13,092 8,987 4,105 8 Lease receivable Interest revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts