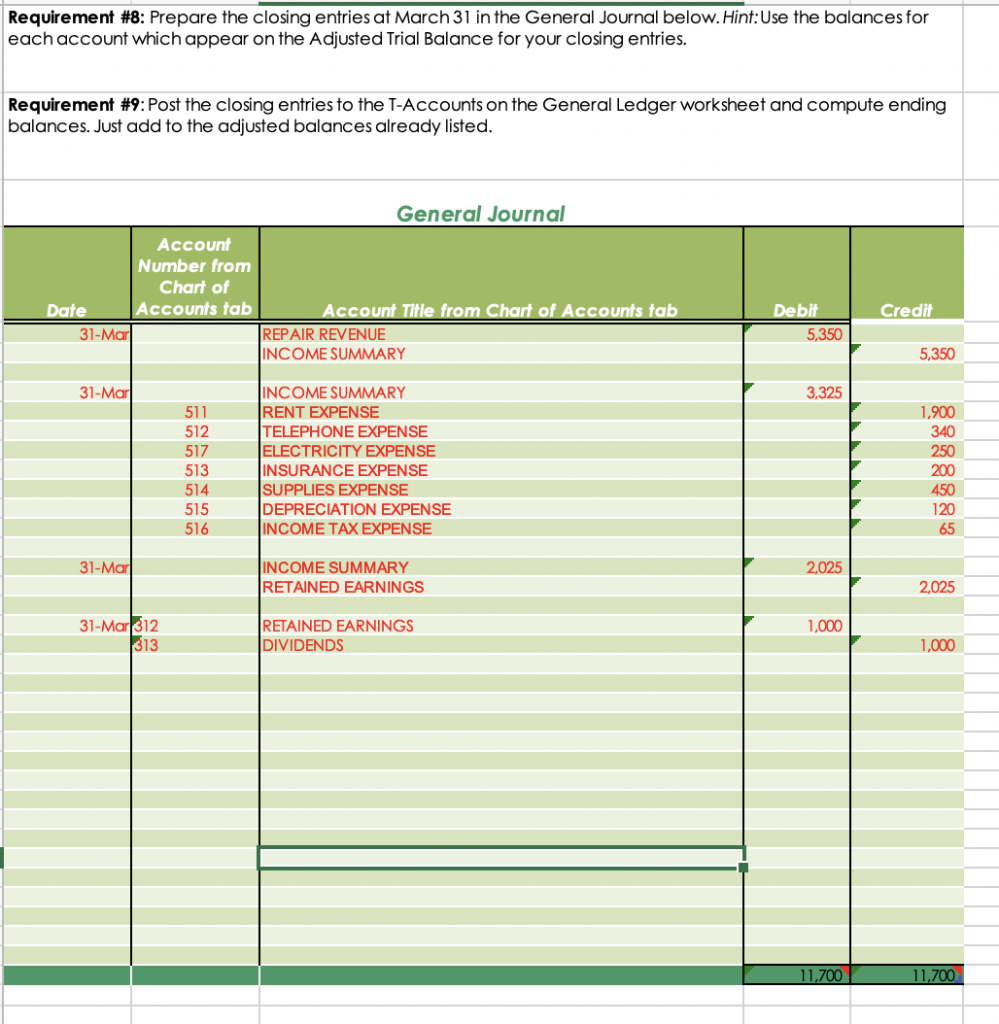

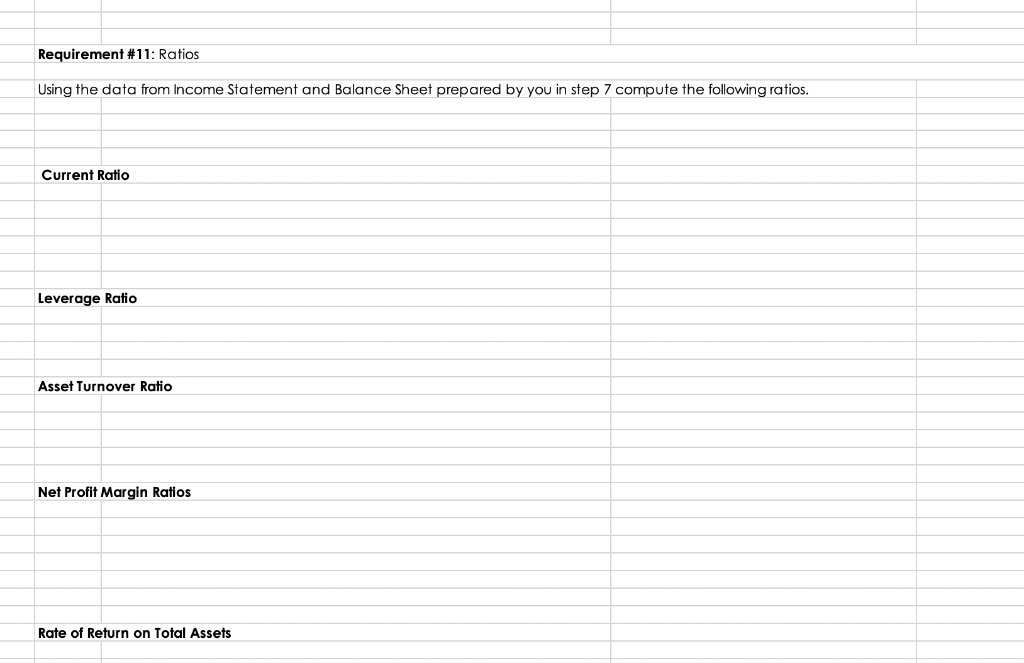

Please help with: Step 8: Closing Journal Entries Journal entries use accurate accounts and amounts; and debits and credits are used correctly. Steps 9 & 10: Posted a Post-closing Trial Balance Posting is correct leading to an accurate trial balance. Steps 11 & 12: Ratios and Interpretation Ratios are calculated correctly. Math process is present. Interpretation of ratios are accurate

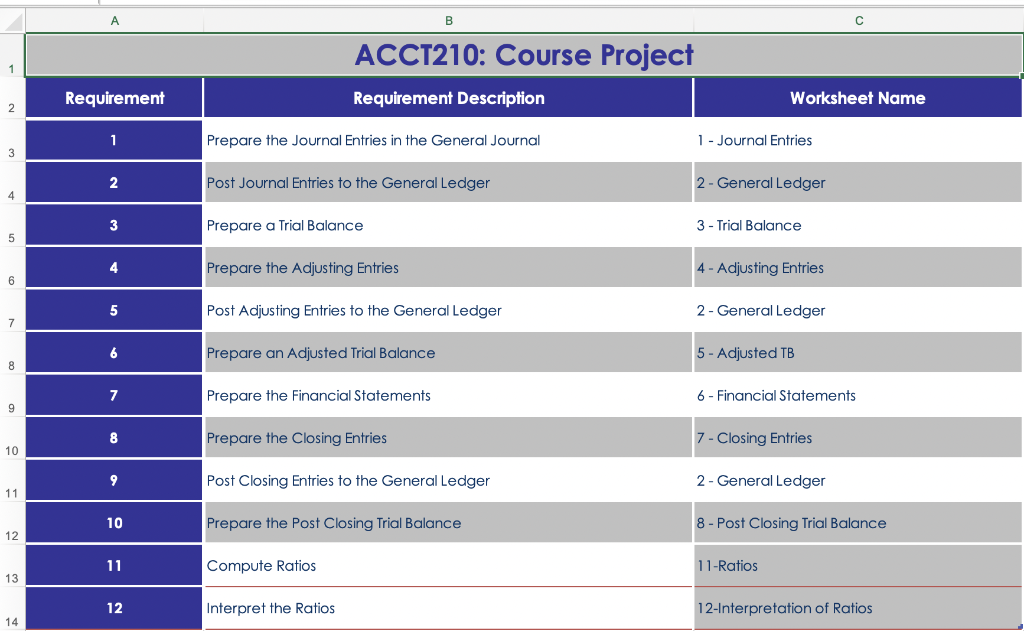

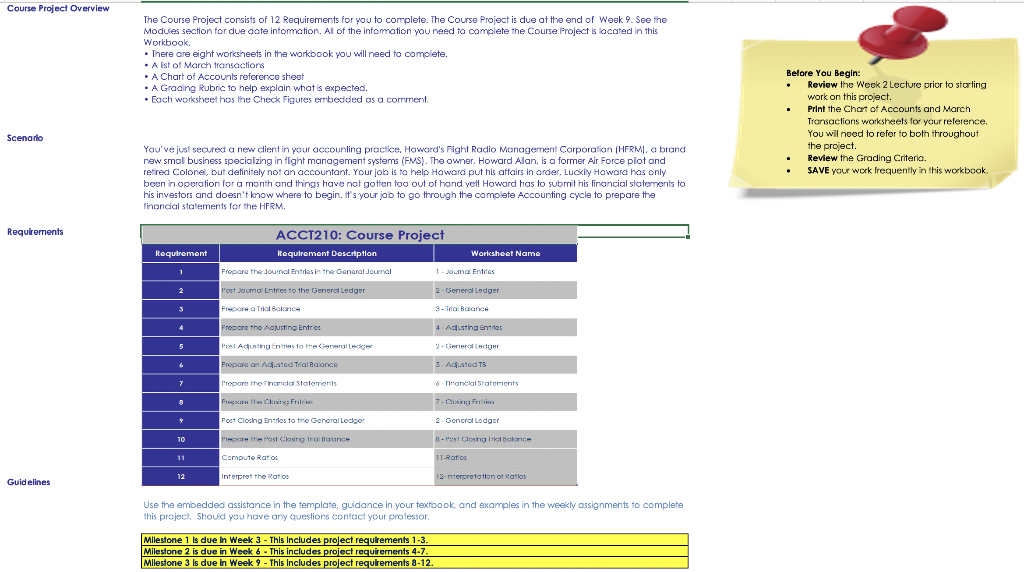

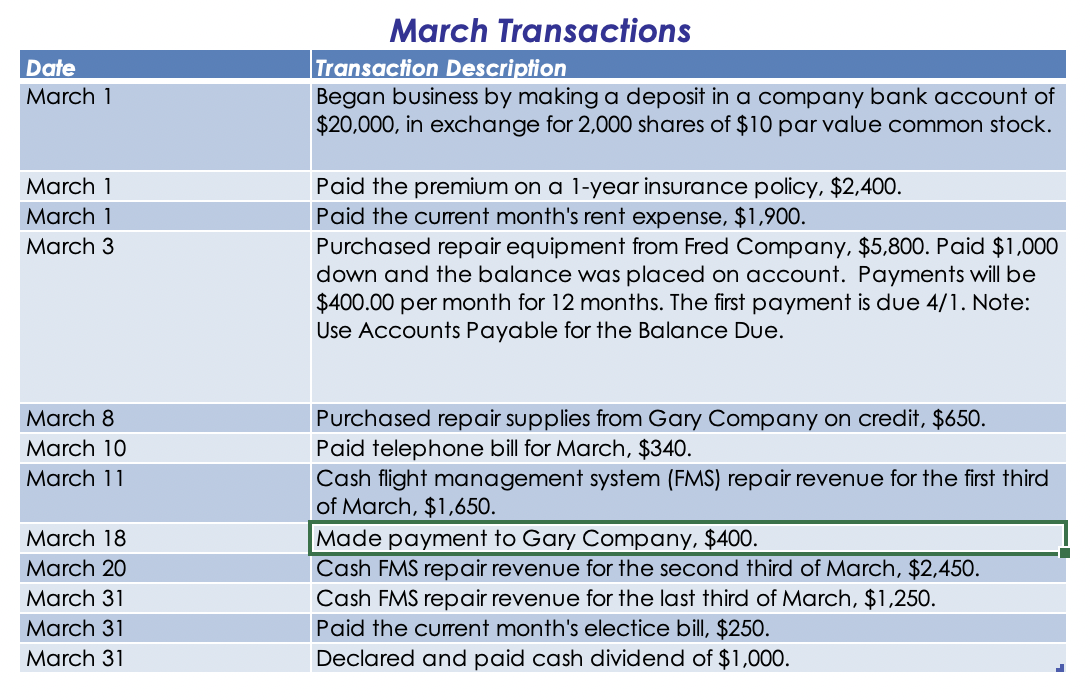

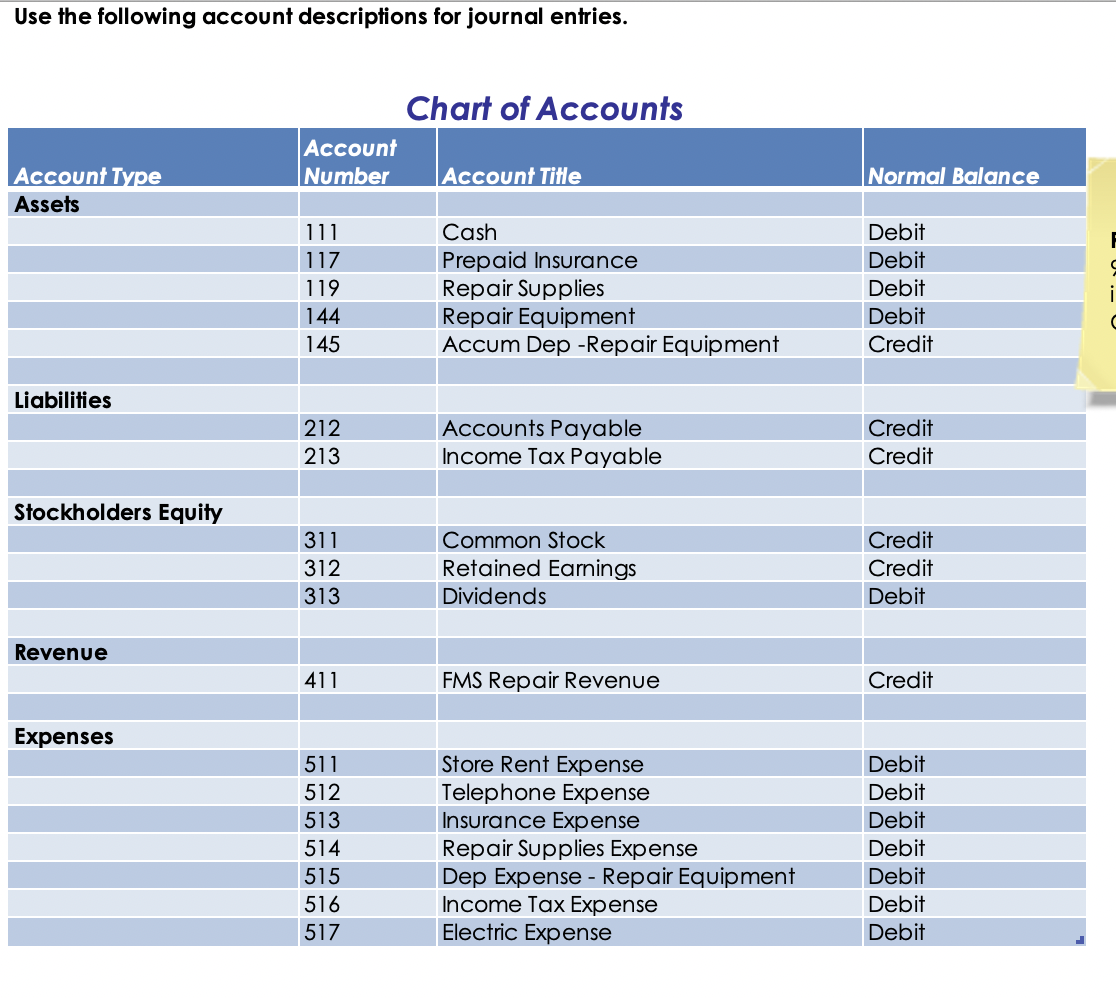

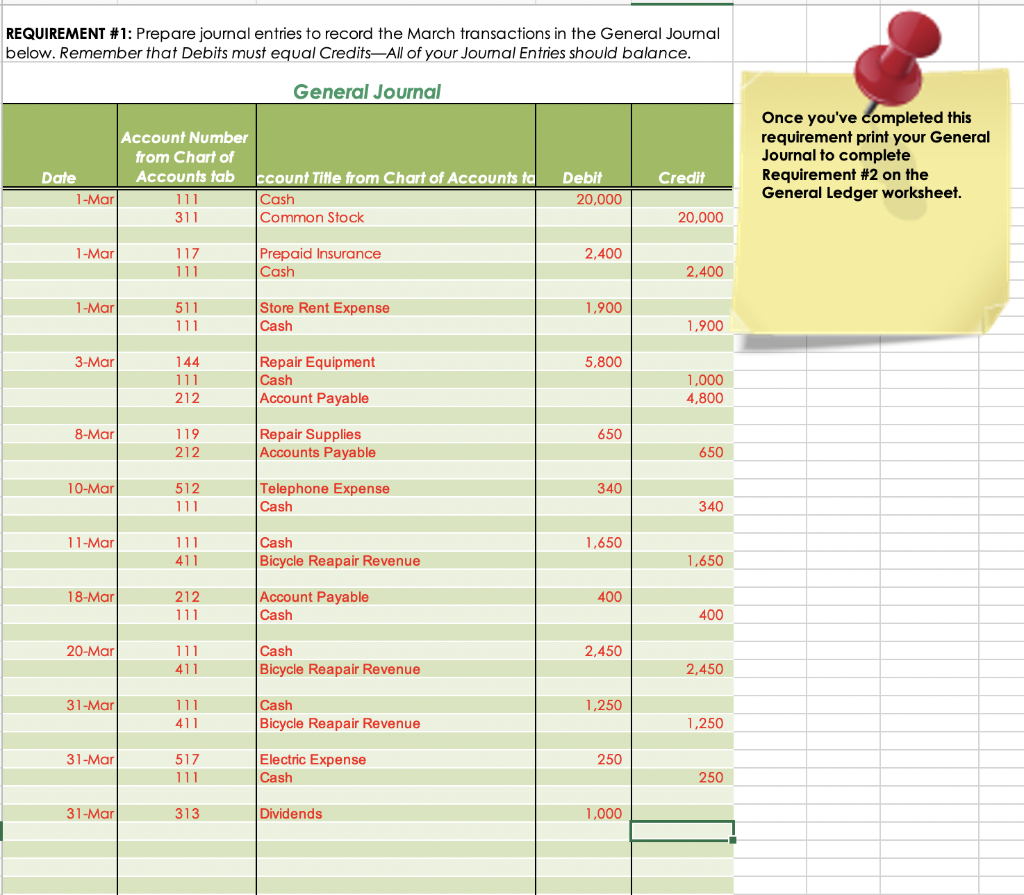

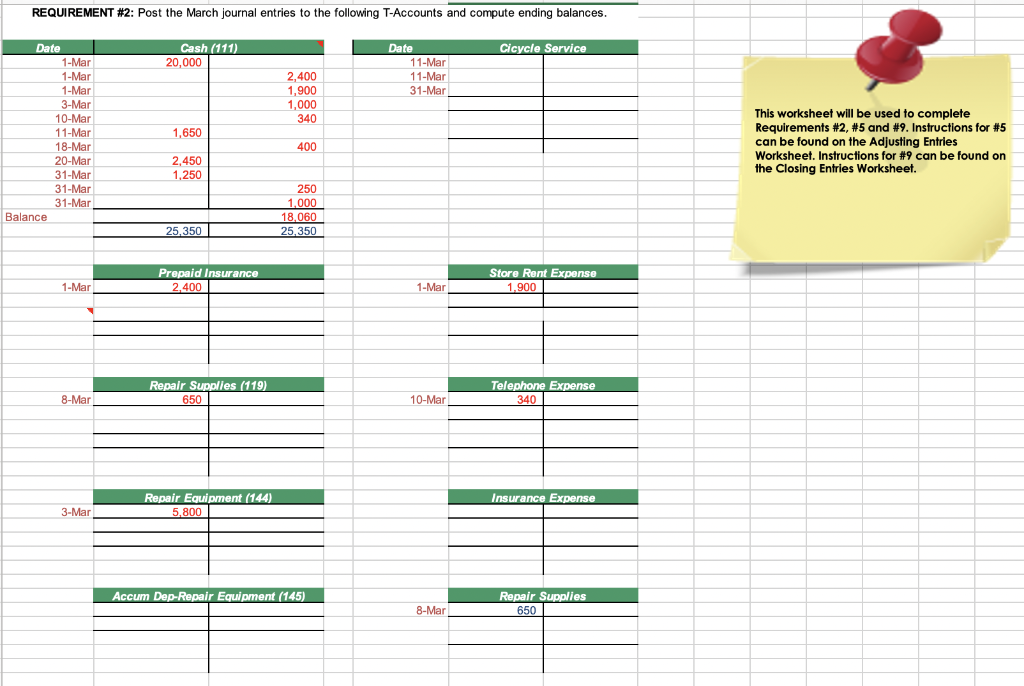

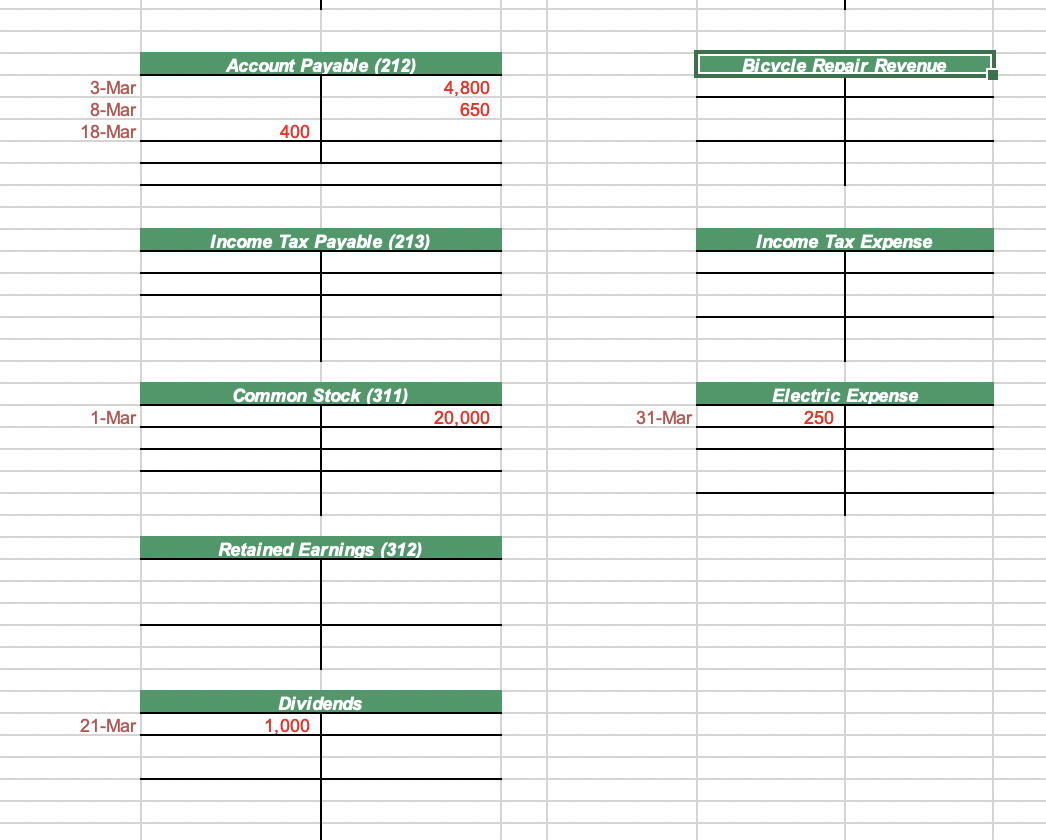

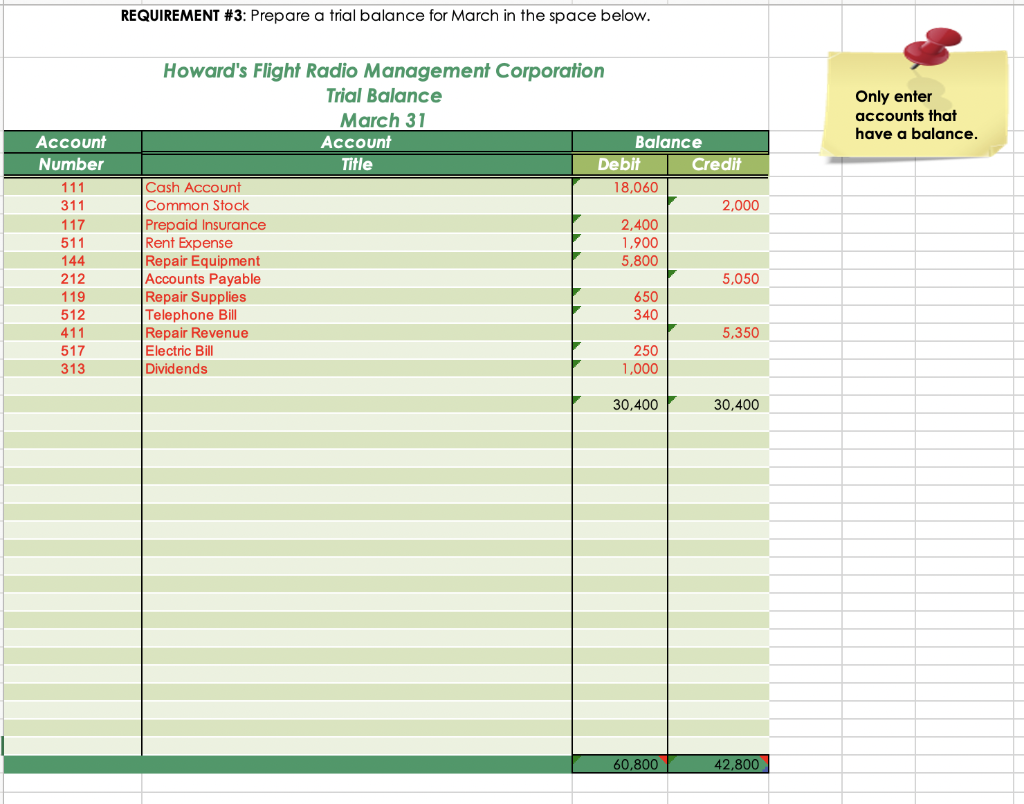

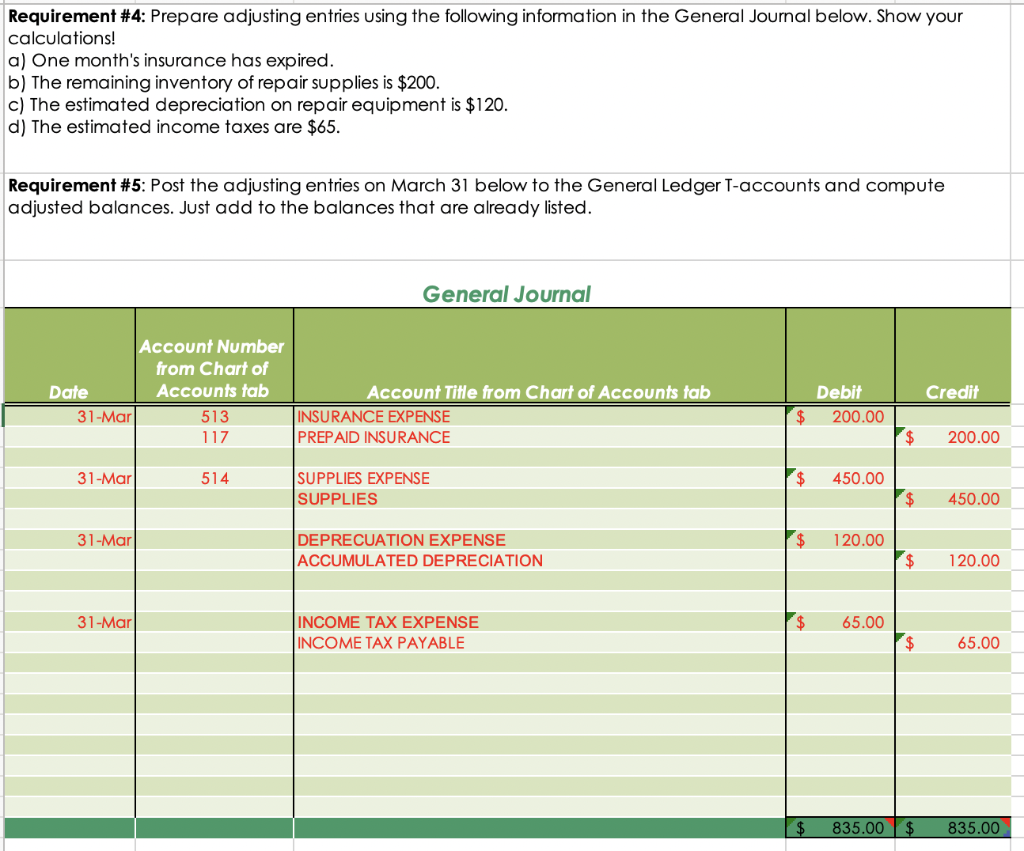

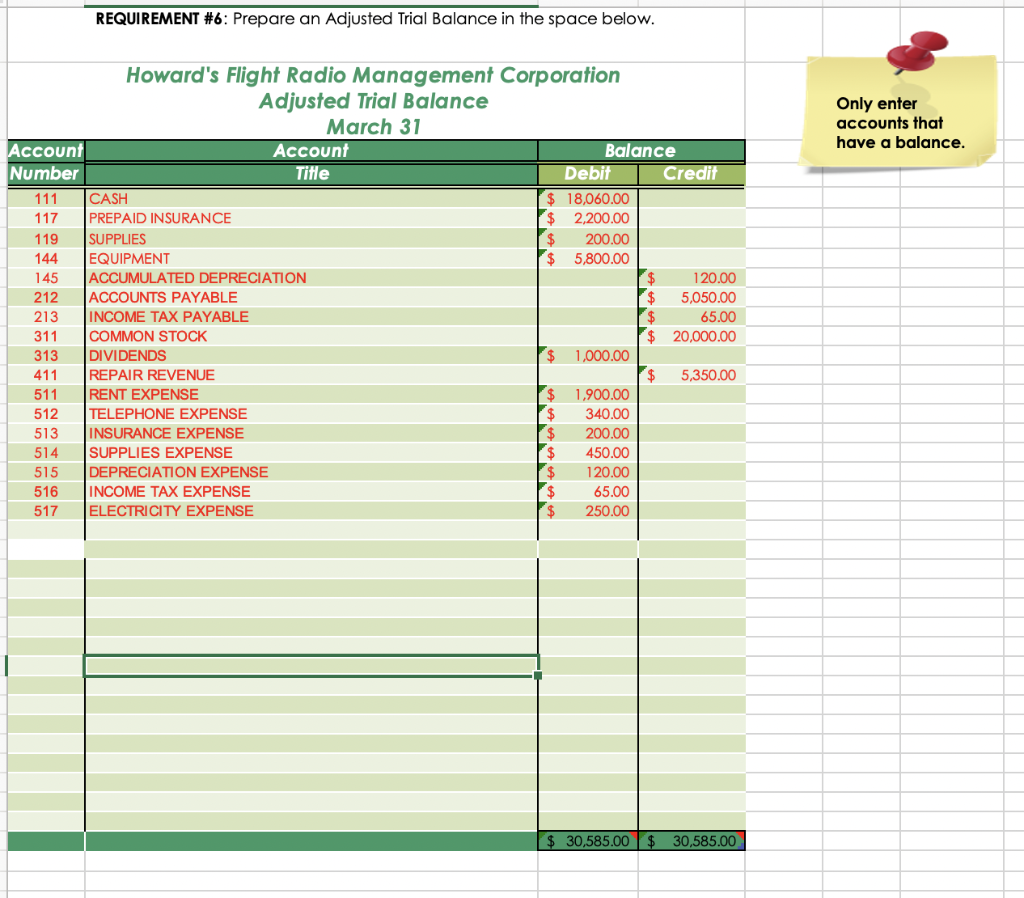

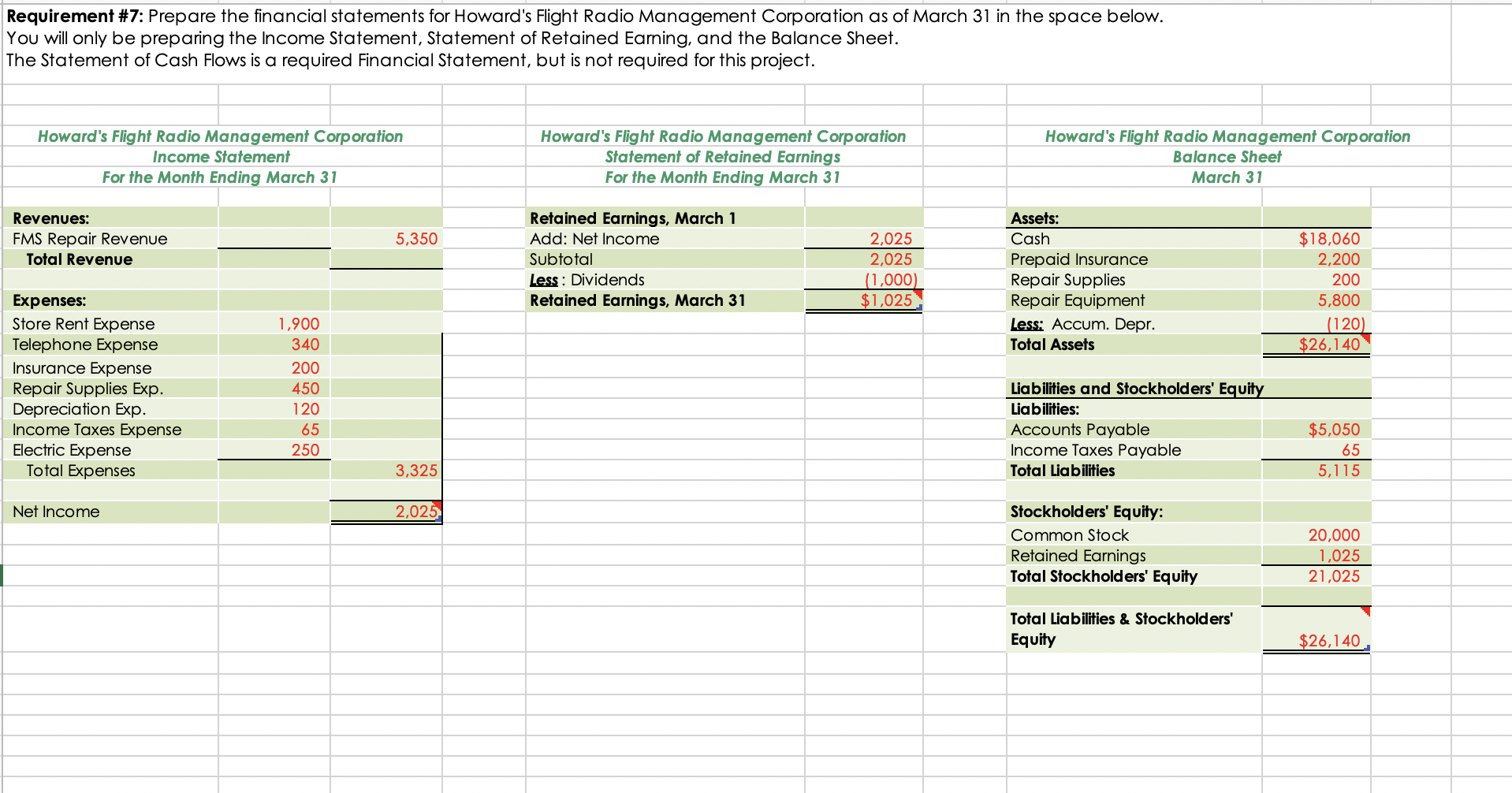

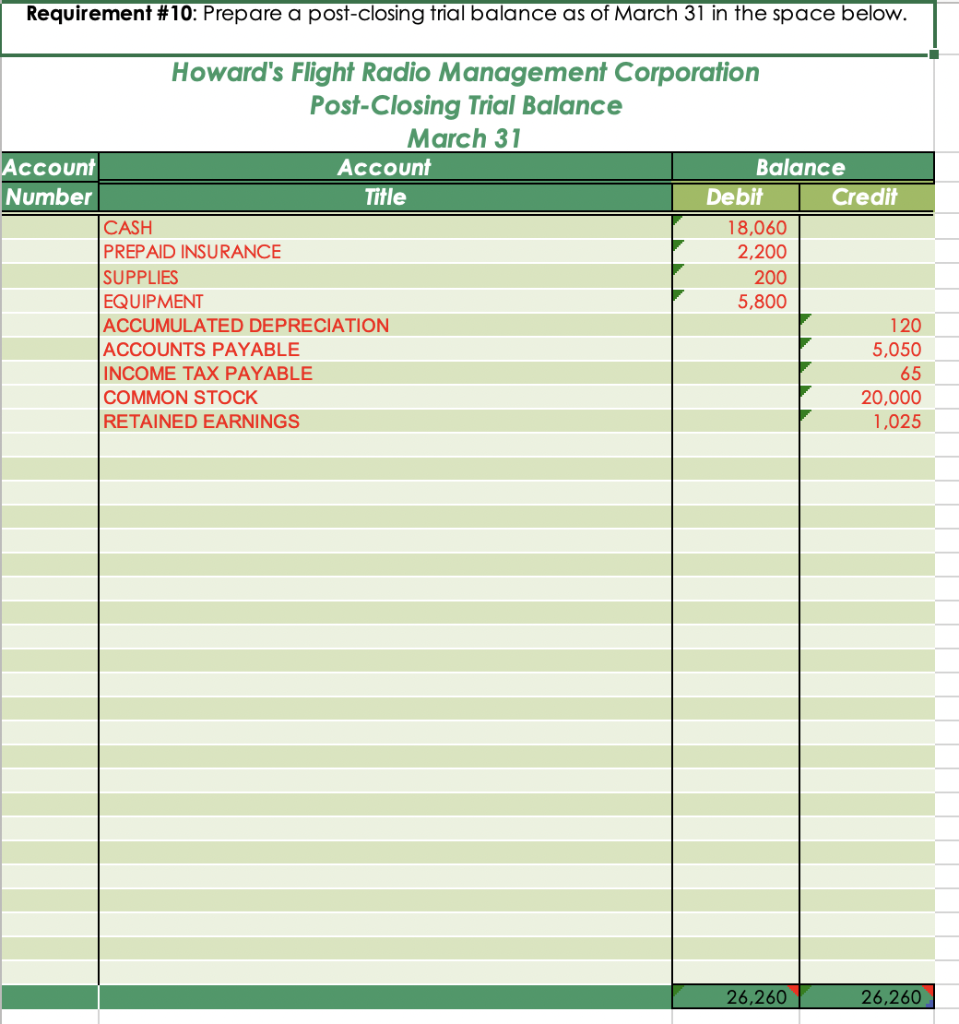

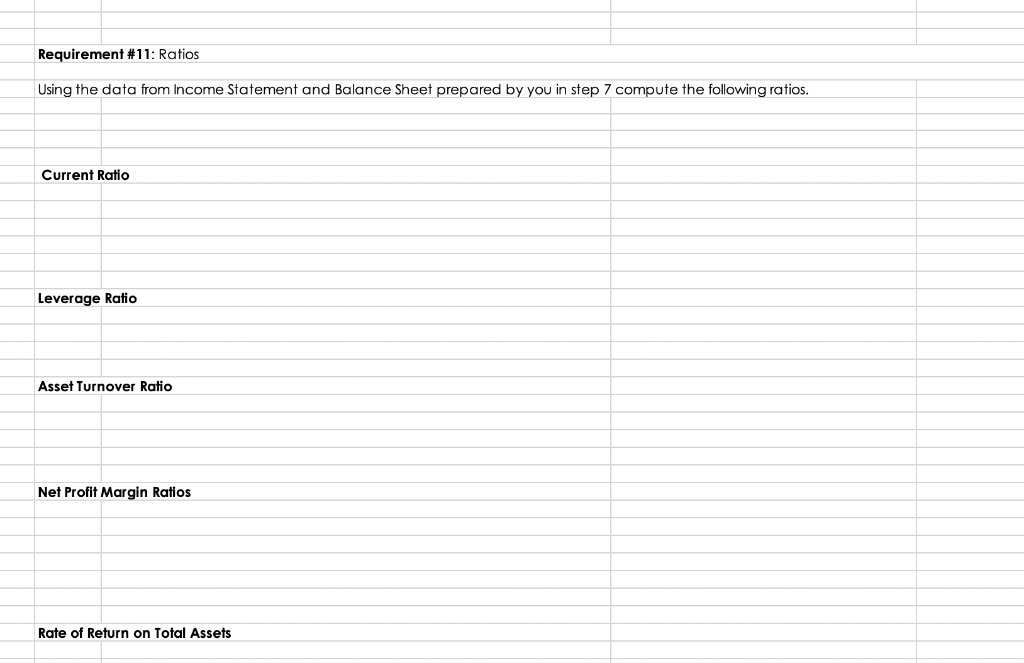

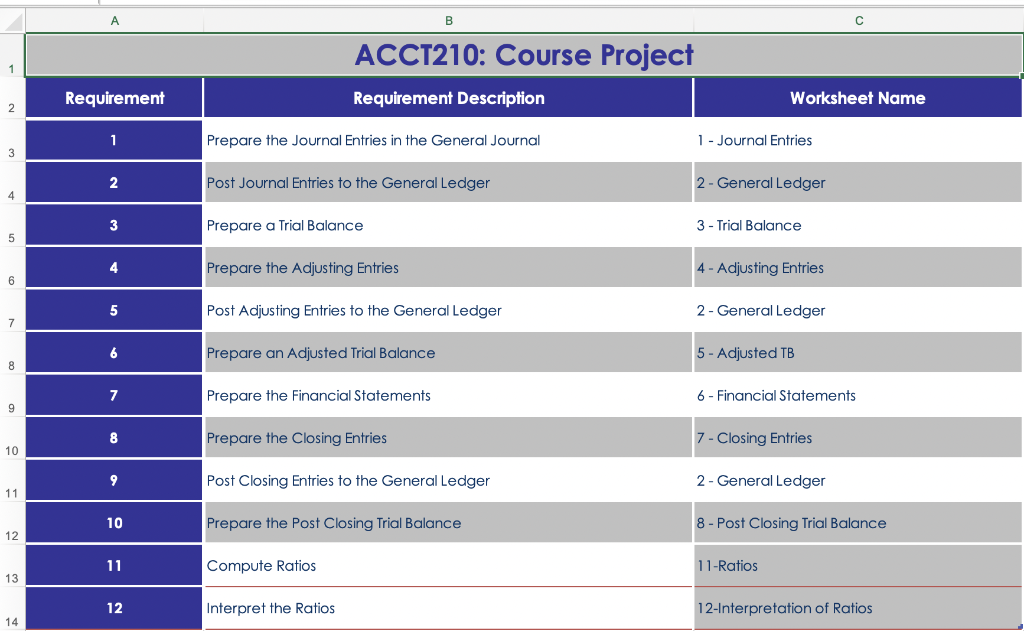

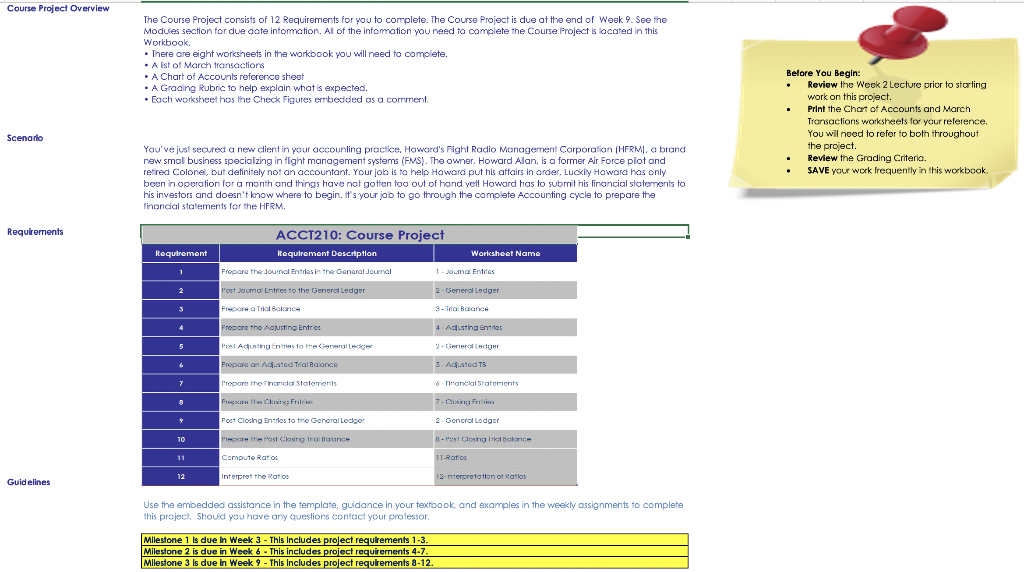

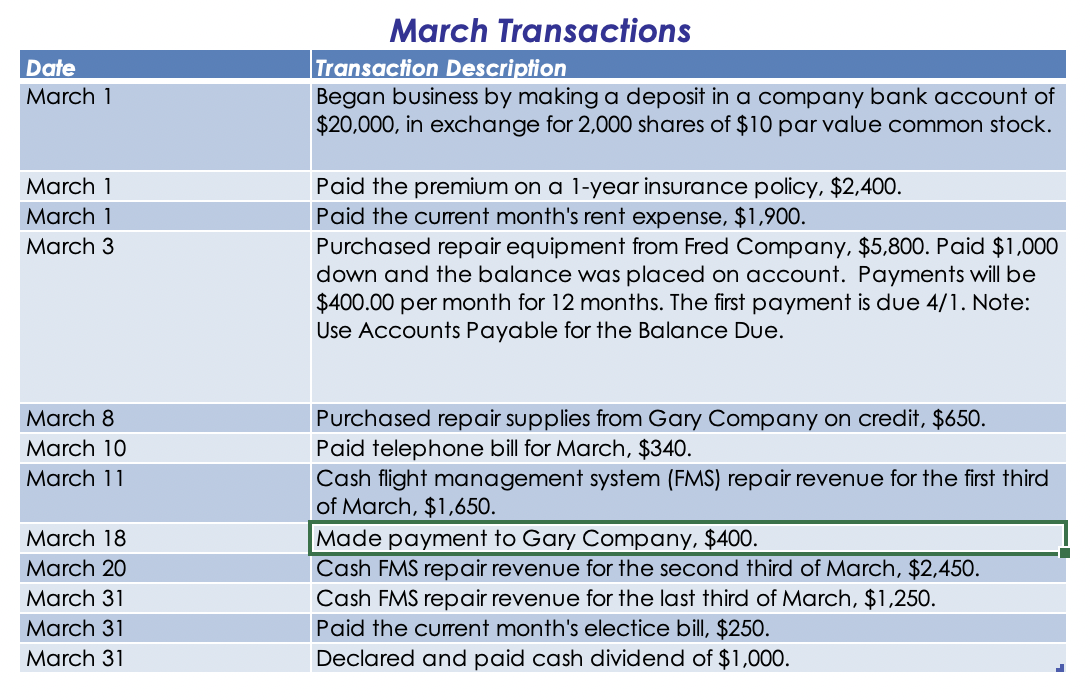

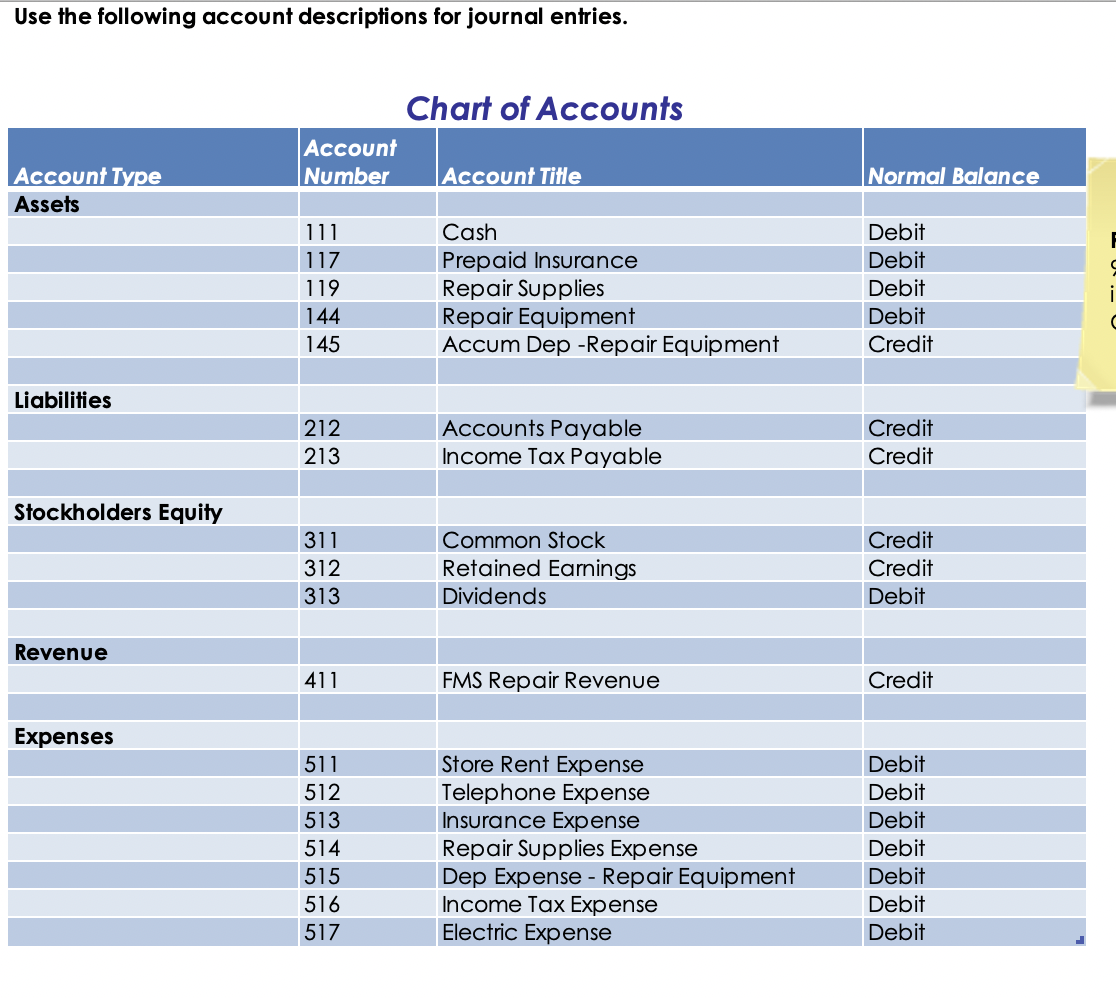

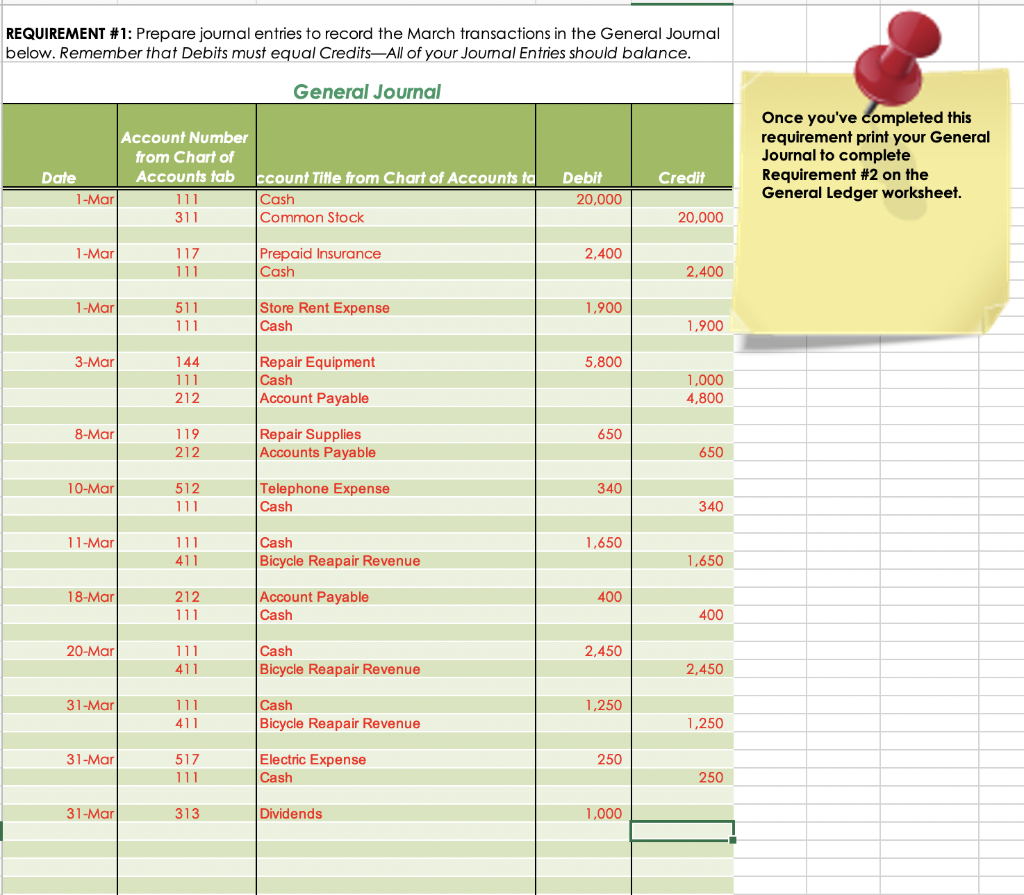

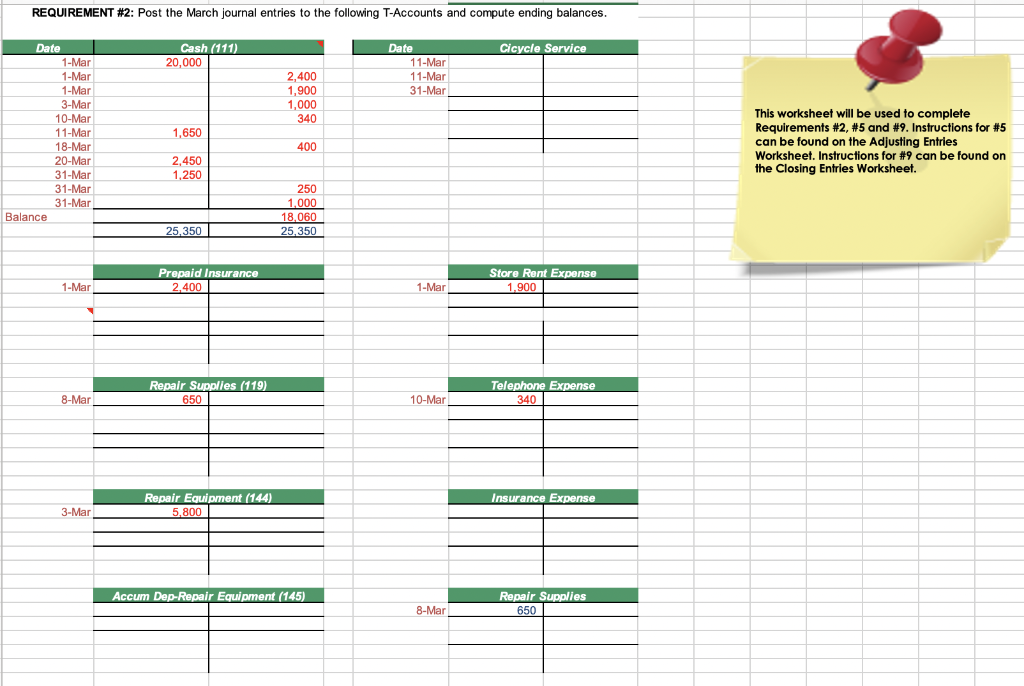

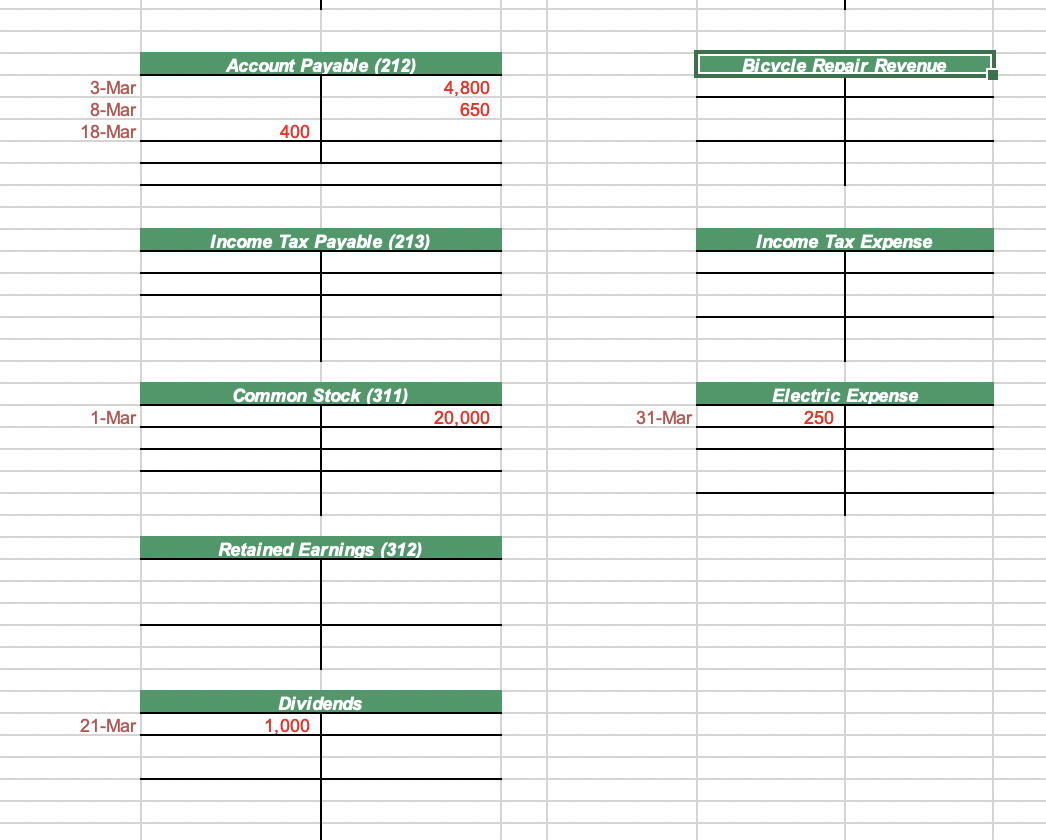

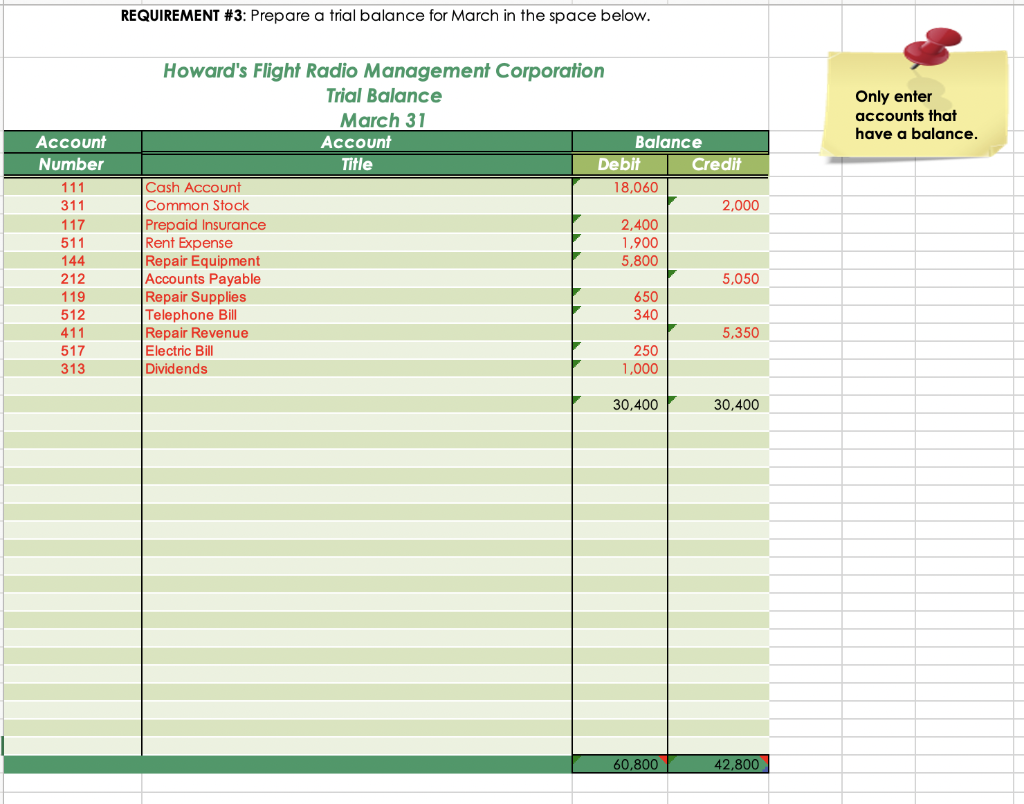

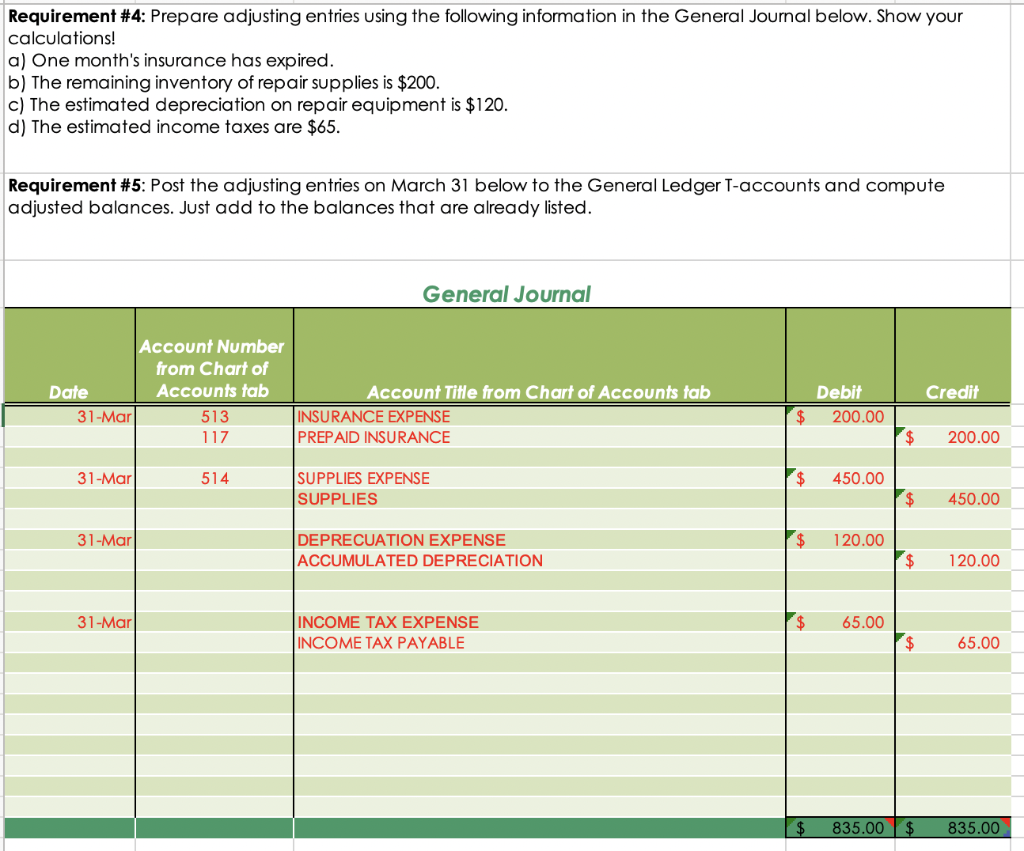

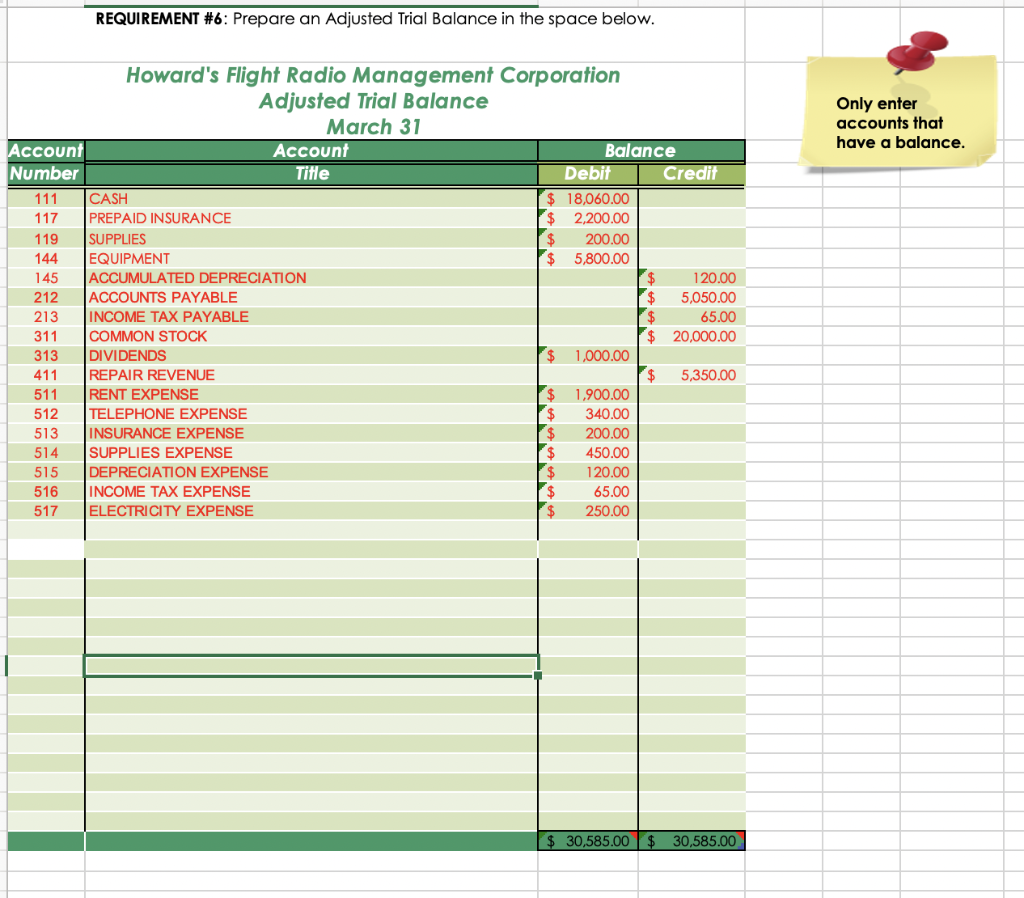

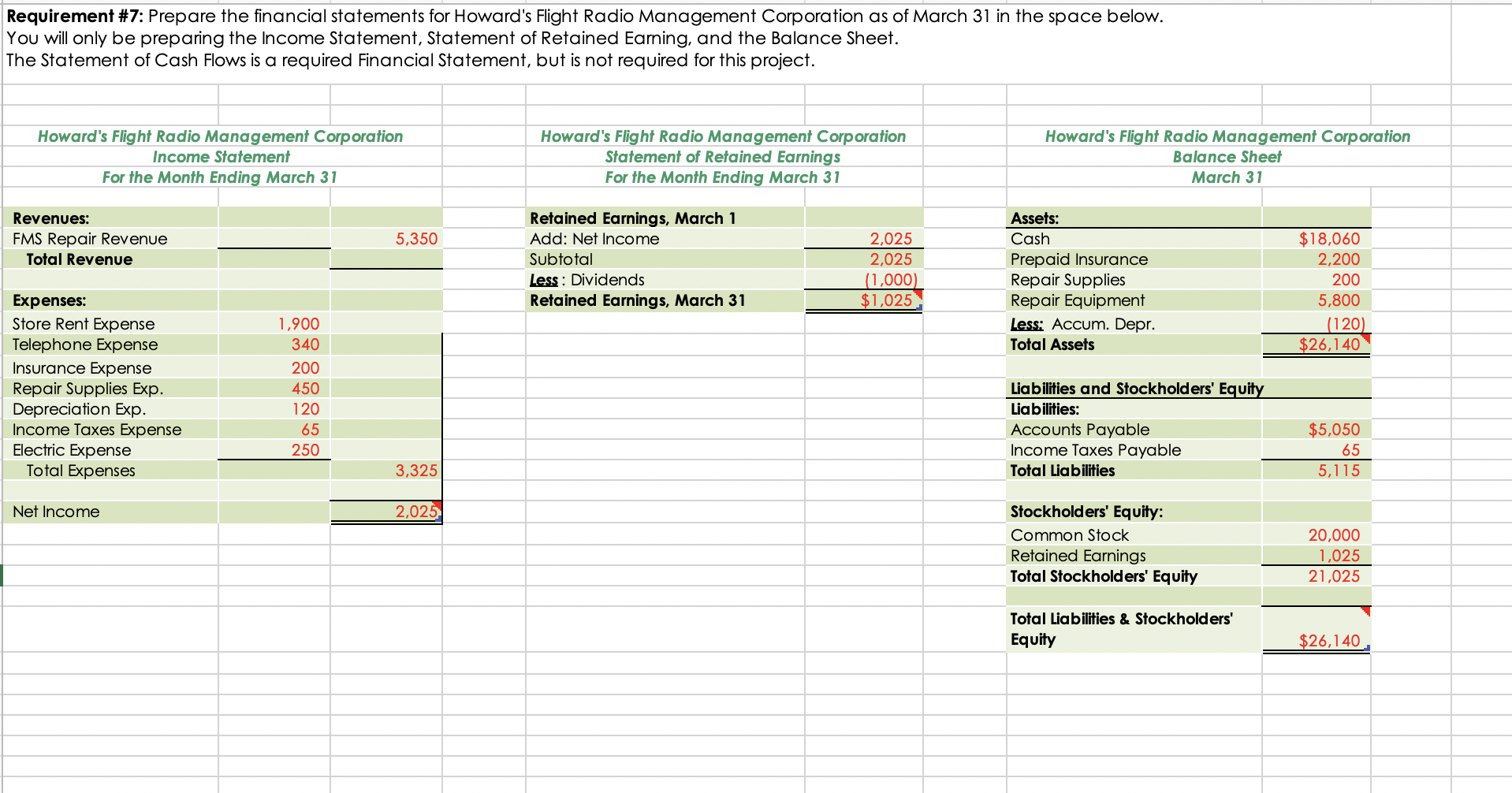

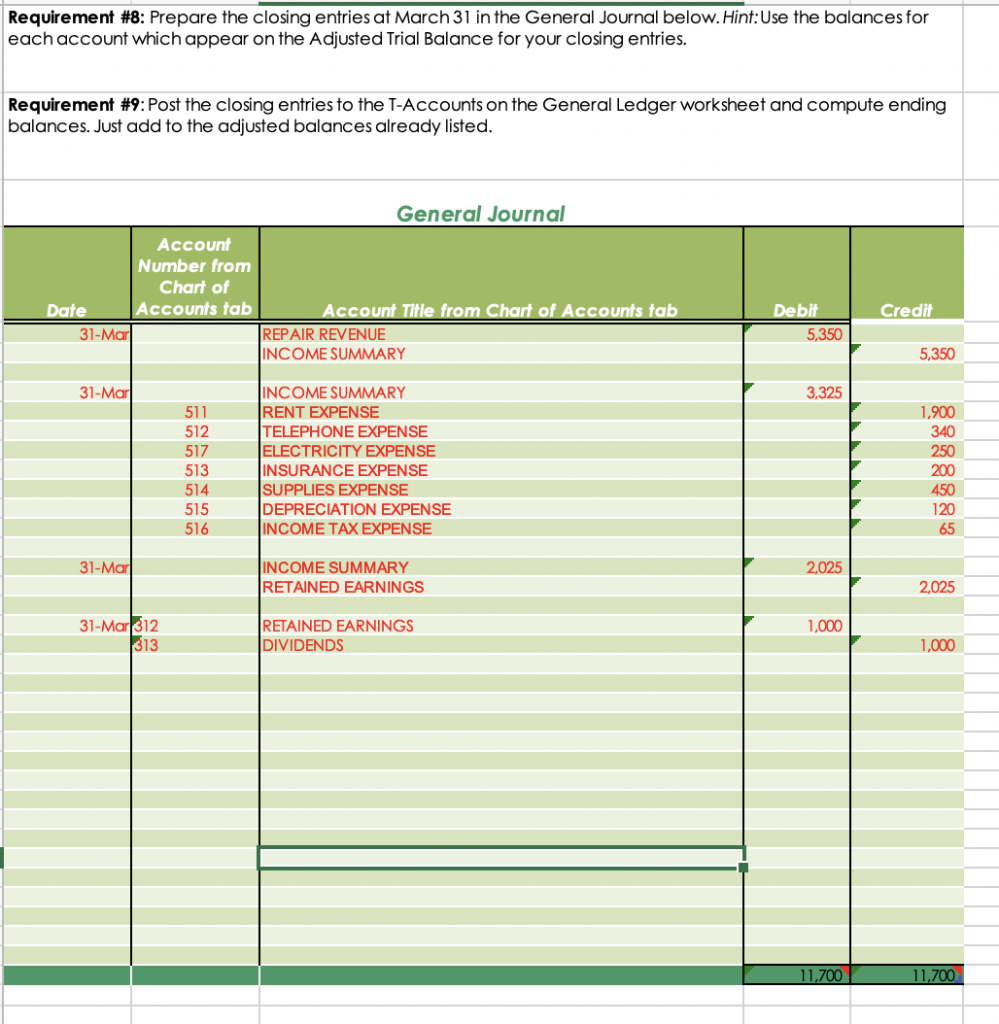

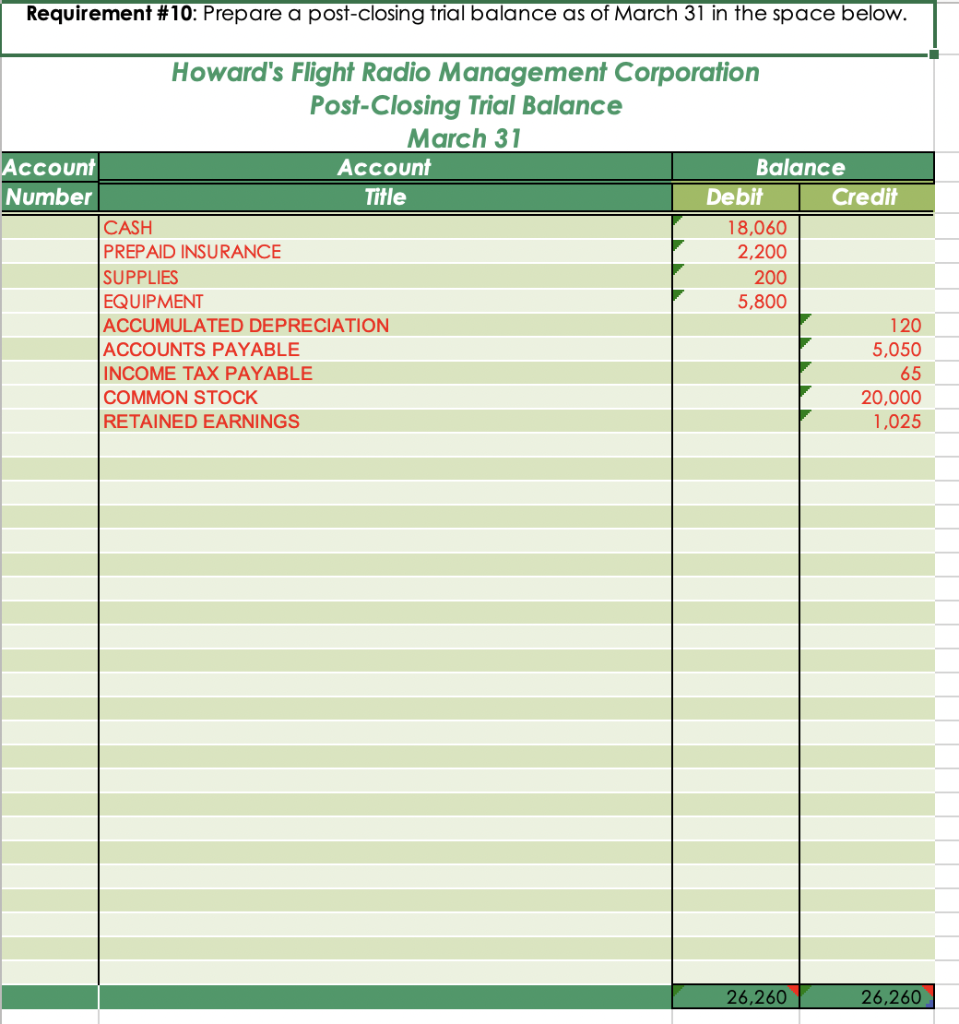

B ACCT210: Course Project Requirement Requirement Description Worksheet Name 2 1 Prepare the Journal Entries in the General Journal 1 - Journal Entries 3 2 Post Journal Entries to the General Ledger 2 - General Ledger 4 3 Prepare a Trial Balance 3 - Trial Balance 5 4 Prepare the Adjusting Entries 4 - Adjusting Entries 6 5 Post Adjusting Entries to the General Ledger 2- General Ledger 7 6 Prepare an Adjusted Trial Balance 5 - Adjusted TB 8 7 Prepare the Financial Statements 6- Financial Statements 9 8 Prepare the Closing Entries 7 - Closing Entries 10 9 Post Closing Entries to the General Ledger 2 - General Ledger 11 10 Prepare the Post Closing Trial Balance 8 - Post Closing Trial Balance 12 11 Compute Ratios 11-Ratios 13 12 Interpret the Ratios 12-Interpretation of Ratios 14 Course Project Overview The Course Project consists of 12 Requirements for you to complete. The Course Project is due at the end of Week 9. See the Modules section for due date information. Al of the infomation you need to complete the Course Project is located in this Workbook. There are eight worksheets in the workbook you will need to complete. A ist of March transactions A Chart of Accounts reference sheet A Grading Rubric to help explain what is expected. Each worksheet has the Check Figures embedded as a comment Belore You Begin: . Review the Week 2 Lecture prior to starting work on this project. Print the Chart of Accounts and March Transactions worksheets for your relerence, You wil need to refer to both throughout the project. Review the Grading Criteria, SAVE your work frequently in this workbook Scenario You've just secured a new client in your accounling practice. Howard's Fight Radio Management Corporation (HFRM, a brand new small business specializing in flight management systems (FMS). The owner, Howard Alan, is a former Force plot and retred Colonel, but definitely not an accountant. Your job is to help Haward put his affairs in order. Luckily Haward has only boen in operation for a month and things have not gotten too out of hond yet! Howard has to submit his financial statements to his investors and doesn't know where to begin. It's your job to go through the complete Accounting cycle to prepare the financial statements for the HFRM. Requirements ACCT210: Course Project Requirement Description Requirement Worksheet Name 1 Frepare the Joumal Entries in the General Journal 1 - Joumai Entries 2 Post Joumanies to the General Ledger 2-General Ledger Preca Trial Balance 9. Tria Balance Propare the dusting Entries 4. Alusting Entries 5 Post Acusing tries to the General Lecte 2-Germercal ledger 5 - Adjusted TS & Prepare an Adisted Trial Balance 7 Prepare the financial Statements 6 Trancial Statements Frex tw Cuir Entries 7 - Casing Free y Foct Closing Entries to the General Ledger 2 General Ledger 10 Prepare the post Closing room 8 - Post Cosinulo Bolonce Compute Ratos 11-Ratios 12 Guidelines 12-nterpretation of Rotlos Interpret the Katios Use the embedded assistance in the template, guidance in your textbook, and examples in the weekly assignments to complete this project. Should you have any questions contact your professor Milestone 1 is due in Week 3 - This includes project requirements 1-3 Milestone 2 is due in Week 6 - This includes project requirements 4-7 Milestone 3 is due in Week 9 - This includes project requirements 8-12. Date March 1 March Transactions Transaction Description Began business by making a deposit in a company bank account of $20,000, in exchange for 2,000 shares of $10 par value common stock. March 1 March 1 March 3 Paid the premium on a 1-year insurance policy, $2,400. Paid the current month's rent expense, $1,900. Purchased repair equipment from Fred Company, $5,800. Paid $1,000 down and the balance was placed on account. Payments will be $400.00 per month for 12 months. The first payment is due 4/1. Note: Use Accounts Payable for the Balance Due. March 8 March 10 March 11 March 18 March 20 March 31 March 31 March 31 Purchased repair supplies from Gary Company on credit, $650. Paid telephone bill for March, $340. Cash flight management system (FMS) repair revenue for the first third of March, $1,650. Made payment to Gary Company, $400. Cash FMS repair revenue for the second third of March, $2,450. Cash FMS repair revenue for the last third of March, $1,250. Paid the current month's electice bill, $250. Declared and paid cash dividend of $1,000. Use the following account descriptions for journal entries. Chart of Accounts Account Number Account Title Normal Balance Account Type Assets 111 117 119 144 145 Cash Prepaid Insurance Repair Supplies Repair Equipment Accum Dep-Repair Equipment Debit Debit Debit Debit Credit i C Liabilities 212 213 Accounts Payable Income Tax Payable Credit Credit Stockholders Equity 311 312 313 Common Stock Retained Earnings Dividends Credit Credit Debit Revenue 411 FMS Repair Revenue Credit Expenses 511 512 513 514 515 516 517 Store Rent Expense Telephone Expense Insurance Expense Repair Supplies Expense Dep Expense - Repair Equipment Income Tax Expense Electric Expense Debit Debit Debit Debit Debit Debit Debit REQUIREMENT #1: Prepare journal entries to record the March transactions in the General Joumal below. Remember that Debits must equal Credits-All of your Journal Entries should balance. General Journal Account Number from Chart of Date Accounts tab ccount Title from Chart of Accounts ta 1-Mar 111 Cash 311 Common Stock Once you've completed this requirement print your General Journal to complete Requirement #2 on the General Ledger worksheet. Credit Debit 20,000 20,000 1-Mar 2,400 117 111 Prepaid Insurance Cash 2,400 1-Mar 1,900 511 111 Store Rent Expense Cash 1,900 3-Mar 5,800 144 111 212 Repair Equipment Cash Account Payable 1,000 4,800 8-Mar 650 119 212 Repair Supplies Accounts Payable 650 10-Mar 340 512 111 Telephone Expense Cash 340 11-Mar 1,650 111 411 Cash Bicycle Reapair Revenue 1,650 18-Mar 212 111 Account Payable Cash 400 400 20-Mar 2,450 111 411 Cash Bicycle Reapair Revenue 2,450 31-Mar 1,250 111 411 Cash Bicycle Reapair Revenue 1,250 31-Mar 250 517 111 Electric Expense Cash 250 31-Mar 313 Dividends 1,000 REQUIREMENT #2: Post the March journal entries to the following T-Accounts and compute ending balances. Cash (111) Cicycle Service 20,000 2,400 1,900 1,000 340 Date 11-Mar 11-Mar 31-Mar Date 1-Mar 1-Mar 1-Mar 3-Mar 10-Mar 11-Mar 18-Mar 20-Mar 31-Mar 31-Mar 31-Mar Balance 1,650 400 This worksheet will be used to complete Requirements #2, #5 and #9. Instructions for #5 can be found on the Adjusting Entries Worksheet. Instructions for #9 can be found on the Closing Entries Worksheet. 2,450 1,250 250 1,000 18.060 25,350 25,350 Prepaid Insurance 2,400 Store Rent Expense 1.900 1-Mar 1-Mar 1 Repair Supplies (119) 650 Telephone Expense 340 8-Mar 10-Mar Insurance Expense Repair Equipment (144) 5,800 3-Mar Accum Dep-Repair Equipment (145) Repair Supplies 650 8-Mar Account Payable (212) Bicycle Repair Revenue 4,800 3-Mar 8-Mar 18-Mar 650 400 Income Tax Payable (213) Income Tax Expense Common Stock (311) Electric Expense 250 1-Mar 20,000 31-Mar Retained Earnings (312) Dividends 1,000 21-Mar REQUIREMENT #3: Prepare a trial balance for March in the space below. Only enter accounts that have a balance. Account Number 111 311 117 511 144 212 119 512 411 517 313 Howard's Flight Radio Management Corporation Trial Balance March 31 Account Balance Title Debit Credit Cash Account 18,060 Common Stock 2,000 Prepaid Insurance 2,400 Rent Expense 1,900 Repair Equipment 5,800 Accounts Payable 5,050 Repair Supplies 650 Telephone Bill 340 Repair Revenue 5,350 Electric Bill 250 Dividends 1,000 30,400 30,400 60,800 42,800 Requirement #4: Prepare adjusting entries using the following information in the General Journal below. Show your calculations! a) One month's insurance has expired. b) The remaining inventory of repair supplies is $200. c) The estimated depreciation on repair equipment is $120. d) The estimated income taxes are $65. Requirement #5: Post the adjusting entries on March 31 below to the General Ledger T-accounts and compute adjusted balances. Just add to the balances that are already listed. General Journal Account Number from Chart of Date Accounts tab Account Title from Chart of Accounts tab 31-Mar INSURANCE EXPENSE 117 PREPAID INSURANCE Credit Debit 200.00 513 $ $ 200.00 31-Mar 514 $ 450.00 SUPPLIES EXPENSE SUPPLIES $ 450.00 31-Mar DEPRECUATION EXPENSE ACCUMULATED DEPRECIATION $ 120.00 $ 120.00 31-Mar $ 65.00 INCOME TAX EXPENSE INCOME TAX PAYABLE $ 65.00 835.00 $ 835.00 REQUIREMENT #6: Prepare an Adjusted Trial Balance in the space below. Only enter accounts that have a balance. Howard's Flight Radio Management Corporation Adjusted Trial Balance March 31 Account Account Balance Number Title Debit Credit 111 CASH $ 18,060.00 117 PREPAID INSURANCE $ 2,200.00 119 SUPPLIES 200.00 144 EQUIPMENT 5,800.00 145 ACCUMULATED DEPRECIATION $ 120.00 212 ACCOUNTS PAYABLE 5,050.00 213 INCOME TAX PAYABLE $ 65.00 311 COMMON STOCK $ 20,000.00 313 DIVIDENDS 1,000.00 411 REPAIR REVENUE $ 5,350.00 511 RENT EXPENSE $ 1,900.00 512 TELEPHONE EXPENSE $ 340.00 513 INSURANCE EXPENSE 200.00 514 SUPPLIES EXPENSE $ 450.00 515 DEPRECIATION EXPENSE 120.00 516 INCOME TAX EXPENSE 65.00 517 ELECTRICITY EXPENSE 250.00 $ 30,585.00 $ 30,585.00 Requirement #7: Prepare the financial statements for Howard's Flight Radio Management Corporation as of March 31 in the space below. You will only be preparing the Income Statement, Statement of Retained Earning, and the Balance Sheet. The Statement of Cash Flows is a required Financial Statement, but is not required for this project. Howard's Flight Radio Management Corporation Income Statement For the Month Ending March 31 Howard's Flight Radio Management Corporation Statement of Retained Earnings For the Month Ending March 31 Howard's Flight Radio Management Corporation Balance Sheet March 31 Revenues: FMS Repair Revenue Total Revenue 5,350 Retained Earnings, March 1 Add: Net Income Subtotal Less : Dividends Retained Earnings, March 31 2,025 2,025 (1,000) $1,025 Assets: Cash Prepaid Insurance Repair Supplies Repair Equipment Less: Accum. Depr. Total Assets $18,060 2,200 200 5,800 (120) $26,140 Expenses: Store Rent Expense Telephone Expense Insurance Expense Repair Supplies Exp. Depreciation Exp. Income Taxes Expense Electric Expense Total Expenses 1,900 340 200 450 120 65 250 Liabilities and Stockholders' Equity Liabilities: Accounts Payable Income Taxes Payable Total Liabilities $5,050 65 5,115 3,325 Net Income 2,025 Stockholders' Equity: Common Stock Retained Earnings Total Stockholders' Equity 20,000 1,025 21,025 Total Liabilities & Stockholders' Equity $26,140 Requirement #8: Prepare the closing entries at March 31 in the General Journal below. Hint:Use the balances for each account which appear on the Adjusted Trial Balance for your closing entries. Requirement #9: Post the closing entries to the T-Accounts on the General Ledger worksheet and compute ending balances. Just add to the adjusted balances already listed. General Journal Account Number from Chart of Date Accounts tab Account Title from Chart of Accounts tab 31-Mar REPAIR REVENUE INCOME SUMMARY Credit Debit 5,350 5,350 31-Mar 3,325 511 512 517 513 514 515 516 INCOME SUMMARY RENT EXPENSE TELEPHONE EXPENSE ELECTRICITY EXPENSE INSURANCE EXPENSE SUPPLIES EXPENSE DEPRECIATION EXPENSE INCOME TAX EXPENSE 1,900 340 250 200 450 120 65 31-Mar 2,025 INCOME SUMMARY RETAINED EARNINGS 2,025 1,000 31-Mar 312 313 RETAINED EARNINGS DIVIDENDS 1,000 11,700 11,700 Requirement #10: Prepare a post-closing trial balance as of March 31 in the space below. Howard's Flight Radio Management Corporation Post-Closing Trial Balance March 31 Account Account Balance Number Title Debit Credit CASH 18,060 PREPAID INSURANCE 2,200 SUPPLIES 200 EQUIPMENT 5,800 ACCUMULATED DEPRECIATION 120 ACCOUNTS PAYABLE 5,050 INCOME TAX PAYABLE 65 COMMON STOCK 20,000 RETAINED EARNINGS 1,025 26,260 26,260 Requirement #11: Ratios Using the data from Income Statement and Balance Sheet prepared by you in step 7 compute the following ratios. Current Ratio Leverage Ratio Asset Turnover Ratio Net Profit Margin Ratios Rate of Return on Total Assets N22 A B D E F G G H 1 J K L M N o P a R S T U V w 1 2 3 4 5 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 4 & 5 Adjusting Entries 6 - Adjusted TB 7 - Financial Statements 8 & 9- - Closing Entries 10 - Post Closing Trial Balance 11 - Ratios 12- Interpretaion of Ratio +