Please help with this case

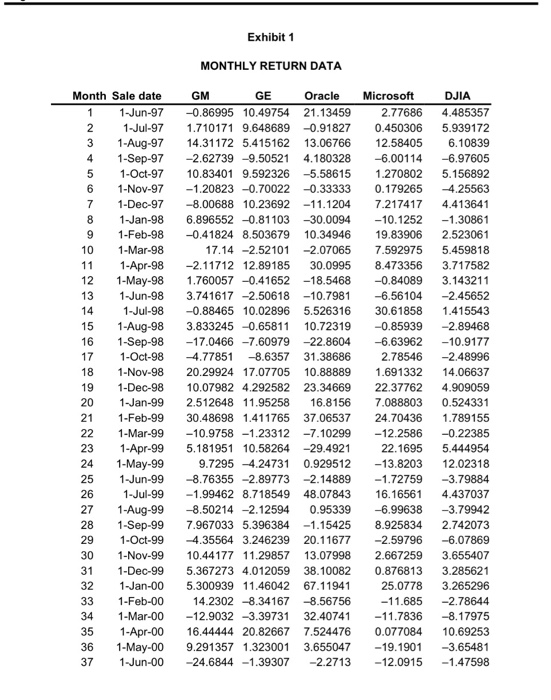

A professor of management science has decided to build an equity portfolio made up of common shares of General Motors, General Electric, Oracle and Microsoft. He has to decide what fraction of the portfolio should be devoted to each of these four issues. DATA COLLECTION Research assistant Rob McGowan agreed to collect some data and obtained first day of the month closing prices for General Motors, General Electric, Oracle and Microsoft common shares for the period May 1997 through June 1, 2000 from Datastream. The values of the Dow-Jones Industrial Average for the same dates and dividend payment information for General Motors and General Electric were also obtained. Oracle and Microsoft shares did not pay any dividends during this period. The yield (as a percentage) on each share issue for each month was computed using: Yield month t = 100 [Price month t-Price month (t-i) + dividends paid in month t)/ [Price month (t-1)] The return on a hypothetical portfolio matching the Dow-Jones Industrial Average was computed using the same calculation applied to the Dow average The data are shown in Exhibit 1 FORMING THE PORTFOLIO The professor recognized that the choice of objective was an important component of portfolio selection. Maximizing return alone generally produced a very risky portfolio, while minimizing risk could lead to low returns. This suggested that it might be important to add one or more constraints into the optimization. For example, he might maximize the return on the portfolio while imposing a maximum level of risk, or A professor of management science has decided to build an equity portfolio made up of common shares of General Motors, General Electric, Oracle and Microsoft. He has to decide what fraction of the portfolio should be devoted to each of these four issues. DATA COLLECTION Research assistant Rob McGowan agreed to collect some data and obtained first day of the month closing prices for General Motors, General Electric, Oracle and Microsoft common shares for the period May 1997 through June 1, 2000 from Datastream. The values of the Dow-Jones Industrial Average for the same dates and dividend payment information for General Motors and General Electric were also obtained. Oracle and Microsoft shares did not pay any dividends during this period. The yield (as a percentage) on each share issue for each month was computed using: Yield month t = 100 [Price month t-Price month (t-i) + dividends paid in month t)/ [Price month (t-1)] The return on a hypothetical portfolio matching the Dow-Jones Industrial Average was computed using the same calculation applied to the Dow average The data are shown in Exhibit 1 FORMING THE PORTFOLIO The professor recognized that the choice of objective was an important component of portfolio selection. Maximizing return alone generally produced a very risky portfolio, while minimizing risk could lead to low returns. This suggested that it might be important to add one or more constraints into the optimization. For example, he might maximize the return on the portfolio while imposing a maximum level of risk, or