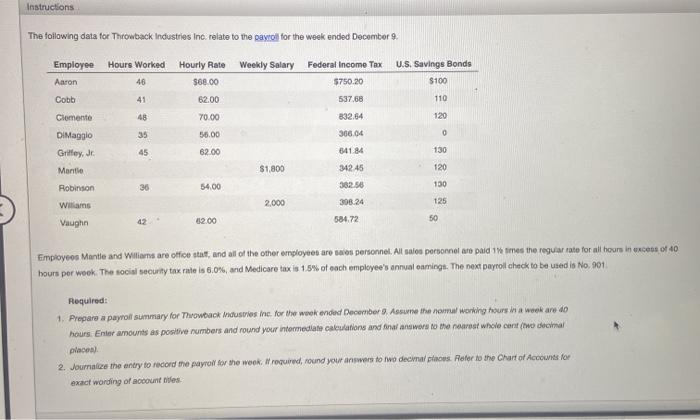

please help with the red blanks i missed thank you!!!

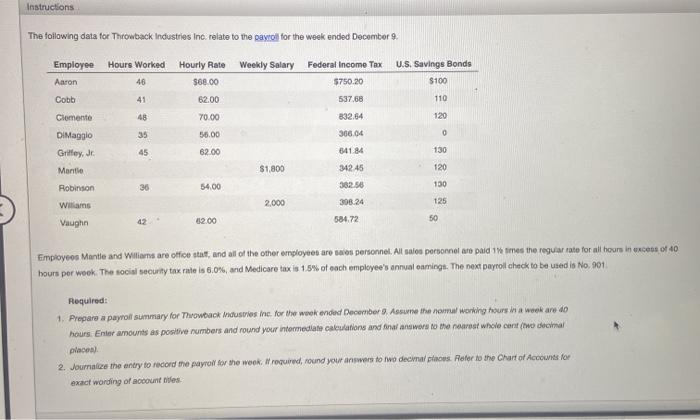

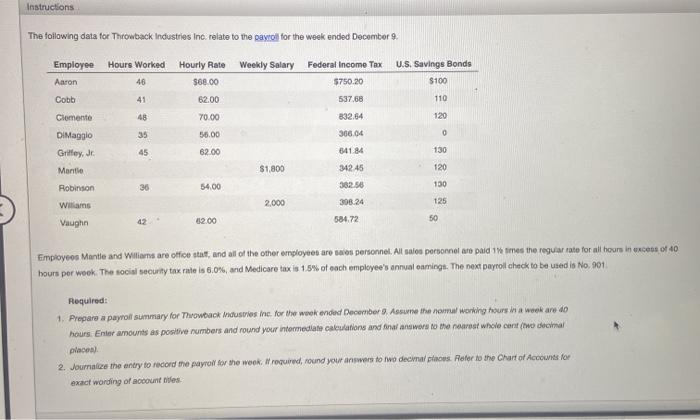

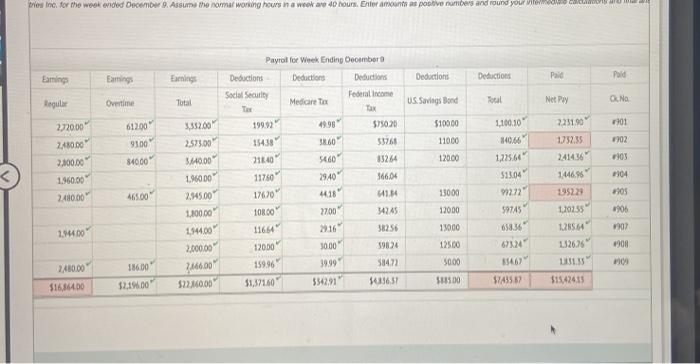

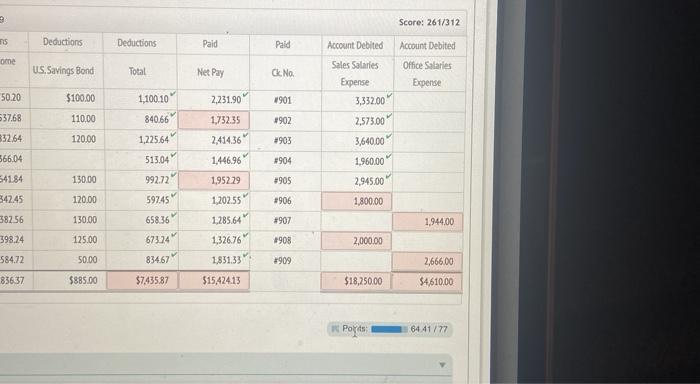

Instructions The following data for Throwback Industries Inc. relate to the payroll for the week ended December 9. Hours Worked Employee Aaron Hourly Rate Weekly Salary Federal Income Tax U.S. Savings Bonds $100 46 $750.20 $68.00 62.00 Cobb 537.68 110 Clemente 48 832.64 120 70.00 56.00 35 366.04 0 45 62.00 541.84 130 DiMaggio Griffey Jr Monte Robinson $1,800 34245 120 36 54.00 38256 130 Wiliams 2.000 125 308.24 584.72 02.00 Vaughn 50 Employees Mantle and Williams are office stat, und all of the other employees are sales personnel. All sales personnel and paid 1 times the regular rate for all hours in excess of 40 hours per wook. The social security tax rate is 6.0%, and Medicare tax is 1.5% of each employee's annual oamings. The next payroll check to be used in No. 901 Required: 1. Prepare a payroll summary for Throwback mustries Inc. for the week ended December 3. Assume the normal working hours a week are do hours. Enter amounts as positive numbers and round your intermediate calculations and final wors to the nearest whole cent two decimal place 2. Jourritilize the entry to record the payroll for the week. #trocured, round your answers to wo decimal places. Roter to the Chart of Accounts for exact wording of account des tries Inc. for the wook ended December 9. Assume the commal working hours in a week 40 hours, Enter amounts as posive sombers and round you. I do Gaming Earings Pald Earning Deductions Deductions Overtime Total Regular Toul US Savings Bond Net Pay a No 61200 2.231.90 1901 1.732.35 9100 202 2.720.00 ZAO.DO 2,100.00 1.960.00 248000 510000 11000 12000 3332.00 2.575.00 40.00 1.96000 Payrol for Week Ending Doomberg Deductions Deductions Deduction Social Security Federal income Medicare te Tax $750,20 15438 38.60 53765 21140 5660 33264 11750 2940 366.04 17670 418 114 10800 2700 34245 11664 2016 12000 3000 59824 15996 58472 $1,57160 54336.37 1.100.10 140.66 1,23564 513.04 840.00 1446.96 0904 105 465.00 13000 12000 92.72 59745 135229 120255 1906 15000 1902 1.44400 2.845.00 1.100.00 1.94400 2.000.00 ?M66.00 $22140.00 125.64 132636 125.00 5000 2908 09 15467 2.480.00 186.00 12.19.00 11.5 $15.424.15 SH1500 SA3537 $1686400 Score: 261/312 Deductions Deductions Paid Paid Account Debited ome U.S.Savings Bond Account Debited Office Salaries Expense Total Net Pay Sales Salaries Expense 3,332.00 Ck. No 50.20 $100.00 1,100.10 2,231.90 1901 537.68 110.00 840.66 #902 2,573.00 3,640.00 332.64 120.00 1,225.64 #903 56604 513.04 1904 1,960,00 54184 130.00 992.72 1.752.35 2,41436 1.446.96 1,952.29 1,202.55 1,285.64 1,326.76 #905 2,945.00 342.45 120.00 #906 1,800.00 59745 65836 382.56 130.00 1.944.00 #907 #908 398.24 125.00 673.24 2,000.00 584.72 50.00 83467 1,831.33 2909 2,666.00 $4,610.00 83637 $885.00 $743587 $15,424.13 $18,750.00 w Port 64.41/77 Instructions The following data for Throwback Industries Inc. relate to the payroll for the week ended December 9. Hours Worked Employee Aaron Hourly Rate Weekly Salary Federal Income Tax U.S. Savings Bonds $100 46 $750.20 $68.00 62.00 Cobb 537.68 110 Clemente 48 832.64 120 70.00 56.00 35 366.04 0 45 62.00 541.84 130 DiMaggio Griffey Jr Monte Robinson $1,800 34245 120 36 54.00 38256 130 Wiliams 2.000 125 308.24 584.72 02.00 Vaughn 50 Employees Mantle and Williams are office stat, und all of the other employees are sales personnel. All sales personnel and paid 1 times the regular rate for all hours in excess of 40 hours per wook. The social security tax rate is 6.0%, and Medicare tax is 1.5% of each employee's annual oamings. The next payroll check to be used in No. 901 Required: 1. Prepare a payroll summary for Throwback mustries Inc. for the week ended December 3. Assume the normal working hours a week are do hours. Enter amounts as positive numbers and round your intermediate calculations and final wors to the nearest whole cent two decimal place 2. Jourritilize the entry to record the payroll for the week. #trocured, round your answers to wo decimal places. Roter to the Chart of Accounts for exact wording of account des tries Inc. for the wook ended December 9. Assume the commal working hours in a week 40 hours, Enter amounts as posive sombers and round you. I do Gaming Earings Pald Earning Deductions Deductions Overtime Total Regular Toul US Savings Bond Net Pay a No 61200 2.231.90 1901 1.732.35 9100 202 2.720.00 ZAO.DO 2,100.00 1.960.00 248000 510000 11000 12000 3332.00 2.575.00 40.00 1.96000 Payrol for Week Ending Doomberg Deductions Deductions Deduction Social Security Federal income Medicare te Tax $750,20 15438 38.60 53765 21140 5660 33264 11750 2940 366.04 17670 418 114 10800 2700 34245 11664 2016 12000 3000 59824 15996 58472 $1,57160 54336.37 1.100.10 140.66 1,23564 513.04 840.00 1446.96 0904 105 465.00 13000 12000 92.72 59745 135229 120255 1906 15000 1902 1.44400 2.845.00 1.100.00 1.94400 2.000.00 ?M66.00 $22140.00 125.64 132636 125.00 5000 2908 09 15467 2.480.00 186.00 12.19.00 11.5 $15.424.15 SH1500 SA3537 $1686400 Score: 261/312 Deductions Deductions Paid Paid Account Debited ome U.S.Savings Bond Account Debited Office Salaries Expense Total Net Pay Sales Salaries Expense 3,332.00 Ck. No 50.20 $100.00 1,100.10 2,231.90 1901 537.68 110.00 840.66 #902 2,573.00 3,640.00 332.64 120.00 1,225.64 #903 56604 513.04 1904 1,960,00 54184 130.00 992.72 1.752.35 2,41436 1.446.96 1,952.29 1,202.55 1,285.64 1,326.76 #905 2,945.00 342.45 120.00 #906 1,800.00 59745 65836 382.56 130.00 1.944.00 #907 #908 398.24 125.00 673.24 2,000.00 584.72 50.00 83467 1,831.33 2909 2,666.00 $4,610.00 83637 $885.00 $743587 $15,424.13 $18,750.00 w Port 64.41/77