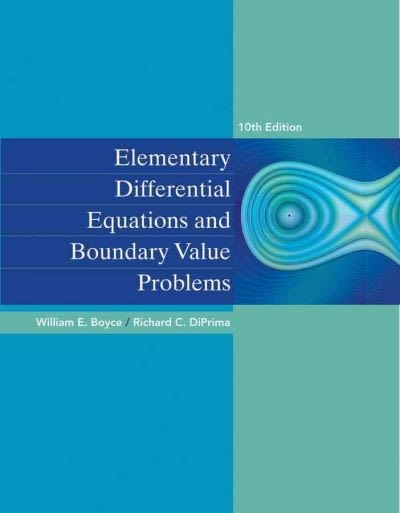

Please help with the attached question(MLC Table attached):

Illustrative Life Table: Basic Functions and Single Benefit Premiums at / = 0.06 Lives are independent. X 1000A 1000/ Axd 1000Axxx+10 1000And X 16.1345 86.73 50.89 16.2844 78.24 34.71 16.6432 57.93 16.51 16.4093 71.17 19.17 Baboo Babao 16 4080 67.96 18, 13 16.1541 85.62 22.70 16.2187 81.96 21.67 15.8187 104.60 28.49 15,9005 99.97 27.00 15.3934 128.67 37.00 21 15.8272 104.12 28.33 15.2962 134.18 39.11 21 15.7502 108.48 29.77 15.1945 139.94 41.39 15.6096 113.04 31.33 15.0883 145.95 43.83 24 15.5851 117.82 33.01 14.9774 152.22 45.46 24 25 15,4987 122 83 34.82 14.8617 158.77 49.28 25 26 15.4041 128.07 36,77 14.7411 165.60 52.31 26 27 15.3073 133.55 38.87 14.6154 172.71 55.56 27 28 15.2062 139.27 41.12 14.4845 180. 12 59.03 29 15.1005 145.20 43.55 14.3484 187.83 62.75 30 14,8901 151.50 46.16 14.2068 195.84 66.72 30 31 14.8750 158,02 48.96 14.0598 204.16 70.97 31 32 14.7549 164.82 51.95 13.9071 212.80 75.50 32 33 14.6298 171.90 55.18 13.7488 221.76 80.34 33 34 14.4995 179.27 58,63 13.5848 231.05 85.48 34 35 14.3640 186.94 62.32 13.4150 240.66 90.96 35 36 14.2230 194.92 66.26 13.2393 250.60 96,78 37 14.0766 203.21 70.48 13.0579 260.80 102.96 37 38 13.9246 211.81 74.98 12.8705 271.48 109.52 39 39 13,7670 220.74 79.77 12 6774 282.41 116.46 39 40 13.6036 229.99 84.89 12.4784 293.68 123.80 40 41 13,4344 239.56 90.32 12.2737 305.26 131.56 41 42 13.2594 249.47 96.11 12.0633 317.17 139.75 42 43 13.0785 259.70 102.25 11.8474 329.39 148.38 43 44 12.8919 270.27 108,76 11.6260 341.92 157.46 44 45 12.6994 281.16 115.66 11.3994 354.75 166.99 45 46 12.5011 292.39 122.95 11.1677 367.87 177.00 46 47 12.2971 303.94 130.67 10 9310 381.26 187.48 47 48 12.0873 315.81 138.80 10.6898 394.92 198,44 48 49 11.8720 320.00 147.38 10.4441 408, 82 209.88 49 50 11.6513 340.49 156.41 10.1944 472.96 221.81 50 51 11.4252 353.29 165,89 9.9409 437.31 234.22 51 52 11.1941 366.37 175.85 9.6840 451.85 247.10 53 10,9580 379.74 186.28 9.4240 466.57 260.46 53 54 10.7172 393.37 197.18 9.1614 481.43 274.27 54 55 10.4720 407 24 208,57 9.8966 196.42 288.54 55 56 10.2227 421.35 220.44 8 6301 511.50 303 24 56 57 9.9696 435.68 232.79 8.3623 526.66 318.35 57 50 9.7131 450.20 245.62 8.0938 541.86 333.85 58 59 9.4535 464.90 258.93 7.8249 557.08 349.73 59 60 9. 1911 479.75 272.69 7.5563 572.28 365.94 60 61 8.9266 494.72 286.91 7 2085 587.44 382.46 61 7.0221 602 53 83 8.6602 509.80 301.56 399.26 62 8 3926 524.95 316,62 6.7574 617.50 416.30 63 64 8. 1241 540,15 332.09 6.4952 632.34 433.53 64 65 7.8552 555.36 347.92 6 2360 647 02 450.93 65Illustrative Life Table: Basic Functions and Single Benefit Premiums at / = 0.06 1000qx 1000A, 1000/AJ 1000,Ex 1000,Ex 100020Ex X 10,000,000 20.42 16.8010 49,00 25.92 728.54 541.95 299 89 9,749,503 0.98 17.0379 35.59 8.45 743 89 553.48 305.90 9,705,588 0.85 16.9119 42.72 9.37 744.04 553.34 305.24 10 9,663,731 52.65 11.33 743.71 15 0.91 16.7384 552.69 303.96 9,617,802 1.03 16 5133 65 28 14.30 743 16 551.64 301.93 20 21 9,607,896 1.05 16.4611 68.24 15.06 743.01 551.36 301.40 21 9,597.695 1.10 16.4061 71.35 15.87 742.86 551.06 300.82 23 9,587, 169 1.13 16.3484 74.62 16.76 742.68 550.73 300.19 24 9,576,288 1.18 16.2878 78.05 17.71 742.49 550.36 299.49 24 25 9,565,017 18.75 549.97 25 1.22 16.2242 81.65 742 29 298.73 26 9,553,319 1.27 16.1574 85.43 19.87 742 06 549.53 207.90 26 27 9,541,153 1.33 16.0873 89.40 21.07 741.81 549.05 297.00 27 28 9,528,475 1.39 16.0139 93.56 22.38 741.54 548.53 296.01 28 29 9,515,235 15,9368 294.92 29 1.46 97.92 23.79 741.24 547.96 30 30 9.501,381 1.53 15 8561 102.48 25.31 740.91 547.33 293 74 31 9,486,854 1.61 15.7716 107 27 26.95 740.56 546.65 292.45 31 32 9,471,591 1.70 15.6831 112 28 28.72 740.16 545.90 291.04 32 33 9,455,522 1.79 15.5906 117.51 30.63 739.72 545.07 289.50 33 34 9,438,571 1.90 15.4938 122.99 32.68 739.25 544.17 287.82 34 35 9.420,657 2.01 15.3926 128.72 34.88 738.73 543.18 286.00 35 9,401,688 214 15.2870 134.70 37.26 738.16 542.11 284.00 36 36 37 9,381,566 2.28 15.1767 140.94 39.81 737.54 540.92 281.84 37 38 9,360,184 2.43 15,0816 147.46 42.55 736.86 539.63 279.48 38 9,337,427 2.60 14.9416 154.25 45.48 736.11 538.22 276.92 39 39 40 9,313, 168 2.78 14.8166 161.32 48.63 735.29 536.67 274.14 40 41 9,287,264 2.98 14.6864 168.69 52.01 734.40 534.99 271.12 41 42 9,259,571 3.20 14 5510 176.36 55.62 733 42 533.14 267 85 42 43 9,229,925 3.44 14.4102 184.33 59.48 732 34 531.12 264.31 43 44 9, 198,149 3.71 14.2639 192.61 63.61 731.17 528.92 260.48 44 45 9, 164,051 4.00 14.1121 201 20 68 02 729.88 526.52 256.34 45 9, 127,426 4.31 210.12 523.89 251.88 46 13.9546 72.72 728.47 46 47 9,088,049 4.66 13.7914 219.36 77.73 726.93 521.03 247.08 47 48 9,045,679 5,04 13.6224 228.92 83.06 725.24 517.91 241.93 48 49 9,000,057 5.46 13.4475 238 82 BB. 73 723.39 514.51 235.39 49 50 8,950,901 5.92 13.2668 249.05 94.76 721.37 510 81 230.47 50 51 8,897,913 6.42 13.0803 259.61 101.15 719.17 506.78 224.15 51 8,840,770 6.97 12.8879 270.50 107.92 716.76 502.40 217.42 52 52 8 779,128 7.58 12.6896 281.72 115.09 714.12 197.64 210 27 53 54 8,712,621 8.24 12 4856 293.27 122.67 711.24 492 47 202.70 54 55 8,640,861 3.96 12 2758 305. 14 130 67 708.10 486.86 194.72 55 56 8,563,435 9.75 12.0604 317.33 139 11 704.67 480.79 186.32 56 57 8.479,90g 10.62 11.8395 329.84 147.99 700.93 474.22 177.53 57 58 8,389,826 11.58 11.6133 342.65 157.33 696.85 467.12 168.37 58 59 B,292,713 12.62 11.3818 355 75 167.13 692.41 459.46 158,87 69 8,180,074 13.76 11.1454 369.13 177 41 687.56 451.20 149.06 GO 61 8,075,403 15.01 10.9041 382.79 188.17 682 29 442.31 139 00 61 62 7,954,179 16.38 10.6594 306.70 199.41 676.56 432.77 128.75 62 63 7,823,879 17 88 10.4084 410.85 211.13 670.33 422.54 118 38 63 64 7,683,979 19.52 10.1544 425.22 223.34 663.56 411.61 107.97 64 85 7,533,964 21.32 9 8969 439.80 236.03 656.23 399 94 97 60 65Extra #4: You have issued a 20-pay semicontinuous whole life policy with $250,000 benefits to a 45-year old. Expenses are 40% of premium in the first year and 2% of premium in renewal years. Acquisition expenses are $450 per policy paid at time 0 and maintenance expenses are $100 per policy paid continuously as long as the policy is in force. Settlement expenses are $600 paid at the moment of death. Using the Exam M table, calculate the Expense Loaded Reserve and the Level Expense Reserve for this policy 10 years after issue and 30 years after issue