Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with the following It is missing informtion please fill in missing info: 2) Please fill in missing info: 3) I need help creating

Please help with the following

- It is missing informtion please fill in missing info:

2) Please fill in missing info:

3)

I need help creating a balance sheet:

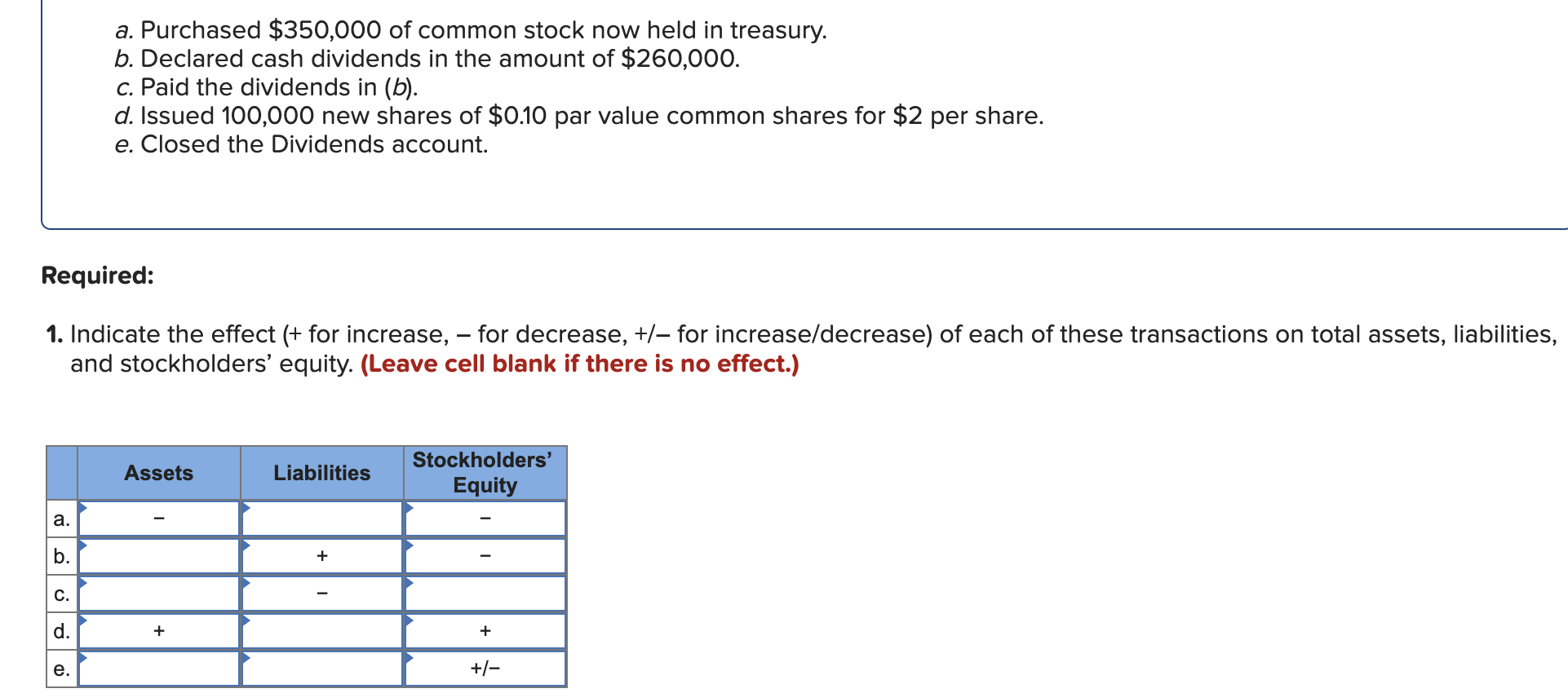

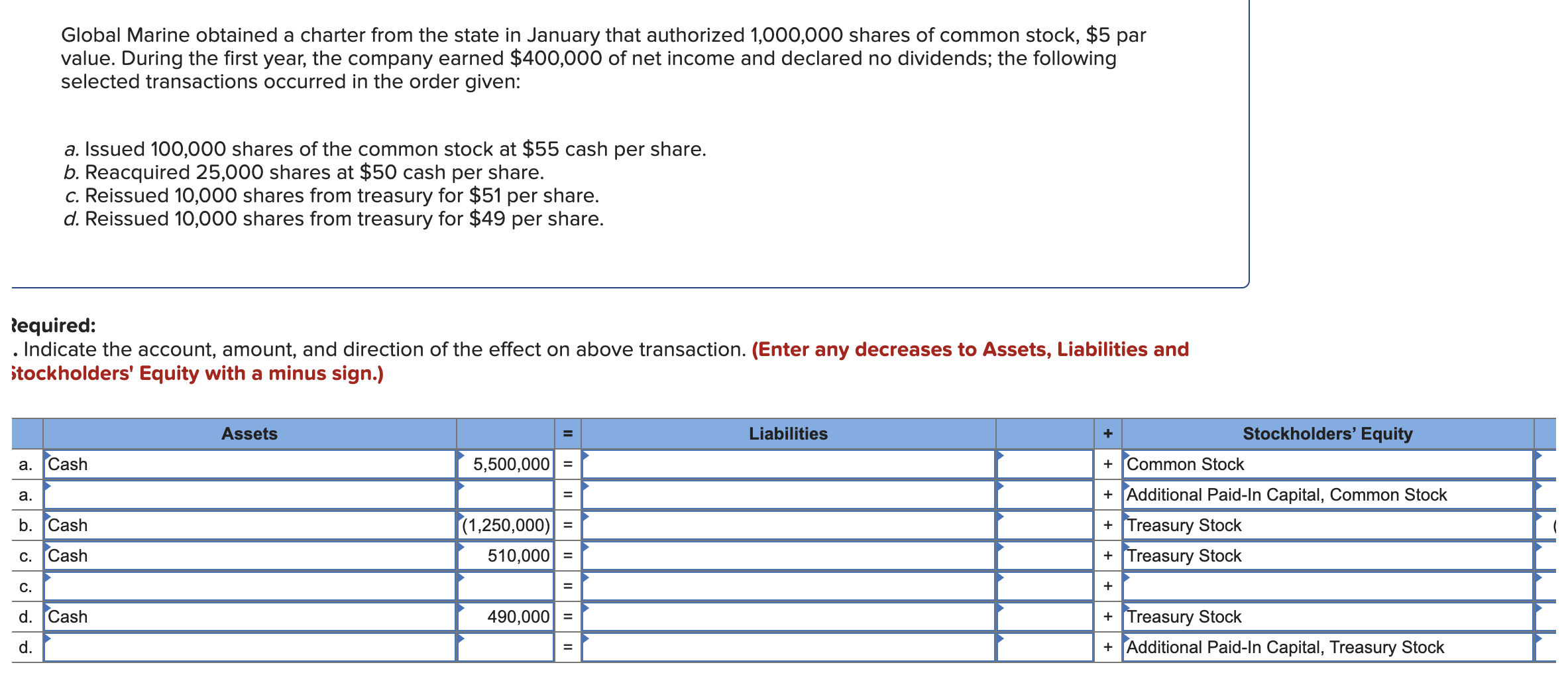

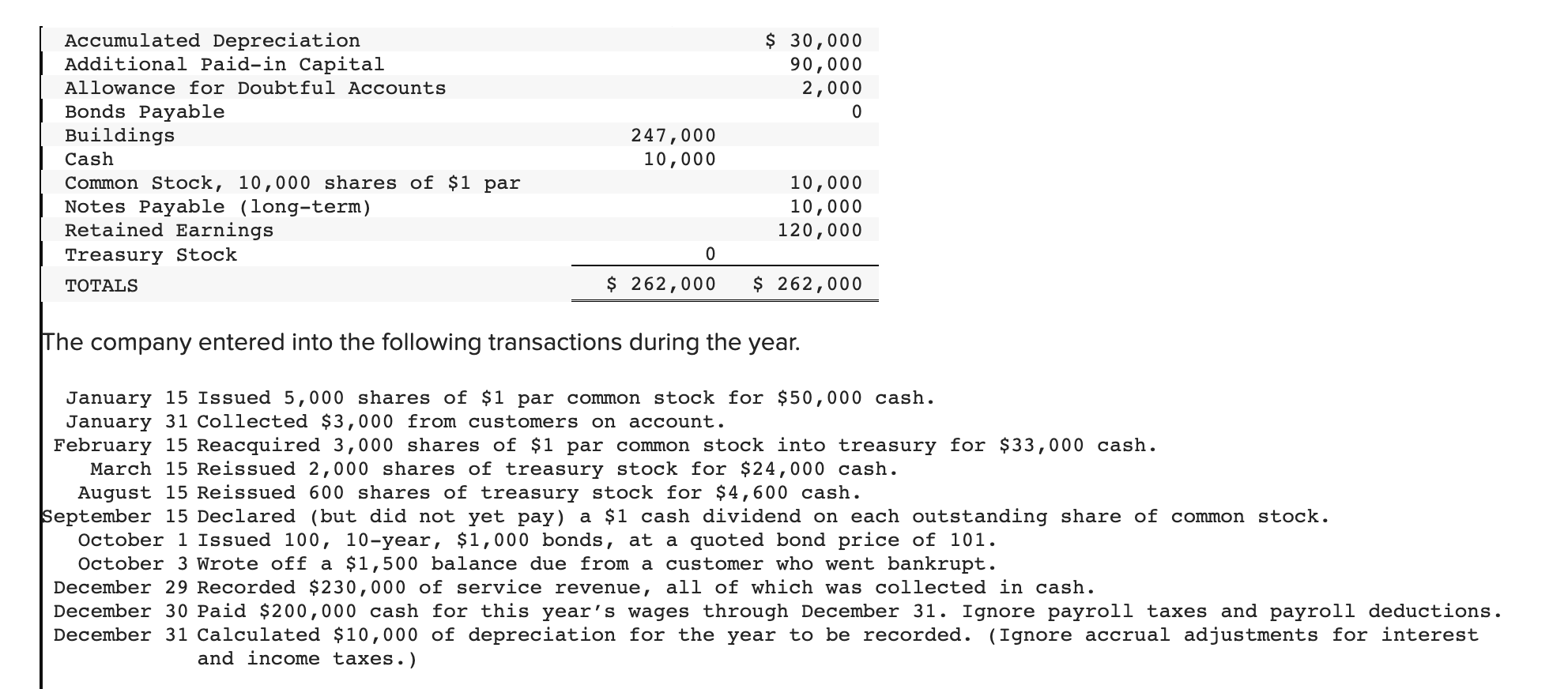

a. Purchased $350,000 of common stock now held in treasury. b. Declared cash dividends in the amount of $260,000. c. Paid the dividends in (b). d. Issued 100,000 new shares of $0.10 par value common shares for $2 per share. e. Closed the Dividends account. equired: - Indicate the effect (+ for increase, - for decrease, +/ for increase/decrease) of each of these transactions on total assets, liabilities and stockholders' equity. (Leave cell blank if there is no effect.) Global Marine obtained a charter from the state in January that authorized 1,000,000 shares of common stock, $5 par value. During the first year, the company earned $400,000 of net income and declared no dividends; the following selected transactions occurred in the order given: a. Issued 100,000 shares of the common stock at $55 cash per share. b. Reacquired 25,000 shares at $50 cash per share. c. Reissued 10,000 shares from treasury for $51 per share. d. Reissued 10,000 shares from treasury for $49 per share. required: - Indicate the account, amount, and direction of the effect on above transaction. (Enter any decreases to Assets, Liabilities and stockholders' Equity with a minus sign.) The company entered into the following transactions during the year. January 15 Issued 5,000 shares of $1 par common stock for $50,000 cash. January 31 Collected $3,000 from customers on account. February 15 Reacquired 3,000 shares of $1 par common stock into treasury for $33,000 cash. March 15 Reissued 2,000 shares of treasury stock for $24,000cash. August 15 Reissued 600 shares of treasury stock for $4,600cash. September 15 Declared (but did not yet pay) a $1 cash dividend on each outstanding share of common stock. October 1 Issued 100, 10-year, $1,000 bonds, at a quoted bond price of 101 . October 3 Wrote off a $1,500 balance due from a customer who went bankrupt. December 29 Recorded $230,000 of service revenue, all of which was collected in cash. December 30 Paid $200,000 cash for this year's wages through December 31 . Ignore payroll taxes and payroll deductions. December 31 Calculated $10,000 of depreciation for the year to be recorded. (Ignore accrual adjustments for interest and income taxes.)

a. Purchased $350,000 of common stock now held in treasury. b. Declared cash dividends in the amount of $260,000. c. Paid the dividends in (b). d. Issued 100,000 new shares of $0.10 par value common shares for $2 per share. e. Closed the Dividends account. equired: - Indicate the effect (+ for increase, - for decrease, +/ for increase/decrease) of each of these transactions on total assets, liabilities and stockholders' equity. (Leave cell blank if there is no effect.) Global Marine obtained a charter from the state in January that authorized 1,000,000 shares of common stock, $5 par value. During the first year, the company earned $400,000 of net income and declared no dividends; the following selected transactions occurred in the order given: a. Issued 100,000 shares of the common stock at $55 cash per share. b. Reacquired 25,000 shares at $50 cash per share. c. Reissued 10,000 shares from treasury for $51 per share. d. Reissued 10,000 shares from treasury for $49 per share. required: - Indicate the account, amount, and direction of the effect on above transaction. (Enter any decreases to Assets, Liabilities and stockholders' Equity with a minus sign.) The company entered into the following transactions during the year. January 15 Issued 5,000 shares of $1 par common stock for $50,000 cash. January 31 Collected $3,000 from customers on account. February 15 Reacquired 3,000 shares of $1 par common stock into treasury for $33,000 cash. March 15 Reissued 2,000 shares of treasury stock for $24,000cash. August 15 Reissued 600 shares of treasury stock for $4,600cash. September 15 Declared (but did not yet pay) a $1 cash dividend on each outstanding share of common stock. October 1 Issued 100, 10-year, $1,000 bonds, at a quoted bond price of 101 . October 3 Wrote off a $1,500 balance due from a customer who went bankrupt. December 29 Recorded $230,000 of service revenue, all of which was collected in cash. December 30 Paid $200,000 cash for this year's wages through December 31 . Ignore payroll taxes and payroll deductions. December 31 Calculated $10,000 of depreciation for the year to be recorded. (Ignore accrual adjustments for interest and income taxes.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started