Please help with test review so i may study. 1. Which of the following statements is true of costing systems? A) A process costing system

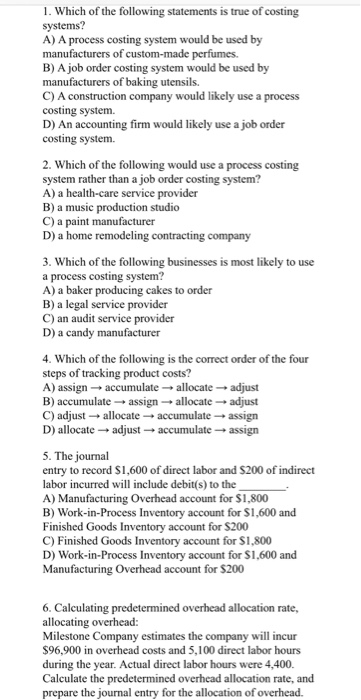

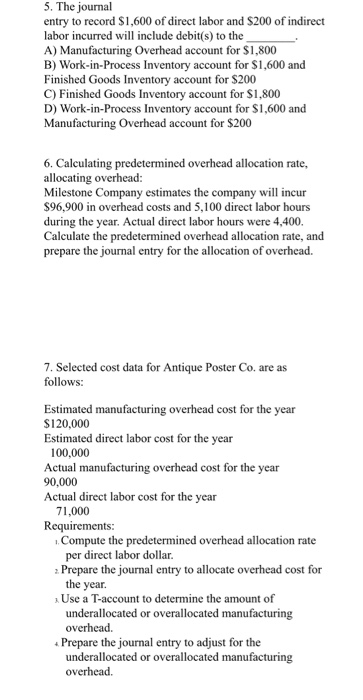

1. Which of the following statements is true of costing systems? A) A process costing system would be used by manufacturers of custom-made perfumes. B) A job order costing system would be used by manufacturers of baking utensils. C) A construction company would likely use a process costing system. D) An accounting firm would likely use a job order costing system. 2. Which of the following would use a process costing system rather than a job order costing system? A) a health-care service provider B) a music production studio C) a paint manufacturer D) a home remodeling contracting company 3. Which of the following businesses is most likely to use a process costing system? A) a baker producing cakes to order B) a legal service provider C) an audit service provider D) a candy manufacturer 4. Which of the following is the correct order of the four steps of tracking product costs? A) assign accumulate B) accumulate assign C) adjust allocate allocate adjust allocate adjust accumulate assign D) allocate adjust accumulate assign 5. The journal entry to record $1,600 of direct labor and $200 of indirect labor incurred will include debit(s) to the A) Manufacturing Overhead account for $1,800 B) Work-in-Process Inventory account for $1,600 and Finished Goods Inventory account for $200 C) Finished Goods Inventory account for $1,800 D) Work-in-Process Inventory account for $1,600 and Manufacturing Overhead account for $200 6. Calculating predetermined overhead allocation rate, allocating overhead: Milestone Company estimates the company will incur $96,900 in overhead costs and 5,100 direct labor hours during the year. Actual direct labor hours were 4,400. Calculate the predetermined overhead allocation rate, and prepare the journal entry for the allocation of overhead.

Step by Step Solution

3.29 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Question Answer to question number 1 D An accounting firm would likely used job order costing system ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started