Answered step by step

Verified Expert Solution

Question

1 Approved Answer

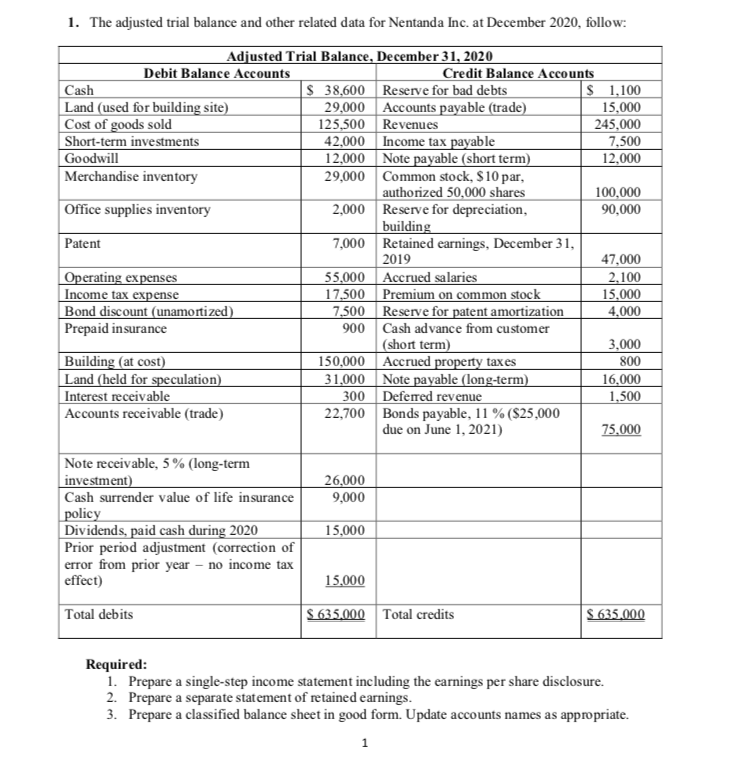

Please help with this question and provide workings! 1. The adjusted trial balance and other related data for Nentanda Inc. at December 2020, follow: Adjusted

Please help with this question and provide workings!

1. The adjusted trial balance and other related data for Nentanda Inc. at December 2020, follow: Adjusted Trial Balance, December 31, 2020 Debit Balance Accounts Credit Balance Accounts Cash $ 38,600 Reserve for bad debts $ 1,100 Land (used for building site) 29,000 Accounts payable (trade) 15,000 Cost of goods sold 125,500 Revenues 245,000 Short-term investments 42,000 Income tax payable 7,500 Goodwill 12,000 Note payable (short term) 12,000 Merchandise inventory 29,000 Common stock, $ 10 par, authorized 50,000 shares 100,000 Office supplies inventory 2,000 Reserve for depreciation, 90,000 building Patent 7,000 Retained earnings, December 31, 2019 47,000 Operating expenses 55,000 Accrued salaries 2,100 Income tax expense 17,500 Premium on common stock 15,000 Bond discount (unamortized) 7,500 Reserve for patent amortization 4.000 Prepaid insurance 900 Cash advance from customer (short term) 3,000 Building (at cost) 150,000 Accrued property taxes 800 Land (held for speculation) 31,000 Note payable (long-term) 16,000 Interest receivable 300 Deferred revenue 1,500 Accounts receivable (trade) 22,700 Bonds payable, 11 % ($25,000 due on June 1, 2021) 75,000 26,000 9,000 Note receivable, 5 % (long-term investment) Cash surrender value of life insurance policy Dividends, paid cash during 2020 Prior period adjustment (correction of error from prior year - no income tax effect) 15,000 15,000 Total debits S 635.000 Total credits S 635.000 Required: 1. Prepare a single-step income statement including the earnings per share disclosure. 2. Prepare a separate statement of retained earnings. 3. Prepare a classified balance sheet in good form. Update accounts names as appropriate. 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started