please help with the second part creating the statement of revenues, expenditures and changes in fund balance and the balance sheet.

please help with the second part creating the statement of revenues, expenditures and changes in fund balance and the balance sheet.

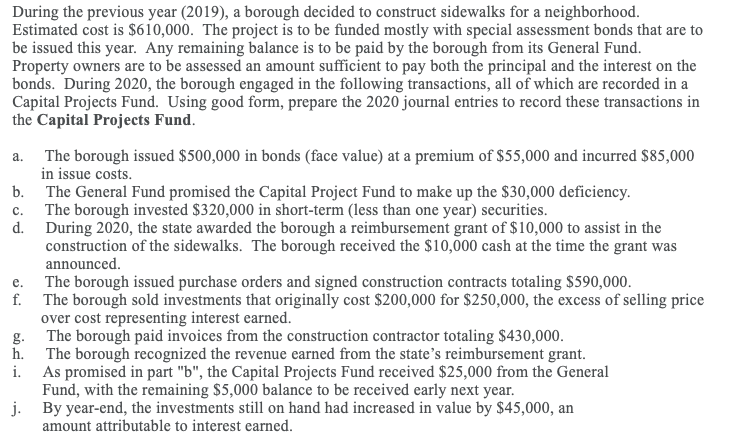

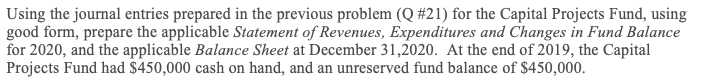

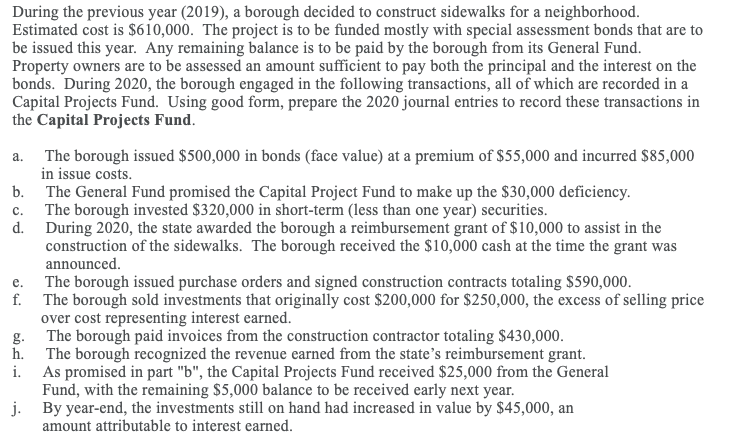

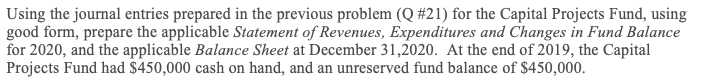

c. During the previous year (2019), a borough decided to construct sidewalks for a neighborhood. Estimated cost is $610,000. The project is to be funded mostly with special assessment bonds that are to be issued this year. Any remaining balance is to be paid by the borough from its General Fund. Property owners are to be assessed an amount sufficient to pay both the principal and the interest on the bonds. During 2020, the borough engaged in the following transactions, all of which are recorded in a Capital Projects Fund. Using good form, prepare the 2020 journal entries to record these transactions in the Capital Projects Fund. a. The borough issued $500,000 in bonds (face value) at a premium of $55,000 and incurred $85,000 in issue costs. b. The General Fund promised the Capital Project Fund to make up the $30,000 deficiency. The borough invested $320,000 in short-term (less than one year) securities. d. During 2020, the state awarded the borough a reimbursement grant of $10,000 to assist in the construction of the sidewalks. The borough received the $10,000 cash at the time the grant was announced The borough issued purchase orders and signed construction contracts totaling $590,000. f. The borough sold investments that originally cost $200,000 for $250,000, the excess of selling price over cost representing interest earned. g. The borough paid invoices from the construction contractor totaling $430,000. h. The borough recognized the revenue earned from the state's reimbursement grant. i. As promised in part "b", the Capital Projects Fund received $25,000 from the General Fund, with the remaining $5,000 balance to be received early next year. j. By year-end, the investments still on hand had increased in value by $45,000, an amount attributable to interest earned. e. Using the journal entries prepared in the previous problem (Q#21) for the Capital Projects Fund, using good form, prepare the applicable Statement of Revenues, Expenditures and Changes in Fund Balance for 2020, and the applicable Balance Sheet at December 31,2020. At the end of 2019, the Capital Projects Fund had $450,000 cash on hand, and an unreserved fund balance of $450,000. c. During the previous year (2019), a borough decided to construct sidewalks for a neighborhood. Estimated cost is $610,000. The project is to be funded mostly with special assessment bonds that are to be issued this year. Any remaining balance is to be paid by the borough from its General Fund. Property owners are to be assessed an amount sufficient to pay both the principal and the interest on the bonds. During 2020, the borough engaged in the following transactions, all of which are recorded in a Capital Projects Fund. Using good form, prepare the 2020 journal entries to record these transactions in the Capital Projects Fund. a. The borough issued $500,000 in bonds (face value) at a premium of $55,000 and incurred $85,000 in issue costs. b. The General Fund promised the Capital Project Fund to make up the $30,000 deficiency. The borough invested $320,000 in short-term (less than one year) securities. d. During 2020, the state awarded the borough a reimbursement grant of $10,000 to assist in the construction of the sidewalks. The borough received the $10,000 cash at the time the grant was announced The borough issued purchase orders and signed construction contracts totaling $590,000. f. The borough sold investments that originally cost $200,000 for $250,000, the excess of selling price over cost representing interest earned. g. The borough paid invoices from the construction contractor totaling $430,000. h. The borough recognized the revenue earned from the state's reimbursement grant. i. As promised in part "b", the Capital Projects Fund received $25,000 from the General Fund, with the remaining $5,000 balance to be received early next year. j. By year-end, the investments still on hand had increased in value by $45,000, an amount attributable to interest earned. e. Using the journal entries prepared in the previous problem (Q#21) for the Capital Projects Fund, using good form, prepare the applicable Statement of Revenues, Expenditures and Changes in Fund Balance for 2020, and the applicable Balance Sheet at December 31,2020. At the end of 2019, the Capital Projects Fund had $450,000 cash on hand, and an unreserved fund balance of $450,000

please help with the second part creating the statement of revenues, expenditures and changes in fund balance and the balance sheet.

please help with the second part creating the statement of revenues, expenditures and changes in fund balance and the balance sheet.