Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with the ones that are wrong. Thank You, will rate up when the answer is right! On 3 January 20X4, Windsor Company purchased

Please help with the ones that are wrong. Thank You, will rate up when the answer is right!

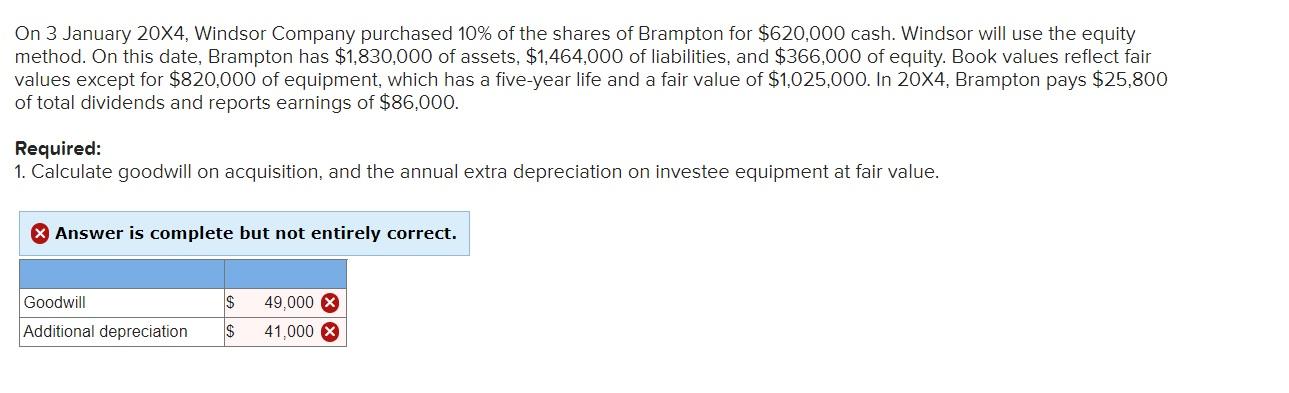

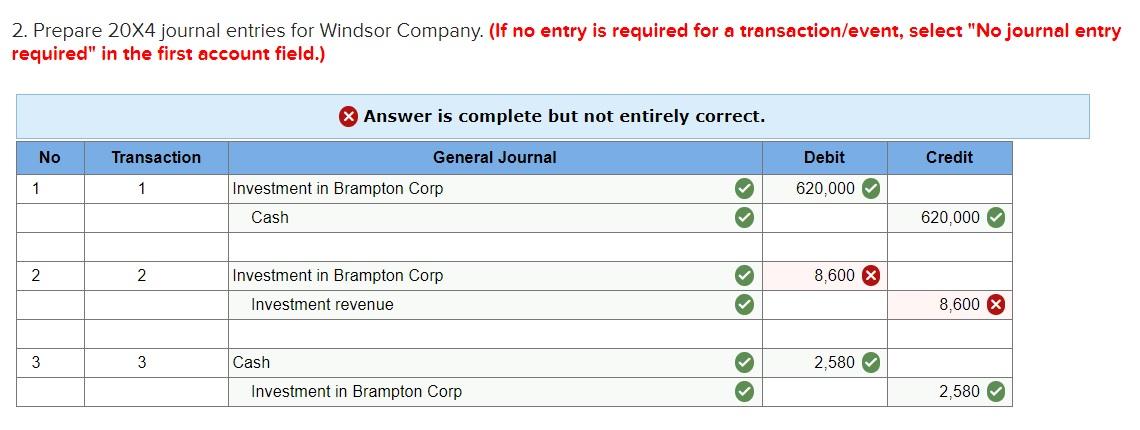

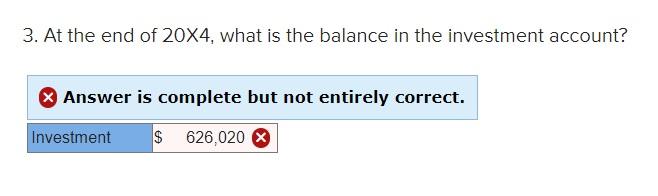

On 3 January 20X4, Windsor Company purchased 10% of the shares of Brampton for $620,000 cash. Windsor will use the equity method. On this date, Brampton has $1,830,000 of assets, $1,464,000 of liabilities, and $366,000 of equity. Book values reflect fair values except for $820,000 of equipment, which has a five-year life and a fair value of $1,025,000. In 20X4, Brampton pays $25,800 of total dividends and reports earnings of $86,000. Required: 1. Calculate goodwill on acquisition, and the annual extra depreciation on investee equipment at fair value. Answer is complete but not entirely correct. $ 49,000 X Goodwill Additional depreciation $ 41,000 X 2. Prepare 20X4 journal entries for Windsor Company. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) X Answer is complete but not entirely correct. No Transaction General Journal Debit Credit 1 1 620,000 Investment in Brampton Corp Cash 620,000 2 2 Investment in Brampton Corp 8,600 X Investment revenue 8,600 3 3 Cash 2,580 > Investment in Brampton Corp 2,580 3. At the end of 20X4, what is the balance in the investment account? Answer is complete but not entirely correct. Investment $ 626,020 XStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started