please help with the wrong answers

please help with the wrong answers

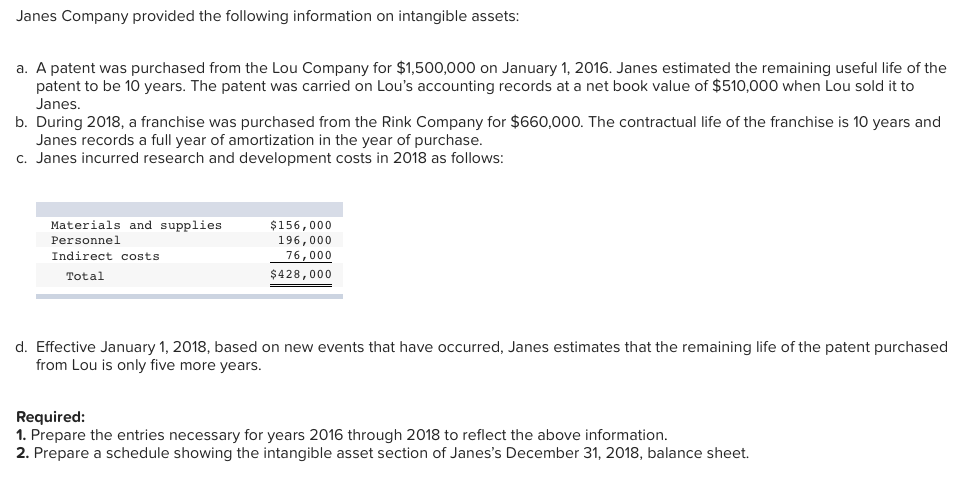

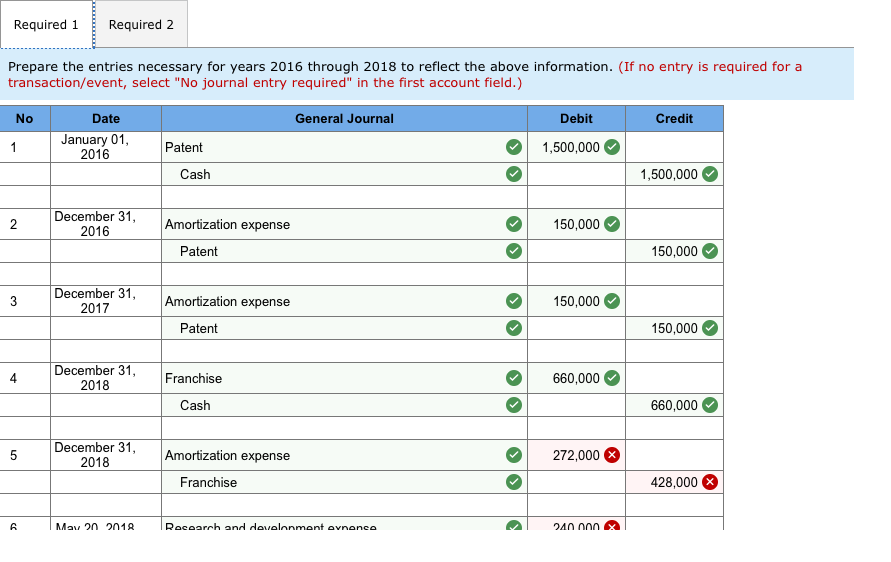

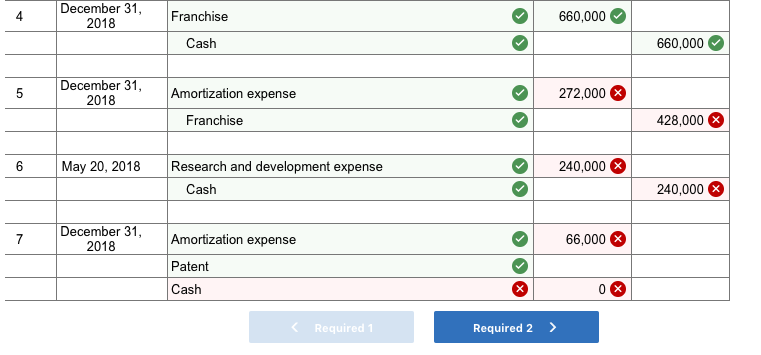

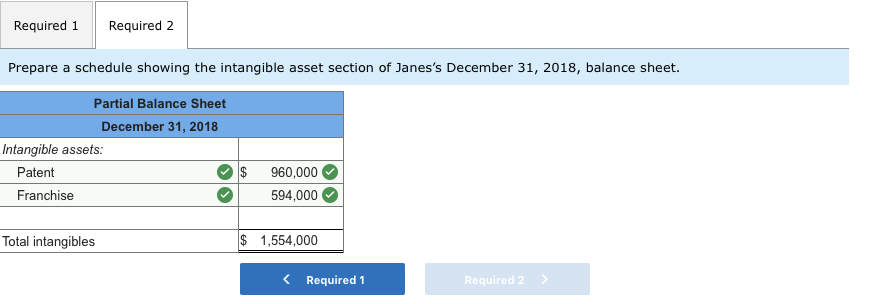

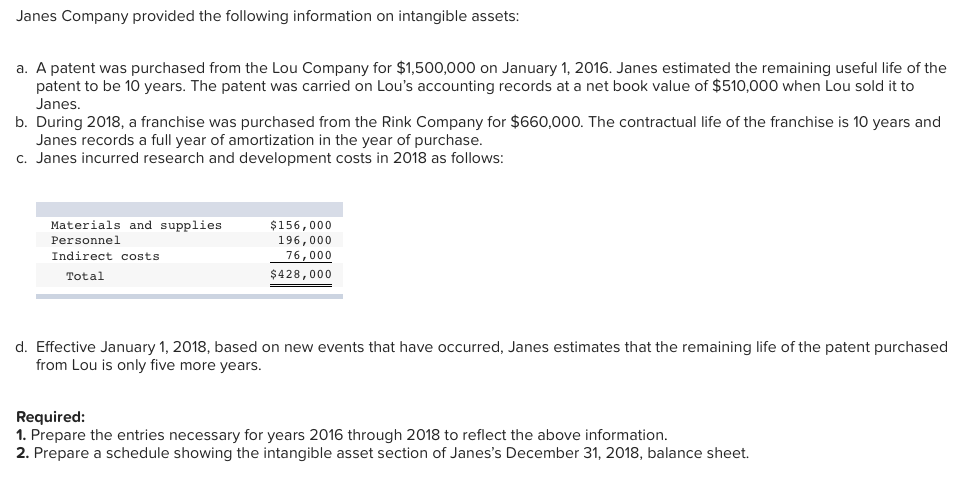

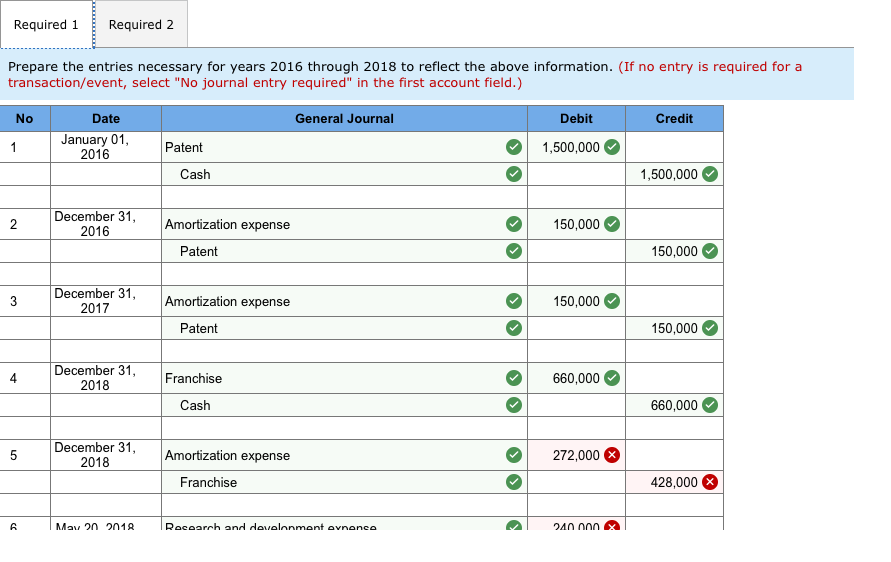

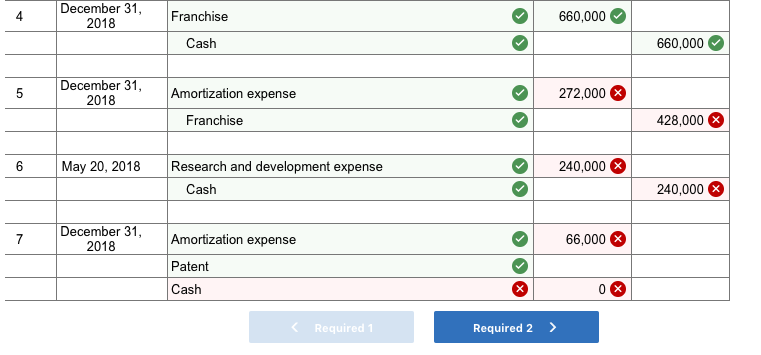

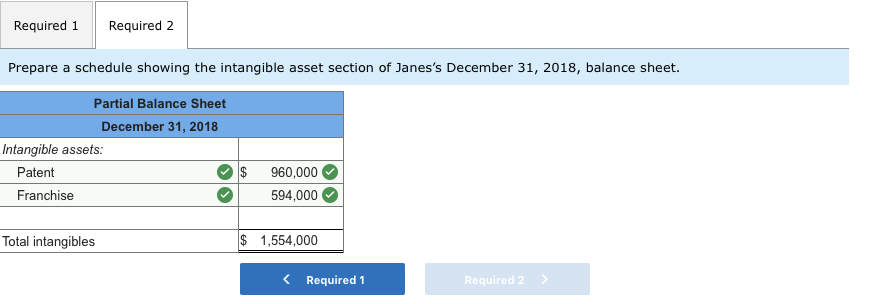

Janes Company provided the following information on intangible assets: a. A patent was purchased from the Lou Company for $1,500,000 on January 1, 2016. Janes estimated the remaining useful life of the patent to be 10 years. The patent was carried on Lou's accounting records at a net book value of $510,000 when Lou sold it to Janes. b. During 2018, a franchise was purchased from the Rink Company for $660,000. The contractual life of the franchise is 10 years and Janes records a full year of amortization in the year of purchase. c. Janes incurred research and development costs in 2018 as follows: Materials and supplies Personnel Indirect costs $156,000 196,000 76,000 $428,000 Total d. Effective January 1, 2018, based on new events that have occurred, Janes estimates that the remaining life of the patent purchased from Lou is only five more years Required 1. Prepare the entries necessary for years 2016 through 2018 to reflect the above information. 2. Prepare a schedule showing the intangible asset section of Janes's December 31, 2018, balance sheet. Required 1Required 2 Prepare the entries necessary for years 2016 through 2018 to reflect the above information. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Date General Journal Debit Credit January 01 2016 Patent 1,500,000 Cash 1,500,000 December 31 2016 150,000 Amortization expense Patent 150,000 December 31 2017 150,000 Amortization expense Patent 150,000 December 31 2018 4 Franchise 660,000 Cash 660,000 December 31 2018 Amortization expense 272,000 Franchise 428,000 December 31 2018 4 Franchise 660,000 Cash 660,000 December 31 2018 Amortization expense 272,000 Franchise 428,000 May 20, 2018 Research and development expense 240,000 Cash 240,000 December 31 2018 66,000 Amortization expense Patent Cash Required1 Required 2> Required 1Required 2 Prepare a schedule showing the intangible asset section of Janes's December 31, 2018, balance sheet. Partial Balance Sheet December 31, 2018 Intangible assets: $ 960,000 594,000 Patent Franchise Total intangibles $ 1,554,000 K Required 1 Required 2

please help with the wrong answers

please help with the wrong answers