Answered step by step

Verified Expert Solution

Question

1 Approved Answer

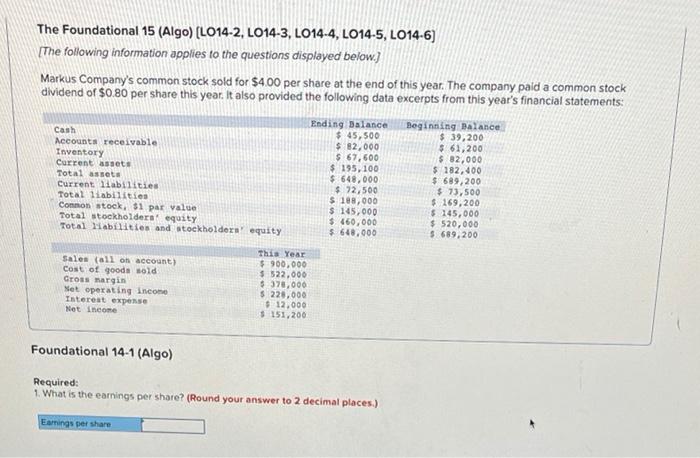

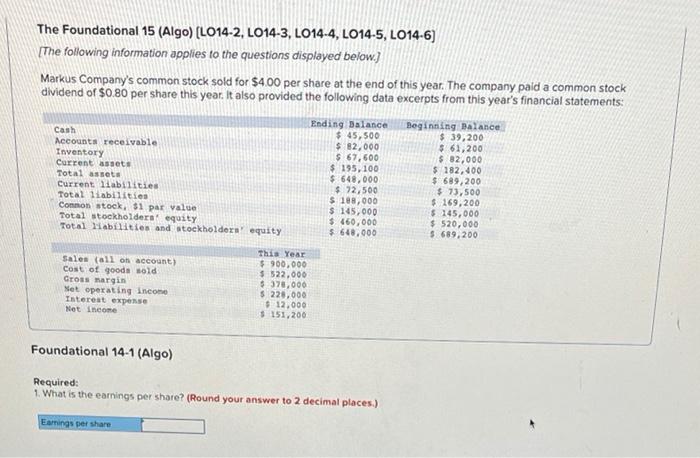

please help with the numbers in the problem The Foundational 15 (Algo) (LO14-2, LO14-3, LO14-4, LO14-5, LO14-6] The following information applies to the questions displayed

please help with the numbers in the problem

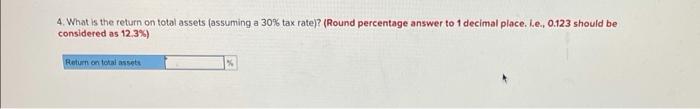

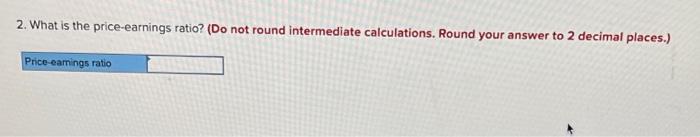

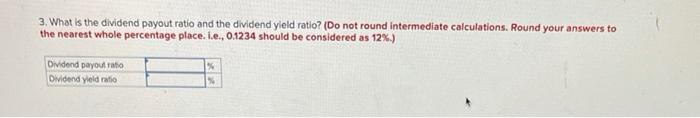

The Foundational 15 (Algo) (LO14-2, LO14-3, LO14-4, LO14-5, LO14-6] The following information applies to the questions displayed below.) Markus Company's common stock sold for $4.00 per share at the end of this year. The company paid a common stock dividend of $0.80 per share this year. It also provided the following data excerpts from this year's financial statements: Cash Accounts receivable Inventory Current assets Total assets Current liabilities Total liabilities Connon stock, $1 par value Total stockholders' equity Total abilities and stockholders' equity Ending Balance $ 45,500 $ 82.000 $ 67,600 $ 195,100 $ 648,000 $ 72,500 $ 188,000 $ 145,000 $ 460,000 $ 648,000 Beginning balance $ 39,200 $ 61,200 $ 82,000 $ 182,400 $ 689,200 $ 73,500 $ 269,200 $ 145,000 $ 520,000 $ 689,200 Sales (all on account) Cost of goods sold Gross margin Net operating Income Interest expens Net Income This Year $ 900,000 $ 522,000 $370.000 $ 220,000 $ 12.000 $ 151,200 Foundational 14-1 (Algo) Required: 1. What is the earrings per share? (Round your answer to 2 decimal places.) Earnings per share 2. What is the price-earnings ratio? (Do not found intermediate calculations. Round your answer to 2 decimal places.) Price-earings ratio 3. What is the dividend payout ratio and the dividend yield ratio? (Do not round intermediate calculations. Round your answers to the nearest whole percentage place. I.e., 0.1234 should be considered as 12%.) Dividend payout ratio Dividend yield ratio 4. What is the return on total assets (assuming a 30% tax rate)? (Round percentage answer to 1 decimal place. Le., 0.123 should be considered as 12.3%) Return on total assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started