Please help with this question

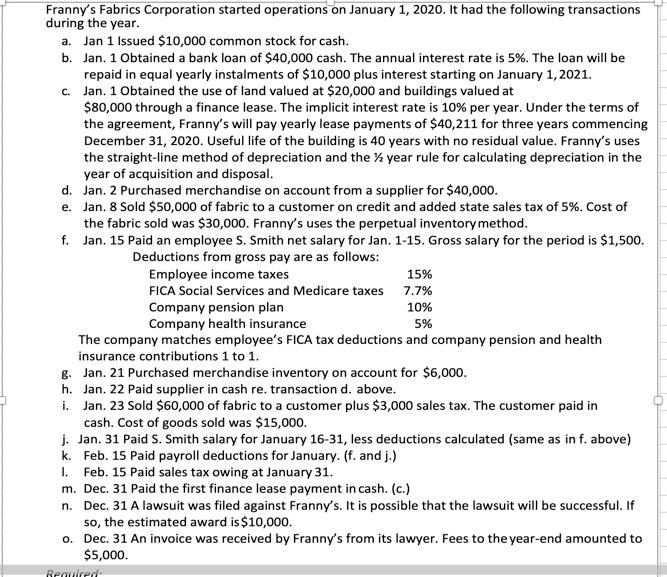

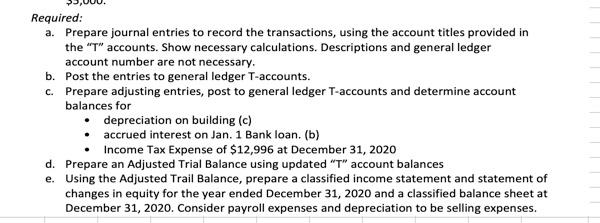

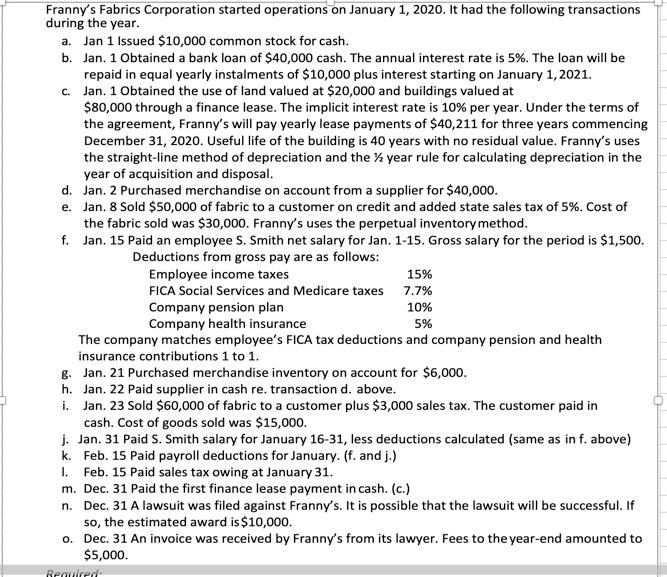

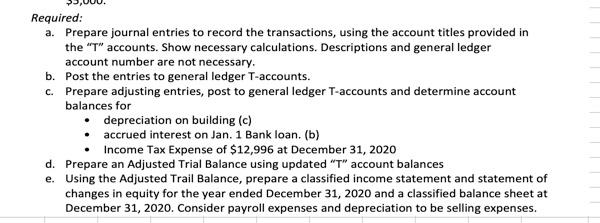

Franny's Fabrics Corporation started operations on January 1, 2020. It had the following transactions during the year. a. Jan 1 Issued $10,000 common stock for cash. b. Jan. 1 Obtained a bank loan of $40,000 cash. The annual interest rate is 5%. The loan will be repaid in equal yearly instalments of $10,000 plus interest starting on January 1, 2021. c. Jan. 1 Obtained the use of land valued at $20,000 and buildings valued at $80,000 through a finance lease. The implicit interest rate is 10% per year. Under the terms of the agreement, Franny's will pay yearly lease payments of $40,211 for three years commencing December 31, 2020. Useful life of the building is 40 years with no residual value. Franny's uses the straight-line method of depreciation and the year rule for calculating depreciation in the year of acquisition and disposal. d. Jan. 2 Purchased merchandise on account from a supplier for $40,000. e. Jan. 8 Sold $50,000 of fabric to a customer on credit and added state sales tax of 5%. Cost of the fabric sold was $30,000. Franny's uses the perpetual inventory method. f. Jan. 15 Paid an employee S. Smith net salary for Jan. 1-15. Gross salary for the period is $1,500. Deductions from gross pay are as follows: Employee income taxes 15% FICA Social Services and Medicare taxes 7.7% Company pension plan 10% Company health insurance 5% The company matches employee's FICA tax deductions and company pension and health insurance contributions 1 to 1. 8. Jan. 21 Purchased merchandise inventory on account for $6,000. h. Jan. 22 Paid supplier in cash re. transaction d. above. i. Jan. 23 Sold $60,000 of fabric to a customer plus $3,000 sales tax. The customer paid in cash. Cost of goods sold was $15,000. j. Jan. 31 Paid S. Smith salary for January 16-31, less deductions calculated (same as in f. above) k. Feb. 15 Paid payroll deductions for January. (f. and j.) 1. Feb. 15 Paid sales tax owing at January 31. m. Dec. 31 Paid the first finance lease payment in cash. (c.) n. Dec. 31 A lawsuit was filed against Franny's. It is possible that the lawsuit will be successful. If so, the estimated award is $10,000. o. Dec. 31 An invoice was received by Franny's from its lawyer. Fees to the year-end amounted to $5,000. Required Required: a. Prepare journal entries to record the transactions, using the account titles provided in the "T" accounts. Show necessary calculations. Descriptions and general ledger account number are not necessary. b. Post the entries to general ledger T-accounts. c. Prepare adjusting entries, post to general ledger T-accounts and determine account balances for depreciation on building (c) accrued interest on Jan. 1 Bank loan. (b) Income Tax Expense of $12,996 at December 31, 2020 d. Prepare an Adjusted Trial Balance using updated "T" account balances e. Using the Adjusted Trail Balance, prepare a classified income statement and statement of changes in equity for the year ended December 31, 2020 and a classified balance sheet at December 31, 2020. Consider payroll expenses and depreciation to be selling expenses