Please help with the following problems --- Thanks

Please help with the following problems --- Thanks

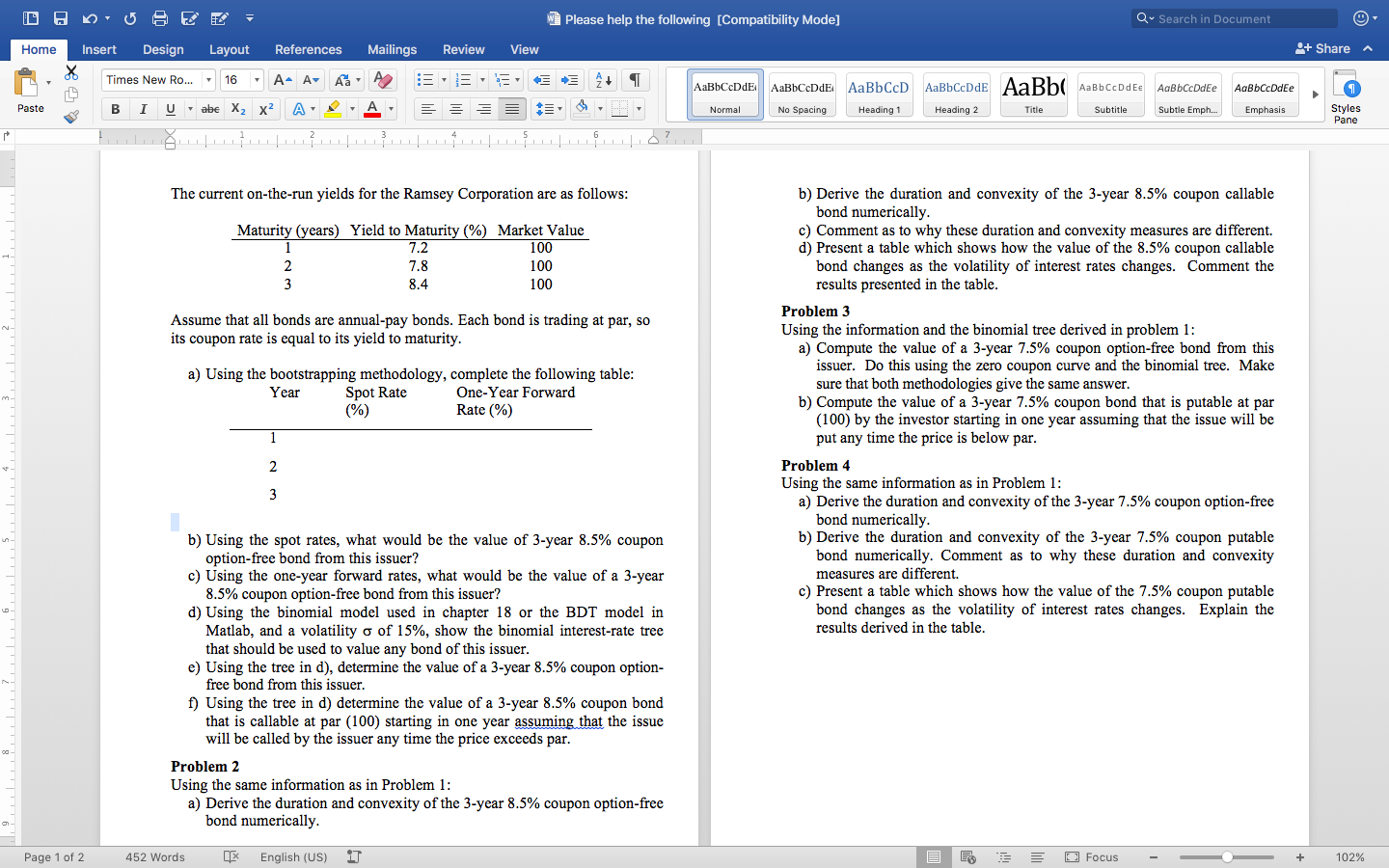

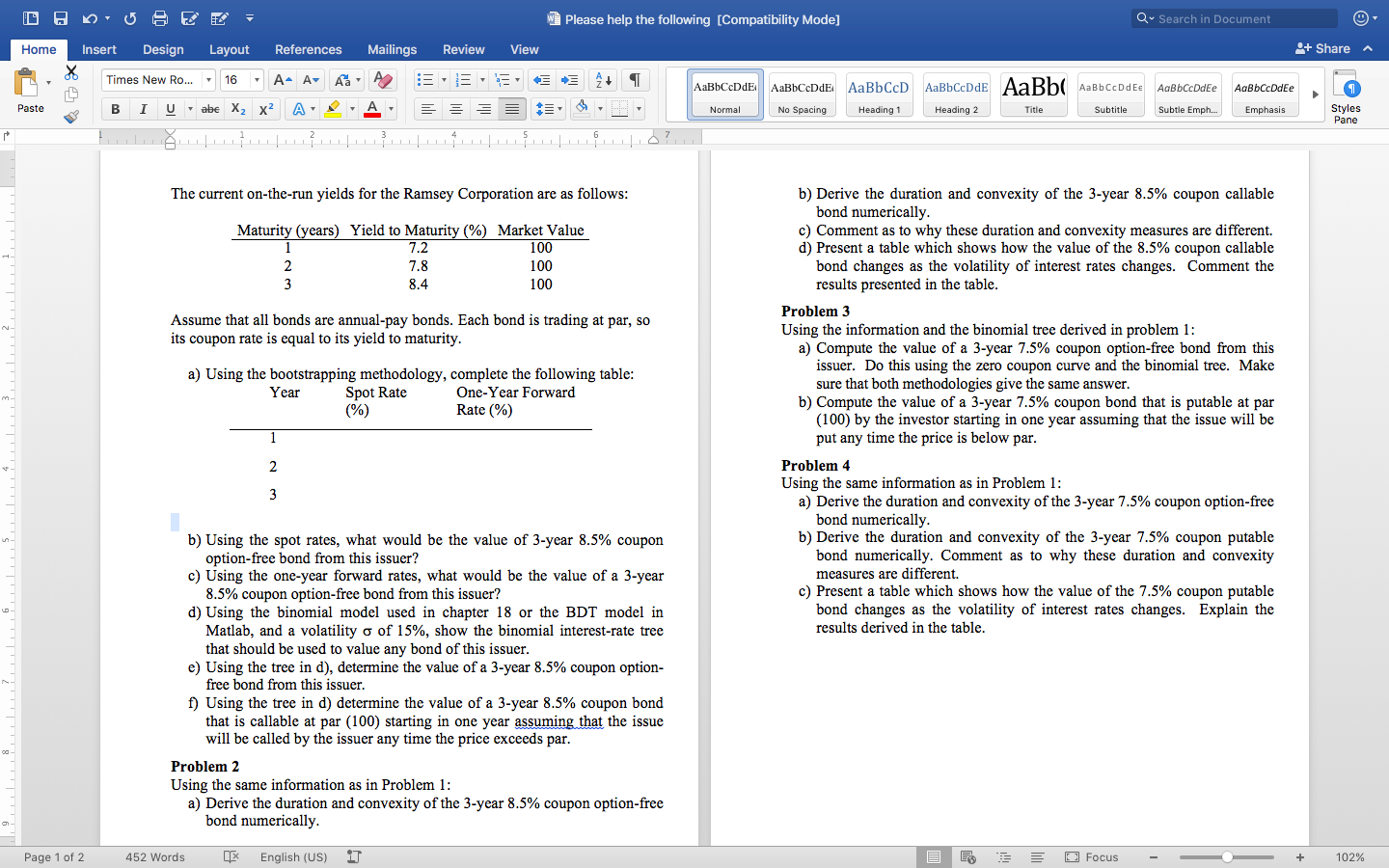

W Please help the following [Compatibility Mode] Qw Search in Document Home + Share Insert Design Layout References Times New Ro... - 16 - A- A A B I vabe X, X A A Mailings A E = Review E = = View 3 = 3 4+ $. AaBbCcDdE AaBbCcDdE: AaBbCcD AaBbCcDdE AaBb Normal No Spacing Heading 1 Heading 2 Title AaBbCcDdEe AaBbCcDdee Subtle Emph... AaBbCcDdee Emphasis Paste Subtitle Styles Pane The current on-the-run yields for the Ramsey Corporation are as follows: 100 Maturity (years) Yield to Maturity (%) Market Value 7.2 7.8 100 8.4 100 Assume that all bonds are annual-pay bonds. Each bond is trading at par, so its coupon rate is equal to its yield to maturity. a) Using the bootstrapping methodology, complete the following table: Year Spot Rate One-Year Forward (%) Rate (%) b) Derive the duration and convexity of the 3-year 8.5% coupon callable bond numerically. c) Comment as to why these duration and convexity measures are different. d) Present a table which shows how the value of the 8.5% coupon callable bond changes as the volatility of interest rates changes. Comment the results presented in the table. Problem 3 Using the information and the binomial tree derived in problem 1: a) Compute the value of a 3-year 7.5% coupon option-free bond from this issuer. Do this using the zero coupon curve and the binomial tree. Make sure that both methodologies give the same answer. b) Compute the value of a 3-year 7.5% coupon bond that is putable at par (100) by the investor starting in one year assuming that the issue will be put any time the price is below par. Problem 4 Using the same information as in Problem 1: a) Derive the duration and convexity of the 3-year 7.5% coupon option-free bond numerically. b) Derive the duration and convexity of the 3-year 7.5% coupon putable bond numerically. Comment as to why these duration and convexity measures are different. c) Present a table which shows how the value of the 7.5% coupon putable bond changes as the volatility of interest rates changes. Explain the results derived in the table. b) Using the spot rates, what would be the value of 3-year 8.5% coupon option-free bond from this issuer? c) Using the one-year forward rates, what would be the value of a 3-year 8.5% coupon option-free bond from this issuer? d) Using the binomial model used in chapter 18 or the BDT model in Matlab, and a volatility o of 15%, show the binomial interest-rate tree that should be used to value any bond of this issuer. e) Using the tree in d), determine the value of a 3-year 8.5% coupon option- free bond from this issuer. f) Using the tree in d) determine the value of a 3-year 8.5% coupon bond that is callable at par (100) starting in one year assuming that the issue will be called by the issuer any time the price exceeds par. Problem 2 Using the same information as in Problem 1: a) Derive the duration and convexity of the 3-year 8.5% coupon option-free bond numerically. Page 1 of 2 452 Words English (US) 17 E. E O Focus - - + 102% W Please help the following [Compatibility Mode] Qw Search in Document Home + Share Insert Design Layout References Times New Ro... - 16 - A- A A B I vabe X, X A A Mailings A E = Review E = = View 3 = 3 4+ $. AaBbCcDdE AaBbCcDdE: AaBbCcD AaBbCcDdE AaBb Normal No Spacing Heading 1 Heading 2 Title AaBbCcDdEe AaBbCcDdee Subtle Emph... AaBbCcDdee Emphasis Paste Subtitle Styles Pane The current on-the-run yields for the Ramsey Corporation are as follows: 100 Maturity (years) Yield to Maturity (%) Market Value 7.2 7.8 100 8.4 100 Assume that all bonds are annual-pay bonds. Each bond is trading at par, so its coupon rate is equal to its yield to maturity. a) Using the bootstrapping methodology, complete the following table: Year Spot Rate One-Year Forward (%) Rate (%) b) Derive the duration and convexity of the 3-year 8.5% coupon callable bond numerically. c) Comment as to why these duration and convexity measures are different. d) Present a table which shows how the value of the 8.5% coupon callable bond changes as the volatility of interest rates changes. Comment the results presented in the table. Problem 3 Using the information and the binomial tree derived in problem 1: a) Compute the value of a 3-year 7.5% coupon option-free bond from this issuer. Do this using the zero coupon curve and the binomial tree. Make sure that both methodologies give the same answer. b) Compute the value of a 3-year 7.5% coupon bond that is putable at par (100) by the investor starting in one year assuming that the issue will be put any time the price is below par. Problem 4 Using the same information as in Problem 1: a) Derive the duration and convexity of the 3-year 7.5% coupon option-free bond numerically. b) Derive the duration and convexity of the 3-year 7.5% coupon putable bond numerically. Comment as to why these duration and convexity measures are different. c) Present a table which shows how the value of the 7.5% coupon putable bond changes as the volatility of interest rates changes. Explain the results derived in the table. b) Using the spot rates, what would be the value of 3-year 8.5% coupon option-free bond from this issuer? c) Using the one-year forward rates, what would be the value of a 3-year 8.5% coupon option-free bond from this issuer? d) Using the binomial model used in chapter 18 or the BDT model in Matlab, and a volatility o of 15%, show the binomial interest-rate tree that should be used to value any bond of this issuer. e) Using the tree in d), determine the value of a 3-year 8.5% coupon option- free bond from this issuer. f) Using the tree in d) determine the value of a 3-year 8.5% coupon bond that is callable at par (100) starting in one year assuming that the issue will be called by the issuer any time the price exceeds par. Problem 2 Using the same information as in Problem 1: a) Derive the duration and convexity of the 3-year 8.5% coupon option-free bond numerically. Page 1 of 2 452 Words English (US) 17 E. E O Focus - - + 102%

Please help with the following problems --- Thanks

Please help with the following problems --- Thanks