Please help with these two questions.

Please help with these two questions.

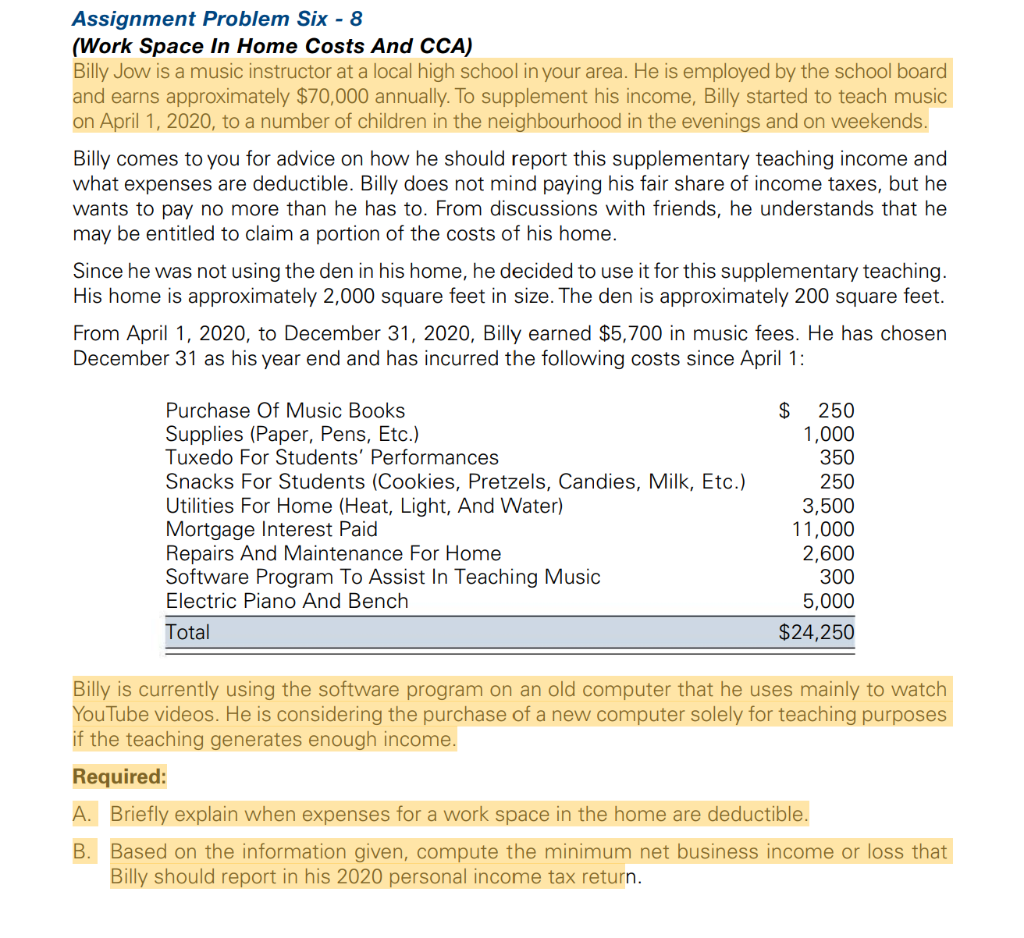

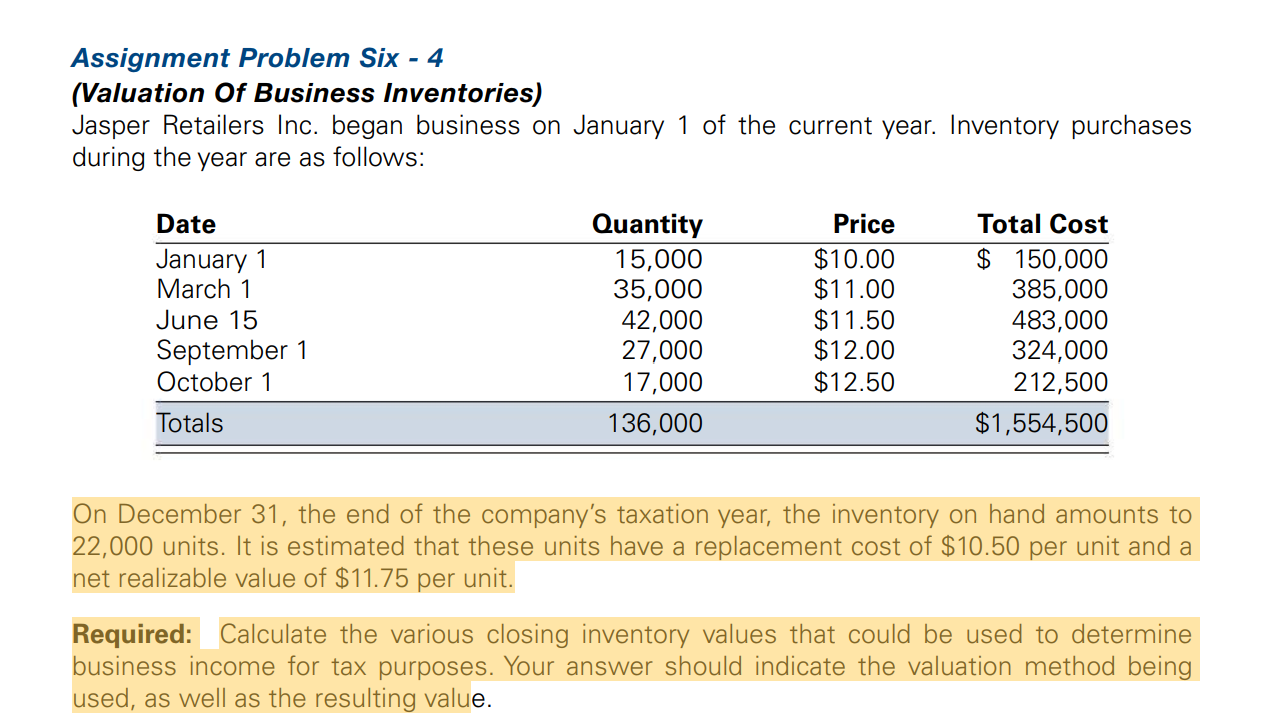

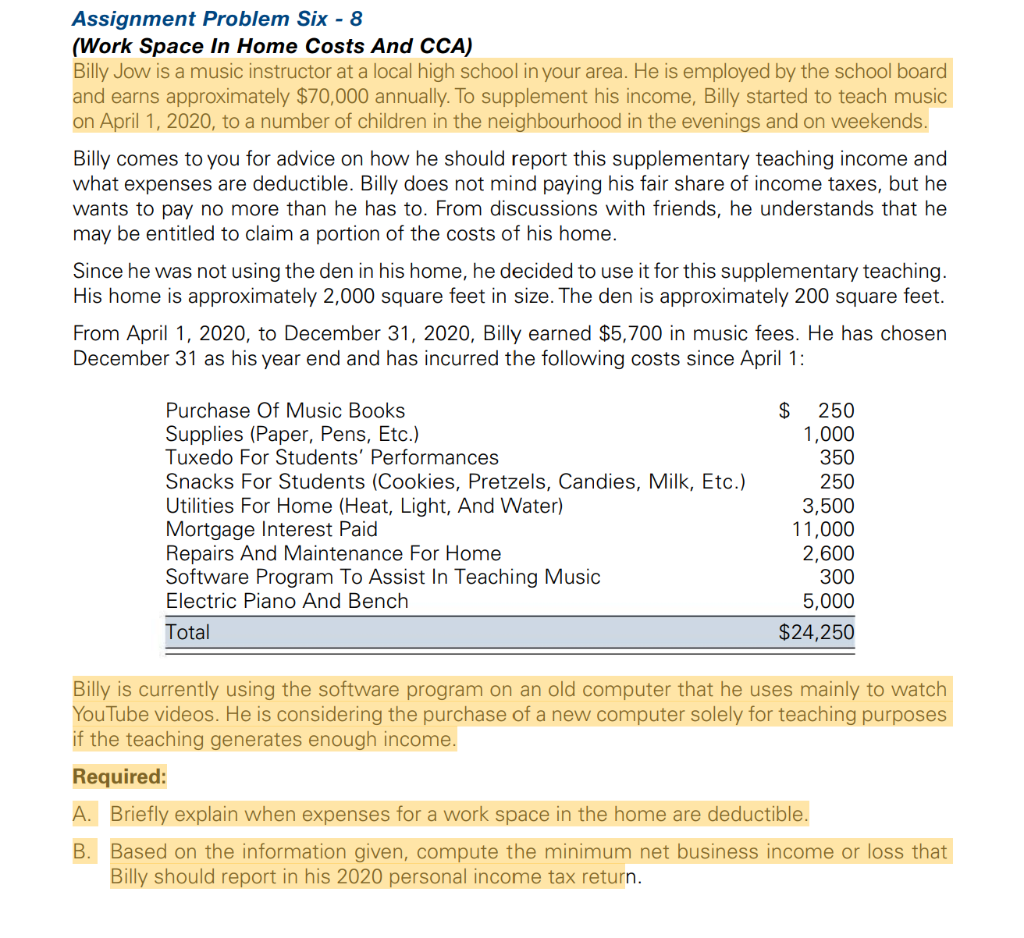

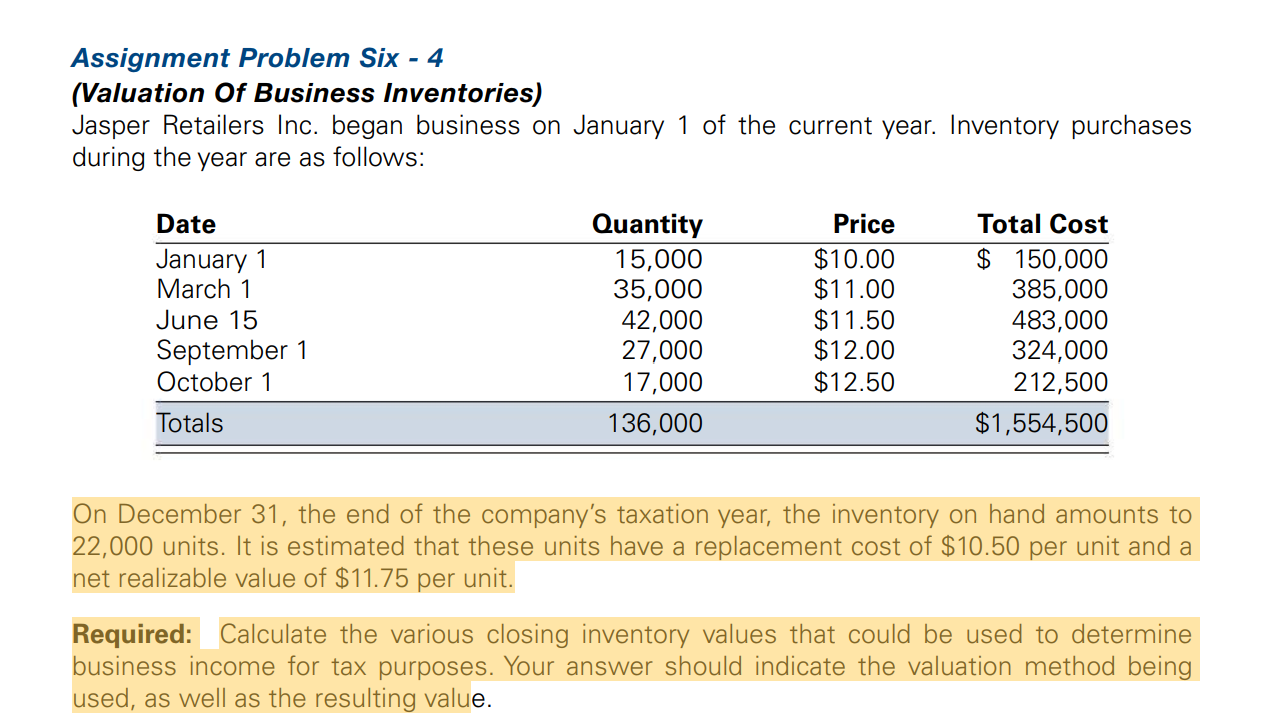

Assignment Problem Six - 8 (Work Space In Home Costs And CCA) Billy Jow is a music instructor at a local high school in your area. He is employed by the school board and earns approximately $70,000 annually. To supplement his income, Billy started to teach music on April 1, 2020, to a number of children in the neighbourhood in the evenings and on weekends. Billy comes to you for advice on how he should report this supplementary teaching income and what expenses are deductible. Billy does not mind paying his fair share of income taxes, but he wants to pay no more than he has to. From discussions with friends, he understands that he may be entitled to claim a portion of the costs of his home. Since he was not using the den in his home, he decided to use it for this supplementary teaching. His home is approximately 2,000 square feet in size. The den is approximately 200 square feet. From April 1, 2020, to December 31, 2020, Billy earned $5,700 in music fees. He has chosen December 31 as his year end and has incurred the following costs since April 1: Purchase Of Music Books Supplies (Paper, Pens, Etc.) Tuxedo For Students' Performances Snacks For Students (Cookies, Pretzels, Candies, Milk, Etc.) Utilities For Home (Heat, Light, And Water) Mortgage Interest Paid Repairs And Maintenance For Home Software Program To Assist In Teaching Music Electric Piano And Bench Total $ 250 1,000 350 250 3,500 11,000 2,600 300 5,000 $24,250 Billy is currently using the software program on an old computer that he uses mainly to watch YouTube videos. He is considering the purchase of a new computer solely for teaching purposes if the teaching generates enough income. Required: A. Briefly explain when expenses for a work space in the home are deductible. B. Based on the information given, compute the minimum net business income or loss that Billy should report in his 2020 personal income tax return. Assignment Problem Six - 4 (Valuation Of Business Inventories) Jasper Retailers Inc. began business on January 1 of the current year. Inventory purchases during the year are as follows: Date January 1 March 1 June 15 September 1 October 1 Quantity 15,000 35,000 42,000 27,000 17,000 136,000 Price $10.00 $11.00 $11.50 $12.00 $12.50 Total Cost $ 150,000 385,000 483,000 324,000 212,500 $1,554,500 Totals On December 31, the end of the company's taxation year, the inventory on hand amounts to 22,000 units. It is estimated that these units have a replacement cost of $10.50 per unit and a net realizable value of $11.75 per unit. Required: Calculate the various closing inventory values that could be used to determine business income for tax purposes. Your answer should indicate the valuation method being used, as well as the resulting value. Assignment Problem Six - 8 (Work Space In Home Costs And CCA) Billy Jow is a music instructor at a local high school in your area. He is employed by the school board and earns approximately $70,000 annually. To supplement his income, Billy started to teach music on April 1, 2020, to a number of children in the neighbourhood in the evenings and on weekends. Billy comes to you for advice on how he should report this supplementary teaching income and what expenses are deductible. Billy does not mind paying his fair share of income taxes, but he wants to pay no more than he has to. From discussions with friends, he understands that he may be entitled to claim a portion of the costs of his home. Since he was not using the den in his home, he decided to use it for this supplementary teaching. His home is approximately 2,000 square feet in size. The den is approximately 200 square feet. From April 1, 2020, to December 31, 2020, Billy earned $5,700 in music fees. He has chosen December 31 as his year end and has incurred the following costs since April 1: Purchase Of Music Books Supplies (Paper, Pens, Etc.) Tuxedo For Students' Performances Snacks For Students (Cookies, Pretzels, Candies, Milk, Etc.) Utilities For Home (Heat, Light, And Water) Mortgage Interest Paid Repairs And Maintenance For Home Software Program To Assist In Teaching Music Electric Piano And Bench Total $ 250 1,000 350 250 3,500 11,000 2,600 300 5,000 $24,250 Billy is currently using the software program on an old computer that he uses mainly to watch YouTube videos. He is considering the purchase of a new computer solely for teaching purposes if the teaching generates enough income. Required: A. Briefly explain when expenses for a work space in the home are deductible. B. Based on the information given, compute the minimum net business income or loss that Billy should report in his 2020 personal income tax return. Assignment Problem Six - 4 (Valuation Of Business Inventories) Jasper Retailers Inc. began business on January 1 of the current year. Inventory purchases during the year are as follows: Date January 1 March 1 June 15 September 1 October 1 Quantity 15,000 35,000 42,000 27,000 17,000 136,000 Price $10.00 $11.00 $11.50 $12.00 $12.50 Total Cost $ 150,000 385,000 483,000 324,000 212,500 $1,554,500 Totals On December 31, the end of the company's taxation year, the inventory on hand amounts to 22,000 units. It is estimated that these units have a replacement cost of $10.50 per unit and a net realizable value of $11.75 per unit. Required: Calculate the various closing inventory values that could be used to determine business income for tax purposes. Your answer should indicate the valuation method being used, as well as the resulting value

Please help with these two questions.

Please help with these two questions.