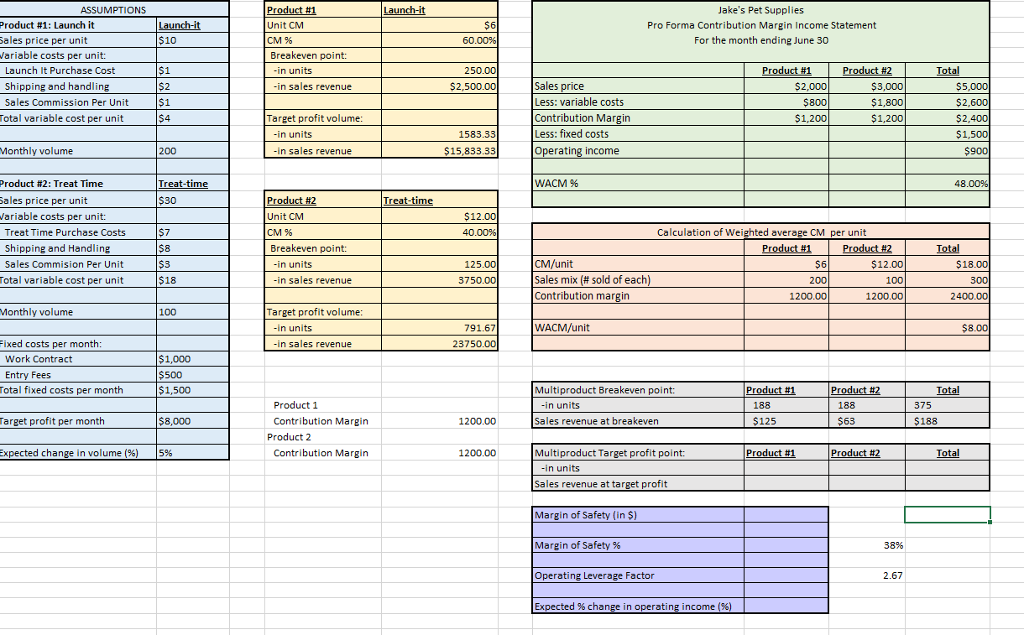

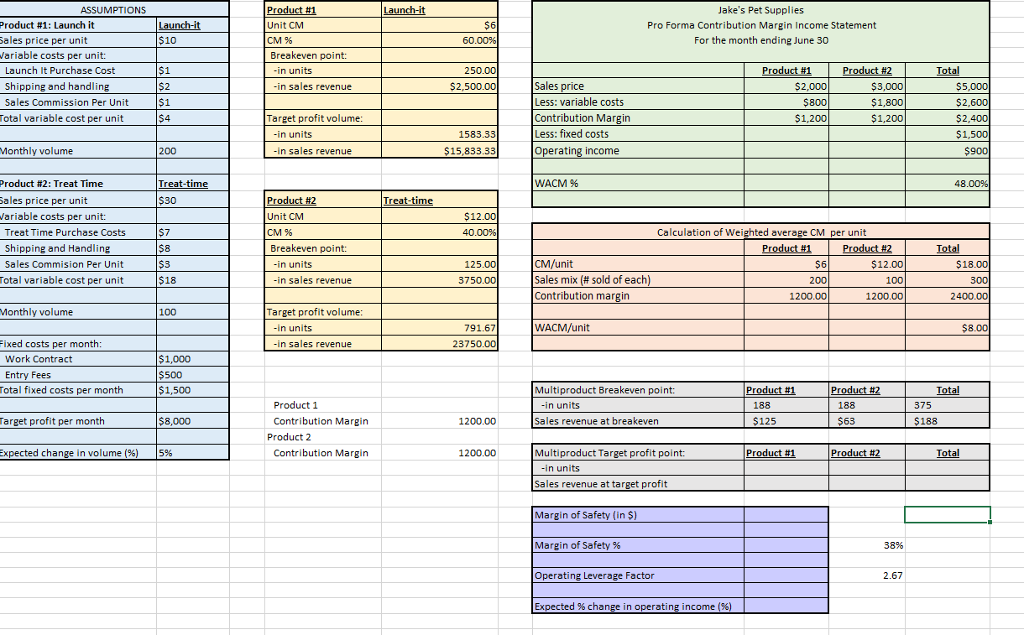

Please help with the Multiproduct Target Profit Point and Sales revenue at Target Profit and Margin of Safety, Margin of Safey Percentage, and Operating Leverage Factor, and lastly Expected % change in operating income (%). This can be solved with the data provided in the document.

Product #1 Unit CM CM % Breakeven point: Launch-it Jake's Pet Supplies Pro Forma Contribution Margin Income Statement For the month ending June 30 ASSUMPTIONS nch-it Product #1: Launch it ales price per unit ariable costs per unit: Launch It Purchase Cost Shipping and handling Sales Commission Per Unit Total variable cost per unit 60 in units 250.00 Total Sales price Less: variable costs Contribution Margin Less: fixed costs Operating income $2,000 $800 $1,200 $3,000 $1,800 $1,200 in sales revenue 2,500.00 $2,600 arget profit volume in units 1583.33 Monthly volume 200 sales revenue $15,833.33 WACM % Product #2: Treat Time Sales price per unit ariable costs per unit Treat Time Purchase Costs Shipping and Handling Sales Commision Per Unit Total variable cost per unit Treat-time 48 $12.00 40 Unit CM Calculation of Wei average CM per unit Breakeven point -in units -in sales revenue Total M/unit Sales mix (# sold of each Contribution margin 5 $12.00 100 1200.00 125.00 3750.00 200 1200.00 2400 Monthly volume Target profit volume WACM/unit 791.67 23750.00 -in units Fixed costs per month -in sales revenu Work Contract Entry Fees Total fixed costs per month $1,000 $500 $1,500 Multiproduct Breakeven point: Total -in units 188 188 375 Target profit per month $8,000 Contribution Margin 1200.00 Sales revenue at breakeven Product 2 Expected chang in volume (%) 15% Contribution Margin 1200.00 Multiproduct Target profit point: Total -in units Margin of Safety (in $) Margin of Safety % Operating Leverage Factor Expected % change in operating income (%) 38% 2.67 Product #1 Unit CM CM % Breakeven point: Launch-it Jake's Pet Supplies Pro Forma Contribution Margin Income Statement For the month ending June 30 ASSUMPTIONS nch-it Product #1: Launch it ales price per unit ariable costs per unit: Launch It Purchase Cost Shipping and handling Sales Commission Per Unit Total variable cost per unit 60 in units 250.00 Total Sales price Less: variable costs Contribution Margin Less: fixed costs Operating income $2,000 $800 $1,200 $3,000 $1,800 $1,200 in sales revenue 2,500.00 $2,600 arget profit volume in units 1583.33 Monthly volume 200 sales revenue $15,833.33 WACM % Product #2: Treat Time Sales price per unit ariable costs per unit Treat Time Purchase Costs Shipping and Handling Sales Commision Per Unit Total variable cost per unit Treat-time 48 $12.00 40 Unit CM Calculation of Wei average CM per unit Breakeven point -in units -in sales revenue Total M/unit Sales mix (# sold of each Contribution margin 5 $12.00 100 1200.00 125.00 3750.00 200 1200.00 2400 Monthly volume Target profit volume WACM/unit 791.67 23750.00 -in units Fixed costs per month -in sales revenu Work Contract Entry Fees Total fixed costs per month $1,000 $500 $1,500 Multiproduct Breakeven point: Total -in units 188 188 375 Target profit per month $8,000 Contribution Margin 1200.00 Sales revenue at breakeven Product 2 Expected chang in volume (%) 15% Contribution Margin 1200.00 Multiproduct Target profit point: Total -in units Margin of Safety (in $) Margin of Safety % Operating Leverage Factor Expected % change in operating income (%) 38% 2.67