Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with the following payroll question ; year 2022- kentucky - PERCENTAGE METHOD. For both employee & employer portions indicated below. I have also

Please help with the following payroll question ; year 2022- kentucky - PERCENTAGE METHOD. For both employee & employer portions indicated below. I have also provided the correct appendixes. Thanks in advance for your help! please show calculations/explanations :)

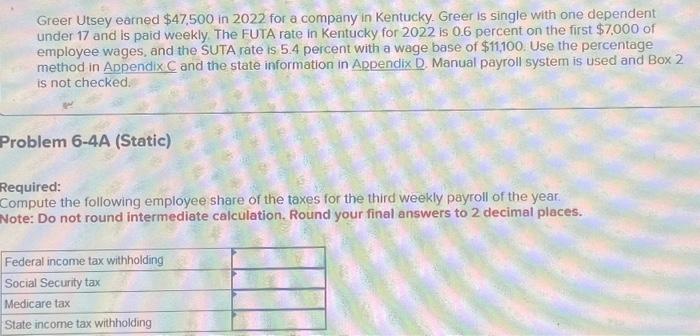

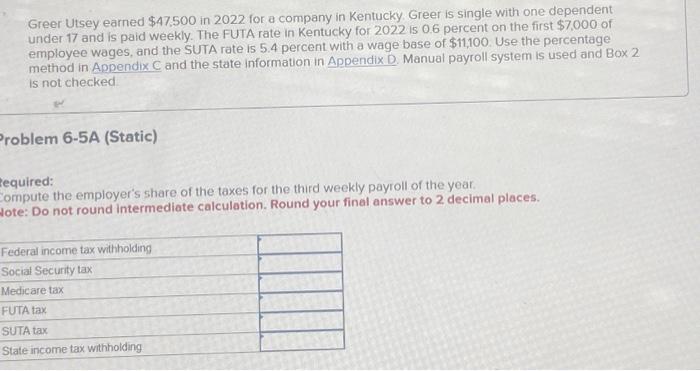

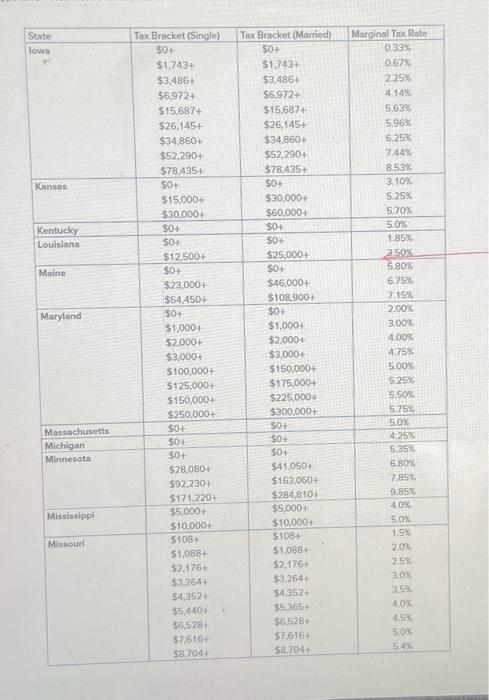

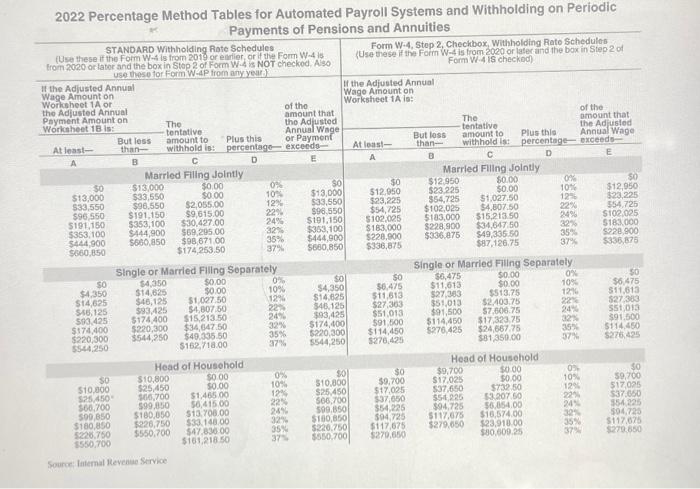

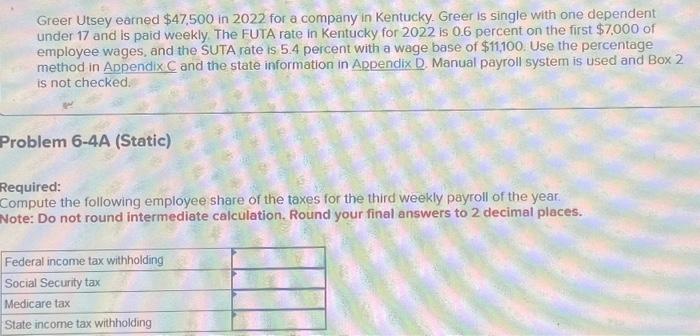

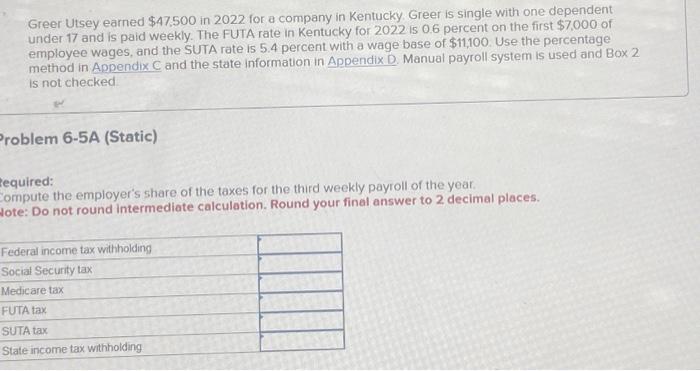

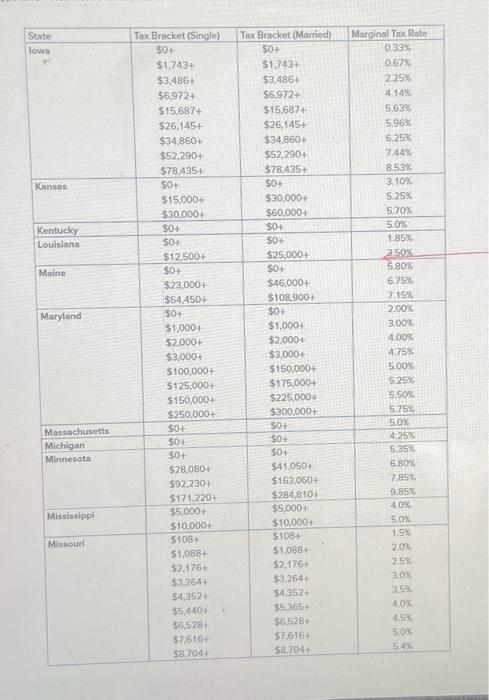

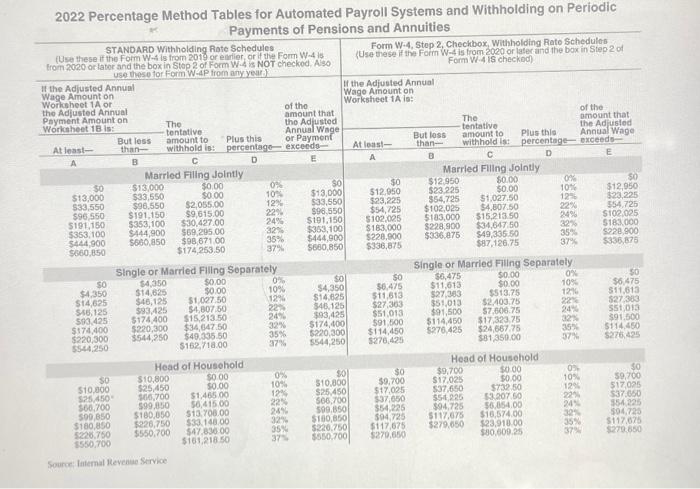

Greer Utsey earned $47,500 in 2022 for a company in Kentucky. Greer is single with one dependent under 17 and is paid weekly. The FUTA rate in Kentucky for 2022 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5.4 percent with a wage base of $11,100. Use the percentage method in Appendix C and the state information in Appendix D. Manual payroll system is used and Box 2 is not checked. Problem 6-4A (Static) Required: Compute the following employee share of the taxes for the third weekly payroll of the year. Note: Do not round intermediate calculation. Round your final answers to 2 decimal places. Greer Utsey earned $47.500 in 2022 for a company in Kentucky. Greer is single with one dependent under 17 and is pald weekly. The FUTA rate in Kentucky for 2022 is 0.6 percent on the first $7,000 of employee wages, and the SUTA rate is 5.4 percent with a wage base of $11,100. Use the percentage method in Appendix C and the state information in Appendix D. Manual payroll system is used and Box 2 is not checked Problem 6-5A (Static) tequired: Compute the employer's share of the taxes for the third weekly payroll of the year. tote: Do not round intermediate calculation. Round your final answer to 2 decimal places. \begin{tabular}{|c|c|c|c|} \hline State & Tax Bracket (Single) & Tax Brocket (Married) & Marginal Tox Rate \\ \hline \multirow{9}{*}{ lowa } & 50+ & 50+ & 0.33% \\ \hline & $1,743+ & $1.743+ & 0.67% \\ \hline & $3,486+ & $3,486+ & 2.25% \\ \hline & $6,972+ & $6,972+ & 4.14% \\ \hline & $15,687+ & $15,687+ & 5.63% \\ \hline & $26,145+ & $26,145+ & 5,96% \\ \hline & $34.860+ & $34.860+ & 6.25% \\ \hline & $52,2904 & $52,290+ & 7.449 \\ \hline & $78.435+ & $78,435+ & 8.53% \\ \hline \multirow[t]{3}{*}{ Kanses } & 50+ & 50+ & 3,10% \\ \hline & $15,000+ & $30,000t & 5.25% \\ \hline & $30,000t & $60,000+ & 570% \\ \hline Kentucicy & $0+ & $0+ & 5.0% \\ \hline \multirow[t]{2}{*}{ Loulsiana } & 50+ & $0+ & 1.85% \\ \hline & $12,500+ & $25,000+ & 2.50K \\ \hline \multirow[t]{3}{*}{ Maine } & 50+ & $0+ & 5800 \\ \hline & $23,000+ & $46,000+ & 6.75% \\ \hline & $54.450+ & 5108,900+ & 7,15% \\ \hline \multirow[t]{8}{*}{ Marylend } & 50+ & 50+ & 2.00% \\ \hline & $1,0004 & $1,000+ & 3.008 \\ \hline & $2.000+ & $2,000+ & 4.00% \\ \hline & $3,000+ & $3,000+ & 4.75% \\ \hline & $100,000t & $150,000+ & 5.00x \\ \hline & $125,000+ & $175,0004 & 5.25% \\ \hline & $150,0007 & $225,000+ & 5.50% \\ \hline & $250.000+ & $300,000t & 575% \\ \hline Massachusetts & $0t & $04 & 5.0% \\ \hline Michigan & 50t & $0t & 4.25% \\ \hline \multirow[t]{4}{*}{ Minnesota } & 50+ & 50+ & 5,358 \\ \hline & $28,080+ & $41,050+ & 6.80% \\ \hline & $92,230+ & $163,060+ & 785% \\ \hline & $171,220t & $284,810+ & 985x \\ \hline Mississippi & \begin{tabular}{l} $5,000+ \\ $10,000t \end{tabular} & \begin{tabular}{l} $5,0004 \\ $10,000t \end{tabular} & \begin{tabular}{l} 4.0% \\ 5.0% \end{tabular} \\ \hline \multirow[t]{9}{*}{ Missouri } & $108+$10.000t & $108+$10,0004 & 1.5%3.05 \\ \hline & $1,088+ & $1,088+ & 2.08 \\ \hline & $2,176+ & $2,176 & 25% \\ \hline & 53,264t & $3.264+ & 3.05 \\ \hline & $4,352+ & $4.352+ & 35% : \\ \hline & $5,440+ & 55,365+ & 40x \\ \hline & $6,528+ & $6,528+ & 4.58 \\ \hline & $7.616+ & $7.616+ & 5,0% \\ \hline & 58,704i & $8.704+ & 5.4x \\ \hline \end{tabular} Mathnd Tahlae for Autnmated Pavroll Svstems and Withholding on Periodic

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started