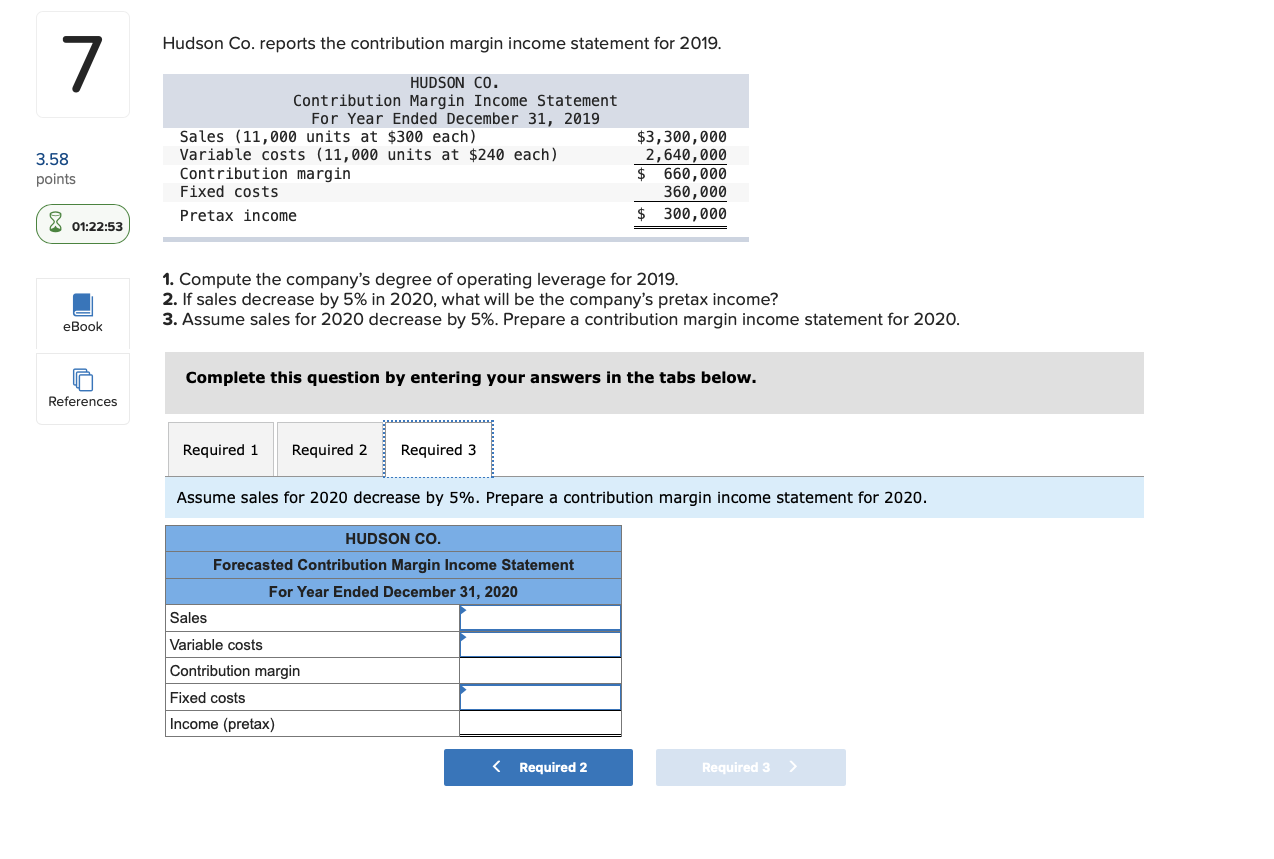

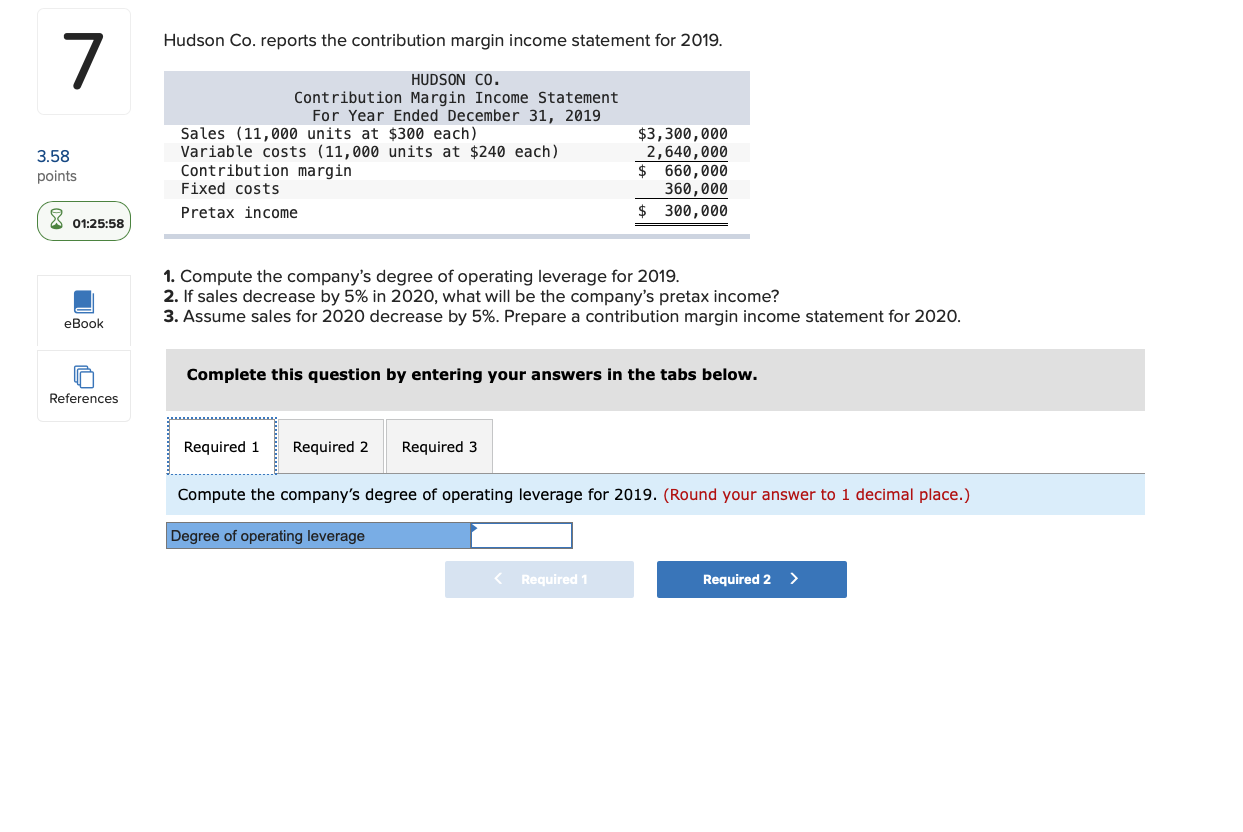

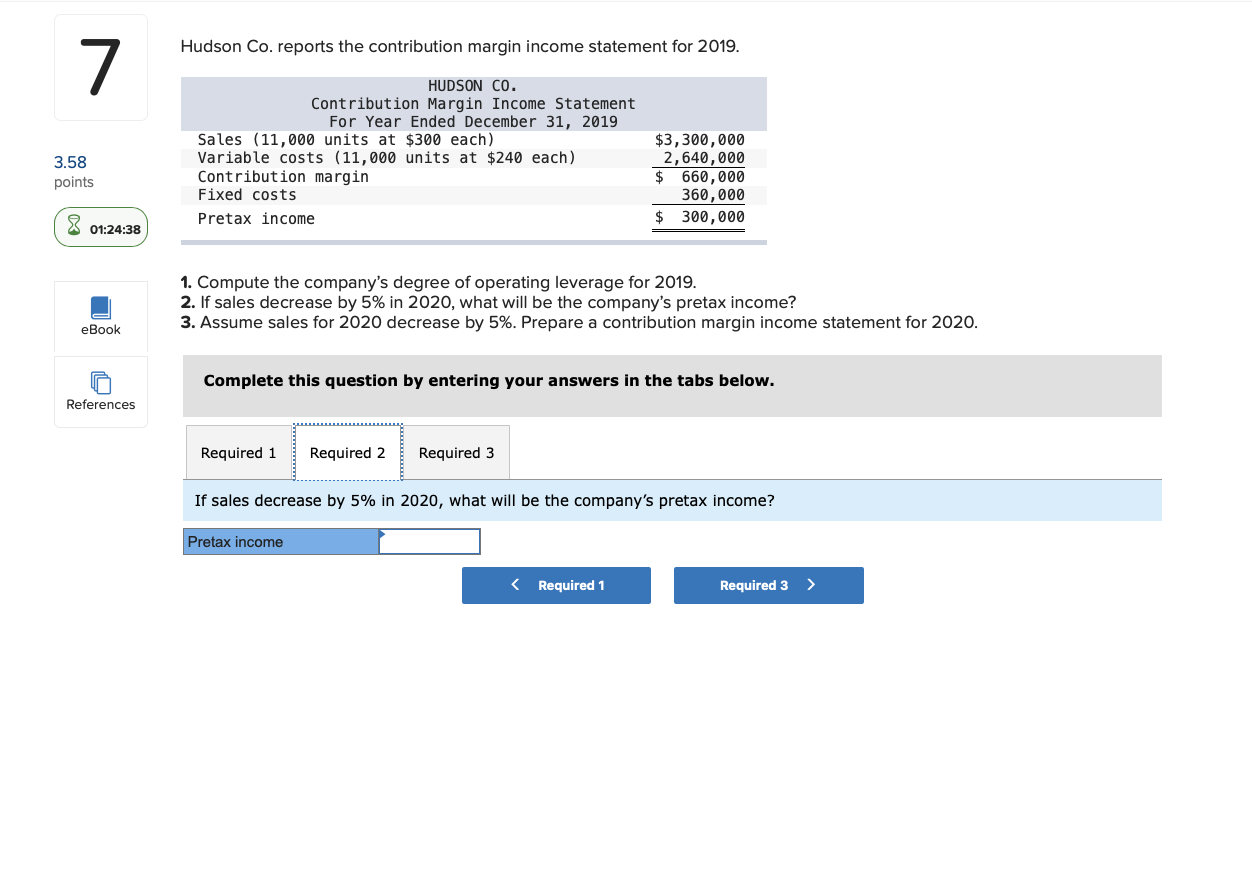

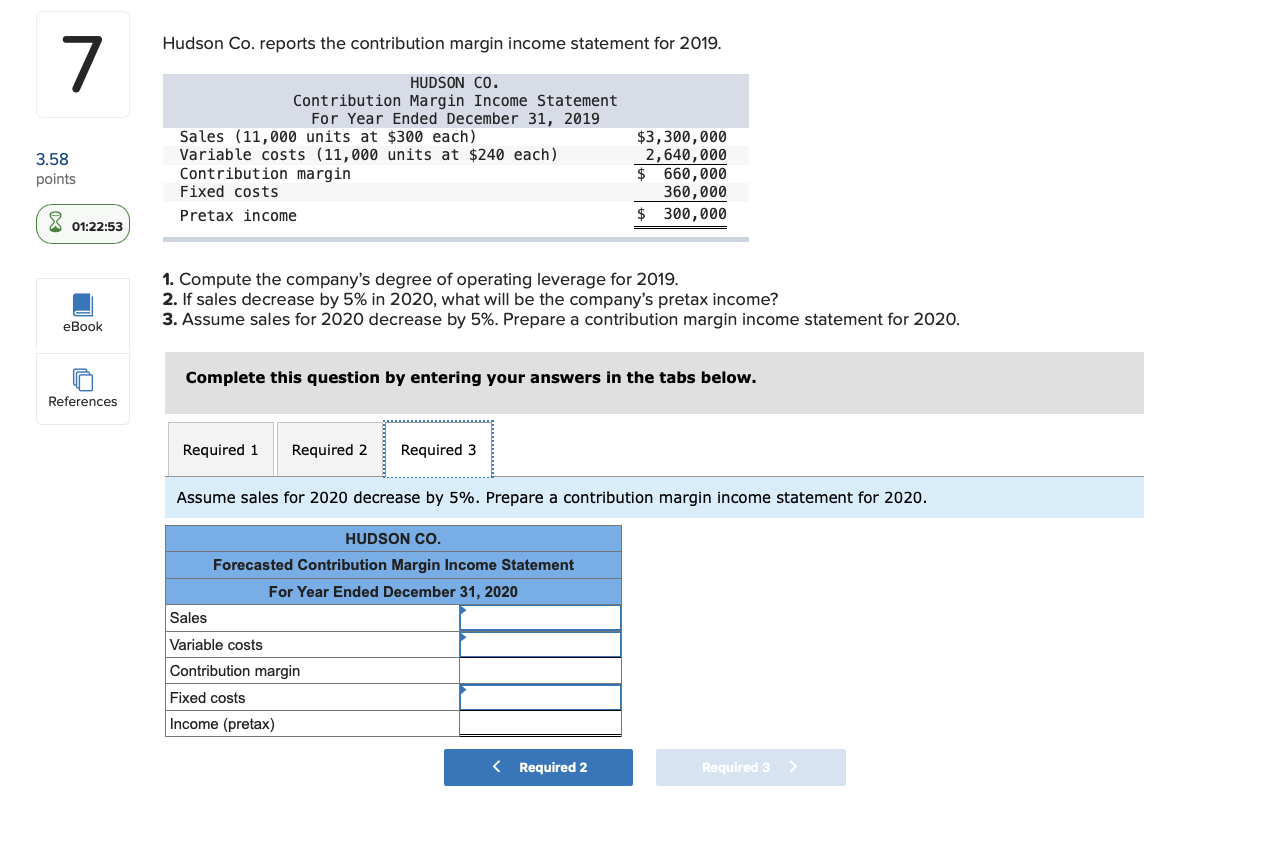

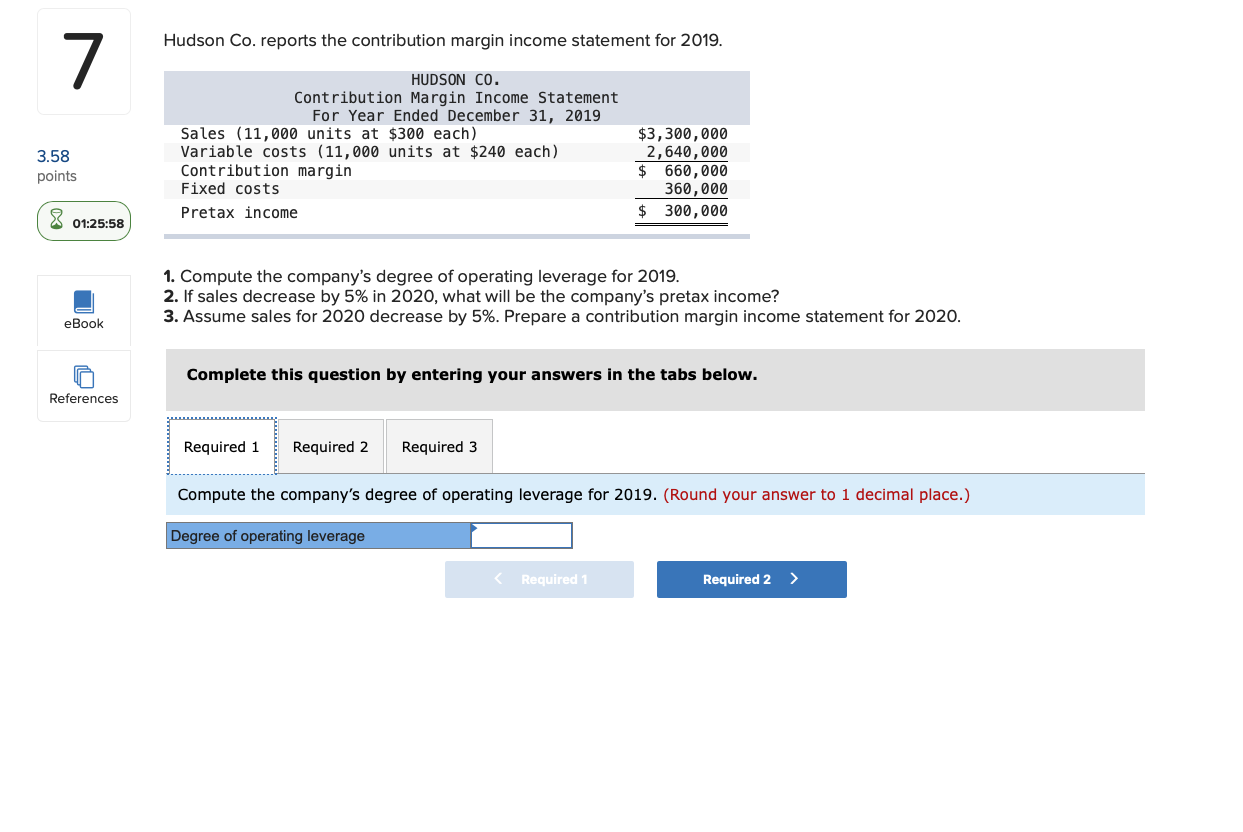

Please Help with this its one question with 3 parts

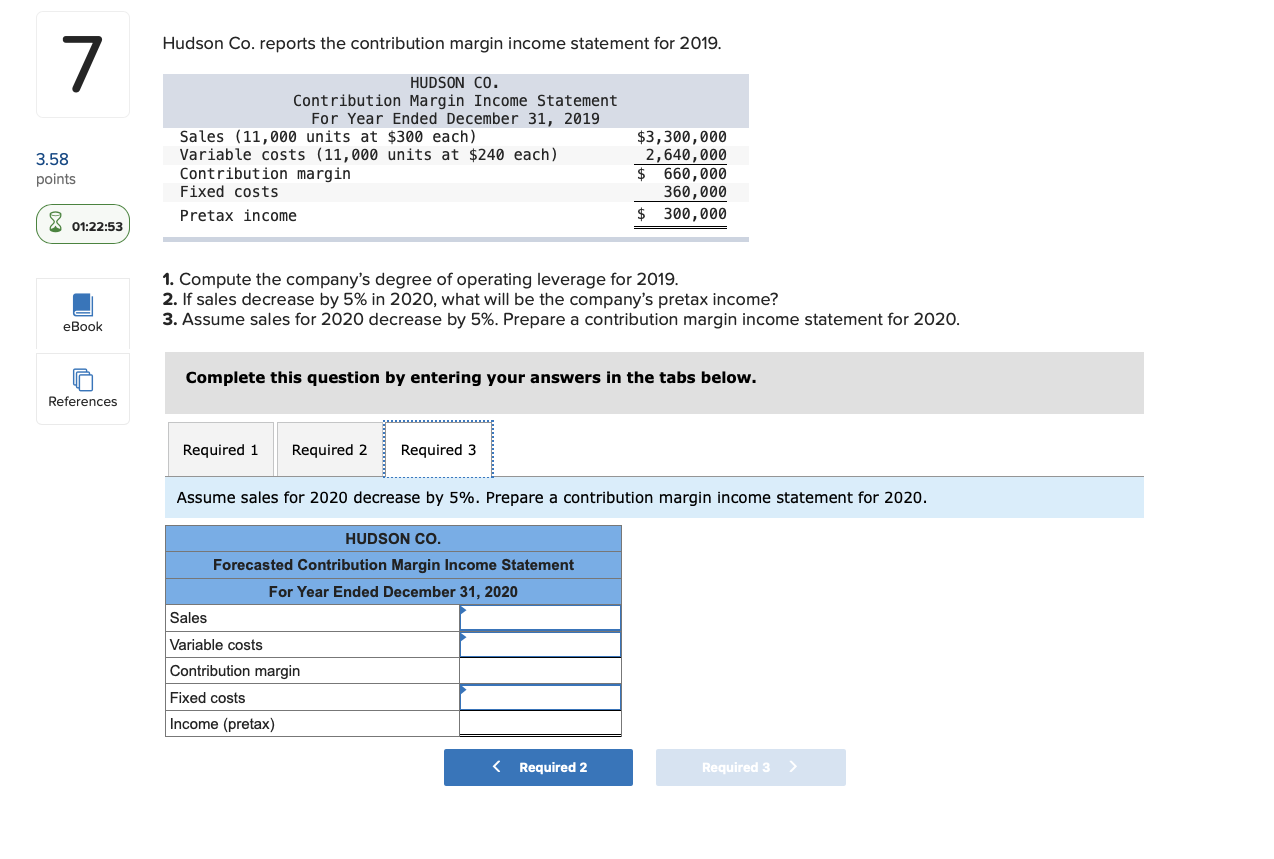

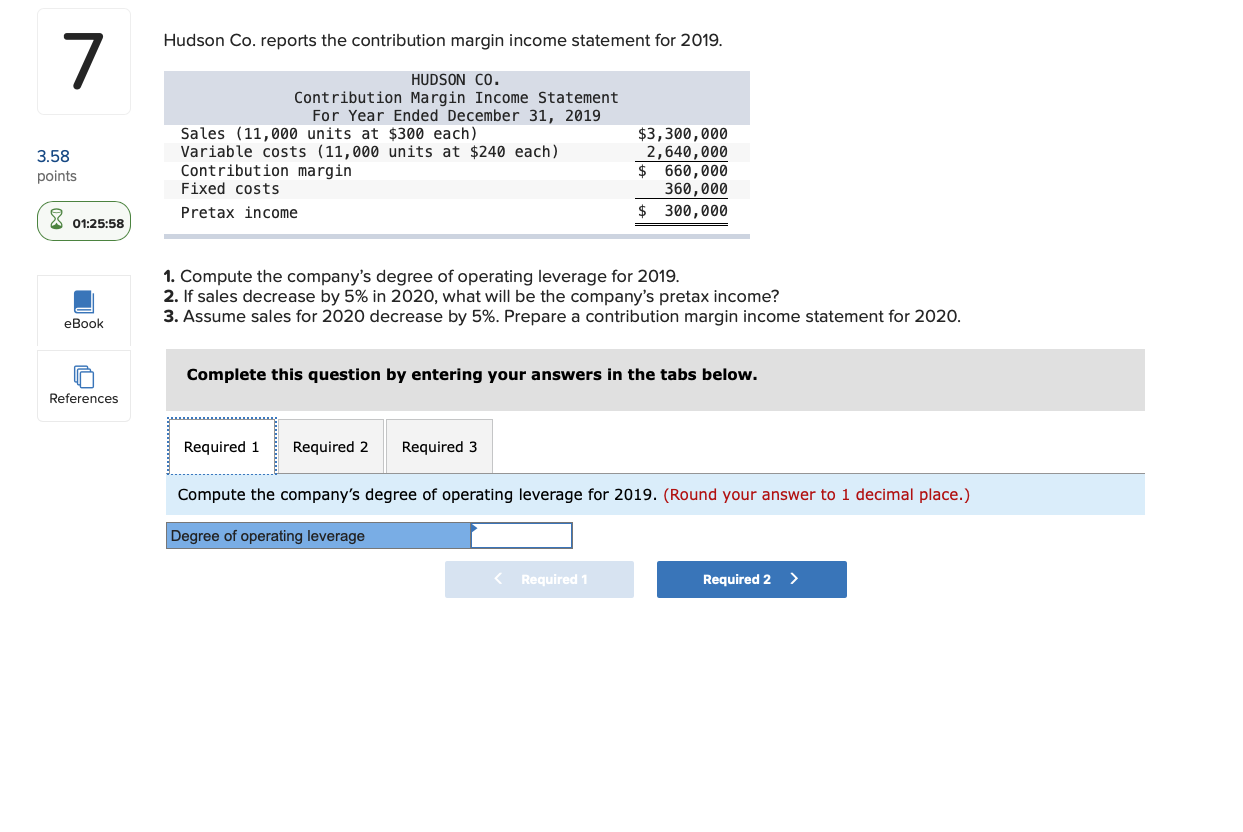

HUDSIJNI C0. Contribution Margin Income Statement For Year Ended December 31. 2319 7 Hudson Co. reports the contribution margin income statement for 2019. Sales {11,333 units at $333 each) $3,333,333 353 Variable costs (11,333 units at $243 each) 2,643,333 points Contribution margin $ 663,333 Fixed costs 363,333 Pretax income 35 333,333 01:24:33 = 1. Compute the company's degree of operating leverage for 2019. El 2. If sales decrease by 5% in 2020, what will be the company's pretax income? eBook 3. Assume sales for 2020 decrease by 5%. Prepare a contribution margin income statement for 2020. @ Complete this question by enterlng your answers In the tabs below. References Required 1 If sales decrease by 5% in 2020, what will be the company's pretax Income? 7 Hudson Co. reports the contribution margin income statement for 2019. HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (11, 000 units at $300 each) $3, 300, 000 3.58 Variable costs (11,000 units at $240 each) 2, 640, 000 points Contribution margin $ 660, 000 Fixed costs 360, 000 8 01:22:53 Pretax income $ 300, 000 1. Compute the company's degree of operating leverage for 2019. 2. If sales decrease by 5% in 2020, what will be the company's pretax income? eBook 3. Assume sales for 2020 decrease by 5%. Prepare a contribution margin income statement for 2020. Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Required 3 Assume sales for 2020 decrease by 5%. Prepare a contribution margin income statement for 2020. HUDSON CO. Forecasted Contribution Margin Income Statement For Year Ended December 31, 2020 Sales Variable costs Contribution margin Fixed costs Income (pretax) 7 Hudson Co. reports the contribution margin income statement for 2019. HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (11,000 units at $300 each) $3, 300, 000 3.58 Variable costs (11, 000 units at $240 each) 2, 640, 000 points Contribution margin $ 660, 000 Fixed costs 360, 000 01:25:58 Pretax income 300, 000 1. Compute the company's degree of operating leverage for 2019. 2. If sales decrease by 5% in 2020, what will be the company's pretax income? eBook 3. Assume sales for 2020 decrease by 5%. Prepare a contribution margin income statement for 2020. Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Required 3 Compute the company's degree of operating leverage for 2019. (Round your answer to 1 decimal place.) Degree of operating leverage