Please help with the F option!!!!

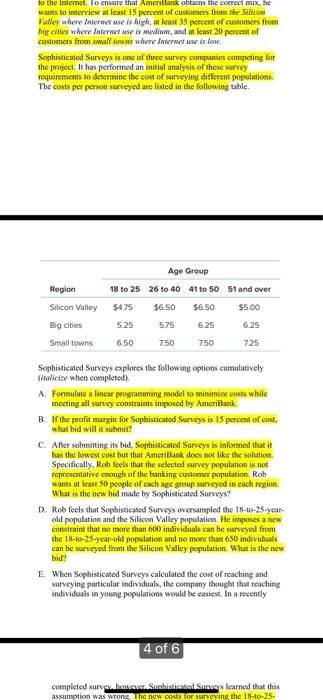

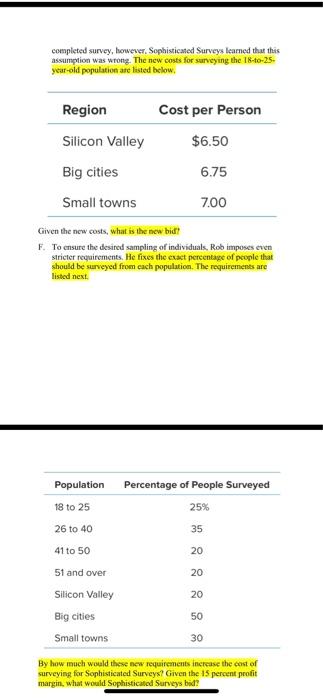

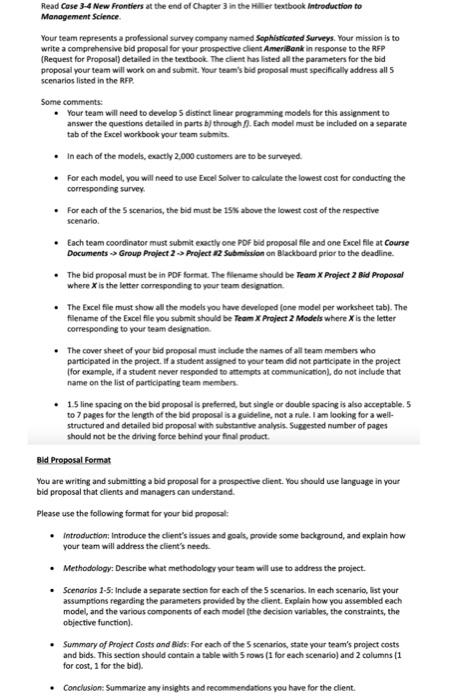

Read Cose 3-4 New Frontiers at the end of Chapter 3 in the Hilier teatbook Introduction to Management Solence. Your team represents a professional survey company mamed Sophishicated Surveys. Your mission is to write a comprehensive bid propesal for your prospective client AmeriBonk in response to the RFP (Request for Proposal) detailed in the tentbook. The client has listed all the parameters for the bid proposal your team will work on and submit. Your team's bid proposal must specifically address all 5 scenarios listed in the RFP. Some comments: - Your team will need to develop 5 distinet linear procramming models for this assignment to answer the questions detalled in parts b) through n. Each model must be included on a separate tab of the Excel workbook your team submits. - In each of the models, ecactly 2.000 customens are to be surveyed. - For each model, you will need to use Ercel Solver to calculate the lowest cost for conducting the corresponding survey. - For each of the 5 scenarios, the bid must be 15$ above the lowest cost of the respective scenario. - Each team coordinator must submit eoctly one PDF bid proposal fle and one Ercel file at Course Documents Group Project 2 Project a2 Submission on Blackboard prior to the deadline. - The bid proposal mast be in PDF format. The fliename should be Team x Project 2 Bid Proposal where x is the letter corresponding to your team desigution. - The Excel fle must show all the models you have developed (one model per worlsheet tab). The fliename of the Excel flie you submit should be feam x Project 2 Models where X is the letter corresponding to your team designation. - The cover sheet of your bid proposal munt indude the names of all team memben who participated in the project. If a student assigned to your team did not participate in the project (for example, if a student never responded to amempts at communication), do not include that name on the list of participating teaen member. - 1.5 line spacing on the bid proposal is preferred, but single or double spacing is also acceptable. 5 to 7 pages for the length of the bid proposal is a guideline, not a rule. I am looking for a weilstructured and detailed bid proposal with substantive analysis. Suggested number of pages should not be the driving force behind your final product. Bid Proposal Format You are writing and submitting a bid proposal for a prospective client. You should use language in your bid proposal that clients and managers can understand. Please use the following format for your bid proposal: - Introduction: Introduce the client's issues and goals, provide some background, and explain how your team will address the client's needs. - Methodology: Describe what methodolomy your team will use to address the project. - Scenarios 1-5: include a sepurate section for each of the 5 scenarios. In each scenario, list your assumptions regarding the parameters provided by the client. Explain how you assembled each model, and the various components of each model (the decirion variables, the constraints, the objective function]. - Summary of Project Costs and Aids: For each of the 5 scenarion, state your team's project costs and bids. This section should contain a table with 5 rows ( 1 for each scenario) and 2 columns ( 1 for cost, 1 for the bid). - Conclusion: Summarize any insights and recommendations you have for the client. New Fantiers Rob Richman, president of AmeriBank, takes oft his glasses, rubs his eyes in exhaustion, and squints at the clock in his study. It reads 3 AM. For the last several hours. Rob has been poring over Amenibank's flnancial stakements from the last three quarters of operation. Amerilkank, a medium-sized bank with branches throughout the Unod States, is headed for dire economic straits, The bank, which provides Ifansetion, savings, investment, and loan services, has been experiencing a steady decline ia its net income over the past year, and trends show that the decline will continue. The bank is simply losing custumers to non-bank and foreign bank competitors. Ameribank is not akone in its struzgle to stay oen of the ted. Froen his daily industry readings, Rob knows that many American banks have been suffering significant losses because of increasing competition from non-bank and foreign bank compethors offeritg services bypically in the domain of American banks. Because the noe-bank and foreign bark. competitors specialioe in particular services, they are able to better captare the market for those eservices by offering less expensive, more efficient, more convesient services. For example, large corpoentions now turn to foreign banks and commercial paper offerings for loans, and aflluent Americans now fum to mocky-market funds for investment Banks face the daunting challenge of Gistingaishing themsetves from non-bank and forejgn bank competitors. Rob has concluded that one strategy for distieguishing AmeriBank from its competitors is to improve services that non bank and forcign bank competitors do nos readily provide: transtiktion services. He has decided that a more coevenient transaktion method must logically saceeed the automatic teller machine, and be believes that electronic banking over the Internct allows this convenient transaction method. Over the Iencrect, cusioeners are able to perform transtetions on their desktop cortputers either at home or work. The explosion of the Intemet means that most potential customers understand and use it. Ife therefore foels that if Amerilkank offers Web banking (as the practice of Internet banking is commonly ealled), the bunk will atrract masy new customers. Before Rob undertakes the project to make Web banking possible, bowever, he needs to understand the market for Web banking and the services Ameribank should provide over the Internet. For example, should the bank osly allow customers to aceess aceount balanees and historical transaction isformation over the Internet, of should the bank develop a strategy to allow customers to make deposits and withdrawals over the Internet? Shoukd the bank try to recapture a portion of the investment market by comtimuously nunning stock prices and allowing customers to make stock transactions over the lawernet for a minimal fee? Thereforc, Rab has concluded that a major survey project shoald be underiaken to leam what cusfomers wanh. Because AmeriBank is not in thi bofnighof perfoeming surveys, Rot has decided to outsource the sueveg prejec to a professional survey company. He has opened the pooject up for bidding by several survey companies and will award the project to the company that is willing to perform the surviy for the least cast. Hob nnovidsd cach survey the Internet allows this convenient transaction method. Over the Interact. customers are able to perform transactions on their desktop consuters either an home or work. The explosioe of the Intemet meass that most potential custonsers understand and use it. He therefore feels that if Amerilank offers Web banking (as the practice of Internet banking is commonly ealled), the bank will atsact matry new custotthers. Before Rob undertakes the project to make Web banking possible, however, he needs to understand the market for Web banking and the services Amerillank should provide over the Internet. For example, should the bank ouly allow customers to aceess aceount balances and bistorical transaction iaformation over the Interbet, of should the bank develop a strategy to allow customers to make deposits and withdrawals over the lnternet? Should the bank fry to recapture a portion of the investment market by contimoously running stock prices and allowing customers to make stock transactions over the Imernet for a minimal fee? Therefore, Rob has coecluded that a major survey project should be undertaken to leam what customers want. Becasse Ameribank is not in the business of perfonning surveys. Rob has decided to outsource the survey project to a professional survey company. Hle has opened the project up for bidding by several survey companies and will awand the project to the compusy that is willing so perfom the semvey for the least cost, Rob providid each sarvey company with a list of survey requircments to ensure that AmeriBank reccives the neoded information for planning the Web banking project. Because different age groups require different services, AmeniBank is interested in surveying four different age jscoups. The first group encompasses customers who are 18 to 25 years old. The bank assumes that this age group has limited yearly income and performs minimal tramsections, The second group etcompasses customens who are 26 to 40 years old. This age groap has significant scurees of income. perforns many transactions, requires numerous loans for new houses and cars. and imests in various securitics. The thind group encompasses custemers who are 41 to 50 years old. These custoeners typically have the same level of income and perform the same number of transactions as the second age groen, but the bunk assumes than these cuslomers are less likely to me Web banking since they have not become as comfortable with the explosioe of computers or the lntemet. Finally, the fourth growp encompusses customers who are 51 years of age and over. These customers conmoaly crave secuity and require coetinuous information on retirement fiinds. The bank belicves that it is highly unlikely that many customers in this age group will use Wob banking. but the bank desires to leam the needs of this age groep for the future. AmeriBank wants to interview 2,000 eusiomers with at least 20 percent from the first age group, at least 27.5 percent from the second age group. at least 15 percent from the thind age group. and at least 15 pertent from the fourh age group. Rob understands that some customers are uncomfortable with using the Intemet. He therefore wants to ctsure that the survey includes a mix of customers who know the Inemet well and those that have less exposure to the Internet. To ensare that AmeriBank obains the correct mix, he wants to imtervicw at least 15 percent of customers from the Salkew Valley where luterner use is high, at least 35 peroent of customers from big cities white lifenet ase is medium, and a least 20 perecet of customers from small fowns where fnternet tope is low. to the lisernct, 10 ensare that AmenHank obtains the correci max, te wants to imervicw at least 15 pereent of customers from the Sllioow Vally where latemel use is high, an least 35 percent of cushamers from big ctites where luternet use is medium, and at least 20 percent of customers from small toms where funcemet use is low: Sophisticated Surveys is one of three sarvey compunies competing for the project. It has performed an initial analysis of these survey requirements to determine the cost of surveying different popalations. The costs per person surveyed are listed in the following table. Sophisticaned Surveys explores the following options cumblatively (itanlicieve when complered). A. Formulate a linear pookramming model to minimize costs while meeting all survey constraints imposed by AmeriBank: B. If the profit margin for Sopbisticated Sarveys is 15 pereent of cost, bhat bid will it sulutir? C. After stibmiting its bid, Sophissicaled Surveys is informed that it thas the lowest cost but that AmeriBark does not like the solutice. Specifically, Rob feels that the selected survey population is not representative enough of the banking customer population. Rob wanss at leas 50 prople of cakh age group surveyd in each nogion. What is the new bid made by Sophisticated Surveys? D. Rob feels that Sophisticaned Surveys oversampled the 18-to-25-yearold population and the Silicon Valley population. He imposes a new constmint that mo more than 600 individuals can be surveyed from the 18-10-25-year-old popelation and no more than 650 individaals can be surveyed from the Silicos Valley population. What is the new bid? E. When Sophisticaled Surveys calculated the cost of reaching and surveying particular individuals, the company thougha that reaching individuals in young populations would be easiest. In a fecently 4 of 6 completed surven lannever. Siohissieaded. Survoys learned that this assumytion was wTonge thic ncw costs ior sureying the 18 -to-25. completed survey, bowever, Sophisticased Surveys learned that this assumption was wrong. The new costs for surveying the 18-to-25yeat-old populatioe are listed below. Given the new costs, what is the new bid? F. To ensure the desired sampling of individuals, Rob imposes even stricter reyairements. He fixes the exact perentage of poople that should be surveyed from cach population. The requirements are listed next. By how mach would these new requirements incrase the cost of surveying for Sophisticated Surveys? Given the 15 percent profit margin, what would Sophisticatcd Sarveys bod