Please help with this question and also provide explaination

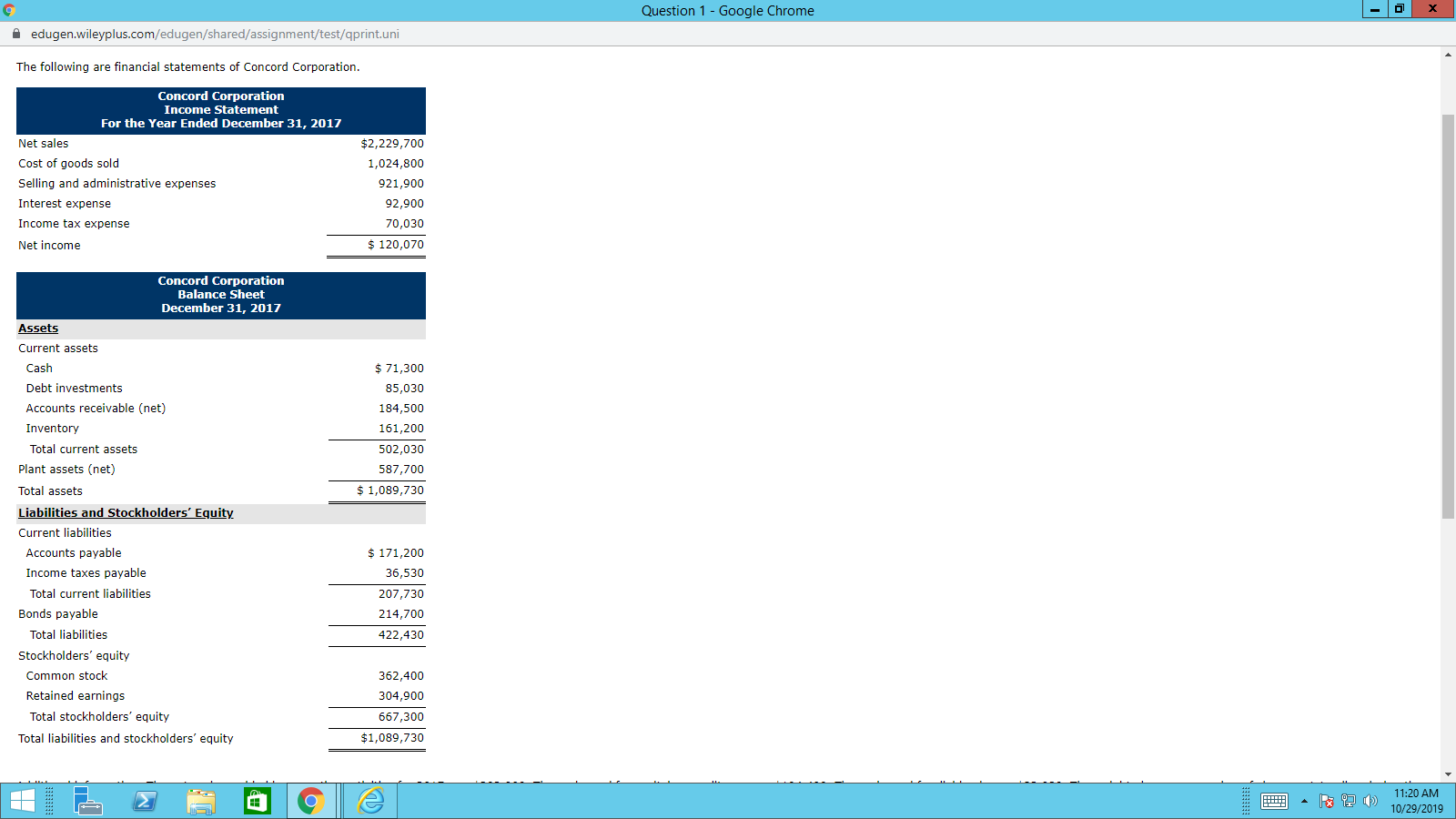

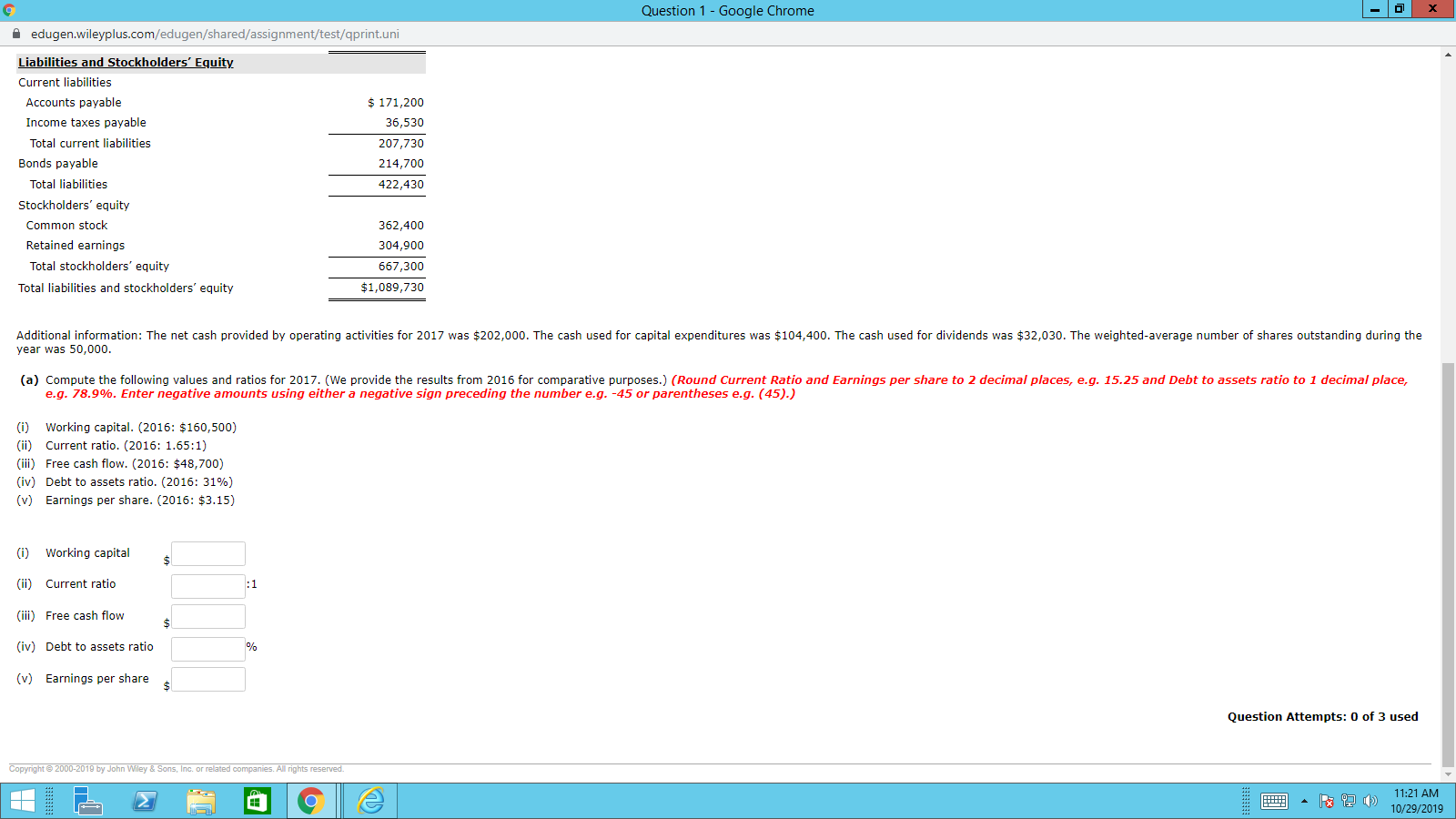

9 Question 1 - Google Chrome - 0 edugen.wileyplus.com/edugen/shared/assignment/test/qprint.uni The following are financial statements of Concord Corporation. Concord Corporation Income Statement For the Year Ended December 31, 2017 Net sales $2,229,700 Cost of goods sold 1,024,800 Selling and administrative expenses 921,900 Interest expense 92,900 Income tax expense 70,030 Net income $ 120,070 Concord Corporation Balance Sheet December 31, 2017 Assets Current assets Cash $ 71,300 Debt investments 85,030 Accounts receivable (net) 184,500 Inventory 161,200 Total current assets 502,030 Plant assets (net) 587,700 Total assets $ 1,089,730 Liabilities and Stockholders' Equity Current liabilities Accounts payable $ 171,200 Income taxes payable 36,530 Total current liabilities 207,730 Bonds payable 214,700 Total liabilities 422,430 Stockholders' equity Common stock 362,400 Retained earnings 304,900 Total stockholders' equity 667,300 Total liabilities and stockholders' equity $1,089,730 K EEEEEEEE 11:20 AM 10/29/20199 Question 1 - Google Chrome - 0 edugen.wileyplus.com/edugen/shared/assignment/test/qprint.uni Liabilities and Stockholders' Equity Current liabilities Accounts payable $ 171,200 Income taxes payable 36,530 Total current liabilities 207,730 Bonds payable 214,700 Total liabilities 422,430 Stockholders' equity Common stock 362,400 Retained earnings 304,900 Total stockholders' equity 667,300 Total liabilities and stockholders' equity $1,089,730 Additional information: The net cash provided by operating activities for 2017 was $202,000. The cash used for capital expenditures was $104,400. The cash used for dividends was $32,030. The weighted-average number of shares outstanding during the year was 50,000. (a) Compute the following values and ratios for 2017. (We provide the results from 2016 for comparative purposes.) (Round Current Ratio and Earnings per share to 2 decimal places, e.g. 15.25 and Debt to assets ratio to 1 decimal place, e.g. 78.9%. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Working capital. (2016: $160,500) ii) Current ratio. (2016: 1.65:1) iii) Free cash flow. (2016: $48,700) (iv) Debt to assets ratio. (2016: 31%) (v) Earnings per share. (2016: $3.15) (i) Working capital (ii) Current ratio : 1 (iii) Free cash flow $ (iv) Debt to assets ratio (v) Earnings per share $ Question Attempts: 0 of 3 used Copyright @ 2000-2019 by John Wiley & Sons, Inc. or related companies. All rights reserved. e 11:21 AM 10/29/2019