Please help with round #1 decisions and what needs to be adjusted. Thanks.

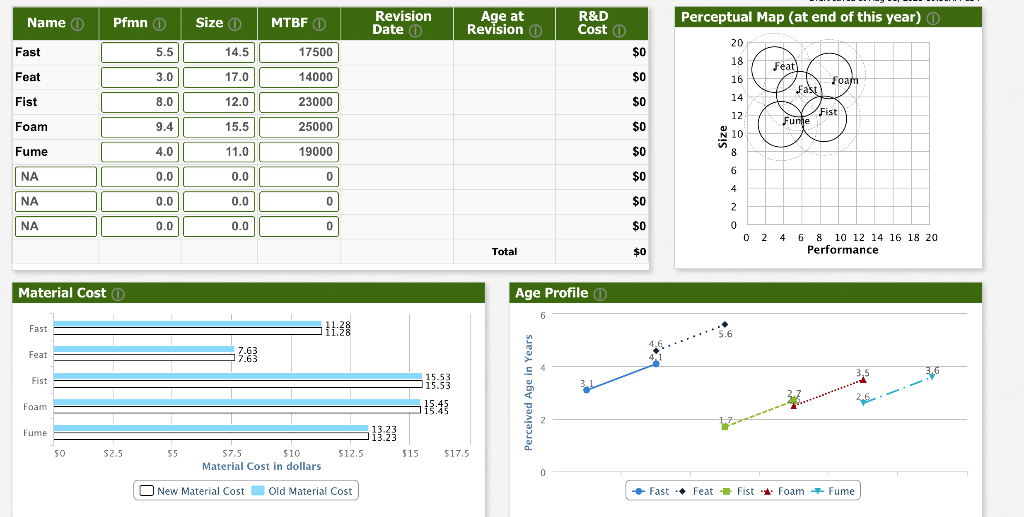

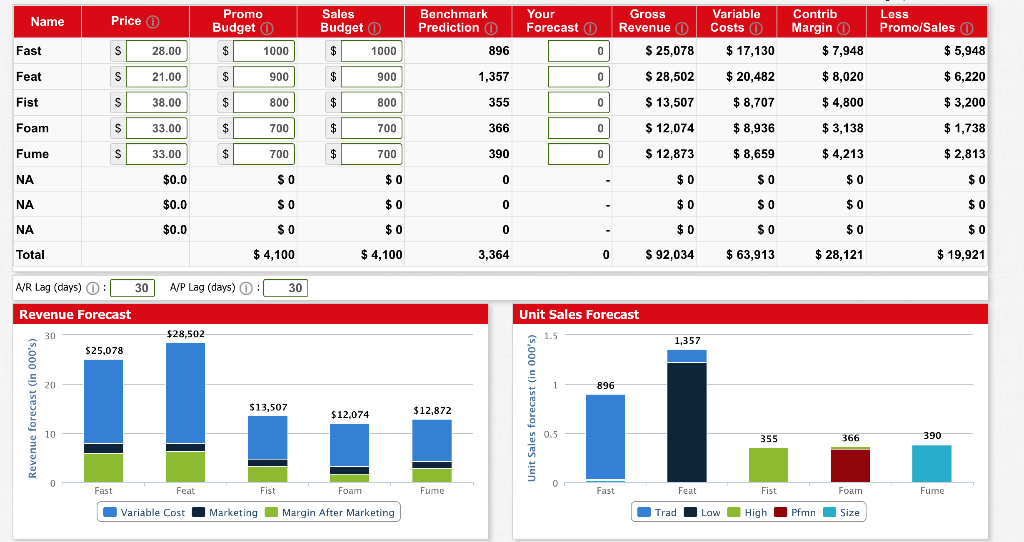

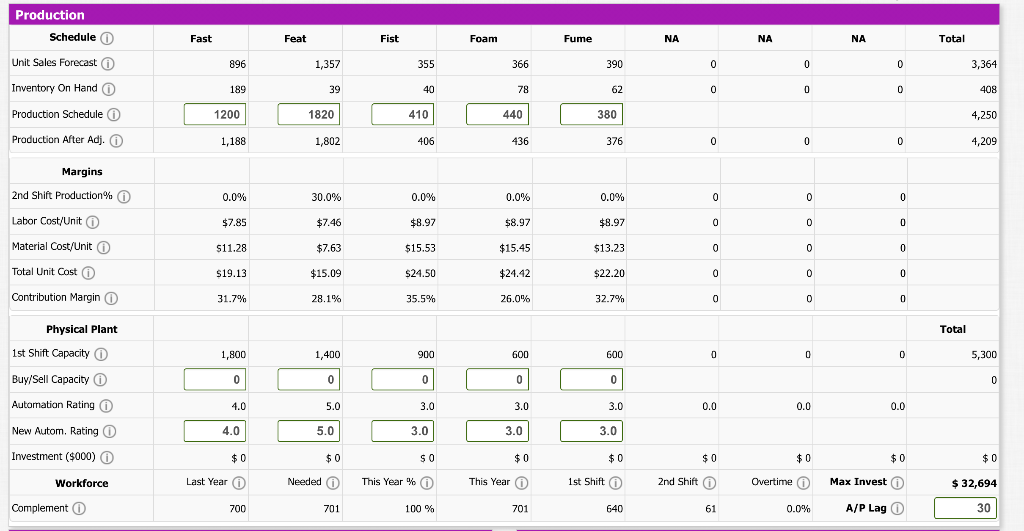

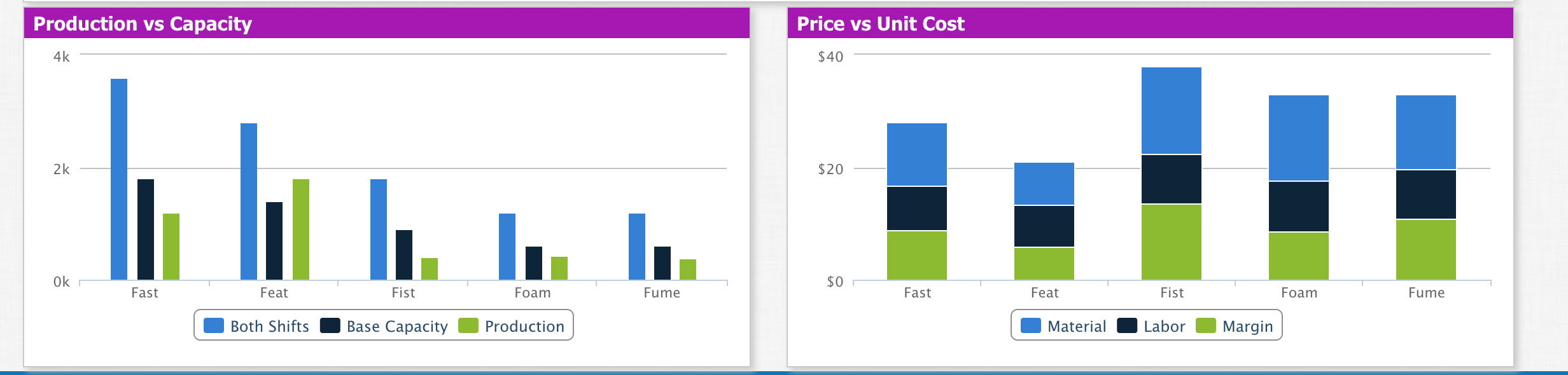

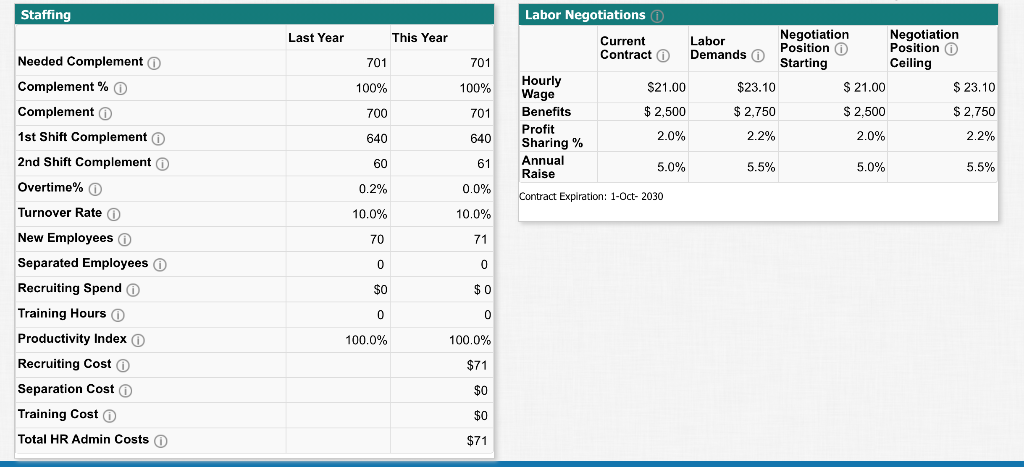

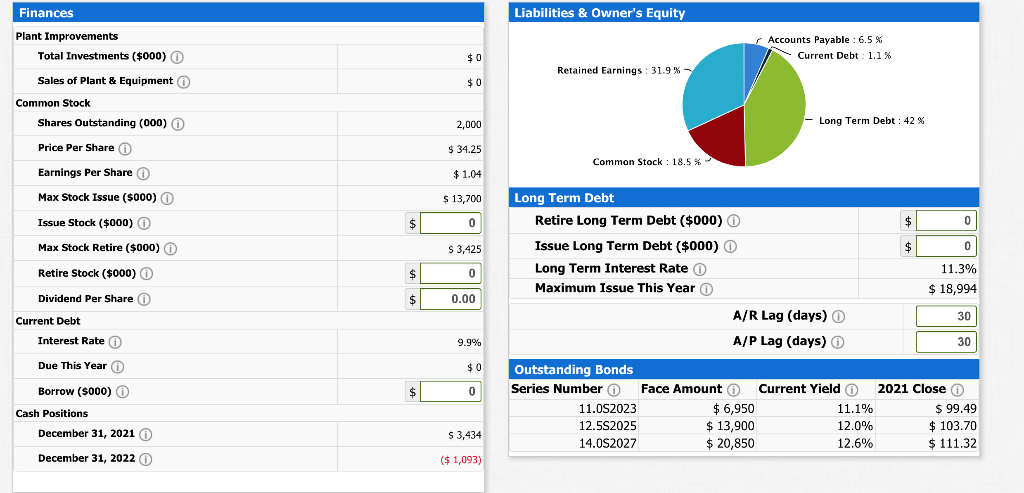

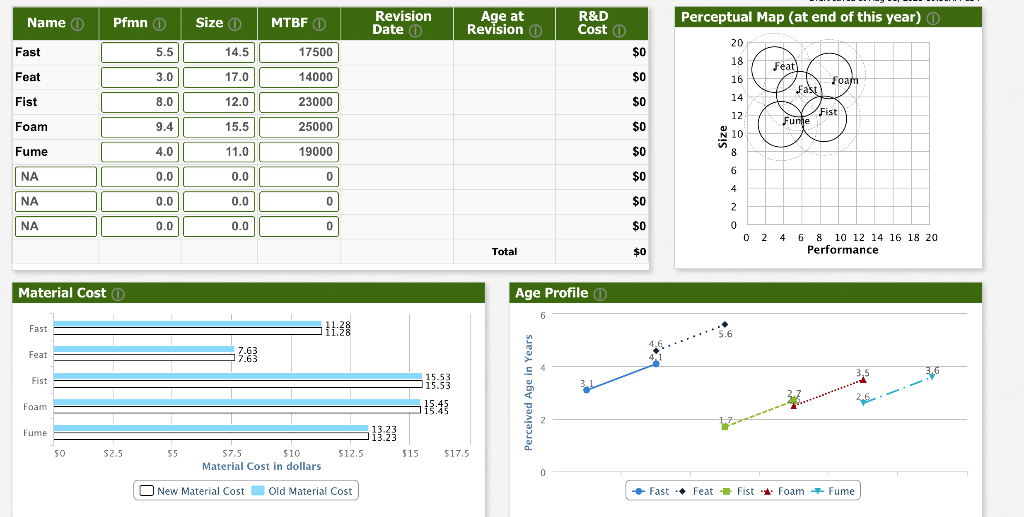

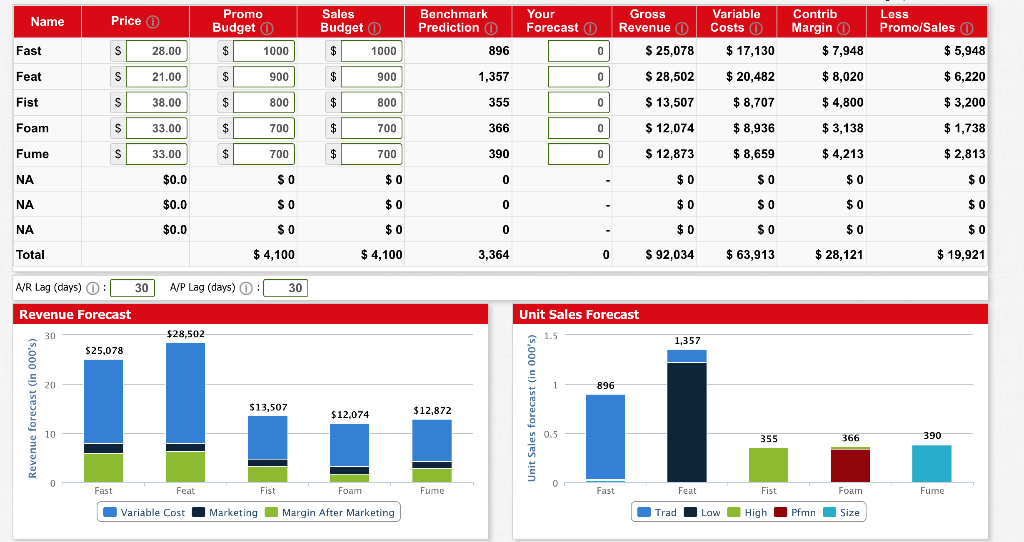

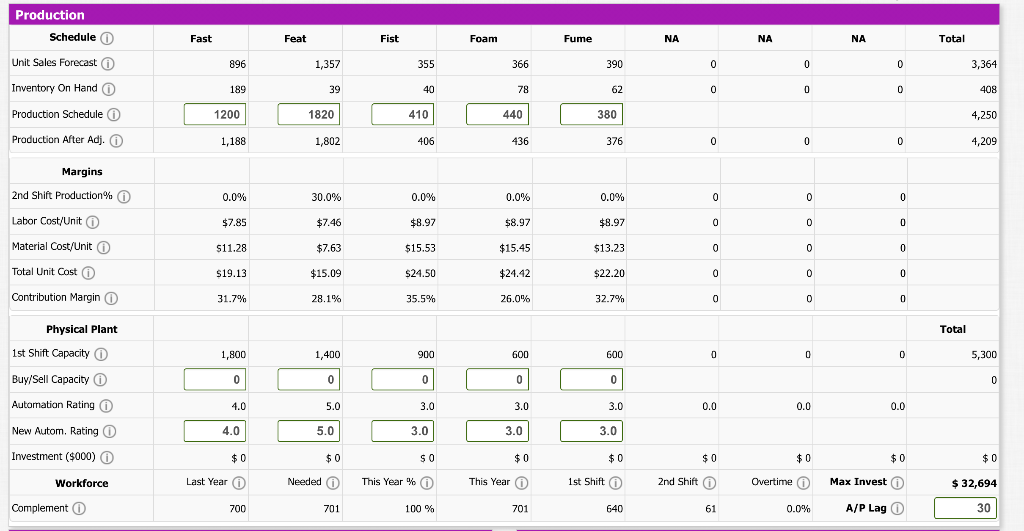

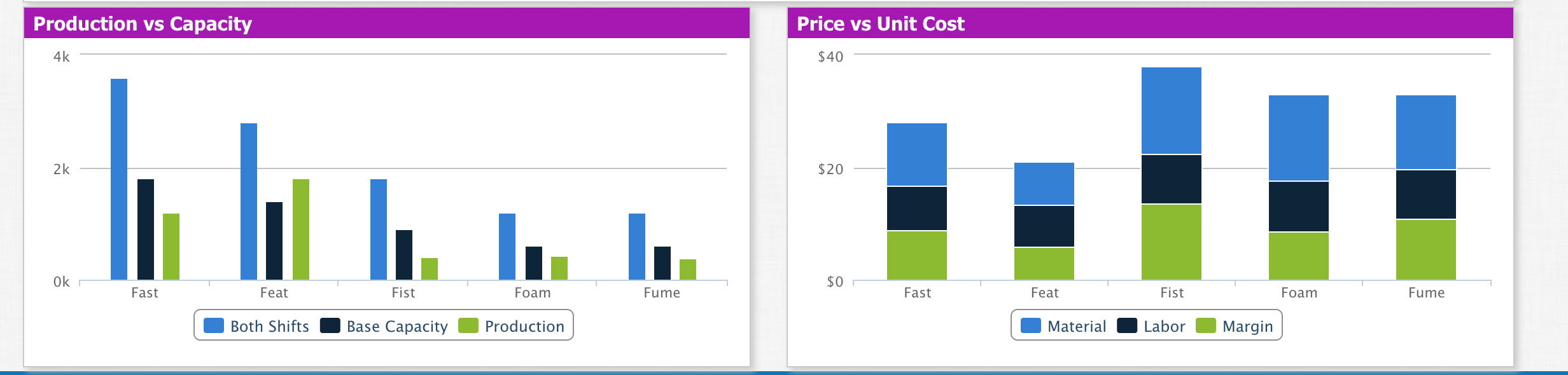

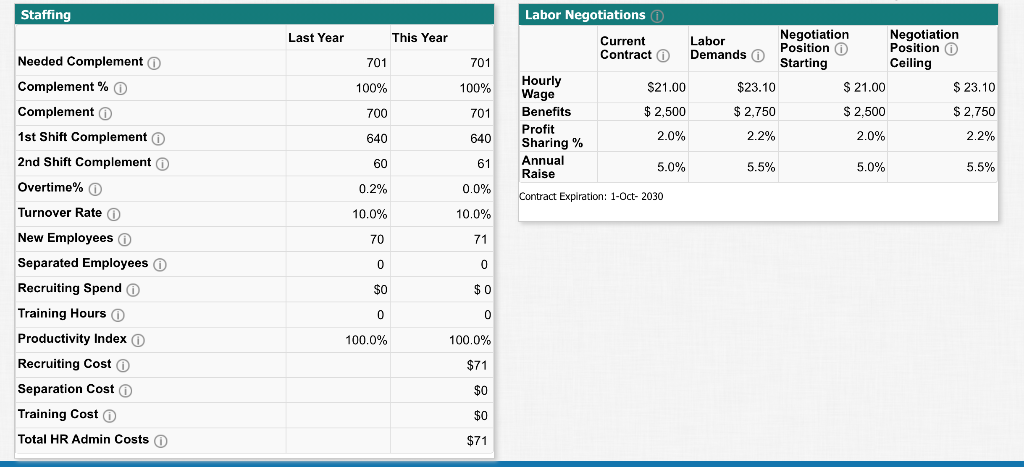

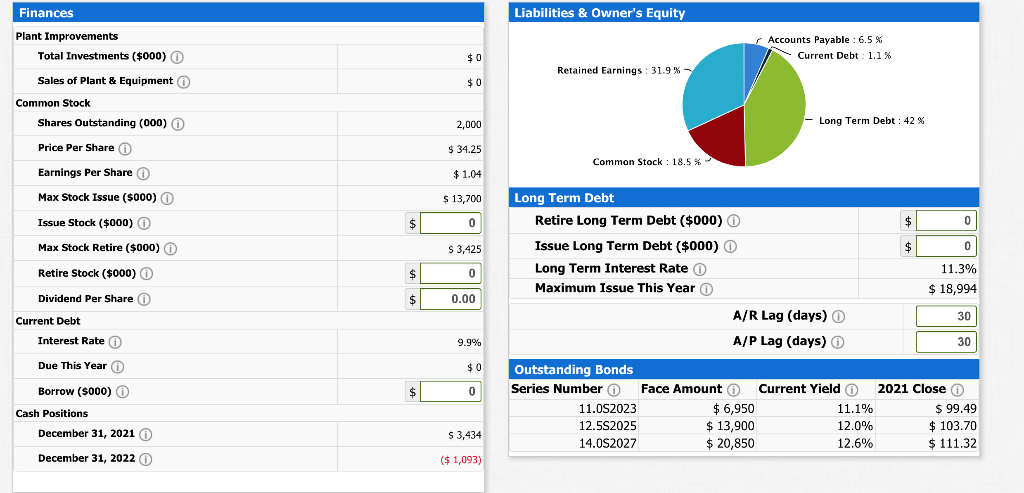

Name Pfmn 0 Size MTBF0 Revision Date 0 Age at Revision R&D Cost Perceptual Map (at end of this year) O 20 Fast 5.5 14.5 17500 $0 $ 18 Feat Feat 3.0 17.0 14000 $0 16 Foam fasi Fist 12.0 14 8.0 23000 $0 12 Fist Foam Funne 9.4 15.5 25000 $0 10 Fume 4.0 11.0 19000 $0 8 6 NA 0.0 0.0 0 $0 4 NA 0.0 0.0 0 $0 2 NA 0.0 0.0 0 $0 0 0 2 4 6 8 10 12 14 16 18 20 Performance Total $0 Material Cost O Age Profile 6 Fast 11:38 5.6 Feat 7.63 7.63 3.5 Fist 15.53 15.53 Perceived Age in Years Foam 15:43 26 Fume 13:23 $12.5 50 $2.5 55 $15 $17.5 57.5 $10 Material Cost in dollars 0 O New Material Cost Old Material Cost Fast Feat + Fist - Foam - Fume Name Price 0 Promo Budget Sales Budget Benchmark Prediction 896 Your Forecast O Gross Revenue 0 $ 25,078 Variable Costs 0 Contrib Margin 0 $ 7,948 Less Promo/Sales O Fast S 28.00 $ 1000 $ 1000 0 $ 17,130 $ 5,948 Feat s 21.00 $ 900 $ 900 1,357 0 $ 28,502 $ 20,482 $ 8,020 $ 6,220 Fist S 38.00 $ 800 $ 800 355 0 $ 13,507 $ 8,707 $ 4,800 $ 3,200 Foam $ 33.00 $ 700 $ 700 366 0 $ 12,074 $ 8,936 $ 3,138 $ 1,738 Fume S 33.00 $ 700 $ 700 390 0 $ 12,873 $ 8,659 $ 4,213 $ 2,813 NA $0.0 $0 $ 0 0 $ 0 SO $0 $0 NA $0.0 $0 $ 0 0 $ 0 $0 $0 $0 NA $0.0 $0 $0 0 $ 0 $0 $0 $0 Total $ 4,100 $ 4,100 3,364 0 $ 92,034 $ 63,913 $ 28,121 $ 19,921 A/R Lag (days) : 30 A/P Lag (days) 30 Revenue Forecast Unit Sales Forecast 30 $28,502 1.5 1,357 $25,078 20 896 $13,507 $12,074 $12,872 Unit Sales forecast (in 000's) Revenue forecast 10 0.5 355 366 390 0 0 Fast Feat Fist Foam Fume Fast Feat Fist Foam Fume Variable Cost Marketing Margin After Marketing Trad Low High Pfmn Size Production Schedule o Fast Feat Fist Foam Foam Fume Fume NA NA NA Total Unit Sales Forecast 896 1,357 355 366 390 0 0 0 0 3,364 Inventory On Hand 189 39 40 78 62 0 0 0 408 Production Schedule 1200 1820 410 440 380 4,250 Production After Adj. 1,188 1,802 406 436 376 0 0 0 0 4,209 Margins 2nd Shift Production% 0 0.0% 30.0% 0.0% 0.0% 0.0% 0 0 0 Labor Cost/Unit $7.85 $7.46 $8.97 $8.97 $8.97 0 0 0 Material Cost/Unit $11.28 $7.63 $15.53 $15.45 $13.23 0 0 0 Total Unit Cost $19.13 $15.09 $ $24.50 $24.42 $22.20 0 0 0 Contribution Margin 0 31.7% 28.1% 35.5% 26.0% 32.7% 0 0 0 Physical Plant Total 1st Shift Capacity 0 1,800 1,400 900 600 600 D 0 0 5,300 0 0 0 0 0 0 Buy/Sell Capacity / Automation Rating 4.0 5.0 3.0 3.0 3.0 0.0 0.0 0.0 New Autom. Rating 4.0 5.0 3.0 3.0 3.0 Investment ($000) O $0 $0 SO $ 0 $0 $ 0 $0 $0 $0 Workforce Last Year Needed This Year % O This Year 1st Shift 2nd Shift Overtime Max Invest $ 32,694 Complement 700 701 100 % 701 640 61 0.0% A/P Lago 30 Production vs Capacity Price vs Unit Cost 4k $40 2k $20 LLLLL Ok $0 Fast Feat Fist Foam Fume Fast Feat Fist Foam Fume Both Shifts Base Capacity Production Material Labor Margin Staffing Last Year This Year 701 701 100% 100% Labor Negotiations Current Labor Negotiation Negotiation Contract Position Position Demands Starting Ceiling Hourly $21.00 $23.10 $ 21.00 $ 23.10 Wage Benefits $ 2,500 $ 2,750 $ 2.500 $ 2,750 Profit 2.0% 2.2% 2.0% 2.2% Sharing % Annual 5.0% 5.5% 5.0% 5.5% Raise 700 Needed Complement Complement% Complemento 1st Shift Complement 2nd Shift Complement Overtime % 0 701 640 640 60 61 0.2% 0.0% Contract Expiration: 1-Oct-2030 Turnover Rate o 10.0% 10.0% New Employees 70 71 0 0 $0 $ 0 0 0 Separated Employees Recruiting Spend Training Hours Productivity Index 0 Recruiting Cost Separation Cost Training Cost 100.0% 100.0% $71 $0 $0 Total HR Admin Costs $71 Finances Liabilities & Owner's Equity Accounts Payable : 6.5 % Current Debt: 1.1% $ 0 Retained Earnings : 31.9% Plant Improvements Total Investments ($000) Sales of Plant & Equipment Common Stock Shares Outstanding (000) $ 0 2,000 Long Term Debt: 42% Price Per Share o $ 34.25 Common Stock : 18.5 % $ 1.04 $ 13,700 Earnings Per Share o Max Stock Issue ($000) O () Issue Stock ($000) Max Stock Retire ($000) Retire Stock ($000) Long Term Debt Retire Long Term Debt ($000) $ 0 $ 0 $ 3,425 0 0 11.3% $ 18,994 Issue Long Term Debt ($000) O Long Term Interest Rate Maximum Issue This Year A/R Lag (days) A/P Lag (days) $ 0.00 Dividend Per Share o Current Debt Interest Rate 30 9.9% 30 Due This Year $0 $ 0 Borrow (5000) Cash Positions December 31, 2021 Outstanding Bonds Series Number 0 Face Amount Current Yield 2021 Close 11.0S2023 $ 6,950 11.1% $ 99.49 12.552025 $ 13,900 12.0% $ 103.70 14.0S2027 $ 20,850 12.6% $ 111.32 $ 3,434 December 31, 2022 ($ 1,093) Name Pfmn 0 Size MTBF0 Revision Date 0 Age at Revision R&D Cost Perceptual Map (at end of this year) O 20 Fast 5.5 14.5 17500 $0 $ 18 Feat Feat 3.0 17.0 14000 $0 16 Foam fasi Fist 12.0 14 8.0 23000 $0 12 Fist Foam Funne 9.4 15.5 25000 $0 10 Fume 4.0 11.0 19000 $0 8 6 NA 0.0 0.0 0 $0 4 NA 0.0 0.0 0 $0 2 NA 0.0 0.0 0 $0 0 0 2 4 6 8 10 12 14 16 18 20 Performance Total $0 Material Cost O Age Profile 6 Fast 11:38 5.6 Feat 7.63 7.63 3.5 Fist 15.53 15.53 Perceived Age in Years Foam 15:43 26 Fume 13:23 $12.5 50 $2.5 55 $15 $17.5 57.5 $10 Material Cost in dollars 0 O New Material Cost Old Material Cost Fast Feat + Fist - Foam - Fume Name Price 0 Promo Budget Sales Budget Benchmark Prediction 896 Your Forecast O Gross Revenue 0 $ 25,078 Variable Costs 0 Contrib Margin 0 $ 7,948 Less Promo/Sales O Fast S 28.00 $ 1000 $ 1000 0 $ 17,130 $ 5,948 Feat s 21.00 $ 900 $ 900 1,357 0 $ 28,502 $ 20,482 $ 8,020 $ 6,220 Fist S 38.00 $ 800 $ 800 355 0 $ 13,507 $ 8,707 $ 4,800 $ 3,200 Foam $ 33.00 $ 700 $ 700 366 0 $ 12,074 $ 8,936 $ 3,138 $ 1,738 Fume S 33.00 $ 700 $ 700 390 0 $ 12,873 $ 8,659 $ 4,213 $ 2,813 NA $0.0 $0 $ 0 0 $ 0 SO $0 $0 NA $0.0 $0 $ 0 0 $ 0 $0 $0 $0 NA $0.0 $0 $0 0 $ 0 $0 $0 $0 Total $ 4,100 $ 4,100 3,364 0 $ 92,034 $ 63,913 $ 28,121 $ 19,921 A/R Lag (days) : 30 A/P Lag (days) 30 Revenue Forecast Unit Sales Forecast 30 $28,502 1.5 1,357 $25,078 20 896 $13,507 $12,074 $12,872 Unit Sales forecast (in 000's) Revenue forecast 10 0.5 355 366 390 0 0 Fast Feat Fist Foam Fume Fast Feat Fist Foam Fume Variable Cost Marketing Margin After Marketing Trad Low High Pfmn Size Production Schedule o Fast Feat Fist Foam Foam Fume Fume NA NA NA Total Unit Sales Forecast 896 1,357 355 366 390 0 0 0 0 3,364 Inventory On Hand 189 39 40 78 62 0 0 0 408 Production Schedule 1200 1820 410 440 380 4,250 Production After Adj. 1,188 1,802 406 436 376 0 0 0 0 4,209 Margins 2nd Shift Production% 0 0.0% 30.0% 0.0% 0.0% 0.0% 0 0 0 Labor Cost/Unit $7.85 $7.46 $8.97 $8.97 $8.97 0 0 0 Material Cost/Unit $11.28 $7.63 $15.53 $15.45 $13.23 0 0 0 Total Unit Cost $19.13 $15.09 $ $24.50 $24.42 $22.20 0 0 0 Contribution Margin 0 31.7% 28.1% 35.5% 26.0% 32.7% 0 0 0 Physical Plant Total 1st Shift Capacity 0 1,800 1,400 900 600 600 D 0 0 5,300 0 0 0 0 0 0 Buy/Sell Capacity / Automation Rating 4.0 5.0 3.0 3.0 3.0 0.0 0.0 0.0 New Autom. Rating 4.0 5.0 3.0 3.0 3.0 Investment ($000) O $0 $0 SO $ 0 $0 $ 0 $0 $0 $0 Workforce Last Year Needed This Year % O This Year 1st Shift 2nd Shift Overtime Max Invest $ 32,694 Complement 700 701 100 % 701 640 61 0.0% A/P Lago 30 Production vs Capacity Price vs Unit Cost 4k $40 2k $20 LLLLL Ok $0 Fast Feat Fist Foam Fume Fast Feat Fist Foam Fume Both Shifts Base Capacity Production Material Labor Margin Staffing Last Year This Year 701 701 100% 100% Labor Negotiations Current Labor Negotiation Negotiation Contract Position Position Demands Starting Ceiling Hourly $21.00 $23.10 $ 21.00 $ 23.10 Wage Benefits $ 2,500 $ 2,750 $ 2.500 $ 2,750 Profit 2.0% 2.2% 2.0% 2.2% Sharing % Annual 5.0% 5.5% 5.0% 5.5% Raise 700 Needed Complement Complement% Complemento 1st Shift Complement 2nd Shift Complement Overtime % 0 701 640 640 60 61 0.2% 0.0% Contract Expiration: 1-Oct-2030 Turnover Rate o 10.0% 10.0% New Employees 70 71 0 0 $0 $ 0 0 0 Separated Employees Recruiting Spend Training Hours Productivity Index 0 Recruiting Cost Separation Cost Training Cost 100.0% 100.0% $71 $0 $0 Total HR Admin Costs $71 Finances Liabilities & Owner's Equity Accounts Payable : 6.5 % Current Debt: 1.1% $ 0 Retained Earnings : 31.9% Plant Improvements Total Investments ($000) Sales of Plant & Equipment Common Stock Shares Outstanding (000) $ 0 2,000 Long Term Debt: 42% Price Per Share o $ 34.25 Common Stock : 18.5 % $ 1.04 $ 13,700 Earnings Per Share o Max Stock Issue ($000) O () Issue Stock ($000) Max Stock Retire ($000) Retire Stock ($000) Long Term Debt Retire Long Term Debt ($000) $ 0 $ 0 $ 3,425 0 0 11.3% $ 18,994 Issue Long Term Debt ($000) O Long Term Interest Rate Maximum Issue This Year A/R Lag (days) A/P Lag (days) $ 0.00 Dividend Per Share o Current Debt Interest Rate 30 9.9% 30 Due This Year $0 $ 0 Borrow (5000) Cash Positions December 31, 2021 Outstanding Bonds Series Number 0 Face Amount Current Yield 2021 Close 11.0S2023 $ 6,950 11.1% $ 99.49 12.552025 $ 13,900 12.0% $ 103.70 14.0S2027 $ 20,850 12.6% $ 111.32 $ 3,434 December 31, 2022 ($ 1,093)