Please help with this question. 2

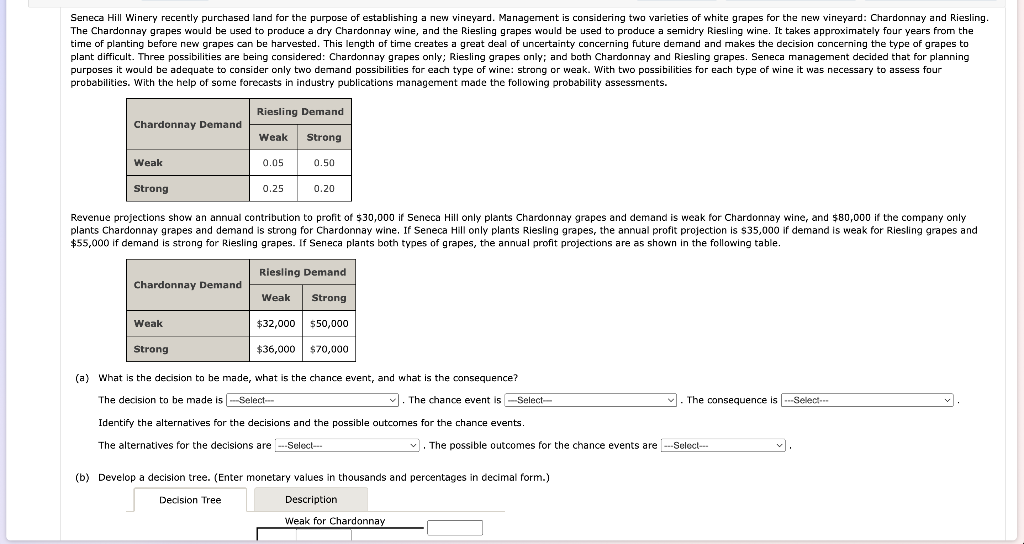

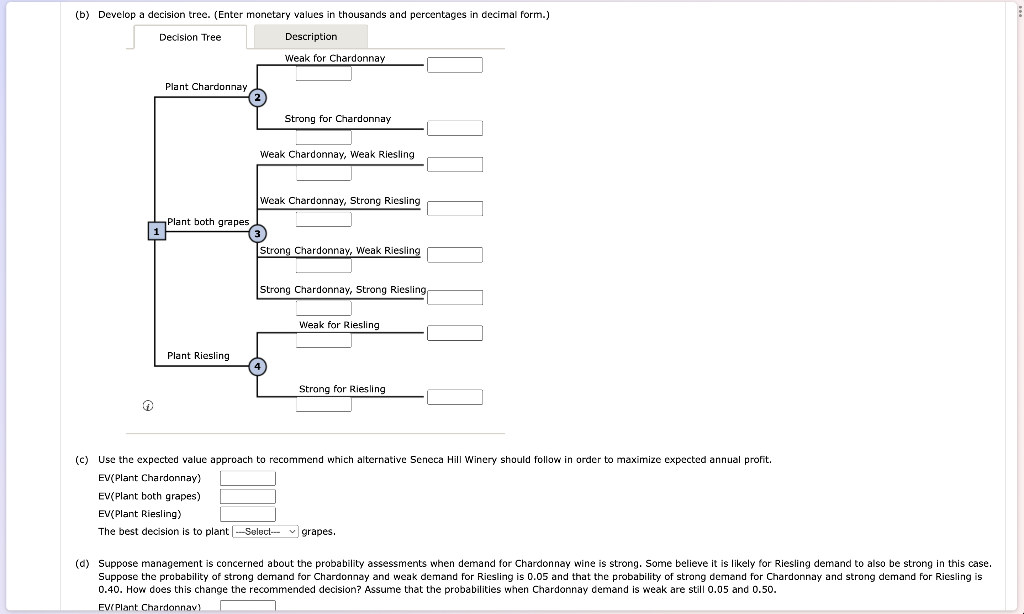

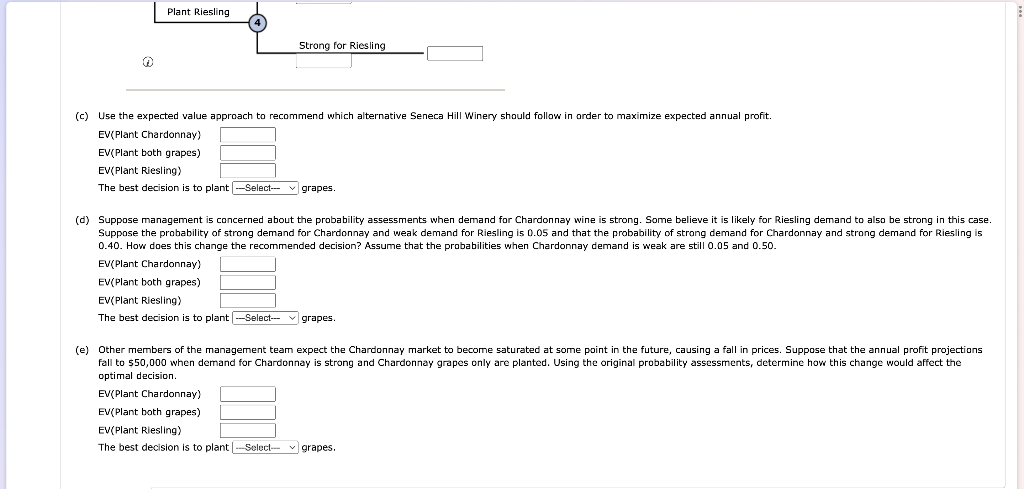

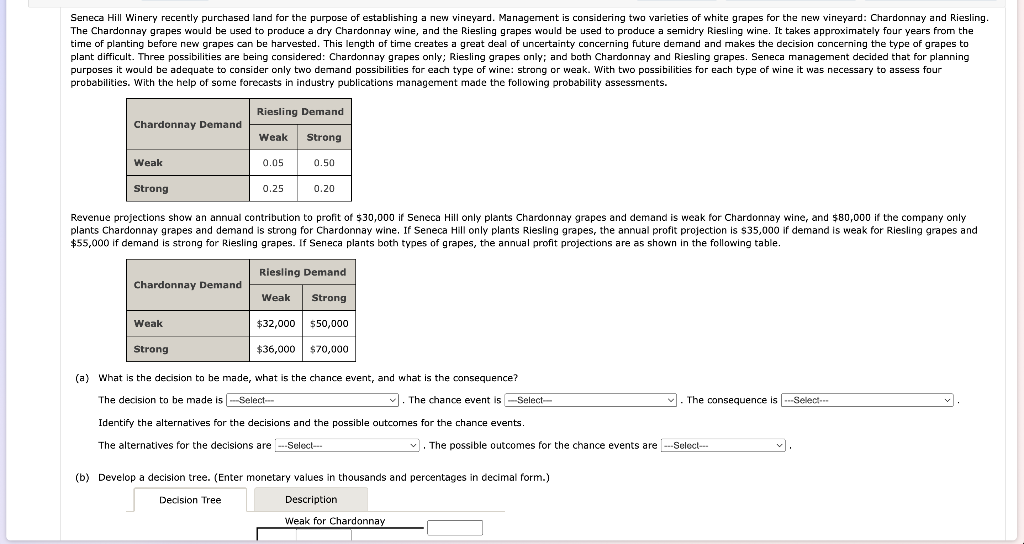

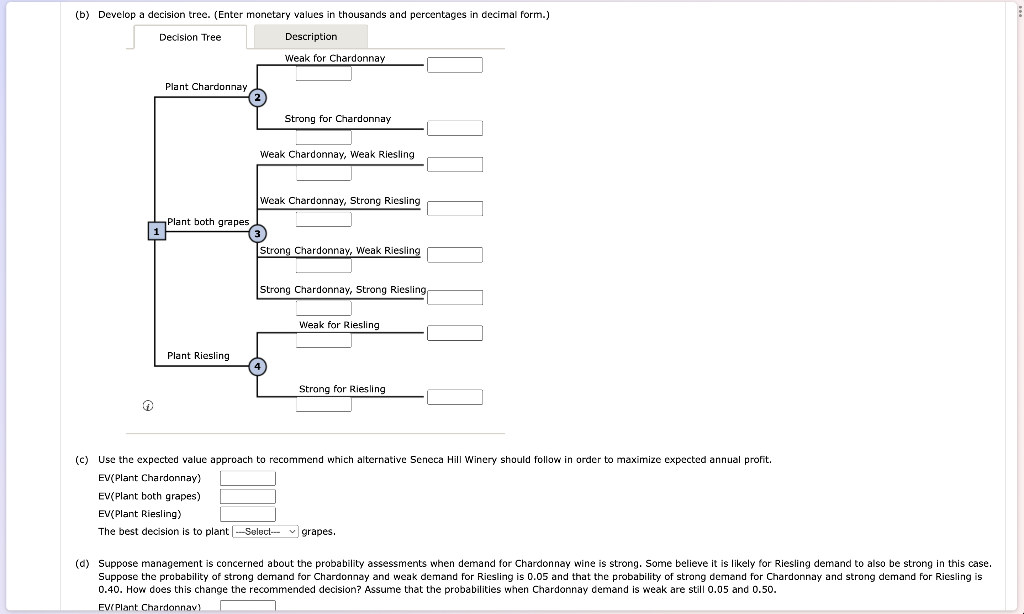

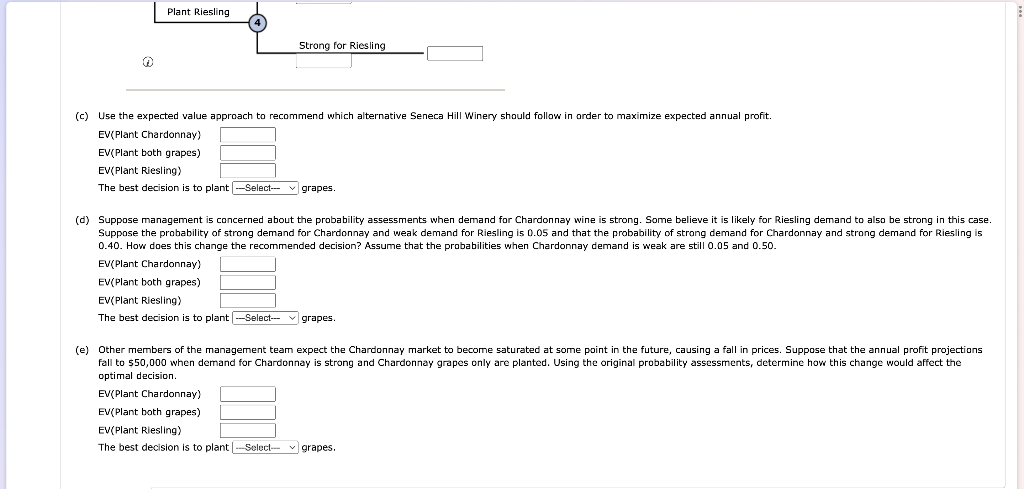

probabilities. With the help of some forecasts in industry publications management made the following probability assessments. $55,000 if demand is strong for Riesling grapes. If Seneca plants both types of grapes, the annual profit projections are as shown in the following table. (a) What is the decision to be made, what is the chance event, and what is the consequence? The decision to be made is . The chance event is . The consequence is Identify the alternatives for the decisions and the possible outcomes for the chance events. The alternatives for the decisions are . The possible outcomes for the chance events are (b) Develop a decision tree. (Enter monetary values in thousands and percentages in decimal form.) Weak for Chardonnay (c) Use the expected value approach to recommend which alternative Seneca Hill Winery should follow in order to maximize expected annual profit. EV(Plant Chardonnay) EV(Plant both grapes) EV(Plant Riesling) The best decision is to plant grapes. (d) Suppose management is concerned about the probability assessments when demand for Chardonnay wine is strong. Some believe it is likely for Riesling demand to also be strong in this case. Suppose the probability of strong demand for Chardonnay and weak demand for Riesling is 0.05 and that the probability of strong demand for Chardonnay and strong demand fiesling is 0.40. How does this change the recommended decision? Assume that the probabilities when Chardonnay demand is weak are still 0.05 and 0.50 . (c) Use the expected value approach to recommend which alternative Seneca Hill Winery should follow in order to maximize expected annual profit. EV(Plant Chardonnay) EV(Plant both grapes) EV(Plant Riesling) The best decision is to plant grapes. 0.40. How does this change the recommended decision? Assume that the probabilities when Chardonnay demand is weak are still 0.05 and 0.50 . EV(Plant Chardonnay) EV(Plant both grapes) EV(Plant Riesling) The best decision is to plant grapes. optimal decision. EV(Plant Chardonnay) EV(Plant both grapes) EV(Plant Riesling) The best decision is to plant grapes. probabilities. With the help of some forecasts in industry publications management made the following probability assessments. $55,000 if demand is strong for Riesling grapes. If Seneca plants both types of grapes, the annual profit projections are as shown in the following table. (a) What is the decision to be made, what is the chance event, and what is the consequence? The decision to be made is . The chance event is . The consequence is Identify the alternatives for the decisions and the possible outcomes for the chance events. The alternatives for the decisions are . The possible outcomes for the chance events are (b) Develop a decision tree. (Enter monetary values in thousands and percentages in decimal form.) Weak for Chardonnay (c) Use the expected value approach to recommend which alternative Seneca Hill Winery should follow in order to maximize expected annual profit. EV(Plant Chardonnay) EV(Plant both grapes) EV(Plant Riesling) The best decision is to plant grapes. (d) Suppose management is concerned about the probability assessments when demand for Chardonnay wine is strong. Some believe it is likely for Riesling demand to also be strong in this case. Suppose the probability of strong demand for Chardonnay and weak demand for Riesling is 0.05 and that the probability of strong demand for Chardonnay and strong demand fiesling is 0.40. How does this change the recommended decision? Assume that the probabilities when Chardonnay demand is weak are still 0.05 and 0.50 . (c) Use the expected value approach to recommend which alternative Seneca Hill Winery should follow in order to maximize expected annual profit. EV(Plant Chardonnay) EV(Plant both grapes) EV(Plant Riesling) The best decision is to plant grapes. 0.40. How does this change the recommended decision? Assume that the probabilities when Chardonnay demand is weak are still 0.05 and 0.50 . EV(Plant Chardonnay) EV(Plant both grapes) EV(Plant Riesling) The best decision is to plant grapes. optimal decision. EV(Plant Chardonnay) EV(Plant both grapes) EV(Plant Riesling) The best decision is to plant grapes