Please help with these short homework problems - Will rate

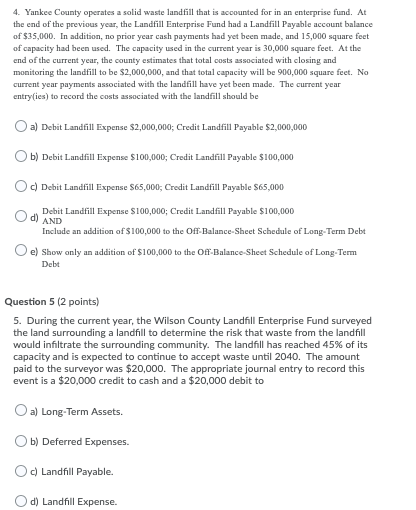

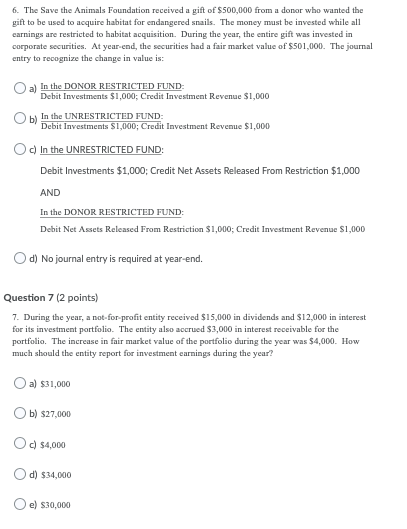

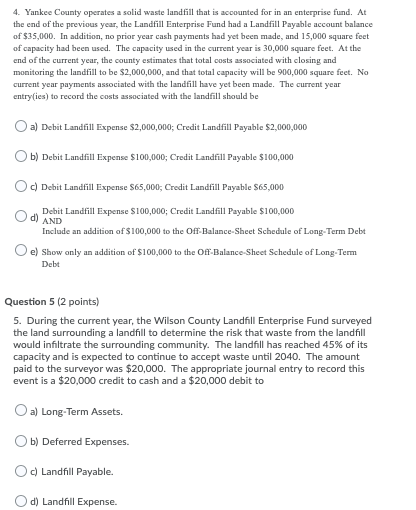

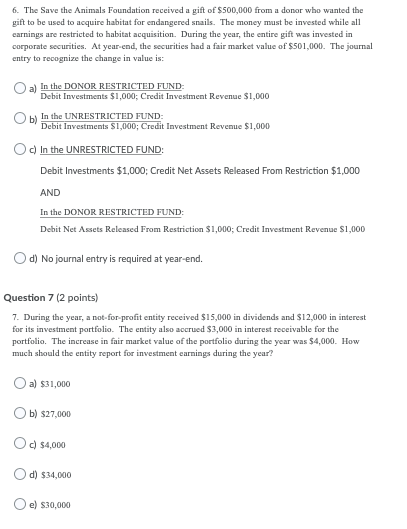

4. Yankee County operates a solid waste landfill that is accounted for in an enterprise fund. At the end of the previous year, the Landfill Enterprise Fund had a Landfill Payable account balance of $35,000. In addition, no prior year cash payments had yet been made, and 15,000 square feet of capacity had been used. The capacity used in the current year is 30,000 square feet. At the end of the current year, the county estimates that total costs associated with closing and monitoring the landfill to be $2,000,000, and that total capacity will be 900,000 square feet. No current year payments associated with the landfill have yet been made. The current year entry(ies) to record the costs associated with the landfill should be a) Debit Landfill Expense $2,000,000; Credit Landfill Payable $2,000,000 b) Debit Landfill Expense $100,000; Credit Landfill Payable $100,000 c) Debit Landfill Expense $65,000; Credit Landfill Payable $65,000 Debit Landfill Expense $100,000; Credit Landfill Payable $100,000 d) AND Include an addition of $100,000 to the Off-Balance Sheet Schedule of Long-Te Debt e) Show only an addition of $100,000 to the Off-Balance Sheet Schedule of Long-Term Debt Question 5 (2 points) 5. During the current year, the Wilson County Landfill Enterprise Fund surveyed the land surrounding a landfill to determine the risk that waste from the landfill would infiltrate the surrounding community. The landfill has reached 45% of its capacity and is expected to continue to accept waste until 2040. The amount paid to the surveyor was $20,000. The appropriate journal entry to record this event is a $20,000 credit to cash and a $20,000 debit to O a) Long-Term Assets. b) Deferred Expenses. Landfill Payable. d) Landfill Expense. 6. The Save the Animals Foundation received a gift of $500,000 from a donor who wanted the gift to be used to acquire habitat for endangered snails. The money must be invested while all earnings are restricted to habitat acquisition. During the year, the entire gift was invested in corporate securities. At year-end, the securities had a fair market value of $501,000. The journal entry to recognize the change in value is: In the DONOR RESTRICTED FUND: Debit Investments $1,000; Credit Investment Revenue $1,000 Ob) In the UNRESTRICTED FUND: Debit Investments $1,000; Credit Investment Revenue $1,000 Od in the UNRESTRICTED FUND: Debit Investments $1,000; Credit Net Assets Released From Restriction $1,000 AND In the DONOR RESTRICTED FUND: Debit Net Assets Released From Restriction $1,000; Credit Investment Revenue $1,000 d) No journal entry is required at year-end. Question 7 (2 points) 7. During the year, a not-for-profit entity received $15,000 in dividends and $12,000 in interest for its investment portfolio. The entity also accrued $3,000 in interest receivable for the portfolio. The increase in fair market value of the portfolio during the year was $4,000. How much should the entity report for investment earnings during the year? a) 531,000 Ob) $27,000 O $4,000 d) $34,000 e) $30,000