Answered step by step

Verified Expert Solution

Question

1 Approved Answer

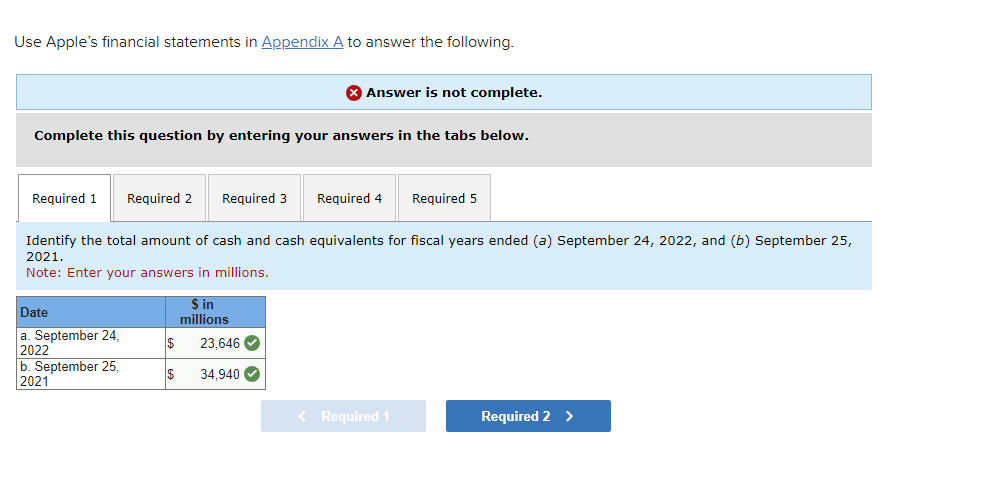

Please help with required 3 Answer is not complete. Complete this question by entering your answers in the tabs below. Compute cash and cash equivalents

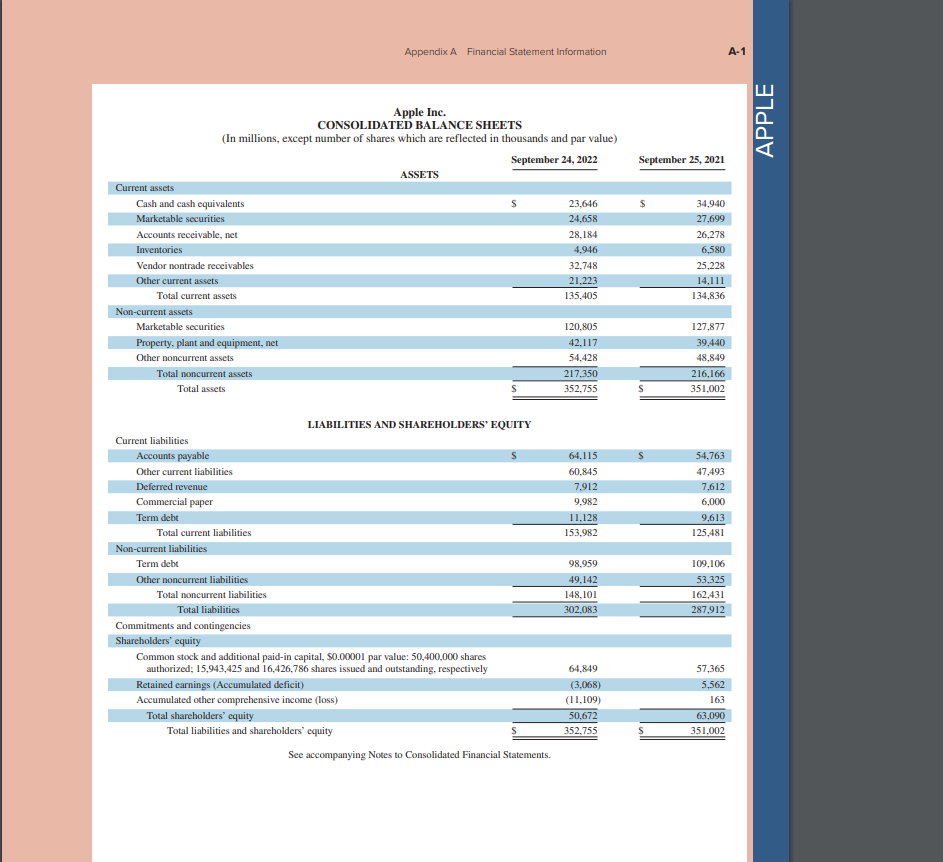

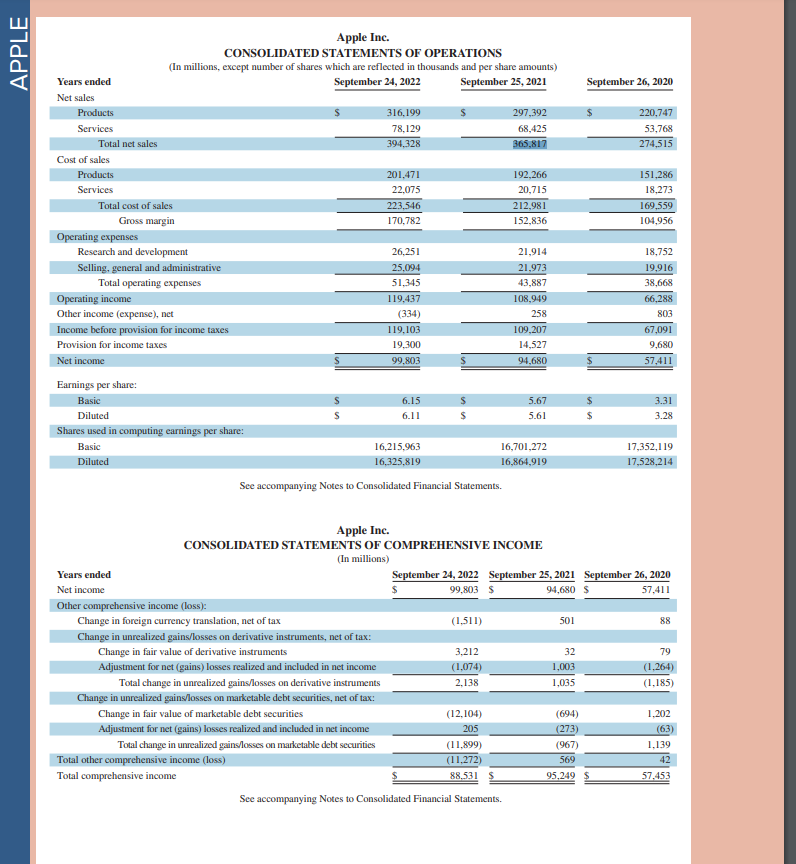

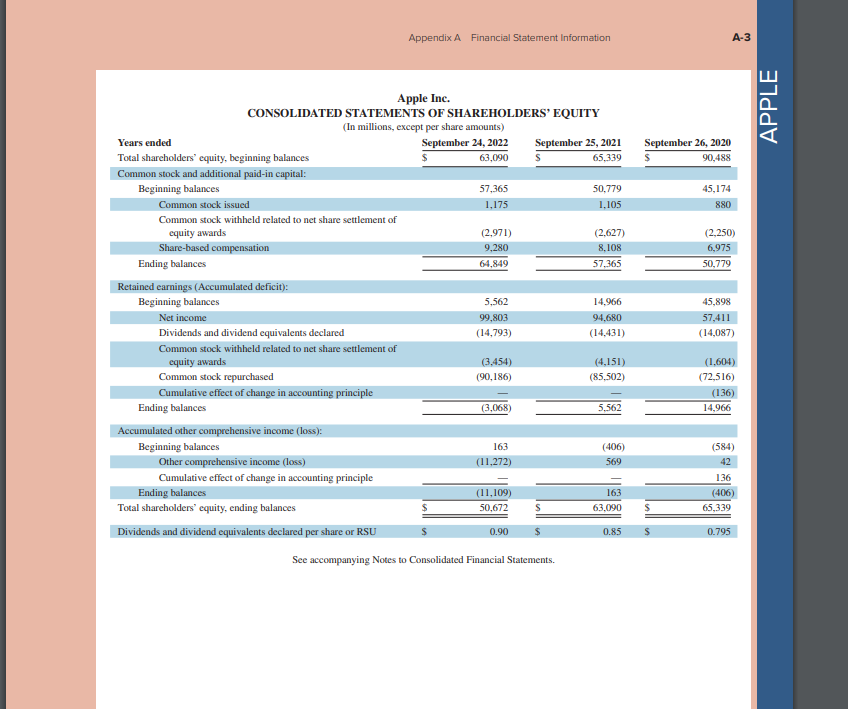

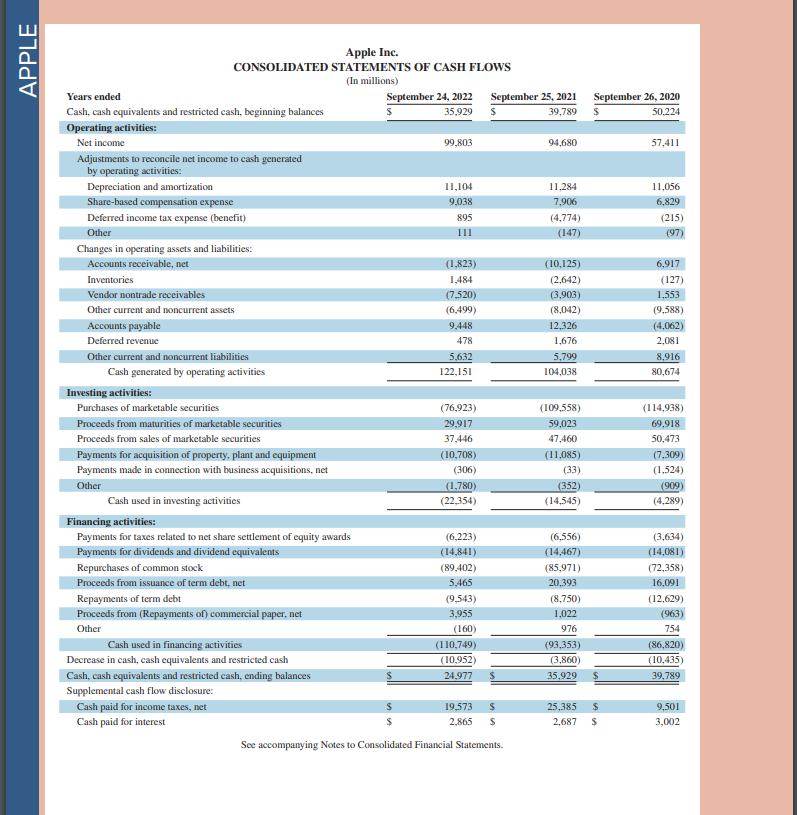

Please help with required 3

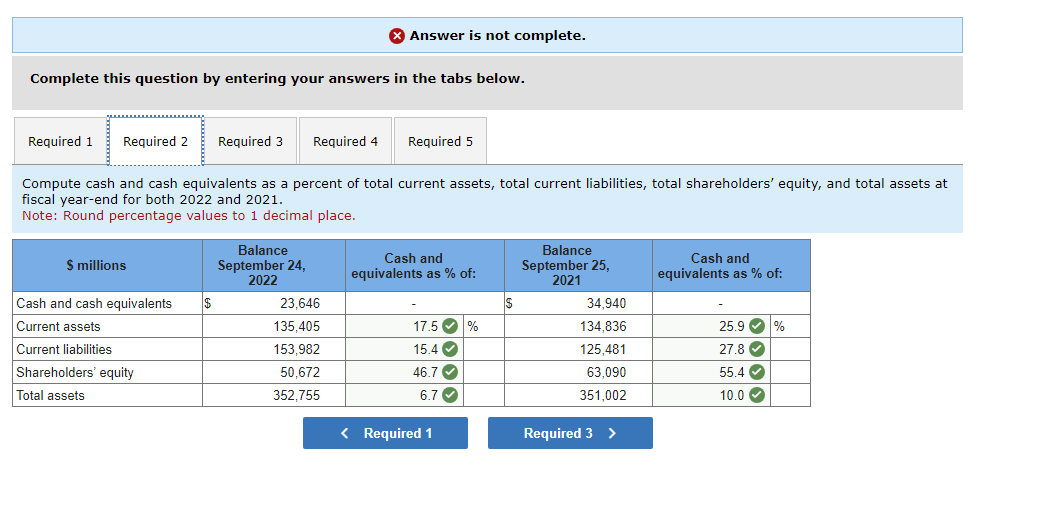

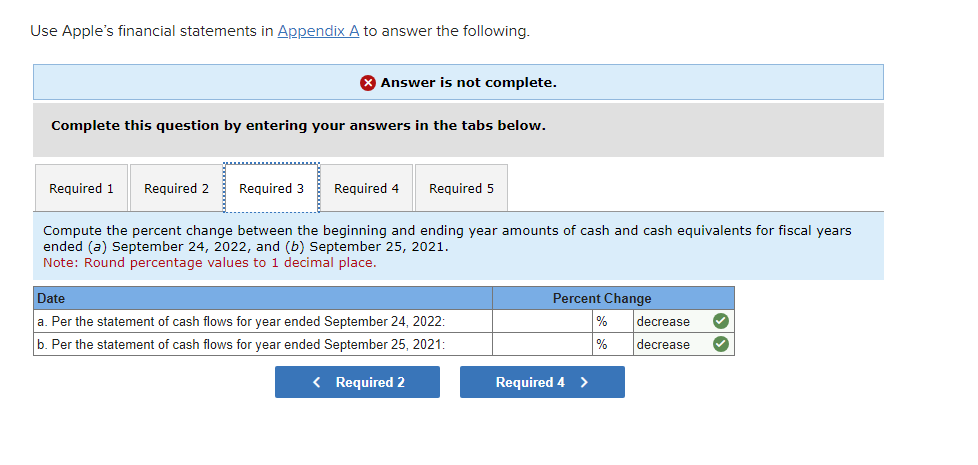

Answer is not complete. Complete this question by entering your answers in the tabs below. Compute cash and cash equivalents as a percent of total current assets, total current liabilities, total shareholders' equity, and total assets at fiscal year-end for both 2022 and 2021. Note: Round percentage values to 1 decimal place. Appendix A Financial Statement Information A-1 Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) LIABILITIES AND SHAREHOLDERS' EQUITY \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|l|}{ Current liabilities } \\ \hline Accounts payable & $ & 64,115 & $ & 54,763 \\ \hline Other current liabilities & & 60,845 & & 47,493 \\ \hline Deferred revenue & & 7,912 & & 7,612 \\ \hline Commercial paper & & 9,982 & & 6,000 \\ \hline Term debt & & 11,128 & & 9,613 \\ \hline Total current liabilities & & 153,982 & & 125,481 \\ \hline Other noncurrent liabilities & & 49,142 & & 53,325 \\ \hline Total noncurrent liabilities & & 148,101 & & 162,431 \\ \hline Total liabilities & & 302,083 & & 287,912 \\ \hline \multicolumn{5}{|l|}{ Commitments and contingencies } \\ \hline Accumulated other comprehensive income (loss) & & (11,109) & & 163 \\ \hline Total shareholders' equity & & 50,672 & & 63,090 \\ \hline Total liabilities and shareholders' equity & s & 352,755 & $ & 351,002 \\ \hline \end{tabular} See accompanying Notes to Consolidated Financial Statements. Appendix A Financial Statement Information See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) \begin{tabular}{|c|c|c|c|} \hline \begin{tabular}{l} Years ended \\ Net sales \end{tabular} & September 24, 2022 & September 25, 2021 & September 26, 2020 \\ \hline Products & 316,199 & 297,392 & 220,747 \\ \hline Services & 78,129 & 68,425 & 53,768 \\ \hline Total net sales & 394,328 & 365,817 & 274,515 \\ \hline \multicolumn{4}{|l|}{ Cost of sales } \\ \hline Products & 201,471 & 192,266 & 151,286 \\ \hline Services & 22,075 & 20,715 & 18,273 \\ \hline Total cost of sales & 223,546 & 212,981 & 169,559 \\ \hline Gross margin & 170,782 & 152,836 & 104,956 \\ \hline \multicolumn{4}{|l|}{ Operating expenses } \\ \hline Research and development & 26,251 & 21,914 & 18,752 \\ \hline Selling, general and administrative & 25,094 & 21,973 & 19,916 \\ \hline Total operating expenses & 51,345 & 43,887 & 38,668 \\ \hline Operating income & 119,437 & 108,949 & 66,288 \\ \hline Other income (expense), net & (334) & 258 & 803 \\ \hline Income before provision for income taxes & 119,103 & 109,207 & 67,091 \\ \hline Provision for income taxes & 19,300 & 14,527 & 9,680 \\ \hline Net income & 99,803 & 94,680 & 57,411 \\ \hline \multicolumn{4}{|l|}{ Earnings per share: } \\ \hline Basic & 6.15 & 5.67 & 3.31 \\ \hline Diluted & 6.11 & 5.61 & 3.28 \\ \hline \multicolumn{4}{|l|}{ Shares used in computing earnings per share: } \\ \hline Basic & 16,215,963 & 16,701,272 & 17,352,119 \\ \hline Diluted & 16,325,819 & 16,864,919 & 17,528,214 \\ \hline \end{tabular} See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) \begin{tabular}{|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} Years ended \\ Net income \end{tabular}} & September 24,2022 & September 25, 2021 & September 26, 2020 \\ \hline & 99,803 & 94,680 & 57,411 \\ \hline \multicolumn{4}{|l|}{ Other comprehensive income (loss): } \\ \hline Change in foreign currency translation, net of tax & (1,511) & 501 & 88 \\ \hline \multicolumn{4}{|l|}{ Change in unrealized gains/losses on derivative instruments, net of tax: } \\ \hline Change in fair value of derivative instruments & 3,212 & 32 & 79 \\ \hline Adjustment for net (gains) losses realized and included in net income & (1,074) & 1,003 & (1,264) \\ \hline Total change in unrealized gains/losses on derivative instruments & 2,138 & 1,035 & (1,185) \\ \hline \multicolumn{4}{|l|}{ Change in unrealized gains/losses on marketable debt securities, net of tax: } \\ \hline Change in fair value of marketable debt securities & (12,104) & (694) & 1,202 \\ \hline Adjustment for net (gains) losses realized and included in net income & 205 & (273) & (63) \\ \hline Total change in unrealized gains/losses on marketable debt securities & (11,899) & (967) & 1,139 \\ \hline Total other comprehensive income (loss) & (11,272) & 569 & 42 \\ \hline Total comprehensive income & 88.531 & 95,249 & 57.453 \\ \hline \end{tabular} See accompanying Notes to Consolidated Financial Statements. Apple Inc. FONERI IDATED CTATEMENTE OE CACH EI NWS Use Apple's financial statements in Appendix A to answer the following. Answer is not complete. Complete this question by entering your answers in the tabs below. Compute the percent change between the beginning and ending year amounts of cash and cash equivalents for fiscal years ended (a) September 24, 2022, and (b) September 25, 2021. Note: Round percentage values to 1 decimal place. Use Apple's financial statements in Appendix A to answer the following. Answer is not complete. Complete this question by entering your answers in the tabs below. Identify the total amount of cash and cash equivalents for fiscal years ended (a) September 24, 2022, and (b) September 25, 2021. Note: Enter your answers in millions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started