Answered step by step

Verified Expert Solution

Question

1 Approved Answer

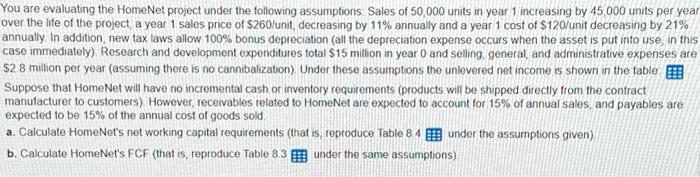

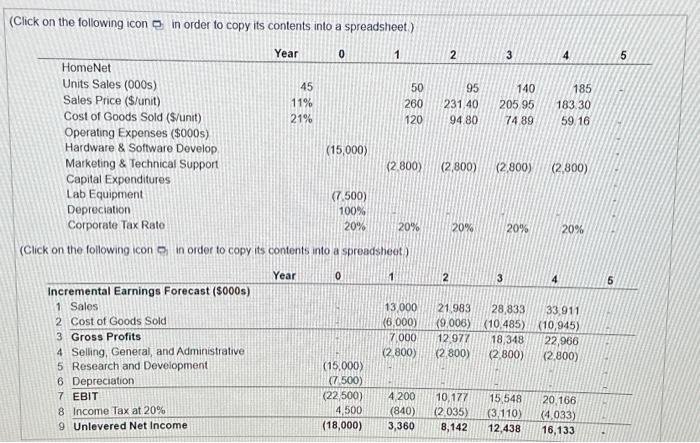

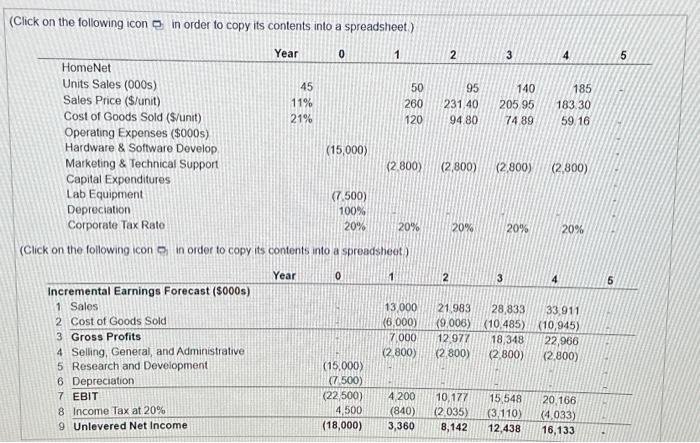

Please help with the following: a. calculate HomeNet's net working capital requirements (that is, reproduce the table in picture 3 under the assumptions given) b.

Please help with the following:

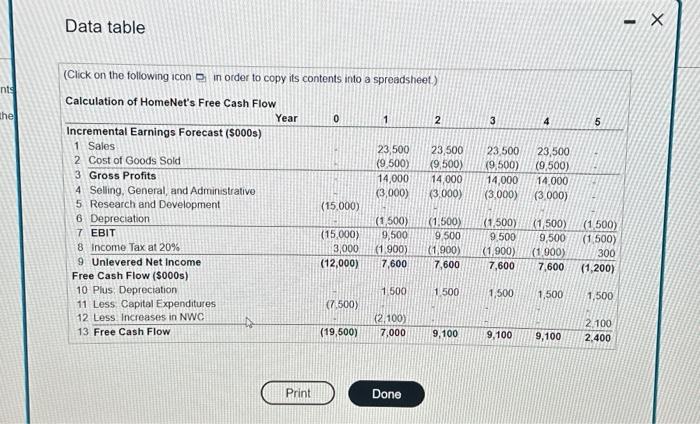

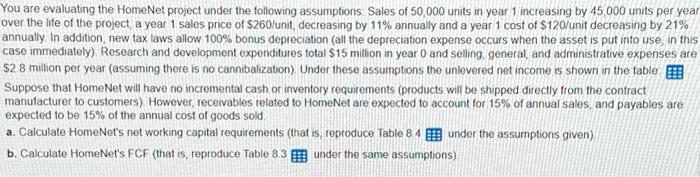

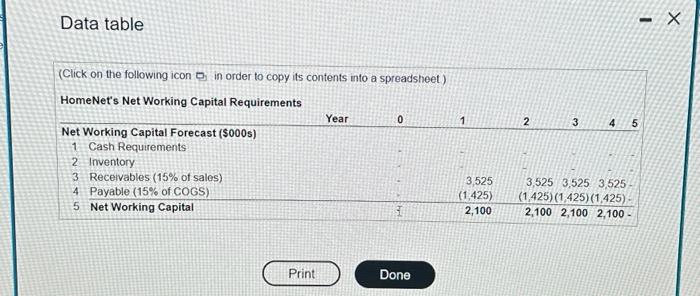

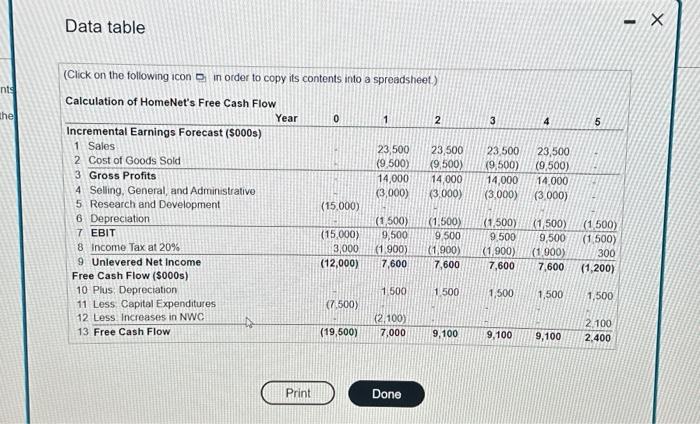

(Click on the following icon p in order to copy its contents into a spreadsheet) (Click on the following icon in order to copy its contents into a spreadsheot) Data table (Click on the following icon 1 in order to copy its contents into a spreadsheet.) You are evaluating the HomeNet project under the following assumptions. Sales of 50,000 units in year 1 increasing by 45,000 units per year ver the life of the project, a year 1 sales price of \$260/unit, decreasing by 11% annually and a year 1 cost of $120/ unit decreasing by 21% annually In addition, new tax laws allow 100% bonus depreciation (all the depreciation expense occurs when the asset is put into use, in this case immediately). Research and development expenditures total $15 millon in year 0 and selling. general, and administrative expenses are $2.8 milion per year (assuming there is no cannibalization). Under these assumptions the unlevered net income is shown in the fable: Suppose that HomeNet will have no incremental cash or inventory requirements (products will be shipped directly from the contract manufacturer to customers). However, recervables related to HomeNet are expected to account for 15% of annual sales, and payables are expected to be 15% of the annual cost of goods sold. a. Calculate HomeNet's net working capital requirements (that is, reproduce Table 8.4 under the assumptions given) b. Calculate HomeNet's FCF (that is, reproduce Table 8.3 under the same assumptions) Data table a. calculate HomeNet's net working capital requirements (that is, reproduce the table in picture 3 under the assumptions given)

b. Calculate homenet's FCF (that is, reproduce the table in photo 4 under the same assumptions)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started