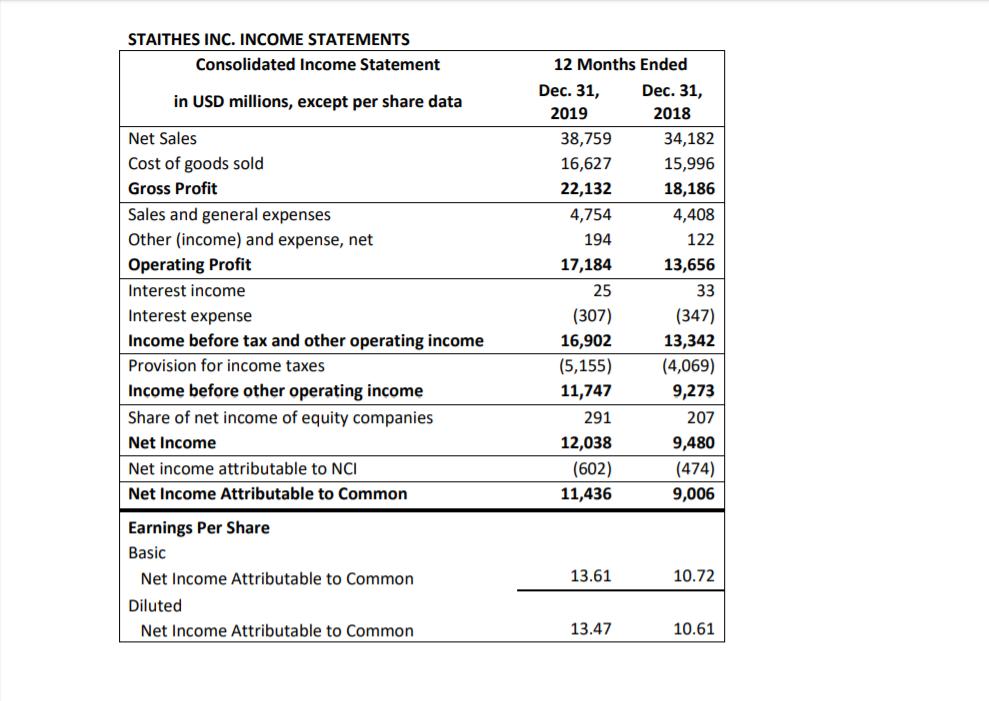

STAITHES INC. INCOME STATEMENTS Consolidated Income Statement in USD millions, except per share data Net Sales 12 Months Ended Dec. 31, Dec. 31, 2019

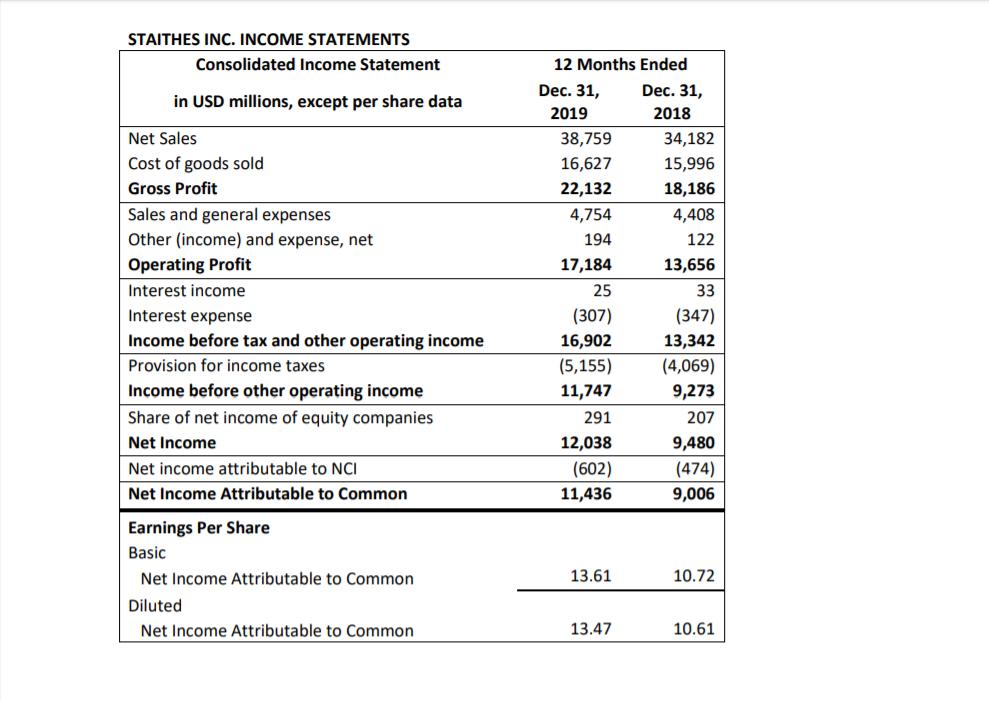

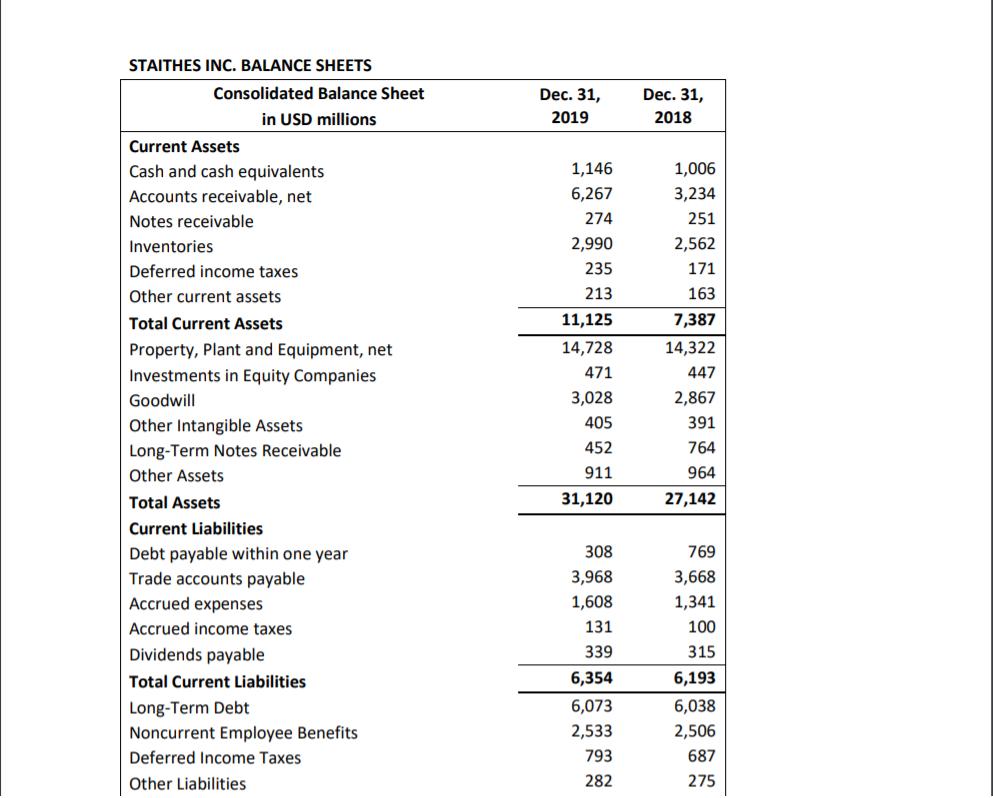

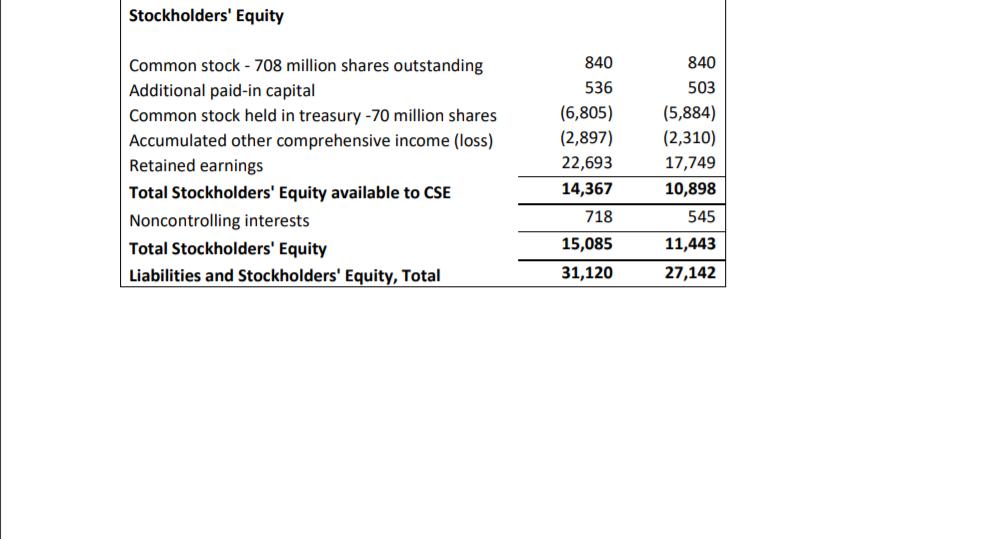

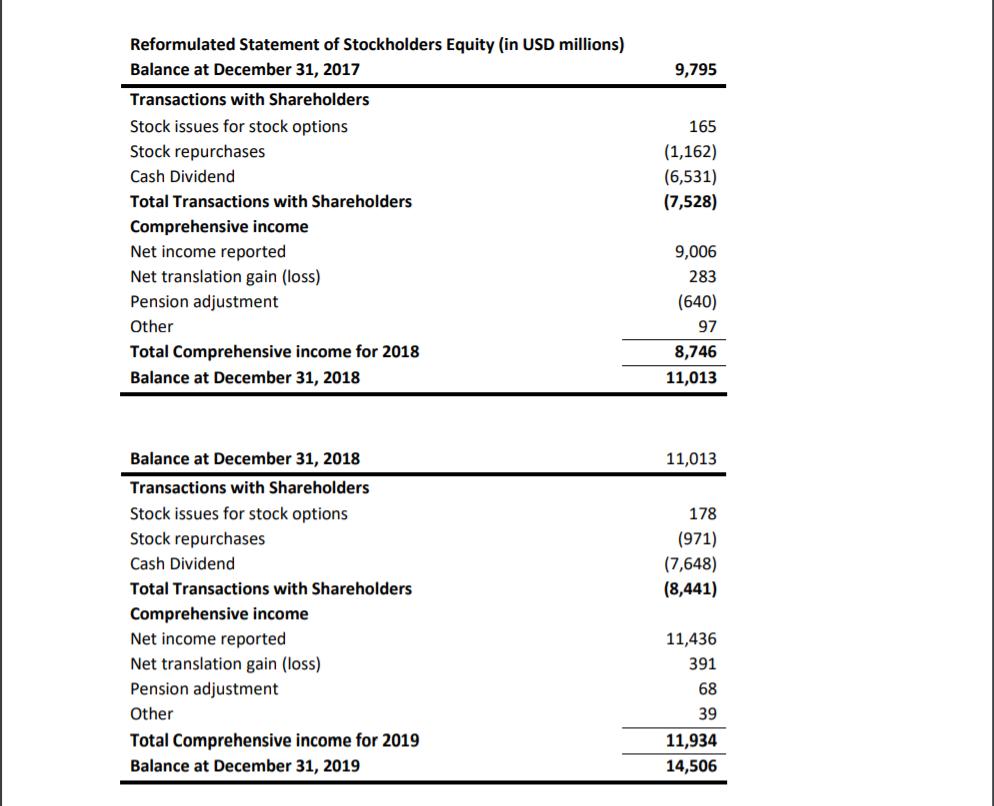

STAITHES INC. INCOME STATEMENTS Consolidated Income Statement in USD millions, except per share data Net Sales 12 Months Ended Dec. 31, Dec. 31, 2019 2018 38,759 34,182 Cost of goods sold 16,627 15,996 Gross Profit 22,132 18,186 Sales and general expenses 4,754 4,408 Other (income) and expense, net 194 122 Operating Profit 17,184 13,656 Interest income 25 33 Interest expense (307) (347) Income before tax and other operating income 16,902 13,342 Provision for income taxes (5,155) (4,069) Income before other operating income 11,747 9,273 Share of net income of equity companies 291 207 Net Income 12,038 9,480 Net income attributable to NCI (602) (474) Net Income Attributable to Common 11,436 9,006 Earnings Per Share Basic Net Income Attributable to Common Diluted 13.61 10.72 Net Income Attributable to Common 13.47 10.61 STAITHES INC. INCOME STATEMENTS Consolidated Income Statement in USD millions, except per share data Net Sales 12 Months Ended Dec. 31, Dec. 31, 2019 2018 38,759 34,182 Cost of goods sold 16,627 15,996 Gross Profit 22,132 18,186 Sales and general expenses 4,754 4,408 Other (income) and expense, net 194 122 Operating Profit 17,184 13,656 Interest income 25 33 Interest expense (307) (347) Income before tax and other operating income 16,902 13,342 Provision for income taxes (5,155) (4,069) Income before other operating income 11,747 9,273 Share of net income of equity companies 291 207 Net Income 12,038 9,480 Net income attributable to NCI (602) (474) Net Income Attributable to Common 11,436 9,006 Earnings Per Share Basic Net Income Attributable to Common Diluted 13.61 10.72 Net Income Attributable to Common 13.47 10.61 STAITHES INC. BALANCE SHEETS Consolidated Balance Sheet in USD millions Dec. 31, Dec. 31, 2019 2018 Current Assets Cash and cash equivalents Accounts receivable, net Notes receivable Inventories Deferred income taxes 1,146 1,006 6,267 3,234 274 251 2,990 2,562 235 171 Other current assets 213 163 Total Current Assets 11,125 7,387 Property, Plant and Equipment, net 14,728 14,322 Investments in Equity Companies 471 447 Goodwill 3,028 2,867 Other Intangible Assets 405 391 Long-Term Notes Receivable 452 764 Other Assets 911 964 Total Assets 31,120 27,142 Current Liabilities Debt payable within one year 308 769 Trade accounts payable 3,968 3,668 Accrued expenses 1,608 1,341 Accrued income taxes 131 100 Dividends payable 339 315 Total Current Liabilities 6,354 6,193 Long-Term Debt 6,073 6,038 Noncurrent Employee Benefits 2,533 2,506 Deferred Income Taxes 793 687 Other Liabilities 282 275 Stockholders' Equity Common stock - 708 million shares outstanding 840 840 Additional paid-in capital 536 503 Common stock held in treasury -70 million shares (6,805) (5,884) Accumulated other comprehensive income (loss) (2,897) (2,310) Retained earnings 22,693 17,749 Total Stockholders' Equity available to CSE 14,367 10,898 Noncontrolling interests 718 545 Total Stockholders' Equity 15,085 11,443 Liabilities and Stockholders' Equity, Total 31,120 27,142 Reformulated Statement of Stockholders Equity (in USD millions) Balance at December 31, 2017 9,795 Transactions with Shareholders Stock issues for stock options Stock repurchases Cash Dividend Total Transactions with Shareholders Comprehensive income Net income reported 165 (1,162) (6,531) (7,528) Net translation gain (loss) 9,006 283 Pension adjustment (640) Other 97 Total Comprehensive income for 2018 8,746 Balance at December 31, 2018 11,013 Balance at December 31, 2018 Transactions with Shareholders 11,013 Stock issues for stock options 178 Stock repurchases (971) Cash Dividend (7,648) Total Transactions with Shareholders (8,441) Comprehensive income Net income reported 11,436 Net translation gain (loss) 391 Pension adjustment 68 Other 39 Total Comprehensive income for 2019 11,934 Balance at December 31, 2019 14,506 Notes: The firm bears a 35% statutory tax rate. Working cash is estimated to be $134 million and $128 million for 2019 and 2018 respectively. Notes receivable bear interest of 10% per calendar year. Required: a) Prepare the Reformulated Balance Sheet and Income Statements for the years 2019 and 2018 in preparation for valuation. [20 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the Reformulated Balance Sheet and Income Statements for the years 2019 and 2018 we must ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started